Fritz Jorgensen/iStock Editorial via Getty Images

By Brian Nelson, CFA

Meta Platforms’ (NASDAQ:META) equity is trading at ~$170 per share, implying a price-to-forward earnings multiple on 2023 consensus earnings expectations of ~12.3x, according to data from Yahoo Finance. The company hauled in over $39 billion in free cash flow during 2021, and it ended the year with an incredible net cash position of nearly $48 billion, excluding equity investments. It has been a very, very long time that we’ve seen a business that is still growing rapidly, trade at ~12.3x next year’s earnings while throwing off tens of billions in free cash flow as it holds a huge net cash position on the balance sheet to use to buy back stock. We think Meta Platforms’ shares represent the bargain of the century, and we’re not kidding.

Meta Platforms’ properties continue to attract consumers, and while Apple’s (AAPL) iOS security changes have generated headwinds for the company, we think Facebook will find a way to continue to deliver acceptable ROI on advertising for businesses. We also don’t think anti-trust issues will rear their ugly head in a meaningful way again, as Meta continues to face competition from the likes of Snapchat (SNAP), Twitter (TWTR), and newcomer TikTok. Even if the Department of Justice decides that Meta Platforms should be broken up, we think the sum of the parts of its properties is worth substantially more than where shares are trading at. Counterintuitively, anti-trust concerns may be a positive for shareholders.

CEO Mark Zuckerberg is focusing Meta Platforms for the long haul, and while building the metaverse will absorb a significant amount of capital, both on the expense line (income statement) and with respect to capital expenditures (cash flow statement), the market has gone overboard in punishing shares, in our view. Even after capturing significant expense increases during the next five years and significant capital spending build during the next five years in our discounted cash flow model, our fair value estimate for Meta stands at ~$367, more than double the last closing price for shares. More than double! Further, our fair value estimate doesn’t consider any meaningful revenue or earnings related to the metaverse, just the costs to build it out–so we’re being extremely conservative in our valuation.

The market may not be reasonable by any stretch to have punished shares of Meta so badly. Whether one is bullish or bearish on the metaverse may not matter either, as for practical purposes, our valuation only considers the massive expected costs and capital spending related to its build. But perhaps even our $367 per share fair value estimate is conservative, as by most estimates, one of the most popular technology gifts over the holidays was Meta’s virtual reality headset. Clearly, Zuckerberg is on to something with the metaverse, and perhaps something big — and we’re giving him zero credit for the metaverse in our model, and shares of Meta still come out significantly undervalued on the basis of our discounted cash flow process. You can download our 16-page stock report on Meta Platforms here (pdf).

