gesrey

The past decade has been characterized by near-0% interest rates and low dividend yields. The low interest rates pushed investors into dividend stocks, which then lead to yield compression.

Still earlier this year, the average yield of REITs (VNQ), Utilities (XLU) and other high yielding sectors was only ~3%, and this is largely because treasuries (IEF) and bonds (BLV) weren’t offering any real return after tax and inflation.

But this changed recently.

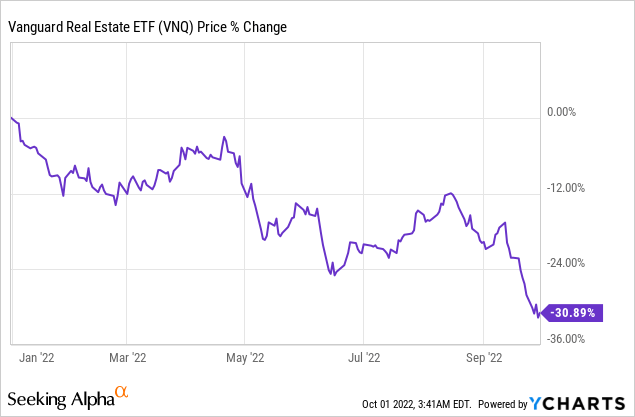

As interest rates began to rise, the market quickly repriced those higher yielding stocks. REITs were hit particularly hard, dropping by over 30% since the beginning of the year:

I have argued in previous articles that this sell-off makes little sense because most REITs aren’t materially affected by rising interest rates. REITs use little debt on average and maturities are long. In fact, in many cases, the positive impact of inflation on rents is far superior than the negative impact of rising interest rates on costs.

But regardless of what we may think, the fact is that REITs are now priced at much lower valuations, and as a result, you can now find “respectable” REITs offering up to 9% dividend yields, which would have been very unusual just 6 months ago.

At High Yield Landlord, we are loading up on these high yielding REITs because we think that they offer the best risk-to-reward in today’s market:

- They allow you to earn a high return from dividend payments alone.

- They are deeply undervalued and offer upside potential in a recovery.

- They provide superior inflation protection with rising rents.

- And in many cases, their fundamentals remain resilient even to recessions.

In what follows, we highlight a few of those 9% yielding REITs that we are buying for our Model Portfolio:

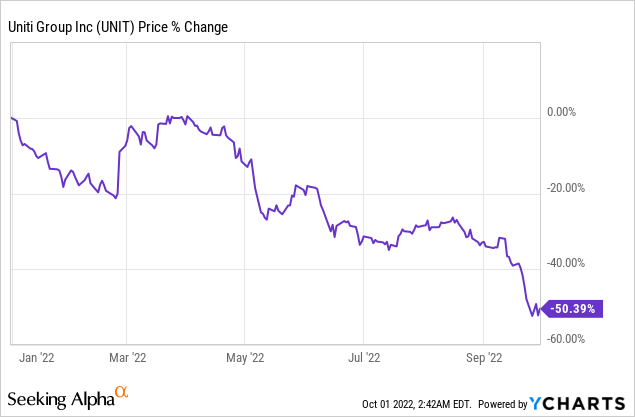

Uniti Group (UNIT)

Uniti Group, the communication infrastructure REIT, is down 50% year-to-date, which is quite exceptional when you consider that its business is more or less unchanged:

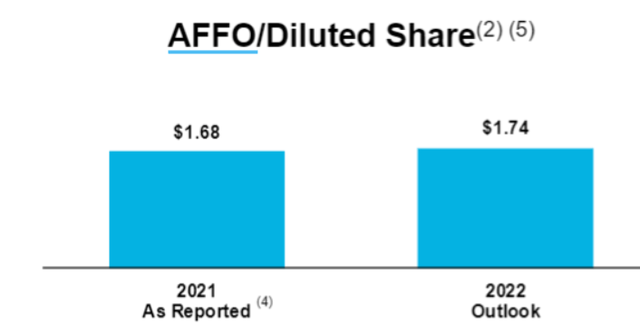

Its cash flow has not dropped. On the contrary, it has risen over the past year:

