SimonDannhauer/iStock via Getty Images

Oftentimes, when thinking about the very best ways to make money in the stock market, it’s important to take a look in the mirror and remind yourself of the K.I.S.S. mindset…

Keep it simple, stupid.

Harsh love, maybe. So go ahead and substitute “sweetheart” for “stupid” if you’d like. Just don’t drop the larger concept in the process.

Far too often, investors get caught up in fancy and sophisticated trading strategies that involve speculation and market timing.

Other times, they convince themselves to take outsized risks in the deep-value space – thereby sacrificing quality – or in very-high-yield areas… forgetting about margin of safety and conservative value-investing principles.

There’s always some hot trend making its way around the internet with regard to a quick and easy way to make money. (Crypto assets or meme stocks, anyone?) And we understand how attractive the idea of becoming exceedingly rich exceedingly quick can be.

Yet the fact of the matter is that get-rich-quick schemes are a farce.

Most people don’t like to hear this, but here goes anyway. It takes time to generate true wealth in the stock market – or anywhere else.

The compounding process is the retail investors’ best friend. And that takes time. Time and patience.

But when you’re dealing with blue-chip stocks like Agree Realty Corporation (NYSE:ADC), it’s amazing how much those disciplines can pay off.

The “Simple” Stock Market Life Can Be The Most Profitable

Over the years, the simplest, easiest, and most reliable way to make money in the stock market has become clear. It’s to buy and hold blue-chip equities like Agree Realty.

Not the most appealing advice, I know. But there it is anyway.

Many of the companies we follow meet the highest-quality standards in terms of reliable sales growth and cash flows. The same goes for high margins, clean balance sheets, and generous shareholder returns.

And, again, that makes them pretty boring businesses more often than not, comparatively speaking. With that said, I’d much rather be boring and rich than exciting and broke.

We apologize if we’re being repetitive, but we really want to drive this point home. The K.I.S.S. stock market strategy of buying and holding blue-chips… collecting their dividends… and reinvesting them back into the market over time… doesn’t mint millionaires overnight.

What it does is slowly but surely snowball into a powerful financial force for you and your family.

Moreover, “boring” blue-chips tend to generate strong positive alpha for investors when the market is more fearful. When we’re experiencing a great deal of negative volatility and investors are running for the hills – or even just upset with their year-to-date returns – these companies can offer much more timely benefits as their share prices don’t sink as much.

If at all.

If that grabs your attention, good! Let’s talk about our market mindset a little bit more…

Another Wise Saying The Old Timers Got Right

Here’s another old saying that fits well with buying and holding blue-chips like Agree Realty: “If it ain’t broke, don’t fix it.” It’s also another one that can take some time to learn.

Far too often, we see investors buy shares of a wonderful company that’s bound to do right by them. But then they get distracted by some “hot-to-trot” stock that promises short-term profits and sell the old to buy the new instead.

Again, we get the appeal. However, we also “get” how the data clearly shows superior returns for our way of doing things.

That’s for a few reasons, including how no one has a crystal ball. So no one can time the market reliably. So no one can know without a shadow of a doubt what stocks are headed up at what time… and which ones are headed down.

And that guessing game becomes even more tricky when you’re dealing with companies that have questionable value.

Sure. Sure. Sometimes investors time the market perfectly and end up accelerating the compounding process with active trading. But that’s not the norm.

The norm is people giving in to fear or greed – another reason to buy and hold blue-chips – and shorting their profits as a result. It’s human nature to run on emotions instead of logic.

You can fight those urges though. They don’t have to win. Don’t allow yourself to be swept up into the idea that trading (rather than investing) is a sure-fire way to come out ahead.

It’s not.

Keep all that – including the basic K.I.S.S. and “if it ain’t broke” concepts – in mind, and you should do just fine. Which brings us to Agree.

It’s a wonderful stock that’s protected investor capital throughout the volatile 2022… all while producing solid fundamental growth and providing a reliably increasing dividend.