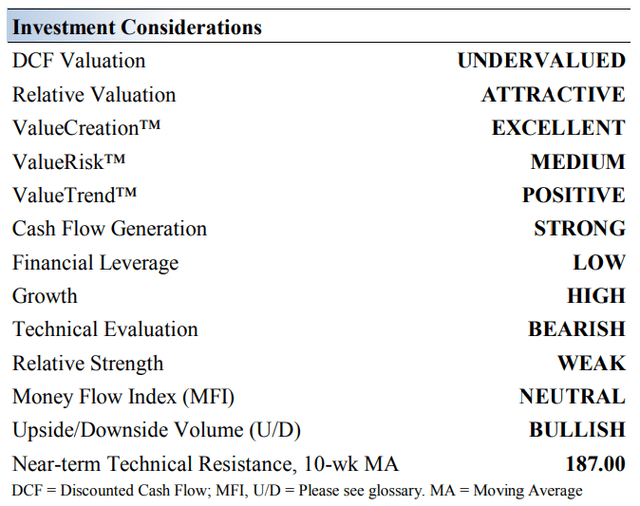

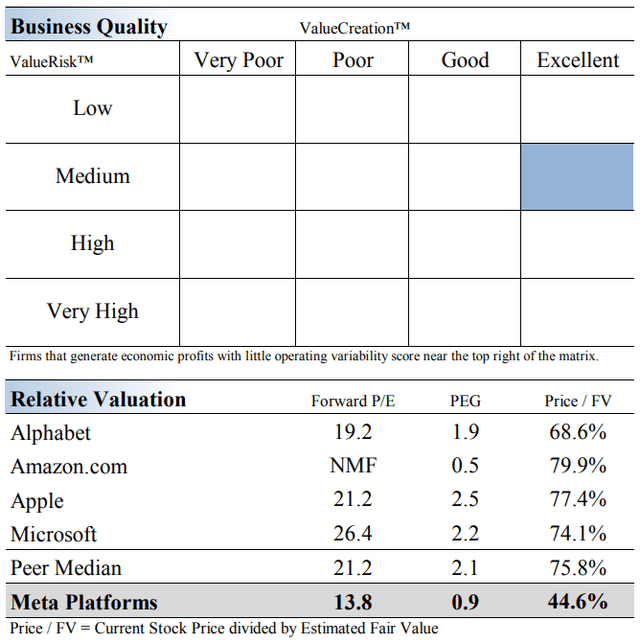

Meta Platforms’ Key Investment Considerations

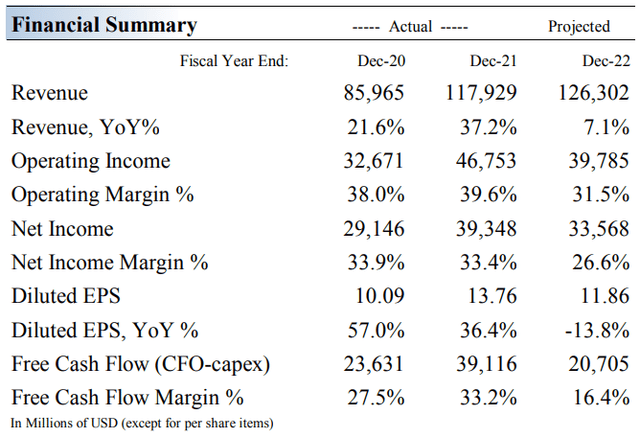

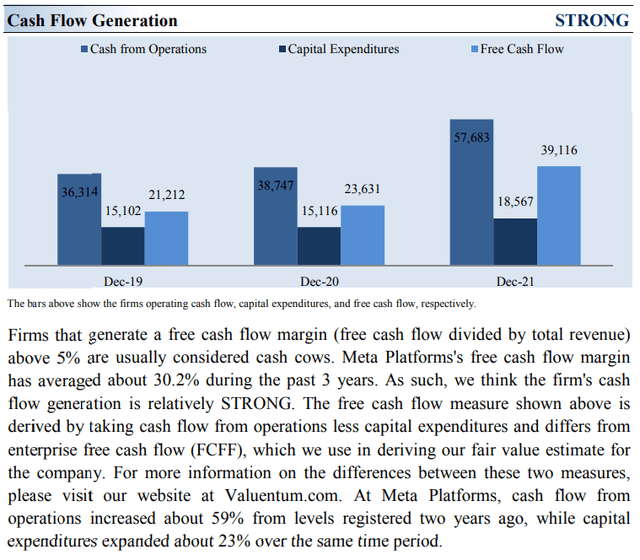

Image Source: Valuentum. The key investment considerations we look at with respect to Meta Platforms. (Image Source: Valuentum) Image Source: Valuentum. Meta Platforms is trading at less than 14x this year’s earnings, and about 12.3x next year’s earnings. Shares are extremely cheap, in our view. (Image Source: Valuentum) Image Source: Valuentum. Meta is a strong free cash flow generator, but free cash flow will face pressure as capital spending increases. Earnings will also face headwinds, but the company is trading well below the average S&P 500 multiple as it continues to grow its top line nicely. (Image Source: Valuentum)

The mission of Meta Platforms, formerly Facebook, is to make the world more connected. People use Facebook to stay in touch with friends/family and to share what matters to them. The company continues to expand with Instagram, Messenger, WhatsApp, and developing the metaverse. Meta reports results in two segments: Family of Apps, and Reality Labs, the latter housing its augmented and virtual reality products. The company was founded in 2004 and is based in California. The firm recently changed its name to Meta Platforms and its ticker to META.

Meta is building out the metaverse, a virtual landscape where users can interact, play games, and conduct a variety of other functions with each other beyond two-dimensional screens. Though investments related to this area will generate headwinds for earnings expansion and free cash flow generation, it remains to be seen whether such investments will pay off. Years ago, however, many doubted Facebook’s business model, even calling its IPO a “faceplant,” so we’re keeping an open mind when it comes to the metaverse, as the company’s Oculus VR app and virtual reality headsets continue to gain traction. Importantly, while we keep an open mind, we’re not building in any revenue or earnings related to the metaverse in our valuation model, just all the costs–so the metaverse with respect to our valuation should be viewed as merely icing on the cake.

Meta’s opportunities and upside potential are vast, and there’s a good chance that in the years to come, Facebook and Instagram may make a push to become “the new Internet.” There may be little reason for Internet users to leave these websites when purchasing items or doing other things on the web. That said, data privacy and security remain paramount, however, and Facebook, in particular, will need to work hard to restore the trust it may have lost with the bad press of yesteryear. As it works to right the ship and build out the metaverse, Meta’s operating margin guidance for the years ahead may not be as strong as it could be due to increased levels of spending in areas such as product development and infrastructure, safety and security, and AR/VR. Again, however, these heightened expenses are captured within our valuation model.

