gremlin

Thesis

Hyundai Motor Company (OTCPK:HYMTF, OTCPK:HYMLF) is a stock that we believe investors should avoid at the current moment. The company has numerous headwinds which leaves a large degree of uncertainty on the company’s future prospects. Such headwinds include the impact of the electric vehicle (“EV”) tax credit bill on the company’s electrification strategy, as well as the extent of the impact of tightening monetary policy. Furthermore, the current book-based valuation leaves room for further downside, and we believe the risk/reward is not favorable for investors.

Company Overview

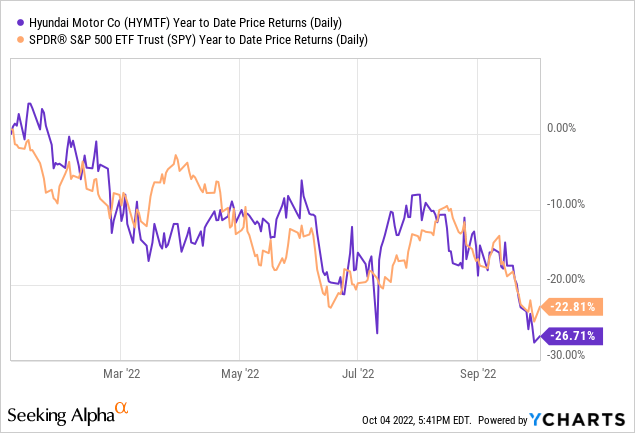

Hyundai Motor Co. is a South Korean auto-manufacturer that owns many subsidiaries such as Hyundai, Kia Motors, and Genesis. Hyundai has a global presence, and competes effectively in major markets around the world. Some of the company’s most popular models include Hyundai Sonata, Elantra, and Genesis G80. Hyundai is the 10th largest manufacturer in the world, and produced 10.9 million cars as of last year. However, by market capitalization, the company’s valuation is the 15th highest in the world, coming behind smaller manufacturers like Rivian and Ferrari with regards to volume. Year-to-date, the company’s stock price performance has tracked closely to the S&P 500 index, as the company returned -26.71% compared to S&P 500’s return of -22.81%.

Many Headwinds

Unfavorable Tax Incentives

It is no secret that the future of the car industry relies on the EV (Electrical Vehicle) market. Hyundai is investing heavily in its electrification strategy and aims to have 7% of the Global EV market by 2030. As part of its electrification strategy, the company is investing heavily in technology, autonomous driving, and working on creating EV models, such as the IONIQ brands and other electrical vehicles within its main Hyundai and Genesis brands. However, the recently passed bill would severely hinder Hyundai’s electrification strategy. Hyundai has more than 5% market share in the large and lucrative car market of the United States. The U.S. is an important market, and the recent passage of the bill would put Hyundai cars at a huge disadvantage as most of it cars would not qualify for the U.S. EV tax credit program amounting to $7,500. Given the importance of the EV market in the future growth of Hyundai’s plans, such legislation would be detrimental to Hyundai’s competitive position in the U.S. and, to a degree, at an international level, as it would impact the company’s overall EV market share.

Currency Pressures

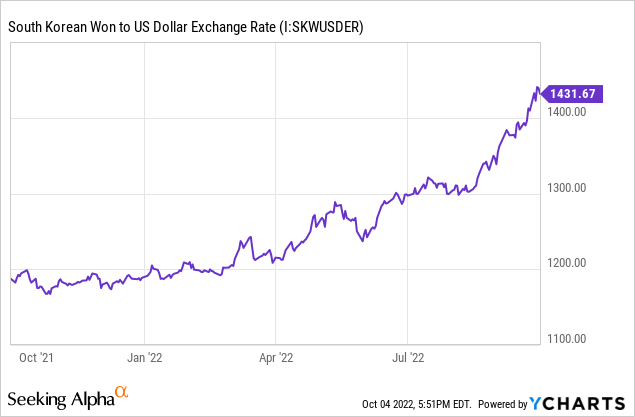

The South Korean Won to USD has seen a tremendous weakening of the won similar to other non-USD currencies as the dollar strengthens from the tighter monetary policy. The South Korean won has weakened more than 20% in the past year, and there are concerns about the impact of such quick currency movement on Hyundai’s financial prospects. We do agree that a weaker currency should be advantageous for price competitiveness abroad in comparison to U.S. competitors. However, in contrast, there’s considerable dollar-denominated bonds that should create higher pressures in local currency. Furthermore, earlier this year (when USD:KRW currency hovered at ~1200), Hyundai made commitments to invest $10 billion in the U.S. by 2025. That’s a huge investment in a span of 3 years, and the weakening currency may create major financial pressures for the company’s operations.

Economic Slowdown

Furthermore, the recent market volatility and the hawkish Federal Reserve raises the risk of a major recession that could further impact Hyundai’s business. Though the company’s cars are generally on the more affordable range with the exception of the Genesis brand, we believe that car demand can be significantly impacted by a slowdown in U.S. consumption and rising auto loan rates. Already, we are seeing used car prices fall, and if the Federal Reserve continues to raise rates or the economy enters a major recession, Hyundai would be meaningfully impacted by the slowdown.

Valuation

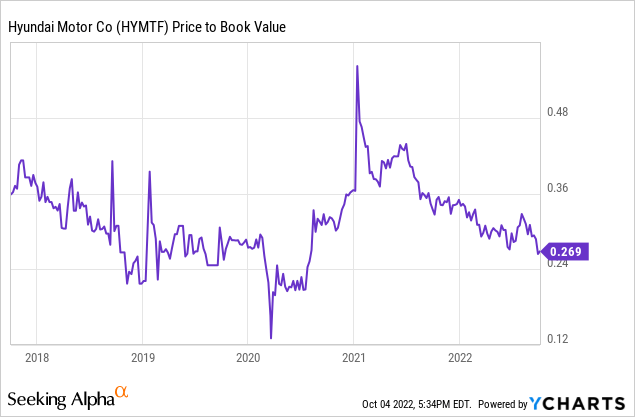

Hyundai Motor is trading at ~0.27 Price-to-Book (P/B) ratio, which is in line with the five year average of the company’s P/B ratio. However, the company’s valuation is more than twice the valuation lows of early 2020, which presents further downside risk. We believe that the numerous headwinds will continue to pressure the P/B ratio, and we expect the valuation to continue down further from this level, even as low as the 0.12 P/B ratio we last saw in 2020.

Upside Risk

We believe that upside risks are tied mainly to macroeconomic conditions that would alleviate some of the headwinds described in the article. The lowering of interest rates and/or the avoidance of a recession would likely help normalize currency levels and allow for strong demand for Hyundai cars. Furthermore, recently there has been a bill proposed to allow the EV tax credit to apply to vehicles made by Hyundai. Though the chances of passage seem low given the upcoming midterms, we believe that any further developments on this bill or policies that allow Hyundai to compete more effectively could serve as meaningful upside catalysts for the stock.

Conclusion

Hyundai is seeing numerous headwinds from the macroeconomic front along with developments in U.S. policies. Regardless of Hyundai’s size and past business performance, the future of the company is cloudy as the industry begins to compete fiercely for dominance in the EV market. As a result, we believe that the current valuation multiple may have further downside, and therefore we recommend a “Sell” on the stock.

Be the first to comment