An Overview Of Agree’s High-Quality Operations

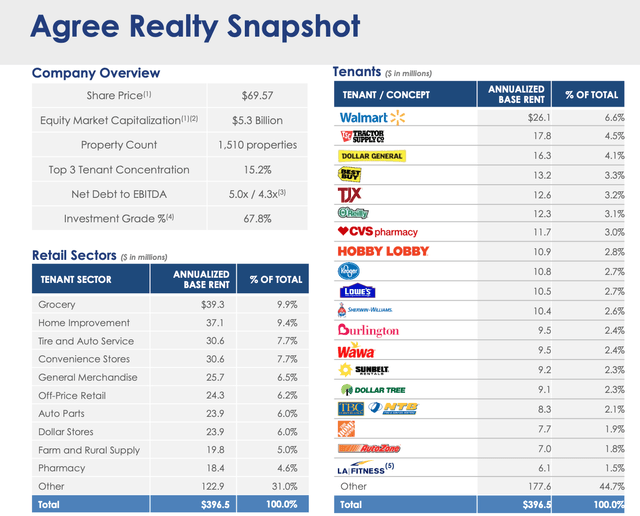

Agree Realty is one of my favorite triple-net-lease stocks around. And I especially appreciate it in this kind of environment.

The S&P 500 is down nearly 21% on a year-to-date basis (as of July 14, 2022). The Vanguard Real Estate ETF (VNQ) is doing slightly worse, down approximately 21.5%.

However, Agree has posted gains of 3.77%, showing its strong, defensive posture.

ADC fits into the K.I.S.S. mindset perfectly. For instance, CEO Joey Agree loves to talk about the idea of “fungible rectangles” when he’s acquiring properties.

It doesn’t get more boring than cookie-cutter rectangles in the commercial real estate business. And there’s nothing exciting about a building that could just as easily be a 7-11, a bank, a Burger King, a dollar store, or a drug store.

But here’s the deal: Those buildings are incredibly easy to build, maintain, and most importantly, lease. That concept remains true even with big-box “rectangles” like Loews (L), Walmart (WMT), or Costco (COST).

Incidentally, those larger retailers tend to stay occupied so long as they’re located in attractive areas.

Working with and within these facts, ADC has maintained a very high occupancy ratio and generated strong cash flows. And that’s throughout the recent tumultuous economic environments we’ve seen.

ADC was one of the few retail-oriented real estate investment trusts (REITs) we track at iREIT on Alpha that posted positive adjusted funds from operations (AFFO) growth throughout 2020

That’s what happens when you focus on high-quality tenants within a high-quality operation.

If you’re looking for an “old reliable” stock market play, we need to further discuss ADC’s tenant situation.

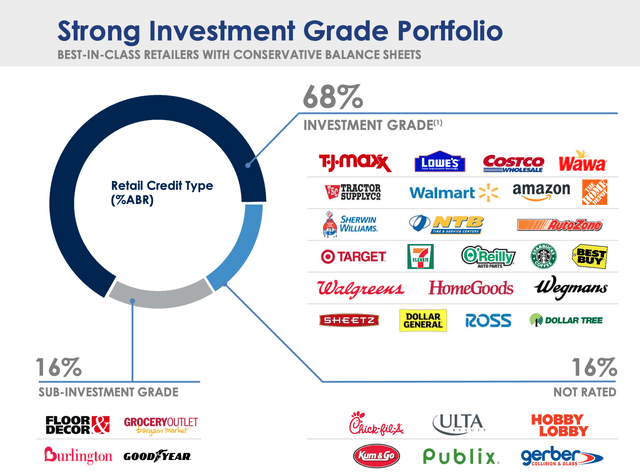

The REIT has about a 68% exposure to investment-grade tenants. And many of those that aren’t rated are very high-quality businesses regardless.

All put together, it’s hard to find a net-lease stock with a more attractive tenant portfolio – and therefore a more dependable cash flow.

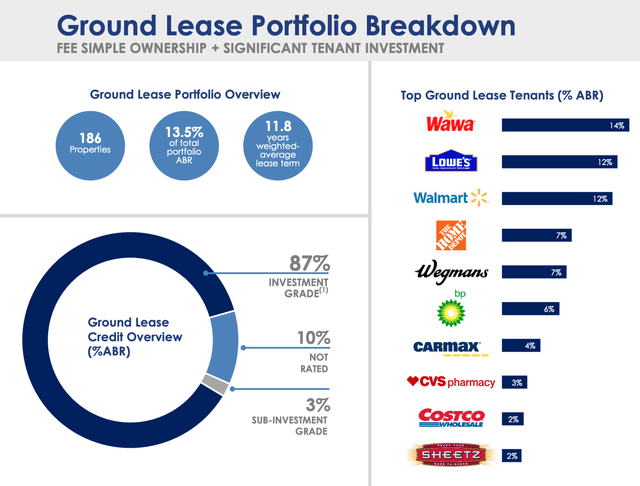

This is also a good time to point out ADC’s fairly unique exposure to ground leases. Rent checks don’t get much more reliable than that considering their lengthy durations and lessee financial requirements.

