visualspace

A month ago, I wrote an article on Cal-Maine Foods, Inc. (NASDAQ:CALM) arguing that investors should sell into the Highly Pathogenic Avian Influenza (“HPAI”) momentum:

Short-term traders may want to capitalize on the short-term HPAI-induced stock momentum as earnings are set to stay elevated in the coming quarters. However, long-term investors are recommended to use this opportunity to lock in windfall profits.

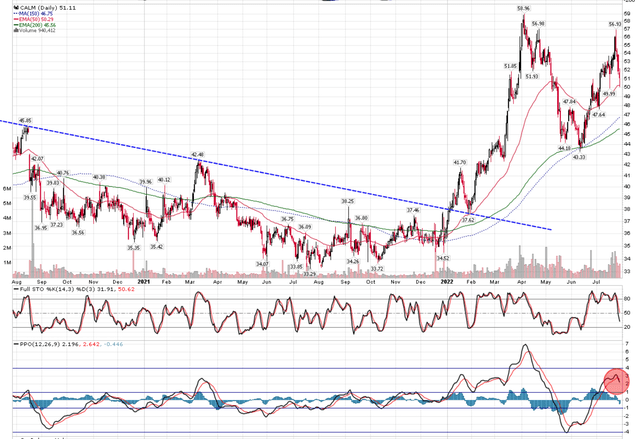

Since the publication of that article, Cal-Maine’s share price rallied another 10% to almost $57 earlier this week, before slipping sharply in the last few days (Figure 1). It has now triggered a mechanical MACD cross-over sell signal.

Figure 1 – CALM stock price peaking (Author created with price chart data from stockcharts.com)

Avian Influenza Impact Receding

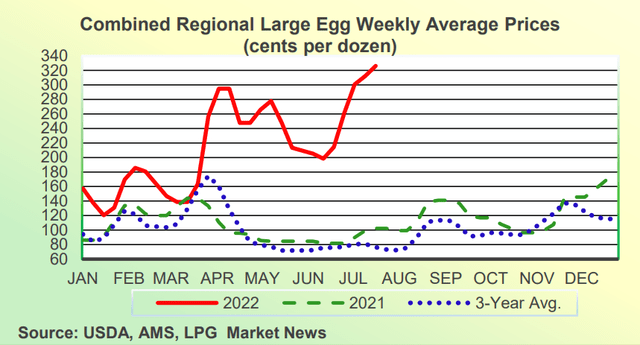

In my opinion, CALM had been ‘over-earning’ as HPAI artificially kept egg prices high (Figure 2).

Figure 2 – Egg prices elevated from HPAI (USDA Egg Market News Report)

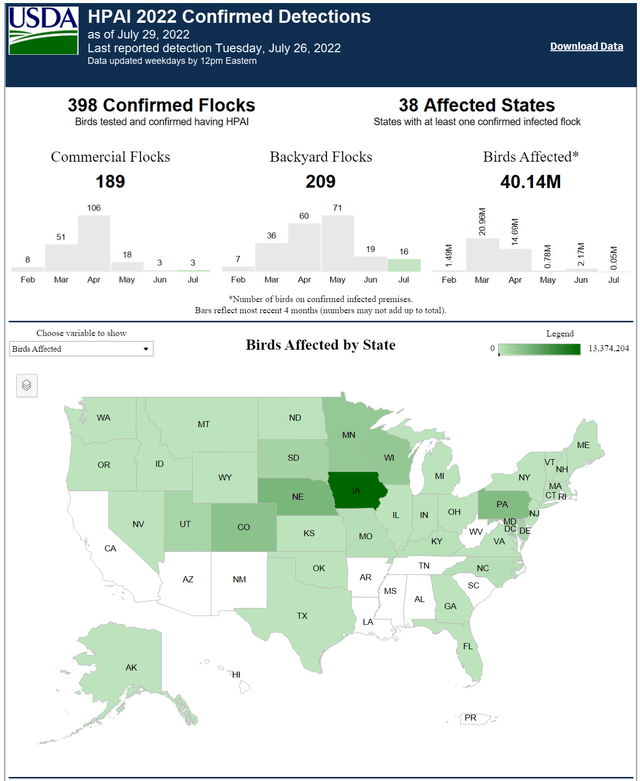

However, if we look at information regarding the current HPAI outbreak, we can see that since peaking in April, the outbreak appears to be rapidly receding (Figure 3), with only 0.05M birds affected in July, a sharp decline from the March and April figures. In fact, CALM’s share price started selling off the date this USDA report was released.

