marekuliasz

Previously we promised to “share extracts from our weekly reviews.” This article is part of that effort, and this is taken from an analysis originally published for Wheel of Fortune’s subscribers on Nov. 22.

——————————————————————————–

Mirror, Mirror On The Wall (Street), Who Is The Most Anticipated (Recession) Of Them All?

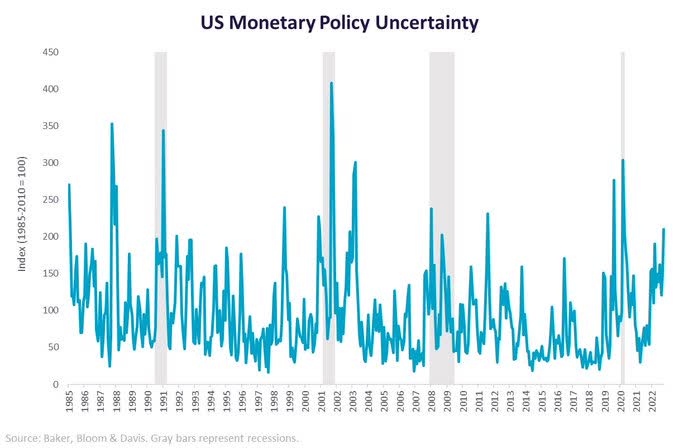

U.S. monetary policy uncertainty is at its highest level since March 2020 (COVID lockdowns) and August 2019 (first 10-2 U.S. Treasury yield curve inversion in years).

A rise in uncertainty level doesn’t necessarily mean/lead to recession, but the two have been highly correlated in the past.

Baker, Bloom & Davis

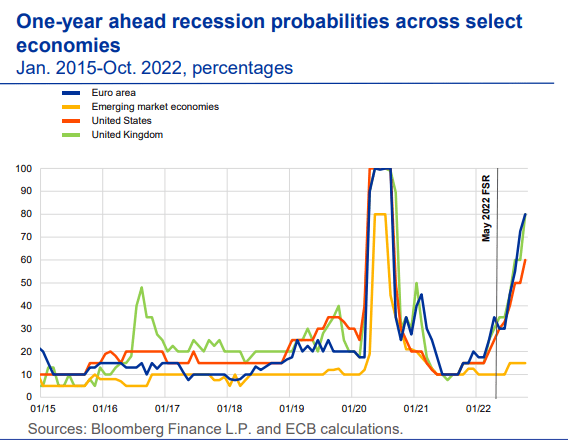

One-year ahead recession chances are surging for the U.S., UK, and EU.

Emerging market economies, on the other hand, are thought to be more resilient in the year ahead.

Bloomberg

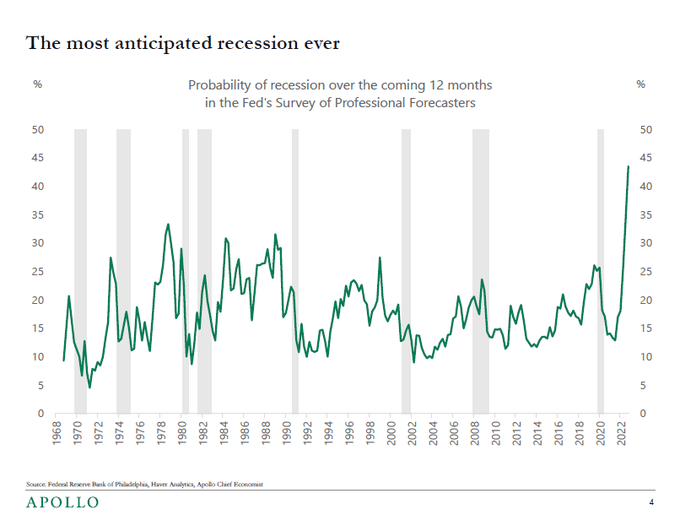

If a recession is upon us next year, it will go down in history as the most widely predicted one ever…

Apollo

I mean, for god’s sake – even Elon Musk is entering a personal (wealth) type of recession!…

Be Careful What You Wish For

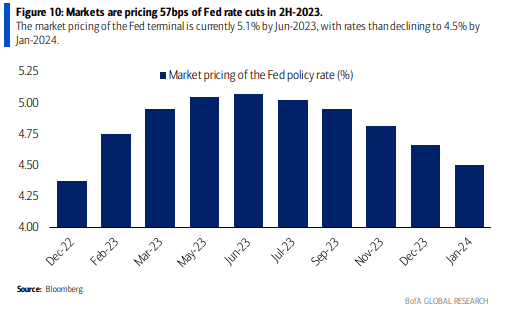

Investors are expecting the Fed to cut rates by 0.57% in the second half of 2023.

I can’t help myself wondering whether this isn’t too much and/or too fast?…

If religion is the “opium of the people,” (expectations for Fed’s) rate ruts surely are the opium of investors.

BofA Global Research

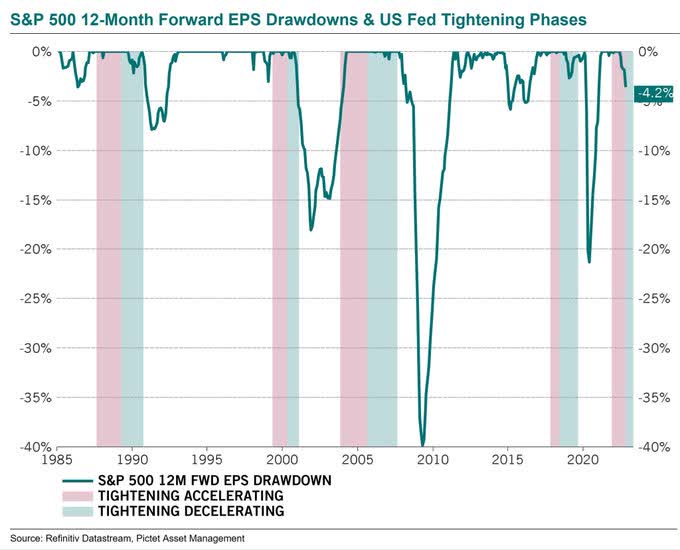

For those who hope for (let alone believe in) a fairly speedy “Pivot,” let us say: be careful what you wish for!

Central banks usually pivot because things are bad, very bad, and if this is the case (who said “recession”?) earnings will collapse in such a significant way that a Pivot would feel like taking Paracetamol in an attempt to treat terminal illness.

Refinitic

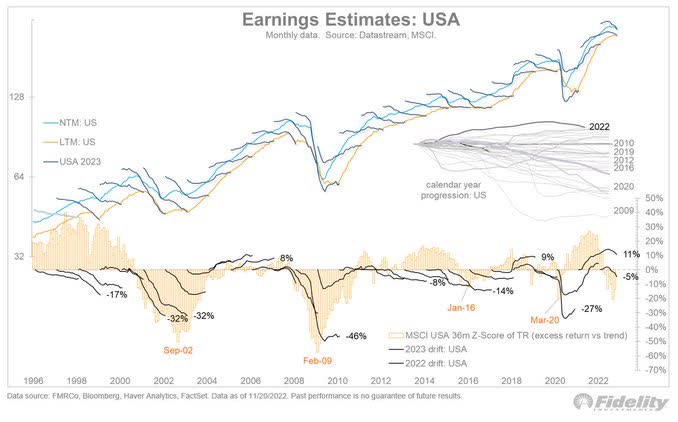

If recession comes, how will it affect earnings?

How much of that is already discounted by the 35% drawdown in the forward P/E multiple?

The stock market continues to trade above its rate-driven fair value (17x vs 15x), while the E in the P/E is at risk.

That’s anything but a bullish picture.

Fidelity

History lesson:

In 2001, the Fed cut rates by nearly 5% over the course of a single year.

That’s what a true Pivot looks like.

Here are some sample returns from 2001:

- S&P 500: -11%

- DXY (US Dollar against a basket of main currencies): +7%

- Gold: +1%

- Bonds: +8%.

If the Fed pivots because things are getting too bad, that’s no good reason to be long stocks and/or short USD.

Be Careful What You Invest In

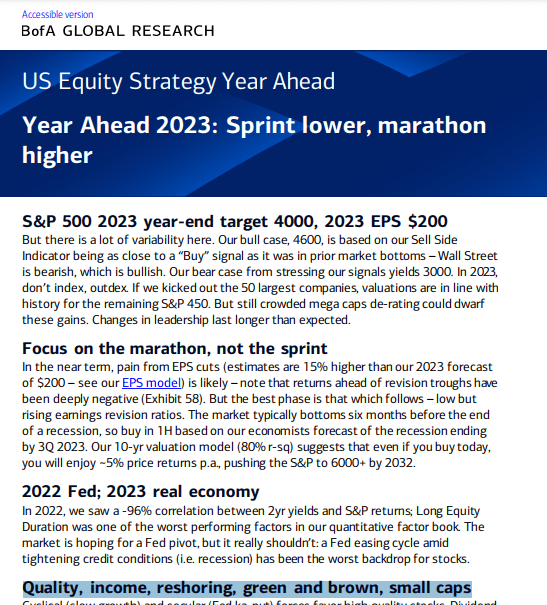

Bank of America:

- S&P 500 2023 year-end target: 4000

- 2023 EPS forecast: $200

- i.e., SPX P/E multiple of 20x >>> anything but cheap.

BofA Global Research

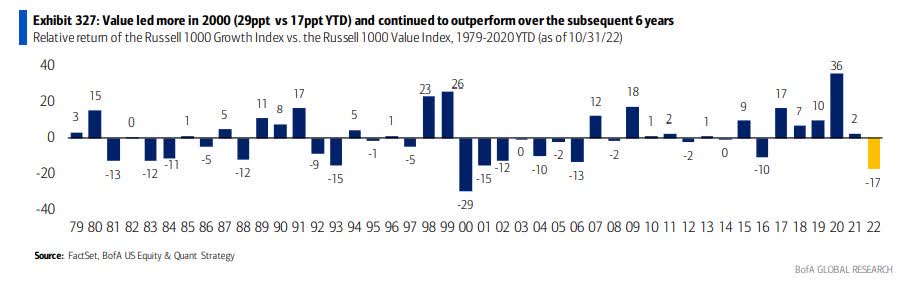

2022 marks the best year for Value investing vs. Growth investing since the technology bubble burst of 2000.

[Take a moment to think about this and what were the background and implications back then that we should keep in mind and adopt nowadays.]

BofA Global Research

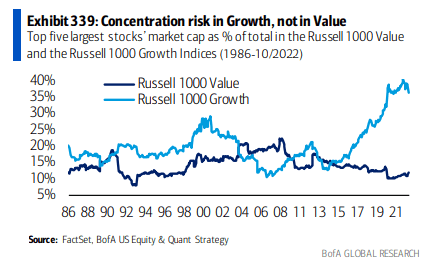

Furthermore, the total market-cap of the top-5 largest stocks is far greater (percentage wise) in the Russell 1000 Growth Index than in the Russell 1000 Value Index.

Growth indices are way more concentrated than Value indices.

BofA Global Research

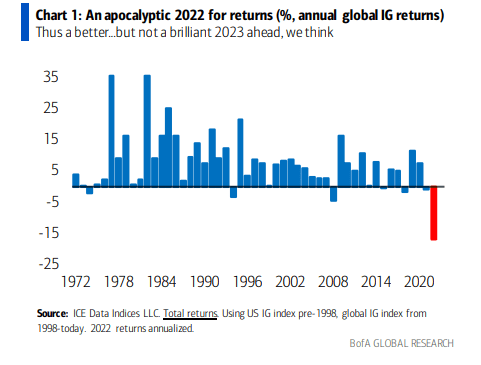

2022 is/was an extremely (and rarely) bad year for corporate bonds, even (shall I say especially?) for the safest ones.

There’s no such thing in investing, however, if history is any guide, 2023 “musts” look/perform a lot better.

BofA Global Research

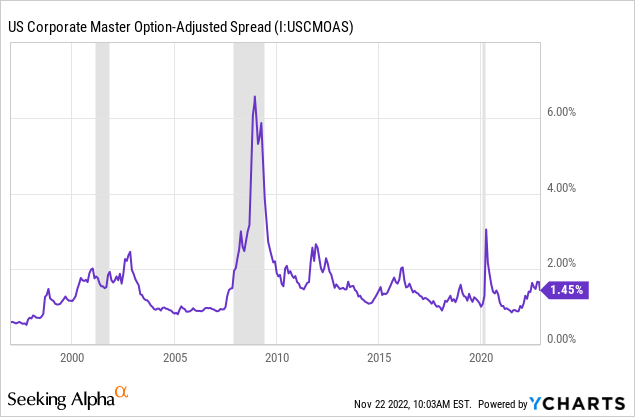

But be careful out there folks!

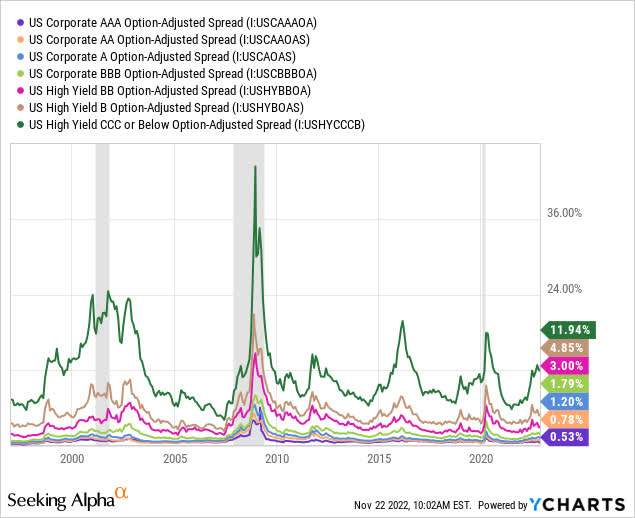

Bond spreads are still nowhere near panic/recession levels.

That can be seen on an aggregate (all inclusive) level:

Y-Charts

And it can be seen on an a per-rating (risk adjusted) level:

YCharts

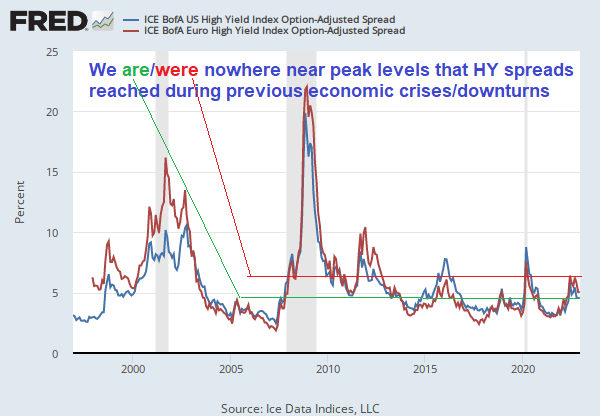

To wit, from a recent article covering bonds:

We’re principally bullish on the entire credit market, particularly high-grade, long duration, bonds.

Nonetheless, we’re not yet anywhere as bullish on high-yield debts because we believe that spreads are nowhere near appropriate levels vs. the risks we see.

Bloomberg

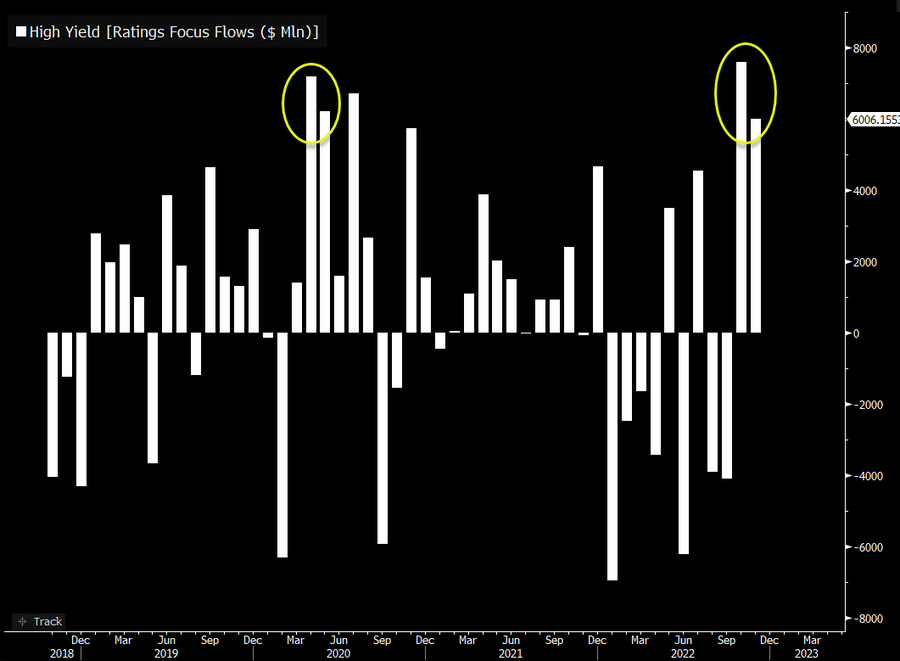

Junk Bond Buying Frenzy

Moreover, there’s currently a quite-mad buying frenzy for junk bond exchange-traded funds (“ETFs”), with no less than $14B (!) flowing into those during the past two months alone.

[For context, it’s about the same flow intensity that was witnessed shortly after March 2020 when everybody and their mother were front-running the Fed’s bond-buying upcoming inflows.]

Bloomberg

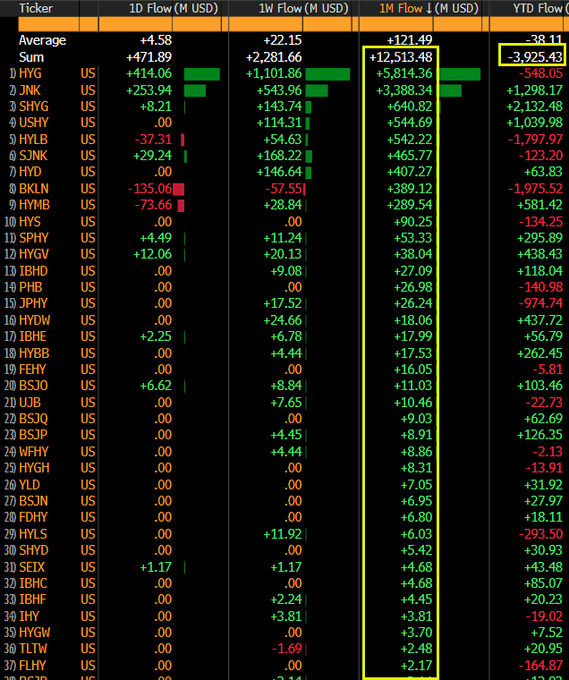

But there’s more to this.

Here is a list of 47 junk bond ETFs and how much new money they’ve absorbed over the past month.

No matter what’s the exact strategy/model these ETFs are using – they’ve all benefited from inflows. Not a single fund has been seeing red (an outflow)!

Interestingly, and despite the $12B inflow of the past month, these ETFs are still counting -$4B of outflows YTD. Still, we’re definitely witnessing a significant trend and momentum reversal.

Bloomberg

All that is left for us is to wait and see whether this isn’t too much and too fast, another attempt to front-running a Pivot that may come later than those who already buy these junk bond ETFs are expecting.

Unlike March 2020, there’s no sign yet from Powell that he is anywhere near folding. If anything, he keeps saying that he intends to play an “all-in” hand, all the way until he beats inflation.

There’s no better evidence than this how investors are already betting that the worst (monetary policy/tightening wise) is over.

We can accept that the worst (=most of the damage) is over but it doesn’t mean that we may not get more rate hikes than are currently priced in.

Furthermore, even if Fed Funds peak around 5% (as widely anticipated), can we say that the worst is over for the US economy? We surely can’t!

And if we can’t say that the worst is over for the U.S. economy, we surely can’t say that the worst is over for HY spreads!!!

Fred, Author

It’s Bad As Is, But It Could & Should Get Worse

Many people incorrectly assume that all bonds are born equal.

That’s completely false.

Bonds differ from each other on many aspects: Credit rating, tenor/duration, coupon types (fixed, floating, reset), inflation protected, early redemption/call dates, etc.

While high-grade credits offer value already, high-yield don’t look attractive as of yet, even though we’re witnessing one of the most extreme drawdowns.

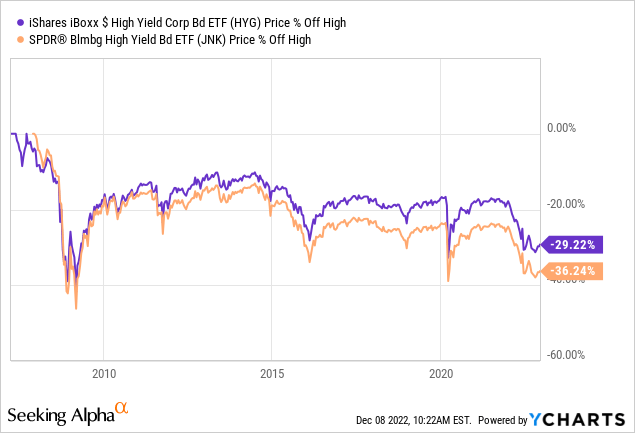

Looking at the two leading HY bond ETFs, iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA:HYG) and SPDR Bloomberg Barclays High Yield Bond ETF (NYSEARCA:JNK), we can clearly see that this year’s collapse is as bad as previous drawdowns; only the GFC (Global Financial Crisis) of 2008/9 is still overshadowing the GFC of 2022.

Y-Charts

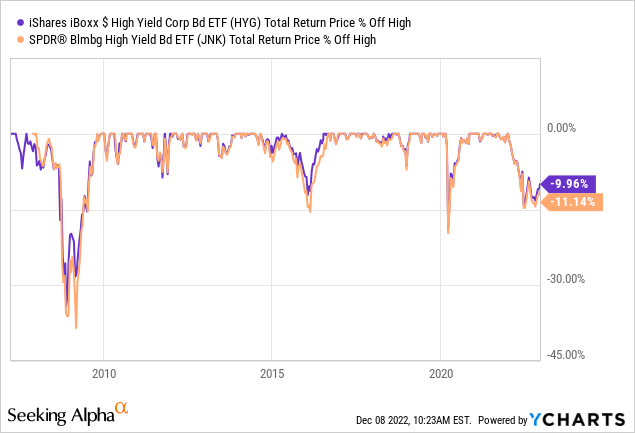

Having said that, on a total return basis things look better, thanks to the compound (interest) element. Putting it differently, the accrued and paid coupons are compensating, over time, for the sharp decline in prices.

On one hand, that’s the beauty of holding bonds: things tend to smoothen out over time. The longer the tenor – the more coupons are reaching the investor’s pocket.

On the other hand, with nominal yields rising so much and with the level of risk being so high – there’s no way to justify tight/er spreads as we see across HY credits.

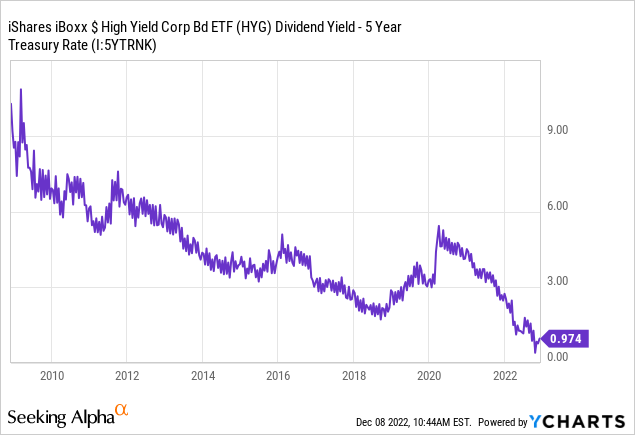

Below you can see how tight is the spread between HYG’s dividend yield to the 5-year U.S. Treasury Yield. As a matter of fact, it’s nearly as tight as it has ever been over the past 14 years.

In more simple words, the risk premium of HY credit compared to the benchmark U.S. treasuries is too low, both relative to the current high level of risk and also in absolute terms when we look back at historical data.

Something’s gotta give and we believe that HY spreads are destined to widen from here. This, in turn, means that it’s not yet time to buy bond ETFs such as HYG and/or JNK.

We believe that better entry prices/points are waiting for patient investors in 2023.

Be the first to comment