Plus, while the land itself increases in value over time, ADC gets to ultimately benefit from the improvements its tenants make on top that land.

An “Agreeable” Valuation

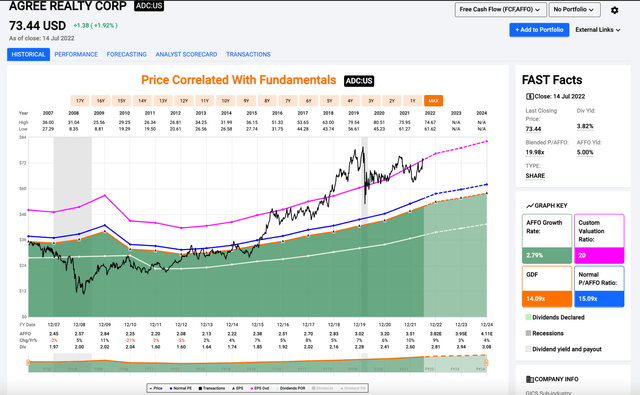

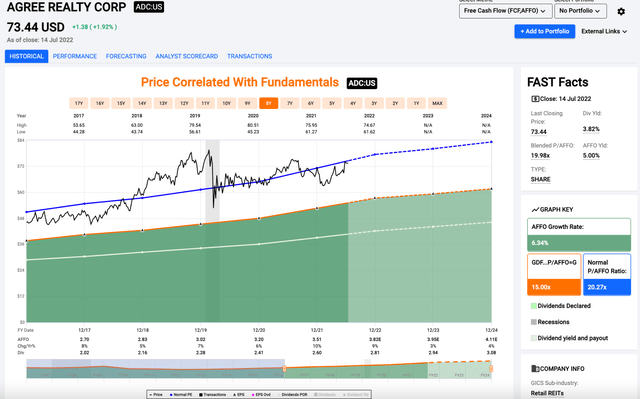

As you can see below, ADC has posted positive year-over-year AFFO growth every year since 2013.

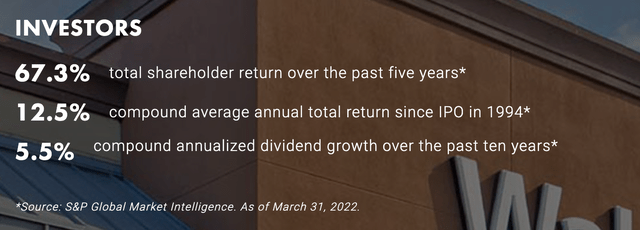

A quick visit to its investor relations page shows its strong total return and dividend growth results. It’s very attractive for a “boring” investment, if you ask us.

Yet its stock isn’t excessively expensive today. Shares are trading with a blended P/AFFO multiple of 19.98x… which is actually slightly below its five-year average of 20.27x.

Admittedly, that doesn’t offer investors a wide margin of safety. It wasn’t long ago that ADC was trading in the low $60 range… which made it an attractive buy on the iREIT Ratings Tracker.

But that day has come and gone, at least for now.

Still, when it comes to simple, safe, and reliable stocks… it often makes sense to pay a premium above peer, industry, and sector averages. Over the long-term, the predictable fundamental growth they generate not only reduces stress and anxiety but produces strong capital gains and a consistently growing dividend.

In other words, it’s worth it. Within reason.

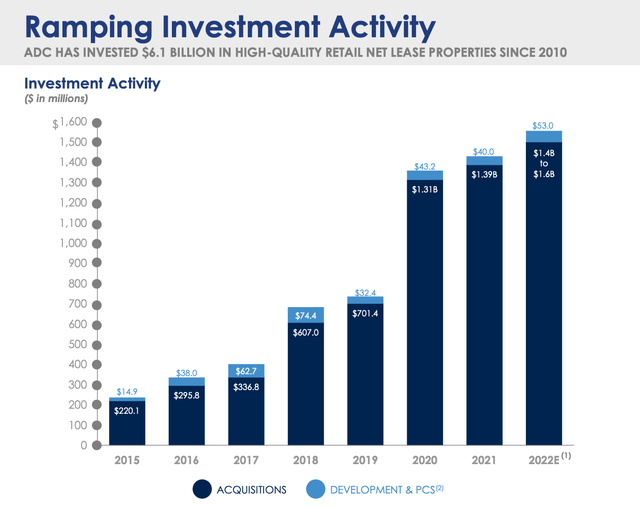

We should also note that we believe Agree Realty will probably beat consensus AFFO growth estimates for 2023 and 2024. It’s acquired property at a record pace in recent years, which should result in copious rent checks falling to the bottom line.

