alexsl/iStock via Getty Images

The market recently fell indiscriminately across the board. It brought down practically everything, regardless of the quality of the underlying business.

In a perfectly efficient market, you would expect highly leveraged, cyclical businesses to drop more than the rest, but against all odds, we recently saw some of the highest-quality blue chips drop even more than the rest.

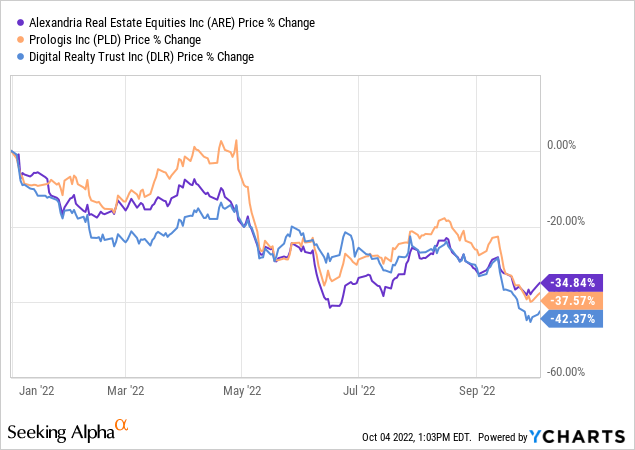

We have seen particularly many such opportunities in the real estate investment trust (“REIT”) sector, which fell more than the rest of the market. It is not uncommon to find blue-chip REITs that are down 30% or even 40% in today’s market. Some examples include Alexandria Real Estate (ARE), Prologis (PLD), and Digital Realty (DLR):

Interestingly, this drop occurred even as rents and dividends kept on rising. The market fears inflation and rising interest rates, but what it appears to ignore is that the inflation actually benefits REITs as it leads to rapidly growing rents, and the rising interest rates aren’t a big issue since most REITs (especially blue-chips) use little debt and have long maturities.

Therefore, we think that now is a great time to accumulate some of those beaten-down, high-yielding blue-chip REITs. Their fundamentals remain strong, and yet they are now priced at historically low valuations and some offer dividend yields in excess of 6%, which is very rare for blue-chip REITs.

In what follows, we highlight two such opportunities that we are buying at High Yield Landlord for our Retirement Portfolio. Unlike our Core Portfolio which seeks to maximize long-term total returns, our Retirement Portfolio is focused on maximizing safe income:

Healthcare Realty

Healthcare Realty Trust Incorporated (HR) is the biggest REIT that focuses on medical office buildings.

Healthcare Realty

Medical office buildings are some of the most defensive properties that exist. Your tenants are physicians. The demand is inelastic. And the rent coverage is typically over 5x, providing significant margin of safety. Even during the early pandemic turmoil, most medical office buildings kept earning steady rent checks.

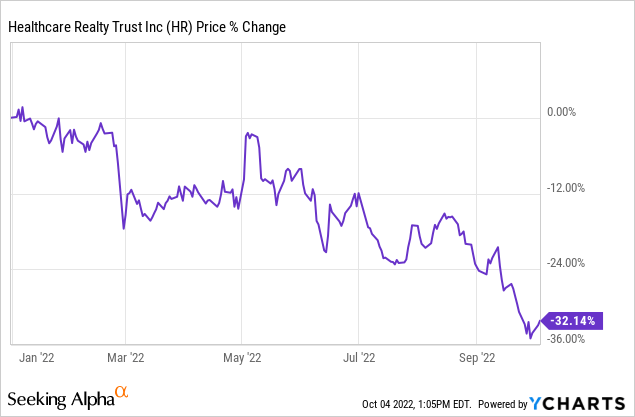

HR specializes in Class A medical office buildings in strong and growing markets, and it pairs this defensive focus with a conservative, investment-grade-rated balance sheet. Therefore, you would expect such a company to be quite resilient to the recent volatility. But against all odds, it has sold off particularly hard:

That’s rather strange when you consider that this is a recession-resistant blue-chip that benefits from inflation and isn’t heavily affected by rising rates.

Why the drop then? I suspect that many investors were quick to sell HR because they didn’t know the company well and weren’t attached to it. HR recently merged with another large medical office REIT called Healthcare Trust of America (“HTA”). The former shareholders of HTA became shareholders of HR but never actually made the decision of buying HR themselves, so their hands were weaker when the market became volatile. The merger also brought some additional complexities, including a special dividend, asset sales, new JVs, etc., and complexity is often punished with higher volatility.

As a result of this sharp selloff, HR now trades at a 6% dividend yield, which is the highest ever since it closed the merger. We think that in the long run, it will be repriced closer to a 4-4.5% dividend yield, which would result in 30-50% upside from here.

But even ignoring this upside, HR is set to deliver double-digit total returns from its yield and growth alone. Most of its leases have 3% annual rent escalations and HR is busy developing more properties to achieve a mid-single-digit funds from operations (“FFO”) per share growth rate.

That’s quite attractive coming from a safe haven in today’s market.

W. P. Carey

W. P. Carey Inc. (WPC) is arguably an even bluer blue chip than HR.

Just like HR, it also owns a defensive portfolio that generates steady and predictable cash flow. But instead of investing in medical office buildings, WPC buys mainly industrial properties and essential retail properties (grocery, home improvement, etc.) that it leases on a triple net basis.

W. P. Carey

W. P. Carey

WPC’s cash flow is extremely consistent because its leases are 10+ years long and its tenants are responsible for all property expenses, including even the maintenance of the properties.

Just like HR, WPC also has a strong investment grade-rated balance sheet with low debt and well-staggered debt maturities.

But here’s why WPC is arguably an even bluer blue chip:

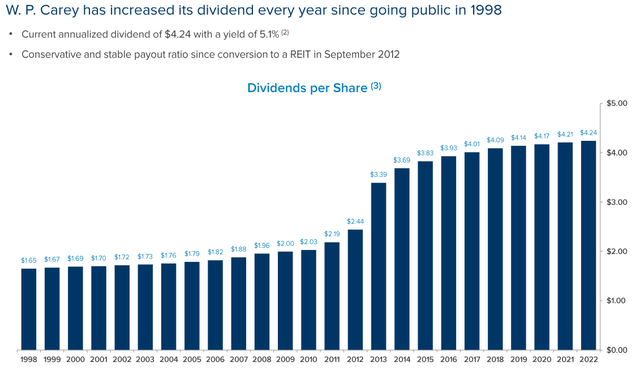

Firstly, it has a 30+ year track record of steady dividend growth:

WPC hiked its dividend even through the dot-com crash, the great financial crisis, and the pandemic. If those crises couldn’t stop WPC’s dividend growth, it surely isn’t this one that will.

I am particularly confident in this because WPC’s growth has actually accelerated in 2022. What the market appears to ignore is that most of WPC’s leases include CPI adjustments, which allow it to hike rents at a faster pace when inflation is high. These rent hikes fall straight to the bottom line since there are no associated expenses. As a reminder, the tenants are responsible for all property expenses and the maintenance of the properties.

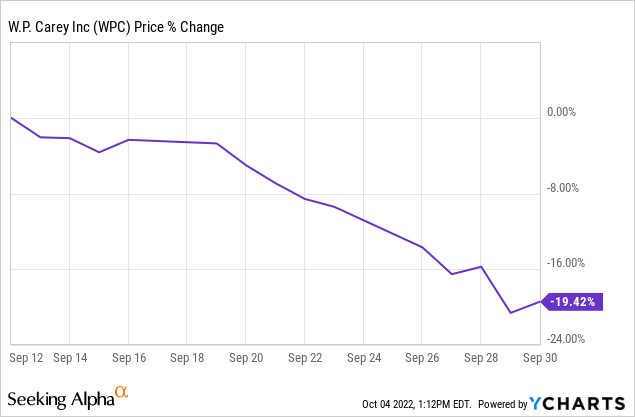

WPC has guided for 7% FFO per share growth in 2022 and despite that, its share price has dropped 20% over the past month:

We think that this dip is an opportunity. WPC now yields ~6%. Historically, it has always paid off to buy WPC when it yielded around 6% and with its growth accelerating, it is hard to see why this time would be any different.

Bottom Line

Our Retirement Portfolio is currently valued at a historically low valuation and offers a 5.5% dividend yield that’s expected to grow at a steady pace, even through a recession.

It has never suffered a dividend cut and each year we see our income rise by investing in blue-chip REITs like HR and WPC.

Be the first to comment