Thinkhubstudio/iStock via Getty Images

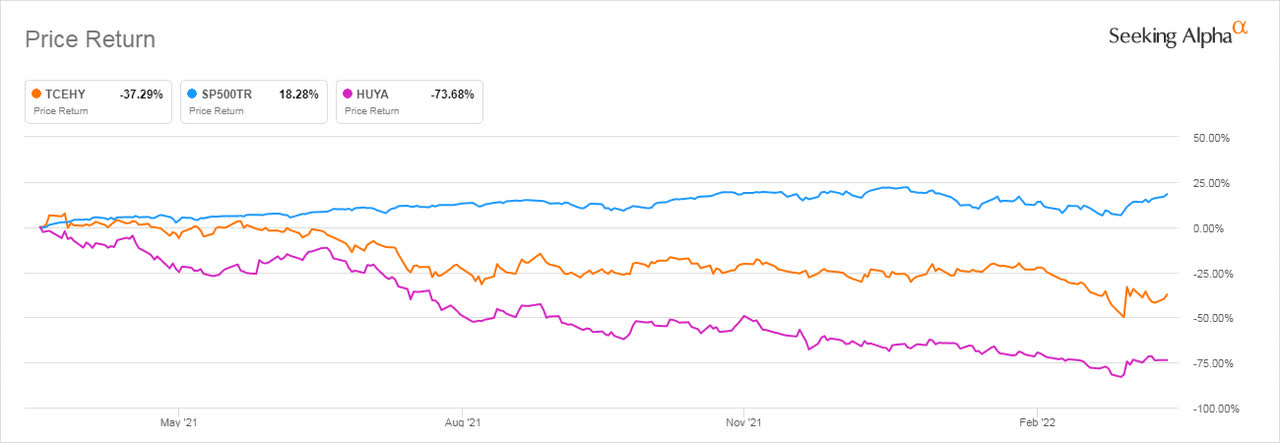

Online gaming in China suffered a huge setback when authorities established new restrictions limiting the time under-18s spend online. Government crackdowns in the first half of 2021 saw online gaming companies endure a four-month suspension. Investment and online advertising provider Tencent Holdings (OTCPK:TCEHY) had more than $450 billion chopped off, after its market cap peaked to $951 billion in 2021. Companies have had to rethink and reposition their standing for sustainable long-term growth while adapting to the new environment. By all means, it appears China will not relent on its push to regulate technology giants and augment social control.

Thesis

HUYA Inc. (NYSE:HUYA) plans to deliver long-term value to stakeholders by diversifying and enriching content. The main challenge will be to leverage the company’s strengths in e-sports and promote the brand’s image amid a decrease in user engagement. There are also macroeconomic uncertainties due to regulatory changes by the Chinese government that may slowly wear off in 2022. Even so, the company is confident in its business fundamentals including operational efficiencies. Allow us to present our reasons why this stock is a hold.

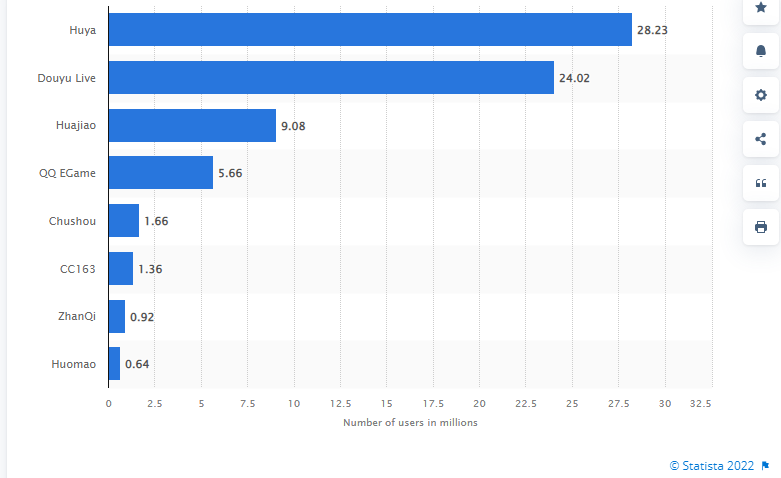

As of December 2021, HUYA had become the largest streaming service for e-sports in China.

Statista

The streaming app amassed up to 28.2 million monthly active users (MAUs) in China. Huya was followed closely by Douyu Live with 24.02 million MAUs. Watching these two platforms garner more than 20 million MAUs while other streaming services have less than 10 million MAUs gives a sense of dominance in the industry that these two services enjoy. Tencent realized this viewership control and opted to be a majority shareholder in the companies.

However, Tencent’s deal to have the two services merged in Q2 2021 hit a snag after it was blocked by the State Administration for Market Regulation (SAMR). The company did not just suffer antitrust concerns but was also fined more than 20 times in 2021 for failing to report mergers or acquisition deals in advance to the regulatory authorities.