ADC has made a habit out of beating Wall Street’s FFO estimates. It’s beaten on the bottom-line in 11 of the last 12 quarters. And with its very high-quality management team in place, we expect that trend to continue.

In short, ADC’s forward growth prospects are in line with its historical growth results. That’s why it makes sense to us to buy in even now at a reasonable premium.

A deep-value investor will probably want to look elsewhere. However, when it comes to a blue-chip like Agree Realty, we think a certain Warren Buffet phrase applies here:

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Who are we to disagree with such a wise statement?

The Dividend You Can Expect From ADC

Agree Realty is currently on a 10-year annual dividend increase streak with a 6.1% five-year growth rate. Better yet, it pays a monthly dividend, which is something many investors (especially retirees) love to see.

ADC has already provided shareholders with a nice 3.1% dividend increase this year. And looking at past results, I certainly wouldn’t be surprised to see it announce another raise before the year is over.

That hasn’t been uncommon at all throughout its current dividend growth streak.

The stock currently yields 3.77%, which isn’t extraordinarily high for a REIT. However, it’s still well above the SPDR S&P 500 Trust ETF‘s (SPY) 1.59% yield and VNQ’s 3.14% yield.

In terms of dividend safety, you’ve likely already guessed this, but… we really like ADC’s relatively low payout ratio.

Right now, the consensus analyst estimate for ADC’s fiscal 2022 AFFO is $3.82. And its current forward dividend is $2.72.

Therefore, ADC’s forward AFFO dividend payout ratio currently sits at 71.2%.

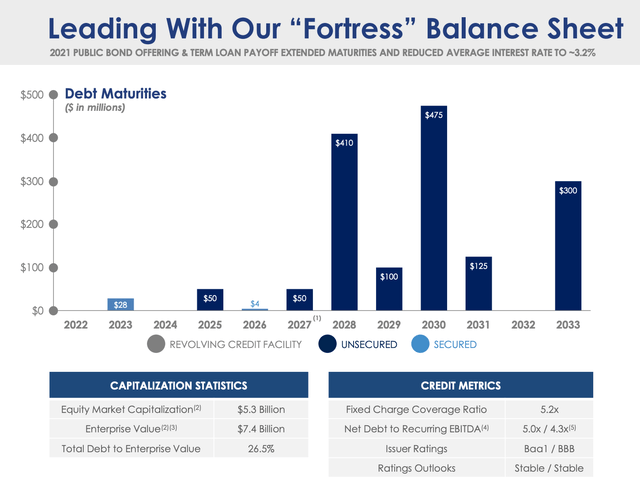

In terms of debt payments coming due that could potentially put pressure on cash flows and reduce dividend growth/safety metrics… well, we’re not concerned there either.

ADC has done a great job reducing that risk with its fortress balance sheet and very little debt coming due until 2028.

All in all, with ADC’s low payout ratio… its strong balance sheet… and the near-double-digit AFFO growth estimates analysts have for this company during 2022…

We believe investors will see another 4%-6% raise before the year is through.

Again, a 4% yield compounding at a high single-digit rate might not seem exciting to some. But to us, that’s a recipe for success that we can’t get enough of.

In Conclusion…

In short, Agree Realty checks just about all our boxes when it comes to quality metrics. That’s why this REIT scores 96/100 on the iREIT IQ quality rating system.

While shares don’t appear to be cheap at the moment, this stock constantly remains on my watchlist. Anytime it falls below our fair-value estimate, we’re pleased to pick up shares of this potential low beta/defensive income-oriented play.

If you’re someone who’s been disappointed with losses through 2022 – or with the relatively high volatility that holdings from certain sectors or industries have produced – then you may want to add ADC to your watchlist too.

Again, we believe that ADC is worth $74.00 per share (our buy below target), meaning that – at today’s price of $74.78 – it offers a margin of safety of just -1%%. But as fundamentals continue to improve over time, so will our fair-value estimate.

Our bottom-line opinion: This is an easy stock to buy and hold for those looking to sleep easy at night by keeping it simple with blue-chip dividend growers.

Be the first to comment