Main Thesis

The purpose of this article is to evaluate the VanEck Vectors High-Yield Municipal Index ETF (HYD) as an investment option at its current market price. With equity losses rattling investor sentiment right now, I felt it was timely to do an updated review of HYD, which holds high yield muni bonds. This is a sector that has held up well, despite the volatility, and has actually out-performed high yield corporate bonds during the market rout.

Looking ahead, I see continued merit to holding on to muni bonds, whether in below investment grade or investment grade sectors. HYD offers more in terms of yield, but does have some unique risks as it is made up primarily of revenue bonds, with a large portion in the Health Care industry. While defaults for the fund have been low, its top sector is one that often sees the largest number of defaults within the high yield muni space. Despite that risk, HYD should continue to be a relevant equity hedge, especially in the short-term, as economic growth fears will continue to dominate headlines until we get more clarity on coronavirus containment efforts. While high yield munis have seen their yields come under pressure over the past few quarters, HYD’s 4% tax-free income stream will remain in-demand, especially if the Fed cuts its benchmark interest rate in the coming months.

Background

First, a little about HYD. The fund’s objective is to “track the overall performance of the U.S.-dollar-denominated, high-yield, long-term, tax-exempt bond market”. Currently, the fund is trading at $65.62/share and has an annual yield of 3.96%. I covered HYD at the end of last year and although I expressed some of the concerns I had with the high yield muni sector, I felt this could be a way for investor’s to hedge their portfolio against potential equity losses. In hindsight, that review was quite timely and accurate. HYD has managed an impressive return in the interim, especially considering the broader equity market has seen a sharp negative drop:

Source: Seeking Alpha

Going forward, this is a sector I expect to continue to perform reasonably well in 2020. Short-term action confirms its relevance as an equity hedge, which is a primary reason for buying in to bonds as a whole. However, I still see unique risks in the sector, and continue to caution that this investment class may not be for everyone. Therefore, I believe maintaining a “neutral” rating on the fund is appropriate, and will explain why in detail below.

High Yield Munis Ended Up Being A Great Hedge

To start, I want to reiterate a key reason why HYD, and high yield munis by extension, have worked out well in the short-term. While the fund is exposed to some unique risks in the muni sector, it is also a way to hedge the risks posed by other sectors. Specifically, the high yield muni sector has a very low correlation to equity markets, which is true for many fixed-income classes. Obviously, this came in handy last week when the domestic equity market dropped around 12% off its high.

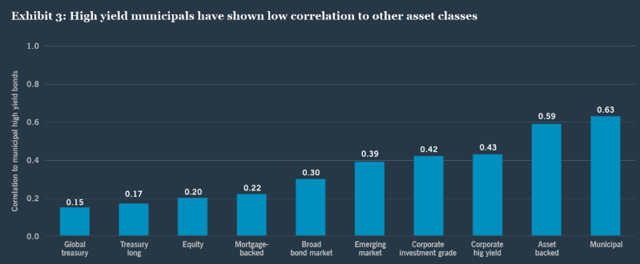

While this was especially relevant, what is also striking about high yield munis in particular is they also have a low correlation with other types of bonds, including the high yield corporate bond sector (among others), as seen below:

Source: Nuveen

Source: Nuveen

As you can see from the above graphic, high yield munis have a generally low correlation to pretty much every other investment type, even the correlation to investment grade munis is lower than one might think. The upside to this is it remains a unique hedge. While equity sell-offs can often send fixed-income sectors higher, this past week shows us this is not always the case, as many riskier fixed-income sectors came under pressure.