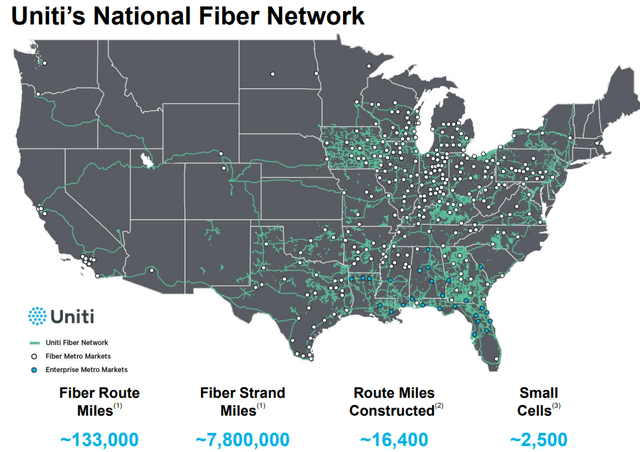

Its assets also haven’t lost value. On the contrary, its network of fiber assets has only become more valuable as a result of inflation.

And therefore, it is hard for us to make sense of this crash.

UNIT owns assets that are absolutely essential to the communities they serve, and these assets are only growing in demand as data usage continue to rise and 5G is deployed.

Despite this, UNIT is now priced at less than 5x FFO and offers a near 9% dividend yield that’s easily covered with a low ~40% payout ratio. This is actually one of the lowest payout ratios in the REIT sector, and we suspect that UNIT will soon need to hike its dividend to keep up with REIT regulations.

That’s quite exceptional coming from a growing, recession-resistant REIT that owns essential, inflation-protected assets.

Surely, there must be a catch. What is?

UNIT’s biggest tenant, Windstream, argues that its current lease rate is abnormally high and it is expected that it will be renegotiated at a lower rate in 2027 when it expires. We have previously argued at High Yield Landlord that Windstream is negotiating in bad faith and that there is little logic in their argument. Our base case scenario is that the lease rate won’t be lowered by more than 20% and that UNIT should be able to make up for most of this drop by growing other revenues. But the great thing here is that even if we are wrong and the revenue drops a lot more than that, this is already more than priced into the stock.

Most REITs trade today at a 15-20x FFO and UNIT trades at just 1/3 of that. I think that once the Windstream drama is resolved once and for all, UNIT will be repriced at a materially higher multiple, unlocking upside for shareholders, and while you wait, you will earn an 8.6% dividend yield that’s likely to be hiked further in the coming years. The cash flow is also recession-resistant and the assets are inflation-proof.

Earlier this year, there were rumors of UNIT being bought out at round $15 per share, but the management argued that this would undervalue the company. They have previously argued that their assets are worth closer to $20 to $30 per share and you can buy them today at just $7 today.

EPR Properties (EPR) Common Shares and Series G Preferred Shares (EPR.PG)

EPR Properties is one of our favorite stocks at the current share price. EPR is a net lease REIT that specializes in experiential properties such as movie theaters, golf complexes, ski areas, and so on.

EPR Properties

It trades at a steep discount to peers and offers a high dividend yield because the market fears that all movie theaters are dying and that EPR will suffer significant pain since 41% of its cash flow comes from them. Moreover, one of its biggest tenant (Regal)’s parent company recently filed for bankruptcy protection.

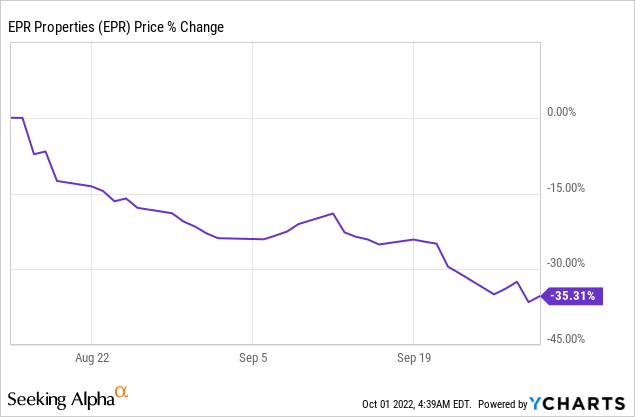

This led many to quickly panic and run for the exit. This is well-reflected in EPR’s recent stock price performance:

But what the market appears to ignore is that:

- EPR is not just a “movie theater REIT” as many appear to think. About 2/3 of its assets (by NAV) are invested in other properties that are performing just fine.

- EPR is a movie theater landlord, not a movie theater operator.

- EPR earns steady rent checks that are pre-agreed for 10+ years to come.

- These rents are automatically rising by ~2% each year, which makes up for some leakage if and when some individual properties suffer vacancies.

- EPR owns some of the most productive theaters in the country. It is the lower quality theaters that are suffering and closing, not these ones.

- The rent coverage of EPR’s theaters is high, meaning that tenants are profitable at the property-level.

- The big issue of its tenants are their debt, not the profitability of EPR’s properties.

- The most likely outcome of Regal’s bankruptcy is that it accepts the lease and the terms are materially unchanged since these properties are profitable, they are under long triple net leases, and they are essential to the business of the tenant.

- Even during the pandemic when its tenants were suffering huge losses and the future was highly uncertain, EPR refused to renegotiate its leases in most cases, and when it did, EPR always got something in return. As an example, if it reduced the rent, it received a longer lease term and other benefits in exchange.

- Finally, EPR has proven that its theaters can be releases and/or redeveloped to recover most of their value or even increase their value in some cases.

These are significant risk-mitigating factors that the market appears to have overlooked. Instead, the market appears to perceive EPR as a proxy for AMC (AMC), Cinemark (CNK), and other theater stocks, causing EPR to drop each time the theater industry suffers some bad news. But it is not quite that simple due to the reasons we listed earlier.

Most net lease REITs at Agree Realty (ADC) and Realty Income (O) trade at least at 15x FFO even at today’s lower share prices.

In comparison, EPR is priced at just 8x FFO and it now offers a 9% dividend yield, which is well covered and has been growing. We think that the company should trade at a materially higher FFO multiple and it likely will once the Regal situation is resolved.

But if you are more risk-adverse and you may want to buy EPR’s Serie G preferred shares instead. They are also priced at a near 30% discount to par and offers an 8% dividend yield.

We think that the risk of the preferred dividend being suspected is very low and you will also earn additional upside as the concerns over EPR’s tenants are mitigated.

Bottom Line

If you missed the high yielding opportunities of early 2020 when the market crashed due to the pandemic, now you are essentially given a second change.

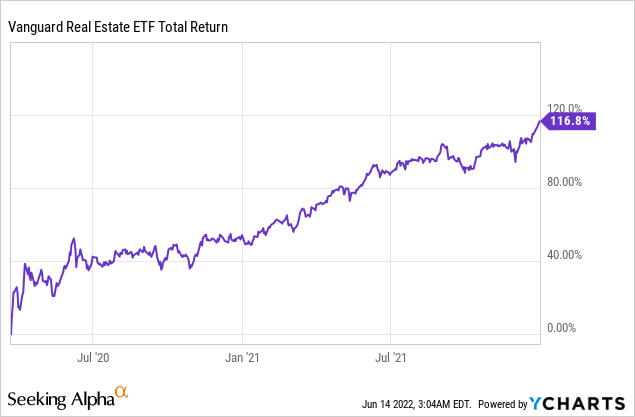

REITs doubled in value in the year following the early 2020 crash and we earned huge returns at High Yield Landlord:

YCHARTS

Now we are again presented with a similar opportunity to profit in the coming years. The market has again overreacted and excessively discounted a number of REITs due to concerns that are only temporary in nature.

Be the first to comment