In the year ending December 2021, Tencent reported revenues of RMB560.118 billion ($88 billion). The Cyber Administration of China (CAC) is said to have drafted new guidelines in 2022 that require a company with more than 100 million users or annual revenues above RMB10 billion ($1.6 billion) to seek approval from the authority before making any investment/ acquisition deals. While the government has worked to deny this claim, Tencent, as well as Alibaba (BABA), have come under scrutiny for their actions seen to shore up dominance in China’s Internet sphere.

Shareholder Value

In the one-year share price return analysis, Tencent has lost 37.29% while HUYA is down 73.68%.

The third quarter saw HUYA witness a 6.07% decline in net revenue to RMB 2.808 billion ($440.8 million) YoY. Net losses also rose to RMB312.7 million ($49.22 million) in contrast to a net income of RMB253.2 million ($39.85 million) in Q4 2020. Interestingly, even though the average MAUs of HUYA Live increased by 7.4% in Q4 2021 to 85.4 million, the number of paying users declined 6.67% in the same period.

To cover for its recent loss and increase revenue streams, HUYA is working to secure rights to various licensed e-sports tournaments through partnerships with e-sport event organizers. In its Q4 2021 earnings release, the company announced its agreement with TC sports in 2021 where it secured the exclusive broadcasting rights for LPL, LTL, and LPL All-Star Weekend series from 2021 to 2024. This is not a minor fete for a company that broadcast 125 third part e-sports tournaments in Q4 2021 and generated total viewership of about 605 million.

The main challenge will be increasing the number of paying users since already Live-stream membership growth was boosted by the e-sports events. As part of its differentiation program, HUYA needs to fine-tune its customized agreements with broadcasters to ensure that its live-stream events interest the younger generation.

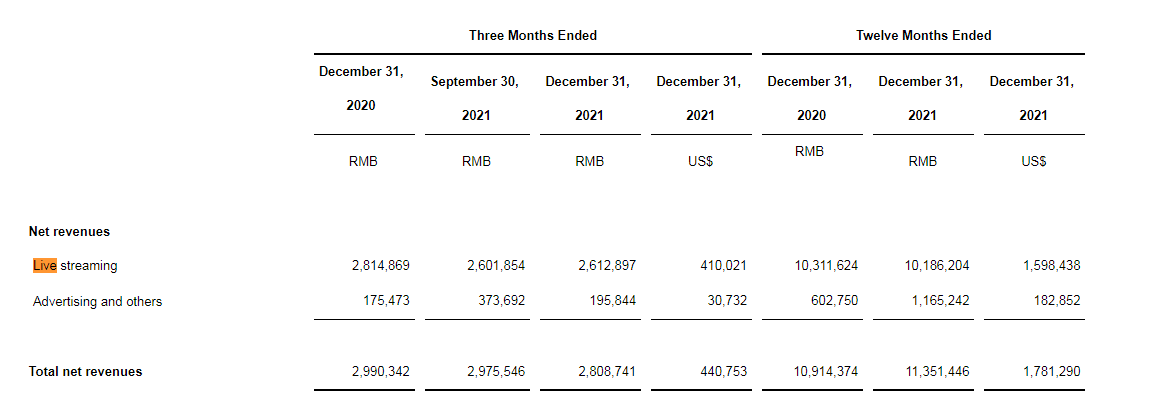

HUYA

Since 2020, Live-streaming net revenues have increased 4.00% (YoY) from RMB10.914 million to RMB11.351 million despite a decrease in the number of paying users. This increase shows HUYA’s interactive social features have worked to increase premium membership. Users on the premium service get to send virtual gifts to broadcasters as well as enjoy premium social status.

On their part, the broadcasters get to create and share their content that including talent shows, anime, and other outdoor activities. HUYA has reiterated its focus on content which is the primary center for user growth. Users are encouraged to develop their content- dubbed user-generated content (UGC), or combine it with a professional in what is termed professional-user-generated content (PUGC).

In my view, HUYA is doing a great job leveraging big data and AI technology. In this way, it can analyze users’ viewing preferences and give accurate content recommendations. The company’s increase in mobile MAUs to 85.4 million from 79.5 million has been attributed to successful content interactions between users and broadcasters. However, HUYA has not explored the metaverse space in content development like its majority shareholder- Tencent.

Metaverse Reality

The beginning of 2022 saw Tencent Holdings embed the Unreal (video game Engine) into its QQ messaging platform. The updated QQ services allowed Tencent to launch a 3D interactive space- called Super QQ Show. This service allows users to socialize, watch shows, and play games- a move is seen as a step to consolidate its sphere in the metaverse.

This new-age fantasy called metaverse is a concept that will integrate the Web3 technology using aspects such as NFTs and Cryptos. It is the future, with analysts claiming that it will replace real-world activities such as working and socializing.