Figure 3 – HPAI outbreak (USDA)

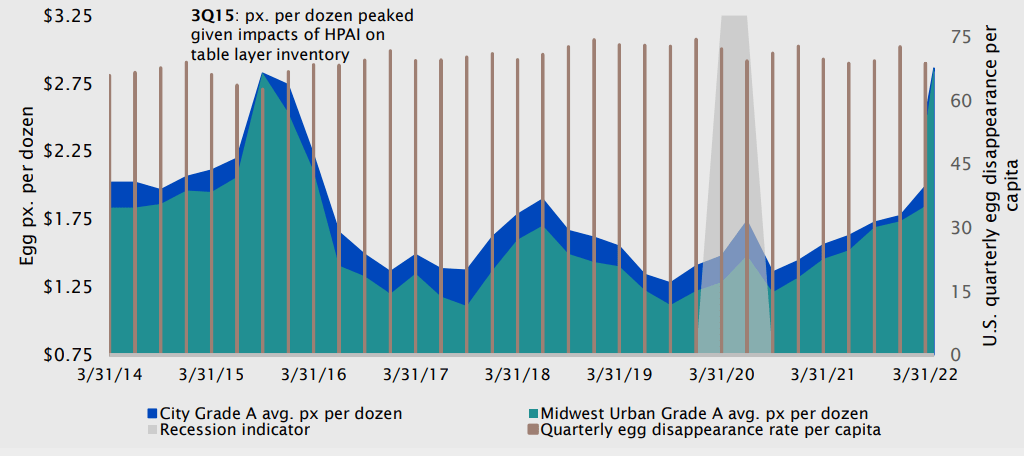

Therefore, my expectation is that towards the end of the year, the HPAI-induced surge in eggs price will normalize. When HPAI last struck in 2015, egg prices quickly normalized within 2 quarters of the peak and prices were substantially less than pre-HPAI one year after the peak (Figure 4).

Figure 4 – Egg prices (Cal-Maine)

Strong Quarter As Expected

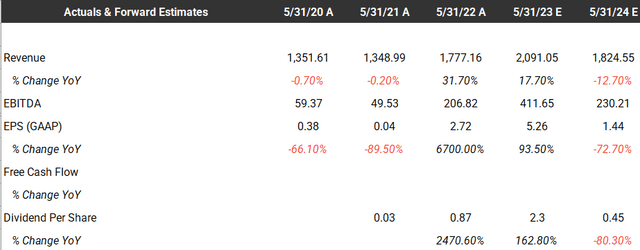

On July 19th, Cal-Maine reported its fiscal fourth quarter, delivering $110 million in net income or $2.25 per diluted share. This was widely expected, as I had written that Wall Street analysts were expecting Cal-Maine to earn $2.21 per share for fiscal 2022. In fact, Cal-Maine exceeded analyst expectations, delivering $2.72 in EPS for the whole year. Cal-Maine also announced a $0.75 dividend for the fourth quarter.

The strong fourth quarter earnings also got Wall Street analysts bulled up for next year, with analysts raising estimates and expecting Cal-Maine to earn $5.26 per share in fiscal 2023, up from $3.44 prior to the quarter (Figure 5).

Figure 5 – Analyst estimates (tikr.com)

However, as I have stated above, I believe the HPAI-induced surge in egg prices will normalize in the coming quarters as the outbreak recedes, and Wall street analysts seem to agree with me, as they brought forth their fiscal 2024 earnings estimate of $1.44, down 73% from their estimate for fiscal 2023.

Normalized Earnings Much Lower; Shares Overvalued

As I wrote in my prior article, I believe Cal-Maine’s normalized earnings power is approximately 6.5% operating margin and $70 million in net income, or $1.43 per share (notice this is very close to what Wall Street estimates for fiscal 2024). At $51 per share, Cal-Maine is currently trading at 35.5x my normalized earnings of $1.43. This is quite overvalued, relative to Consumer Staples sector which trades at 21x forward earnings.

Conclusion

In conclusion, I would reiterate that investors should sell into the current HPAI-induced price momentum. In fact, the price momentum may have already crested with the stock down sharply following the HPAI report that came out on July 26th. While near-term earnings look robust, Cal-Maine is clearly over-earning and the windfall profits will likely end in the next few quarters.

Be the first to comment