Khanchit Khirisutchalual

Thesis

Fidelity Stocks for Inflation ETF (BATS:FCPI) is an exchange-traded fund (“ETF”) that invests in large and mid-capitalization U.S. stocks that have a propensity to outperform in inflationary environments as per the asset manager’s views. The vehicle aims to provide investment returns which generally correspond to the performance of the Fidelity Stocks for Inflation Factor Index. As per the Index literature:

The Fidelity Stocks for Inflation Factor Index is designed to reflect the performance of stocks of large- and mid-capitalization U.S. companies with attractive valuations, high quality profiles and positive momentum signals. The index overweights those sectors/industries that tend to outperform in inflationary environments.

The fund’s name is a nice little play on The Consumer Price Index (“CPI”) and Fidelity’s name (“F”). But that is where the fun ends. With record inflation in 2022 and true inflationary plays outperforming this year (such as Energy), FCPI is left in the dust with a negative -6% performance in 2022.

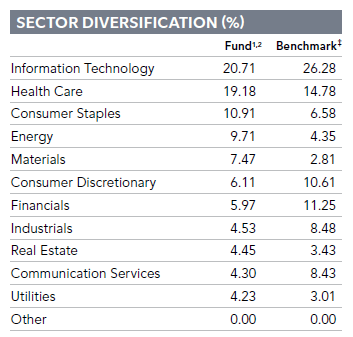

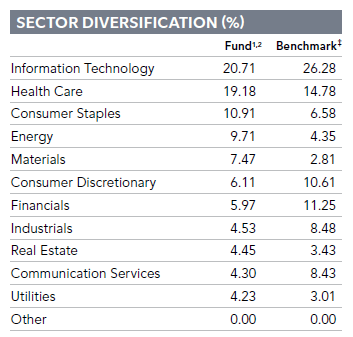

What gives? Well, the fund’s composition is not reflective of sectors which historically have outperformed in inflationary environments. Let us have a look. Currently the fund’s portfolio sectoral slicing is as per the below table:

Sector Allocation (Fund Fact Sheet)

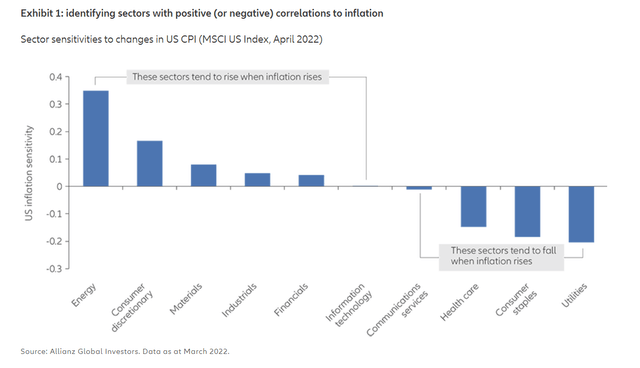

We can surprisingly see Tech as a top sector here, when Tech is bearing the brunt of a lower valuation re-set due to an inflationary environment. But do not take our word for it, let us see what Allianz’s research indicates are the best industries during inflationary periods:

Inflation Correlation (Allianz)

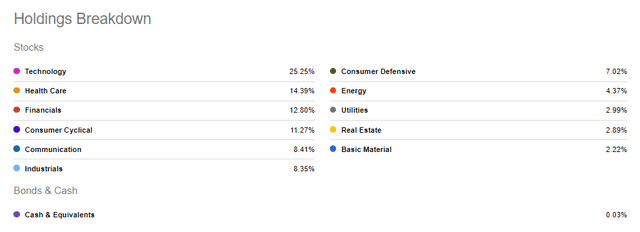

We can see from the above graph that the best sectors to own during an inflationary environment are Energy stocks followed by Consumer Discretionary and Materials. The top sectors in the FCPI fund all fall in what NOT to own during times like 2022. In effect, FCPI has a bastardized S&P 500 portfolio rather than anything else:

S&P 500 Sector Allocation (Seeking Alpha)

If we look at the above composition for the S&P 500 we can see that, with the exception of Financials, the top sectors are fairly similar to FCPI.

We are the first to admit 2022 has been a rough year for securities, but when you name your fund “Stocks for Inflation” and post deep negative results in a record year for CPI, something is not quite right. We would have expected a larger allocation to Energy and Commodities here, which would have boosted significantly the fund’s performance. As a reminder, Energy Select Sector SPDR ETF (XLE) is up almost 50% year-to-date while the Invesco DB Commodity Index Tracking Fund (DBC) is up over 27%.

We tend to like funds which provide for uniform risk factors because they are much more readily quantifiable. The market now contains many vehicles with bombastic names but very little in terms of substance. We have covered some of them here and here. FCPI falls in the “name trap” category for us – at the first glance it would seem FCPI is a great investment for a retail investor expecting inflation to surge. If one digs into the details they will find out FCPI, in fact, is not correctly set-up to take advantage of higher inflation / CPI figures. Its performance has proven its poor set-up as well, with the fund being down -6% in 2022. To us, FCPI is just a bastardized version of the S&P 500 in terms of sectoral allocation. There are better standard index allocation alternatives out there. An investor looking for gains on the back of higher inflation should look elsewhere.

Holdings

For a fund aimed at fighting the gravity of inflation, FCPI surprisingly has a very high allocation to Technology:

FCPI Sectors (Fund Fact Sheet)

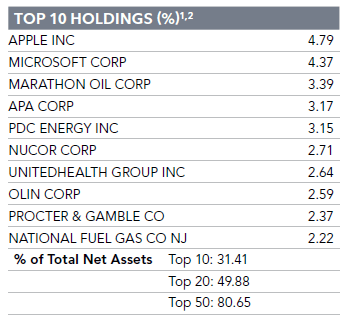

We can see that IT composes over 20% of the fund, closely followed by Health Care and Consumer staples. The top 3 industries account for more than 50% of the fund holdings. The top names in the portfolio are:

Top Holdings (Fund Fact Sheet)

We can see the top fund holdings are a mix of technology, healthcare and energy companies.

Performance

FCPI is down over -6% year to date on a total return basis:

YTD Performance (Seeking Alpha)

On a 1-year lookback period the fund is now just marginally higher:

1-Year Total Return (Seeking Alpha)

A 3-year graph shows a positive performance for FCPI but the fund underperforms the S&P 500:

3Y Total Return (Seeking Alpha)

Conclusion

Fidelity Stocks for Inflation ETF is an exchange-traded fund that invests in large and mid-capitalization U.S. stocks that are supposed to outperform in inflationary environments. However, the ETF’s holdings are not reflective of sectoral allocations consistent with Allianz’s inflation correlation analysis and in effect represent a bastardized S&P 500 sectoral split. FCPI’s performance is reflective of that poor composition, being down -6% year to date. As a reminder, Energy (XLE) is up almost 50% year to date while the Invesco DB Commodity Index Tracking Fund (DBC) is up over 27%. FCPI falls in the “name trap” category for us. An investor looking for gains on the back of higher inflation should look elsewhere.

Be the first to comment