RiverNorthPhotography

Buying great companies when they are trading down in the dumps is generally a good idea for generating outsized returns. In other words, past downturns look like opportunities, while future downturns look like risk. While I wouldn’t recommend going all in at once, I do see now as being an opportune time for layering in capital in tranches into one’s favorite stocks.

This brings me to Bank of New York Mellon (NYSE:BK), which can’t seem to catch a break. BK is now trading well below its 52-week high of $64.63 from as recently as February, as well as below its near term trading range of around $45. This article highlights what makes now a great opportunity to layer into BK, so let’s get started.

Why BK?

BNY Mellon is a global investments company, providing wealth management and investment services to clients in 35 countries and 100+ markets. It’s the largest custody bank in the world, with $43 trillion in assets under custody and/or administration, and has $1.9 trillion in AUM.

BNY’s wide-reaching scale enables it to offer its clients a broader range of investment products. This reflected by the fact that it’s the largest U.S. provider of depositary receipts of international stocks. Having scale in this industry is important, as this enables it to spread costs over a wide asset base, thereby resulting in lower fees.

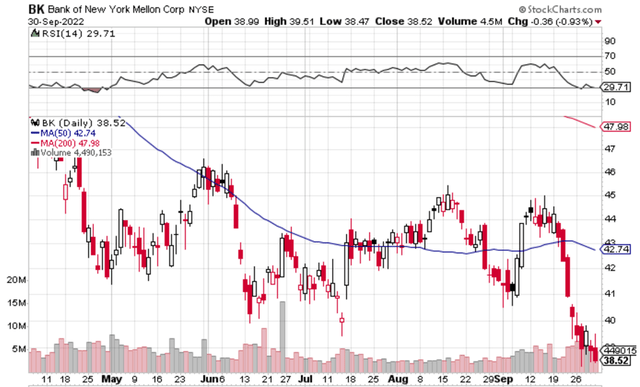

Meanwhile, BK’s stock has fallen precipitously in recent weeks, from being rangebound around the ~$45 mark down to $38.52 at present. BK now trades well below its 200- and 50-day moving averages of $48 and $42.74, respectively, and carries an RSI score of 29.7, indicating that BK is now in oversold territory.

BK Stock Technicals (StockCharts)

Headwinds to BK include global market volatility, which impacts BK’s assets under management. It appears, however, that most of these risks have already been baked into the share price. In some ways, I even see the share price downturn as being an overreaction, considering the fact that BK enjoys a sterling reputation with its clients with a retention rate above 90%. Its ETF servicing business is also doing well, with total funds serviced up 5% year-to-date, and the overall enterprise is generating a strong return on common equity of 21% (19% including the impact of one-time items).

Moreover, unlike pure-play asset managers such as T. Rowe Price (TROW), BK enjoys more steady returns through its investment servicing business that includes corporate trustee and ADRs, giving BK more all-weather appeal. This quality is reflected by Morningstar in its recent analyst report:

BNY Mellon’s investment servicing segment is much more than asset servicing; it offers issuers services that include corporate trustee and depositary receipts such as ADRs. Though it is the largest provider of depositary receipts, BNY Mellon has lost ground to competitors. BNY Mellon’s clearance and collateral management (about 7% of revenue) is unique in that it is the sole provider of tri-party repos for U.S. government securities. Pershing, which BNY acquired in 2003, provides broker/dealer clearing and Registered Investment Advisor custody services and has been a bright spot for BNY Mellon. We expect Pershing to continue to benefit from the secular growth of RIAs.

Meanwhile, BK sports a safe CET1 ratio of 10.0%, and pays a very well covered 3.8% dividend yield with a 32.6% payout ratio. Notably, BK has grown its dividend consecutively for 11 straight years, and has an impressive 5-year dividend CAGR of 11.4%. It’s also worth noting that outside of the 2020 timeframe, BK’s current 3.8% dividend yield at its highest in over 10 years.

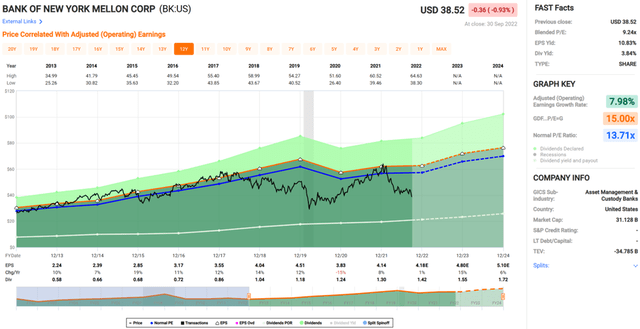

For the reasons above, I view BK as offering compelling value at the current price of $38.52 with a forward PE of just 9.0, sitting well below its normal PE of 13.7 over the past decade. Morningstar has a $56 fair value estimate and sell side analysts have an average price target of $48.91. Using the more conservative of the two estimates, BK could potentially give a one-year 31% total return including dividends.

BK Valuation (FAST Graphs)

Investor Takeaway

BNY Mellon is one of the world’s largest custody banks, with a wide-reaching global scale. Its shares have fallen sharply in recent weeks, but this appears to be an overreaction to global market volatility. BK boasts a strong reputation with clients, a well-covered dividend yield, and a compelling valuation metric. I believe it offers a very attractive risk/reward at the current price for long-term value and income investors.

Be the first to comment