Finextra

Like the real world, the metaverse “future virtual world” will have its distinct economies driven by creators and providers of infrastructure. Meta (FB) has planned to expend huge sums of capital soon to concentrate and bring the metaverse project to life. Facebook already has its cyberspace including virtual reality (VR) headsets to explore all options available.

To boost its international portfolio, Tencent went ahead and acquired a 40% stake in Epic Games and a 100% ownership of Riot Games- all US gaming companies. This move was strategic since China is undergoing regulatory scrutiny that may hamper mainland revenues into 2022. WeChat, Tencent’s messaging platform hit 1.2 billion MAUs as of September 30, 2021, while QQ was at 573.7 million at the same time. With such a strong average utilization rate, Tencent should be able to create and populate a metaverse environment. Other gaming companies such as NetEase, Inc. (NTES) and TikTok parent company, ByteDance (BDNCE), are hot on Tencent’s heels with the metaverse now looking like a reality.

Scalability

Despite fierce completion from Douyu, TikTok, and KuaiShou, HUYA still has the advantage of scale and sustainability due to its unique user-broadcaster social experience.

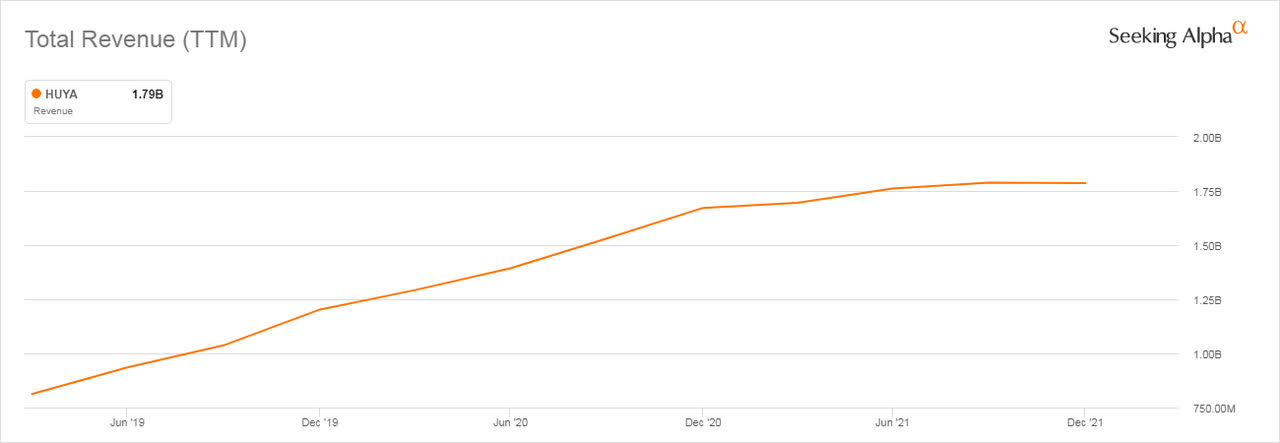

Seeking Alpha

In terms of revenue growth, the past three years have seen HUYA’s total revenue rise close to $1 billion or 120.38% to $1.79 billion in 2021.

HUYA’s MAU growth is also motivated by the launch of big games. Further, the company expects more traffic and financial help from Tencent which is leading in the race to build a metaverse. The gaming world got hotter when Microsoft (MSFT) announced that it would acquire Activision Blizzard (ATVI) for $68.7 billion. This transaction, according to the company, will make it the third-largest gaming service (by revenue) behind Tencent and Sony (SONY). This move will propel higher Microsoft’s mobile gaming segment, which accounts for 95% of all players.

On its part, Sony intends to roll out the PlayStation Plus gaming subscription service beginning in June 2022. It will debut in Asia, then expand to North America and Europe. The three-tier service will take on Microsoft’s Xbox Game Pass with subscription benefits to gamers in the Essential, Plus Extra, and Plus Premium segments. By all standards, it seems Asia remains a key ground for virtual game launches and developments despite the ongoing tech crackdown in China.

Risks

HUYA’s gross profit declined 29.44% as of December 2021 (YoY) despite the increase in total revenues due to an increase in costs. The company is also facing stiff competition from Douyu and TikTok in China which is pressuring user growth and revenue margins. The regulatory climate in China still presents a potential headwind for growth. However, the company’s strong cash position at RMB10.959 billion ($1.73 billion) is sufficient to push the company through its planned investments in 2022.

Bottom Line

HUYA’s business model gives the company scale and sustainability. It operates on a unique user-broadcaster social experience platform that has seen an increase in users over the years. The company’s growth is expected to be supported and monetized by Chinese gaming powerhouse Tencent Holdings. However, HUYA is still facing the challenge of regulatory pressure from the Chinese government which has seen a decrease in paying users. For these reasons, we propose the hold option on this stock.

Be the first to comment