designer491/iStock via Getty Images

The VanEck High Yield Muni ETF (BATS:HYD) is a high-yield municipal bond index ETF. HYD offers investors an above-average, tax-exempt 3.9% dividend yield, the prospect of moderate dividend growth due to rising interest rates, and some potential capital gains as interest rates stabilize. The fund is a buy, and particularly appropriate for income investors and retirees.

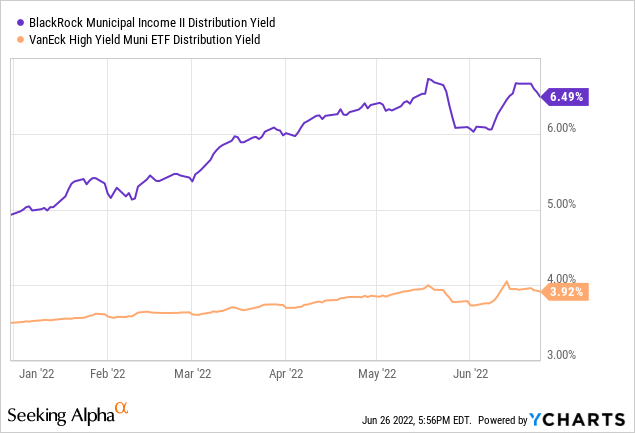

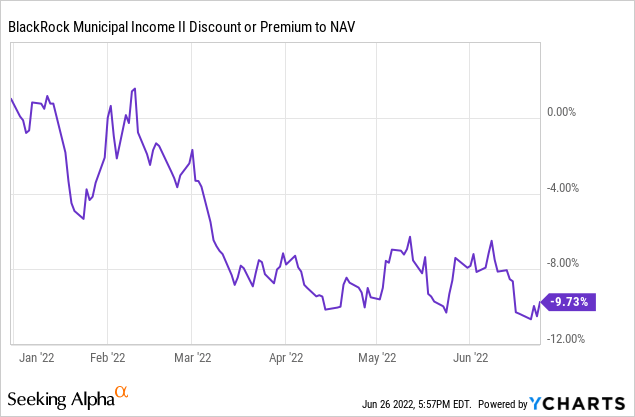

On the other hand, there are several municipal bond CEFs with stronger yields, returns, and overall value propositions. BlackRock has over a dozen of these, most of which are fantastic investment. Of these, the BlackRock Municipal Income Trust II (BLE) currently trades with the largest discount, of 9.7%, and yields 6.5%, quite a bit more than HYD. HYD is fine, but BLE and its peers are better.

HYD – Basics

- Investment Manager: VanEck

- Underlying Index: ICE U.S. High Yield Crossover Municipal Bond Index

- Expense Ratio: 0.35%

- Dividend Yield: 3.92%

- Total Returns CAGR 10Y: 3.14%

HYD – Overview

HYD is a high-yield municipal bond index ETF, administered by VanEck. HYD recently switched its index provider, and will be tracking the ICE U.S. High Yield Crossover Municipal Bond Index in the following months. Said switch should not significantly impact the fund, its characteristics or performance, although there will almost certainly be some transaction costs involved in the transition.

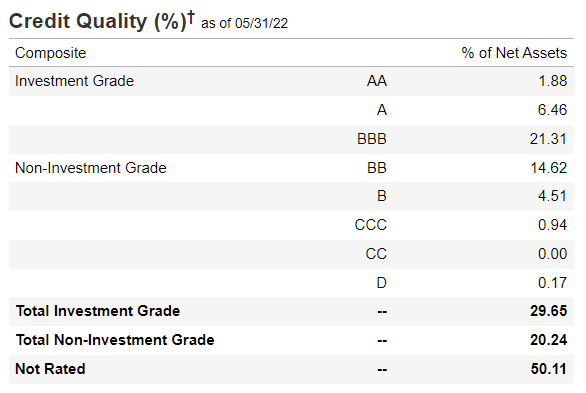

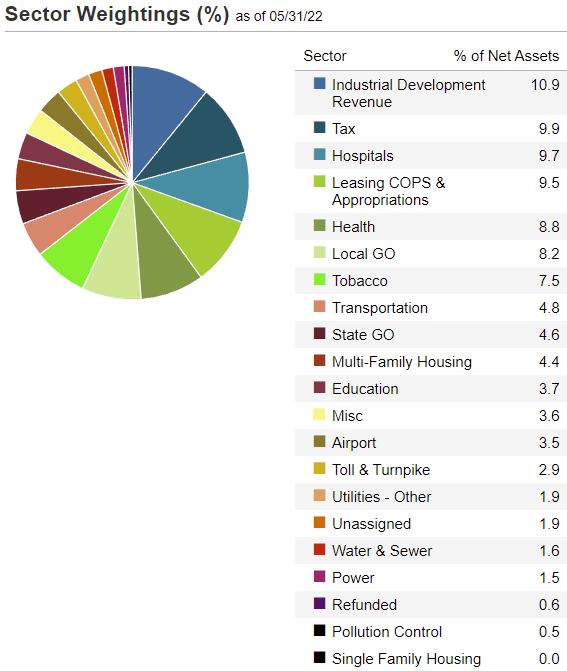

HYD’s index is quite simple, and includes all dollar-denominated, tax-exempt, municipal bonds in the market, subject to a basic set of liquidity, size, and maturity criteria. Credit rating weights are explicitly targeted by the index, as follows.

- 5% A rated securities

- 25% BBB rated securities

- 70% non-investment grade / unrated securities

As can be seen above, HYD’s underlying index focuses on non-investment grade securities, but has sizable investments in investment-grade securities as well. HYD’s actual credit ratings are quite close to the above, as expected. Widening credit spreads have caused the investment-grade portion of the fund’s holdings to temporarily increase, but only slightly.

HYD Corporate Website

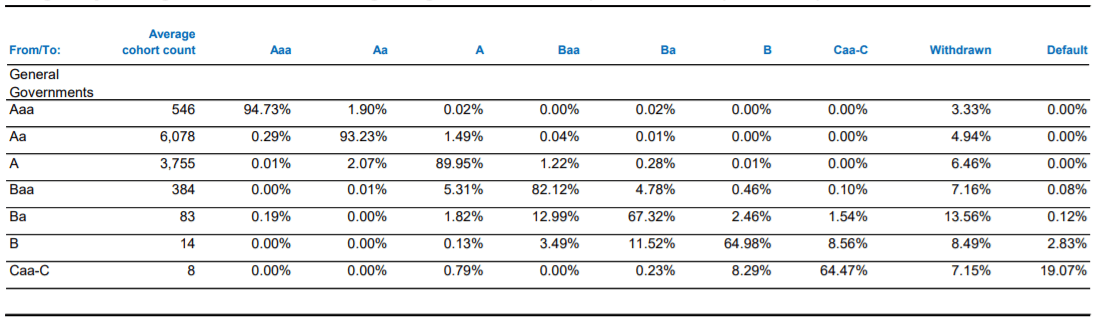

In general terms, municipal bonds have very low credit risk, as default rates for these securities are exceedingly low. HYD focuses on non-investment grade securities, issued by comparatively weak municipal entities, so default rates are somewhat higher than average, but still low on an absolute basis. As per Moody’s, default rates for non-investment grade bonds average around 0.10% per year, an extremely low, effectively zero, figure. Defaults do increase during downturns and recessions, but not significantly so. As per Lord Abbett, default rates increased to around 0.16% in 2020, during the onset of the coronavirus pandemic, a small increase, all things considered.

Moody’s

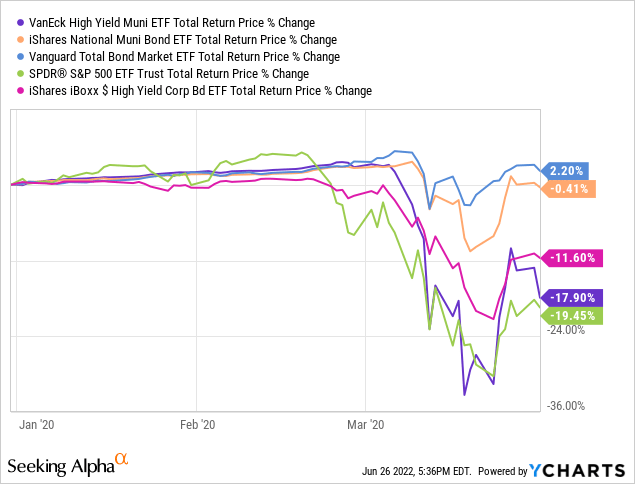

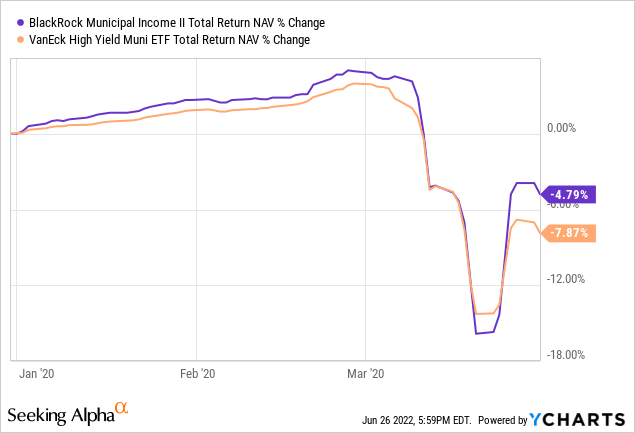

As should be clear from the above, HYD’s holdings are of reasonably good quality, if a bit worse than average for a municipal bond fund. HYD’s holdings should suffer comparatively low losses during downturns and recessions, but this has not been the case in the past. As an example, the fund suffered losses of around 17.9% during 1Q2020, the onset of the coronavirus pandemic. These were massive losses, and significantly greater than those experienced by broad-based bond index ETFs, municipal bond index ETFs, and high-yield corporate bond index ETFs, although slightly lower than S&P 500 losses.

In my opinion, HYD’s losses during the above did not accurately reflect the fund’s level of risk. HYD’s holdings are not that risky, notwithstanding the above. Still, the market does seem to consider the fund’s underlying holdings to be quite risky, an important fact for investors to consider.

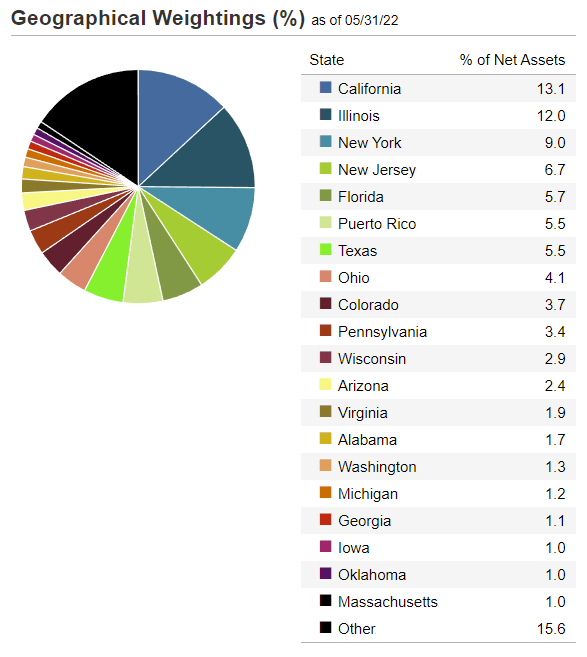

Finally, HYD’s holdings are well-diversified across issuers, industries, and states. Diversification reduces risk and volatility, and is a benefit for shareholders.

HYD Corporate Website

HYD Corporate Website

Besides the above, nothing else stands out about the fund’s or its holdings. It is a high-yield municipal bond index ETF, with the holdings and characteristics one would expect from a fund of its type.

HYD – Investment Thesis

HYD’s investment thesis is quite simple, and rests on the fund’s above-average, tax-exempt 3.9% yield, prospective dividend growth, and potential capital gains. Let’s have a closer look at each of these points.

Above-Average Tax-Exempt Yield

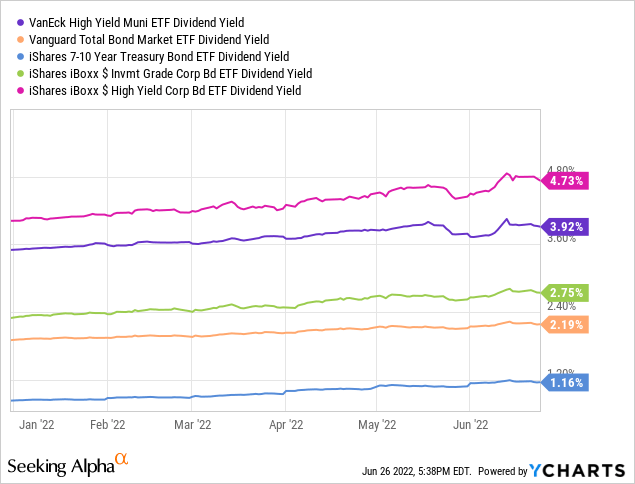

HYD currently yields 3.9%. Although the yield is not particularly strong on an absolute basis, it is somewhat higher than average for a broad-based bond fund, including those focused on municipal bonds. High-yield corporate bond funds do yield somewhat more, in the 4.5% – 5.5% range.

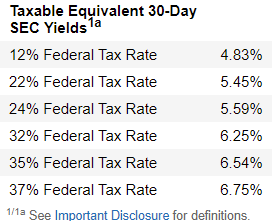

HYD’s dividend does have one key benefit relative to its peers: its tax-exempt status. Most dividends are taxable, HYD’s dividends are not, a benefit for the fund and its shareholders. The magnitude and relevance of these savings is dependent on the type of investment account used to invest (401k, personal investment portfolio, etc.), and on an investor’s tax-bracket. For some investors, these tax savings will be significant, for others, irrelevant. Readers should consider their own personal circumstances before investing in HYD, or other municipal bond funds. HYD provides investors with a simple graph that calculates the fund’s taxable equivalent yield, based on an relevant federal tax rates. As an example, for investors with a federal tax rate, HYD’s yield is equivalent to a 4.83% taxable yield, quite a bit higher than the fund’s headline 3.9% number, due to the aforementioned tax benefits.

I’ve included the graph below, which might be of interest and use to readers and prospective investors.

HYD Corporate Website

Prospective Dividend Growth

HYD is a bond fund, so dividends are ultimately dependent on prevailing interest rates. Interest rates are increasing across the board, as the Federal Reserve hikes rates to combat skyrocketing inflation. Higher interest rates should ultimately result in greater income for the fund, and higher dividends / dividend growth for shareholders.

As per the fund’s management team, and per my own calculations, the fund’s underlying holdings have yield to maturity / weighted average interest rate of around 4.8%, quite a bit higher than the fund’s current 3.9% dividend yield. With very few exceptions, ETFs distribute any and all income generated to shareholders as dividends, so the fund’s dividends should see some growth in the coming months, until the fund’s yield (roughly) reaches 5.1%. On a more negative note, it generally takes months for higher interest rate payments on a fund’s bond portfolio to translate into higher dividends for shareholders, and growth can be uneven. HYD’s dividends should see some growth in the coming months, but there are no guarantees that growth will come quickly.

Potential Capital Gains

Bond prices have tumbled in the past few months, as higher interest rates and bearish market sentiment reduce demand for currently existing, low-yield bonds. Importantly, bonds must be repaid in full at maturity, even when bond prices decrease, which means some capital gains when bonds mature. As per my calculations, potential capital gains are in the 6% – 8% range till maturity, or less than 1% per year assuming maturities are evenly spaced out through time. These are relatively small potential capital gains, but gains are gains, and a potential benefit for shareholders regardless.

Quick MYI Comparison

HYD’s above-average, tax-exempt 3.9% dividend yield, and moderate potential dividend growth and capital gains make the fund a reasonable investment opportunity. On the other hand, I think there are several municipal bond CEFs out there with stronger yields, returns, and overall value propositions. BlackRock has a suite of these, of which BLE is looking particularly attractive under current market conditions.

BLE’s 6.5% distribution yield is quite a bit higher than HYD’s 3.9% yield. BLE yields a bit more due to leverage, and due to focusing on higher-yielding securities.

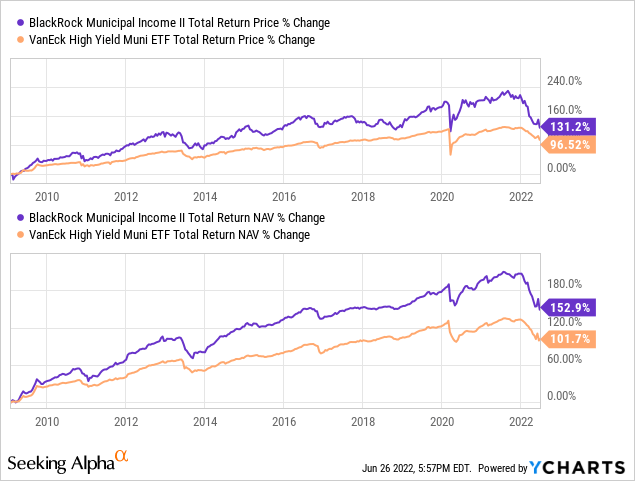

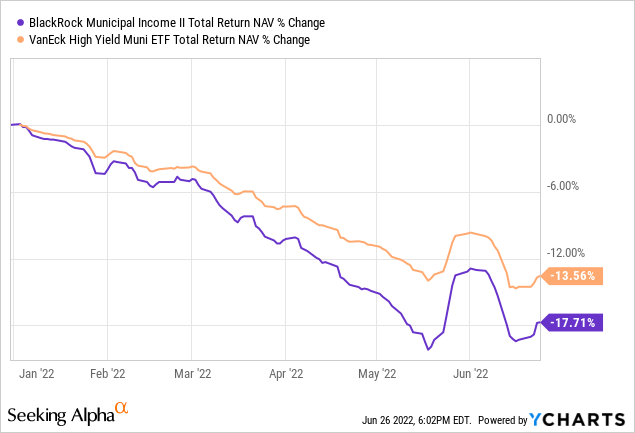

BLE’s higher distribution yield has led to stronger total shareholder returns since inception compared to HYD, on both a NAV and price basis.

BLE’s higher distribution yield, total shareholder returns, and discount to NAV, make the fund a broadly superior investment opportunity relative to HYD.

Conclusion

HYD offers investors an above-average, tax-exempt 3.9% dividend yield, and moderate potential dividend growth and capital gains. In my opinion, although the fund is a reasonably good investment opportunity, there are several better opportunities out there, including BLE.

Be the first to comment