Facebook’s free cash flow generation and balance sheet are amazing, but investors must be cognizant of the low barriers to entry in the social media space and the fickle nature of its users. Recent social and political pressures have impacted public perception, and testifying in Congress has become the norm. During 2021, Meta hauled in over $39 billion in free cash flow, and while we expect the company’s free cash flow generation to fall to ~$21 billion in 2022 due to significantly increased capital-spending expectations, the measure remains robust. At the end of 2021, Meta held a massive net cash position of nearly $48 billion.

Competition is heating up, especially with TikTok, but Meta is working hard to counter this new entrant, namely with respect to Reels. In light of the massive capital that Meta can throw at countering TikTok, we’re not concerned, and Meta’s diversified advertising revenue stream across the likes of Facebook and Instagram, in particular, gives it considerable resiliency as TikTok nips at its heels. Concerns over user growth in Europe and U.S. & Canada regions have cropped up, too, but its advertising business is as strong as ever, in our view. As noted before, Facebook and Instagram may become the “new Internet”, and we expect that e-commerce (Shops) and payments technology could offer huge upside potential at Meta, both in and out of the metaverse.

We expect Meta Platforms to handle adversity with respect to Apple’s iOS changes rather well, and while Alphabet (GOOG) (GOOGL) may be better able to navigate this market environment, we remember a time when investors were extremely skeptical about Meta Platforms’ ability to migrate to mobile advertising. Those worries seem really silly today, and we expect the worries related to Apple’s iOS changes will seem silly at some point down the road, too. Meta is here to stay, and the company remains a free-cash-flow generating, net cash-rich, secular growing powerhouse with tremendous upside optionality.

Meta Platforms’ Economic Profit Analysis

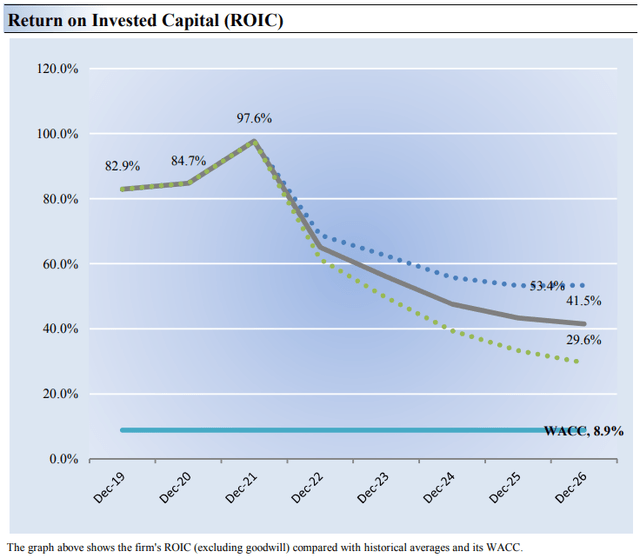

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Meta Platforms’ 3-year historical return on invested capital (without goodwill) is 88.4%, which is above the estimate of its cost of capital of 8.9%.

As such, we assign the firm a ValueCreation™ rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Due to increased investments in the metaverse and related to safety and security on the web, we expect Meta’s economic returns to shrink a bit but remain rather large.

Image Source: Valuentum. We expect Meta to continue to generate value for shareholders, despite major investments in the metaverse. (Image Source: Valuentum)

Meta Platforms’ Cash Flow Valuation Analysis

Image Source: Meta has been a huge free cash flow generator in years past. Going forward, it retains significant free cash flow generating capacity, but such generation will be hindered by massive investments to build out the metaverse. (Image Source: Valuentum)

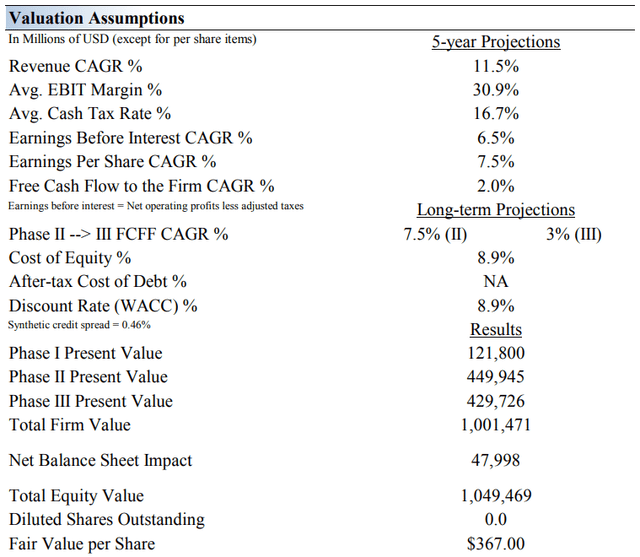

We think Meta Platforms is worth $367 per share with a fair value range of $275-$459. The margin of safety around our fair value estimate is driven by the firm’s MEDIUM ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them. Again, we emphasize that we are only building in increased expenses and higher capital spending with respect to the metaverse, not any revenue or earnings contribution.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. As we show in the duration of value composition, an image that follows, most of Meta’s value is generated in the out-years, well beyond what the company does this quarter or next year, for example. Our model reflects a compound annual revenue growth rate of 11.5% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 28.3%. To reiterate the conservatism in our model, we’re expecting substantially lower revenue growth, and our per-share fair value estimate is still coming out more than double its share price.