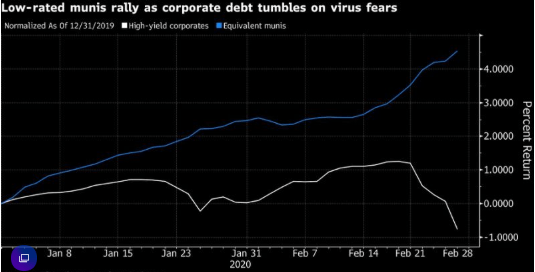

To illustrate, consider that last week high yield corporates showed a sharp drop lower, while high yield munis actually had a very strong week, as seen below:

Source: Bloomberg

My takeaway here is investors may be surprised to see how performance between high yield munis and high yield corporates can diverge. In fairness, it makes sense that below investment grade debt might come under pressure during market selloffs, especially the current one as investors are worried about economic growth impacting corporate profits. However, last week’s performance shows that not all “high yield” debt is created equal. With a low correlation to corporate bonds, high yield munis could be just the place investors want to be to ride out current economic concerns.

Benefits and Risks Of High Yield Munis and HYD

While the above discussion highlighted how high yield munis have been performing of late, I want to get in to more of the why behind this divergence. When we think of “high yield”, regardless of sector, we should inherently think it means more risk. With respect to munis, this is absolutely the case compared to investment grade munis. But while the risk may be larger, why would high yield munis out-perform high yield corporates by such a large amount during a period of volatility?

The answer relates partly to historical performance. Consider research conducted by Moody’s, a credit ratings agency. During a historical look-back at default rates among muni issuers compared to corporate bonds from 1970 through 2017, the research showed a default rate of less than 1% for munis, compared with over 6% for corporate bonds. Clearly, the corporate bond market is more volatile and a bit riskier, and that can help explain why investors were so quick to flee high yield corporates last week, while high yield munis registered positive performance.

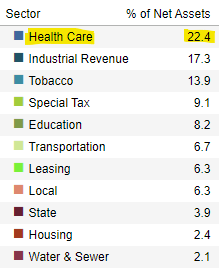

Of course, that is just one example, and it is important to understand that high yield munis have risks of their own. While the historical look-back shows that defaults in the sector are rare, they do occur, and disproportionately so in the high yield sector. To relate this back to HYD, let us take a look at the underlying securities in this ETF. While the fund is primarily made up of revenue bonds, what is striking is that almost a quarter of the assets are in the Health Care sector, as the chart below illustrates:

Source: VanEck

Clearly, this is an area of critical importance for HYD, so it is worth taking a look at the Health Care sector in isolation.

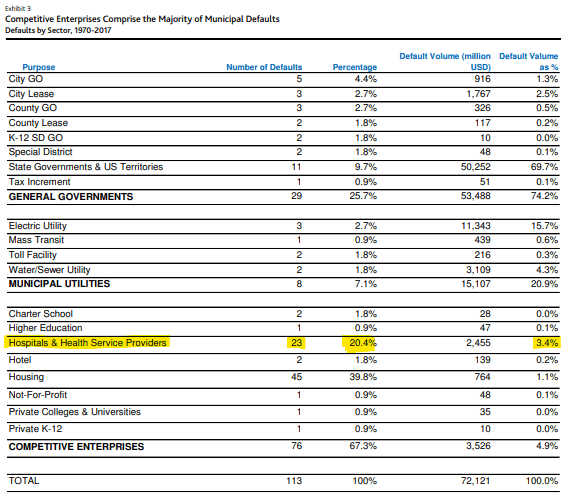

While I generally believe muni bonds, even in the high yield sphere, will hold up well in 2020, investors should be aware that HYD’s make-up is a bit riskier than alternative muni funds, especially those in the investment grade space. While I noted that overall muni defaults are low, when we consider where the defaults do occur, we see they are heavily concentrated in the Health Care sector. This should make HYD investors a bit cautious, as Hospital and Health Service Providers actually made up over 20% of defaults between the 1970 – 2017 period, as shown below:

Source: Moody’s Investor Services

As you can see, this sub-sector is responsible for a sizable number of defaults, although the actual dollar value of the payments is relatively small when we consider it in dollar terms. However, it is clear that this is a sub-sector that appears to be the most at risk of defaulting on obligations, so that is something to keep in mind if economic growth does slow. Further, while this research does not take in to account the current environment, data from 2019 paints a similar picture.

For support, consider recent data compiled by VanEck, the manger of HYD. It shows the total value of first-time non-payments of interest or principal due in 2019 was just .1% of the $3.8 trillion muni bond market. However, these defaults have been predominately from smaller Health Care sub-sectors, such as nursing homes and continuing care retirement communities. In fact, those sub-sectors accounted for almost 75% of the 2019 default total.

My takeaway here is this is a story investors need to be aware of, and evaluate if this is really the right place for them to be. While muni bonds have low levels of defaults, HYD, and the high yield muni market, is made up mostly of revenue bonds, not general obligations bonds, and are therefore backed by specific revenue streams, and not the faith of local or state governments. With respect to the Health Care sector, this often means muni bond investors are exposed to unique risks, such as patient’s ability to pay for medical expenses, which is a challenge facing our society right now. Therefore, while HYD has indeed performed well in the short-term during a period of market volatility, investors should remain keenly aware of the risks inherent in this asset class.

High Yield Munis Had Only 3 Negative Years Out Of the Last 20

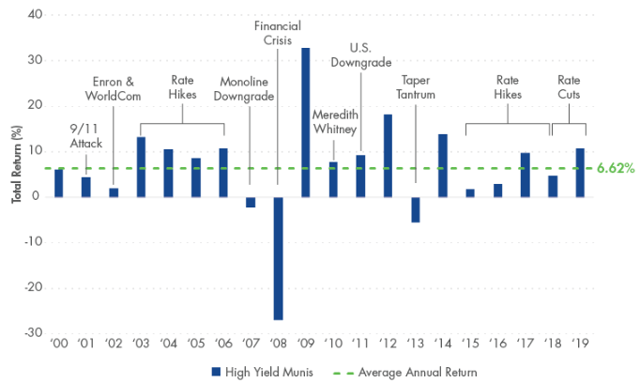

My final point on HYD concerns the high yield muni debt as a whole, and why I believe it could continue to deliver positive returns going forward. Specifically, when we consider how this sector has performed over time, the results are very positive. Consider that over the past twenty years, which includes multiple negative geo-political events and the 2008-09 financial crisis, high yield munis have only seen negative annual returns in three of those years, as shown in the graph below:

Source: VanEck

As you can see, this sector is a pretty consistent performer over time. HYD, as a passive ETF that tracks a high yield muni index, has indeed seen similar performance, with an annualized gain just under 6% for the past ten years.

My takeaway here is for investors looking to continue to hedge their equity positions, HYD, or other high yield muni funds, should help round out a diversified portfolio. While I personally favor investment grade munis, as my readers should be aware from my prior articles, high yield muni bond performance speaks for itself. The sector has a long track record of positive returns, and generally sees only single digit moves in either direction. This lack of volatility should help keep investor’s minds at ease when other sectors are seeing large swings. Therefore, I view this as support that 2020 should bring more of the same for HYD.

Bottom line

The market is seeing wild swings, which underscores the need to have proper hedges in place to smooth out portfolio volatility. While not the only sector to have held up well last week, high yield munis are one of the few that registered a positive gain. What was especially striking was the alpha over high yield corporates, which was quite informative. Given HYD’s long-term performance of steady returns, I would expect the fund to hold up well this year as well.

However, investors need to remain aware of the risks inherent in HYD, which are different than most asset classes and a key reason for the low correlation with pretty much every other sector. While defaults in the space are rare, they are heavily concentrated within bonds originating from insurers in the Health Care sector, which is HYD’s largest sector by weighting. This is an area that often sees more defaults than the broader muni market, and that trend continued in 2019 as well. Similarly, I would expect the yield to come under pressure throughout the year, as central banks may continue to lower interest rates to combat a growing fear of the coronavirus. While tax-free debt will remain in demand, new issuance will likely come in with lower yields, which could pressure returns in the sector. Therefore, while I see plenty of merit to owning this fund, especially during turbulent times, I continue to believe a “neutral” rating on HYD is most appropriate at this time.

Disclosure: I am/we are long PMX, RMI, NEA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment