Leon Neal/Getty Images Entertainment

It’s always nice to see when crown jewel types of investments go on sale. While I’m tempted to increase exposure to net lease REITs such as Realty Income Corp. (O), it’s also important to keep diversification in mind. That brings me to Crown Castle (NYSE:CCI), which is a cell tower REIT that enjoys a very stable and growing income stream and attractive growth potential. This article highlights what makes the current dip an ideal buying opportunity on this moat-worthy REIT, so let’s get started.

Why CCI?

Crown Castle, along with peer American Tower (AMT) are the 2 largest cell tower REITs on the market today. CCI owns and operates 40K+ cell towers and 85K+ miles of fiber, supporting fiber solutions and small cells across every major market in the U.S. Its moat-worthy collection of assets connects populations to essential data, technology, and wireless service.

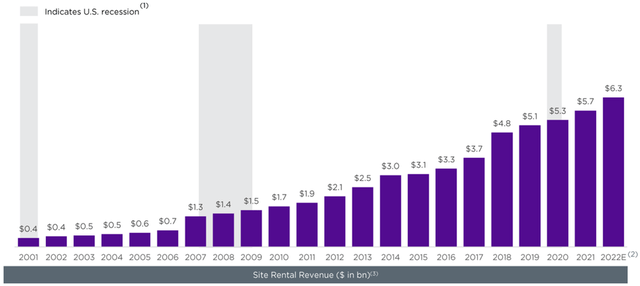

CCI enjoys a very steady and growing revenue stream from its towers, which represent around 70% of revenue. That’s because once a cell tower is in place and leased out, there are high switching costs that disincentivize tenants from leaving. This, combined with the proliferation of mobile devices over the past 2 decades has given CCI site revenue growth every year, including through two recessions. This trend has continued this year, with site rental revenues growing by 10% YoY during the second quarter.

CCI Site Revenue Growth (Investor Presentation)

Moreover, this revenue stream is set to continue growing with the proliferation of mobile devices and 5G deployment from the big wireless carriers AT&T (T), Verizon (VZ), and T-Mobile (TMUS). The large carriers enter long-term contracts with CCI with rent escalators, and CCI enjoys strong operating leverage with existing towers, considering that additional equipment can be added for little incremental cost.

Potential headwinds to CCI include its increasing investments in small cells connected by fiber optic cable, which sees competition from large carriers with their own fiber footprints, and which does not enjoy the same moat-worthy characteristics of CCI’s cell towers. However, I see a future in which small cells and towers complement each other to form a virtuous cycle of investment, with carrier demand leading the way. This notion was highlighted by management during the recent Goldman Sachs (GS) Communacopia Tech Conference held last month:

Densification will require a very different kind of asset than what macro towers existed. Macro towers are tall. They’re very difficult to zone and plan. And so the densification of just macro towers of putting more of them in a small area was not a viable alternative. And so we saw small cells at the place where the carriers would use in order to densify their network as data traffic growth.

So it’s the tower model 2.0. It’s the place where wireless traffic is existing. It needs to be brought into their network. And so it was the logical asset to own. And that’s how we thought about it is, how do we put assets in the places where the wireless carriers are going to need it. And how it’s gone is basically as we expected. We put the assets in following a carrier to a location just like we would either built or build towers.

Verizon says we need we need an asset in a location, we build the asset with the expectation that the other carriers, T-Mobile or an AT&T are going to need it. Same thing has happened on the small cell side. We have followed the carriers. We don’t build any of these on spec. We follow 1 of the major carriers to build the assets where it’s needed. And the expectation is you follow a T-Mobile or an AT&T to a location and you assume the other carriers are going to need it based on data traffic.

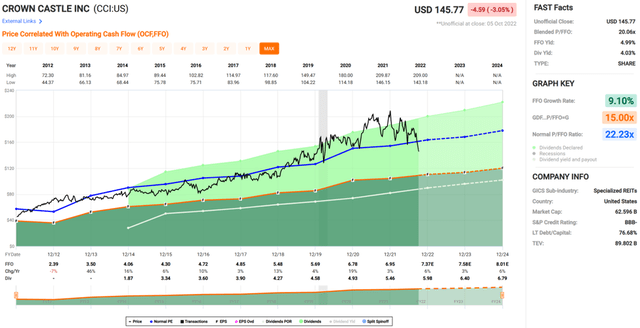

Meanwhile, CCI sports a respectable investment grade BBB- rated balance sheet. The share price weakness has driven CCI’s yield now to 4.0%. The dividend is also well-covered by an 80% AFFO payout ratio (based on management’s guidance for $7.36 AFFO per share this year), and comes with a 5-year CAGR of 9.1%.

Lastly, the recent material drop in CCI’s share from $177 in mid-September to $145.77 at presents a great buy the dip opportunity. While the forward P/FFO of 19.0 doesn’t scream cheap, it does sit below CCI’s normal P/FFO of 22.2. Moreover, I wouldn’t expect CCI’s share price to get abysmally cheap considering its durable income stream. Sell side analysts have a consensus buy rating on CCI with an average price target of $191, which comes to a potential one-year 35% total return including dividends.

Investor Takeaway

CCI has moat-worthy characteristics, strong fundamentals, and a clear growth strategy as the wireless revolution is set to continue. Income investors searching for a fast-growing and well-above average dividend yield would do well to consider Crown Castle after the price drop in recent weeks.

Be the first to comment