Our valuation model reflects a 5-year projected average operating margin of 30.9%, which is below Meta Platforms’ trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 7.5% for the next 15 years and 3% in perpetuity. We think a below-average operating margin is reasonable for a firm that will be increasing expenses materially, and we think free cash flow expansion in the high-single-digits makes a lot of sense following the step-change adjustment of higher capital spending that will occur in the next two years or so at Meta. For Meta Platforms, we use an 8.9% weighted average cost of capital to discount future free cash flows.

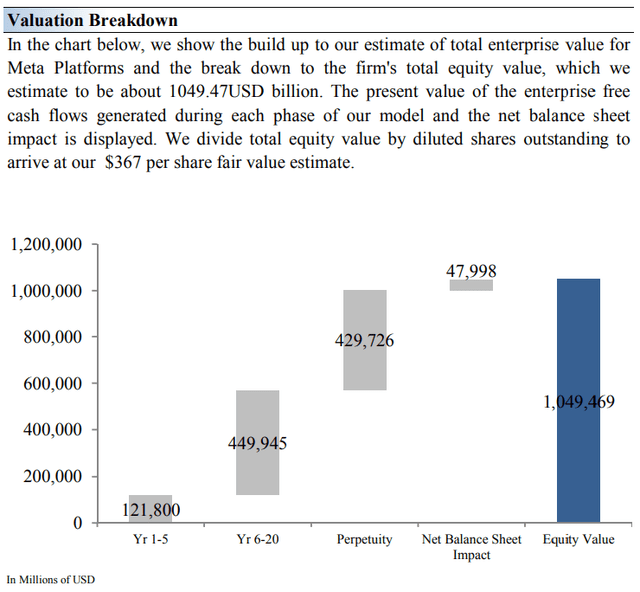

Image Source: Valuentum. The valuation assumptions we use to derive Meta’s fair value estimate. (Image Source: Valuentum) Image Source: Valuentum. The duration of value composition. The value derived beyond the first five years of our valuation model is far more significant than any near-term performance at Meta. (Image Source: Valuentum)

Meta Platforms’ Margin of Safety Analysis

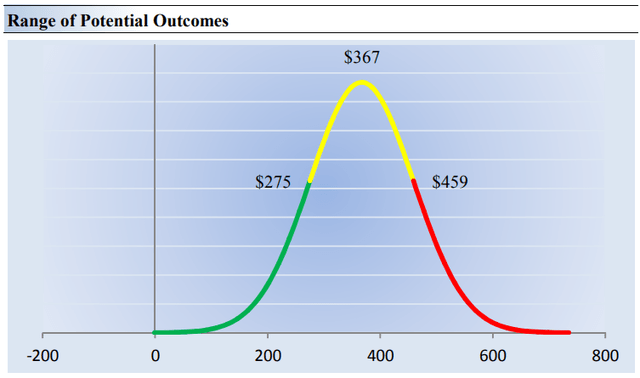

Image Source: Valuentum. The fair value estimate range we ascribe to our valuation of Meta. (Image Source: Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Meta’s fair value at about $367 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

This is an important way to view the markets as an iterative function of future expectations. As future expectations change, so should the company’s value and its stock price. Stock prices are not a function of fixed historical data but rather act in such a way to capture future expectations within the enterprise valuation construct.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Meta Platforms. We think the firm is attractive below $275 per share (the green line), but quite expensive above $459 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

There are a lot of moving parts at Meta Platforms. First, the company is dealing with Apple iOS changes that are complicating its advertising business. Second, anti-trust concerns have served as a huge distraction to management, at the same time it has faced increased competition from the likes of TikTok. Third, the company is taking on a huge investment cycle to build out the metaverse, something of which many are skeptical, much like Facebook’s ability to transition to mobile advertising many years ago.

With all this in the background, we think shares are extremely cheap, trading at ~12x 2023 expected consensus earnings. Meta retains a huge net cash-rich position on the balance sheet, which it can deploy to buy back its undervalued stock. Though earnings growth and free cash flow generation will be impacted by the investment cycle this year, we believe earnings will get back on track come 2023, and our forecasts are still calling for about ~$21 billion in free cash flow for this year.

Meta’s shares are trading well below the low end of our fair value estimate range, as derived by our discounted cash flow process, further supporting our view that the company offers a “bargain of the century,” with or without the metaverse.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment