Double stranded DNA ArtemisDiana

CRISPR-based therapies continue to move towards platform validation with every clinical data point, and Intellia (NASDAQ:NTLA) continues to deliver first-in-field advances in in vivo gene editing technology. In vivo gene therapy, as compared to ex vivo applications, is preferred as these methods deliver the therapeutic payload directly to a patient’s cells, reducing the time and resources needed for the gene editing therapy. NTLA’s lead in vivo candidate, NTLA-2001 for transthyretin amyloidosis (ATTR), is the first CRISPR/Cas9-based candidate to be administered systemically for gene editing in a target tissue in humans. While Intellia is developing ex vivo gene editing treatments in collaborations with Novartis (NVS) and AvenCell, recent successes in its in vivo portfolio are worth reviewing in forming an investment thesis.

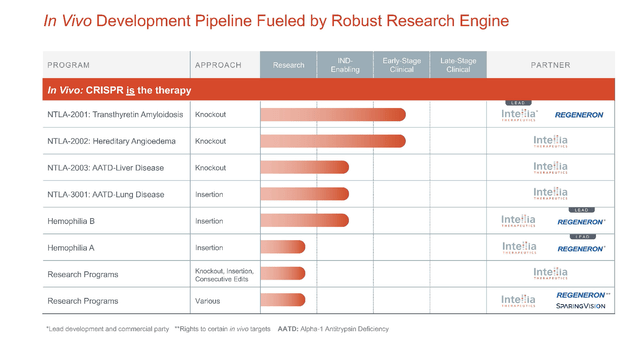

NTLA in vivo pipeline (Intellia Therapeutics)

Intellia recently reported additional positive interim data from its ongoing Phase 1 study with Regeneron (REGN) on NTLA-2001, a developing single-dose candidate for transthyretin amyloidosis. As a refresher, ATTR is a rare, progressive and terminally fatal disease, affecting between 200,000 and 500,000 people worldwide. Hereditary ATTR (ATTRv) amyloidosis occurs when someone is born with mutations in the TTR gene, causing the liver to produce structurally-incorrect TTR protein that misfolds and builds amyloid aggregates in the body. These misfolded proteins build up and cause issues in multiple tissues, including the heart, central nervous system, and digestive tract. NTLA-2001 is a CRISPR-based therapy that aims to inactivate the TTR gene responsible for the disease phenotype, reducing the disease-causing protein to provide a therapeutic response. Under the collaboration, Regeneron fronts 25% of the R+D costs for 25% of commercial profits in addition to a $70 million upfront payment in 2016, a $30 million equity investment, and a potential of about $110 million of milestones.

The results are shockingly positive. At the highest dose evaluated, NTLA-2001 (1.0 mg/kg) resulted in a 93% mean (98% max response) by day 28 among six patients in the group, reductions that continue to be sustained through six months. Additionally, three patients in the 1.0 mg/kg cohort reached nine months post-treatment with no evidence of TTR protein reduction after a single dose, another point for treatment durability. This durable response was also observed in the 0.7 mg/kg dose cohort, with 86% mean serum TTR reduction observed at day 28 that remained durable through six months. This trend followed in the 0.1 and 0.3 mg/kg cohorts, whose patients have now reached 12 months of follow-up with a robust response to treatment. Importantly, patients have tolerated the drug well throughout the follow-up study period, with 73% of patients reporting a maximal adverse event severity of Grade 1.

“Based on the interim data shared today, we believe NTLA-2001’s potential to be a transformational treatment for patients with ATTR amyloidosis is becoming clearer. The safety, depth of serum TTR reduction and durability profile demonstrated thus far highlights its potential for halting and reversing the disease after a single dose. These data further underscore the power of genomic medicines and bolster the probability of success across our broader in vivo genome editing platform. We look forward to progressing the clinical development of the first-ever systemically administered in vivo CRISPR investigational therapy.”

John Leonard, M.D., Intellia President and Chief Executive Officer

Catalysts and Risks

Intellia has surmised that initial interim data for the ongoing Phase 1/2 trial with NTLA-2002 will be presented in the second half of 2022. Previous data on NTLA-2002 in nonhuman primates has shown a 90% reduction in target protein reduction (where >60% reduction is required for a clinical response) and has remained durable throughout the 2-year observation window. Positive results from this dose-escalation trial in humans will provide critical answers on the safety and activity profile of NTLA-2002 and provide human proof-of-concept for the program. The company also projects filing for IND or equivalent application for NTLA-3001, for the treatment of AATD-associated lung disease, in early 2023.

The most obvious risk to Intellia is a failure of the platform to deliver robust or durable responses in any clinical trial readout moving forward. While we have no indication yet that any of the Intellia responses reported thus far will drop off, it certainly remains a potential event through the course of the investigative therapy.

There is also the ever-present discussion over the probability and impact of off-target cuts by CRISPR/Cas machinery. While Intellia uses lipid nanoparticles as a more advanced method of accurate dosing of CRISPR/Cas machinery, potential endonuclease-induced off-target events may affect cellular viability or promote tumorigenesis. Reviews on the clinical impacts of these off-target effects may be found here and here.

Technical and Financial Analysis

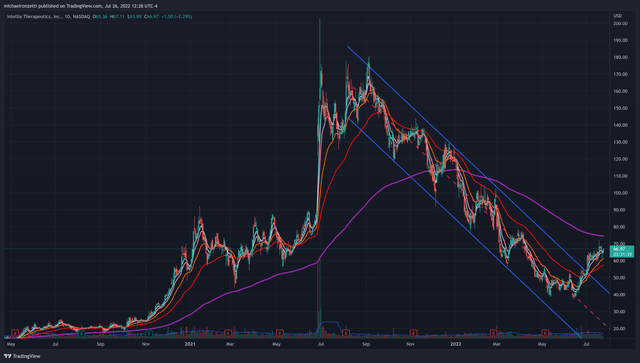

NTLA daily candle chart (Author)

NTLA has been trading in a downtrend channel for a year, only recently breaking out of the channel on elevated volume in the beginning of July. Recent momentum is certainly bullish, with 5/9/21 exponential moving averages crossing above the 50-day EMA, but NTLA remains in a bearish longer-term trend while trading below its 200 EMA at 74.47. Additional catalysts from clinical trial data, institutional or insider accumulation, or reduced headwinds in the current economic climate, have the potential to add to recent bullish price action.

With only $11.25 million in revenue last quarter, and projected positive earnings per share all the way in December 2027, Intellia is likely to keep doing what CRISPR-based biotechs are known for right now: burning through cash. Intellia has cash and marketable securities at a total of $994M (vs. $1.1bn as of Q1 2022), and with Q1 2022 net loss of around $146 million, the company has at least seven quarters of cash burn. The stock is set to report Q2 2022 earnings on August 4, 2022, and we’ll update this article with any findings related to research and development costs and revenue.

Conclusion

The landmark patent ruling against UC Berkeley certainly turned this gene editing space on its head (for a comprehensive review, see this author’s article). Leading CRISPR/Cas companies like Intellia and CRISPR (CRSP) saw precipitous declines as the companies seem forced to renegotiate new license deals between themselves and the Broad Institute and MIT. Ongoing appeals will add uncertainty to this situation, but one thing is becoming clear with every additional clinical data readout: we are seeing robust and durable gene editing responses that are supporting a curative, one-dose therapy. In the long run, this patent issue may not be as consequential as delivering a successful commercialized treatment, and the most recent NTLA-2001 data adds promise to a potential in vivo CRISPR future in the near future.

Be the first to comment