VioletaStoimenova

Intro

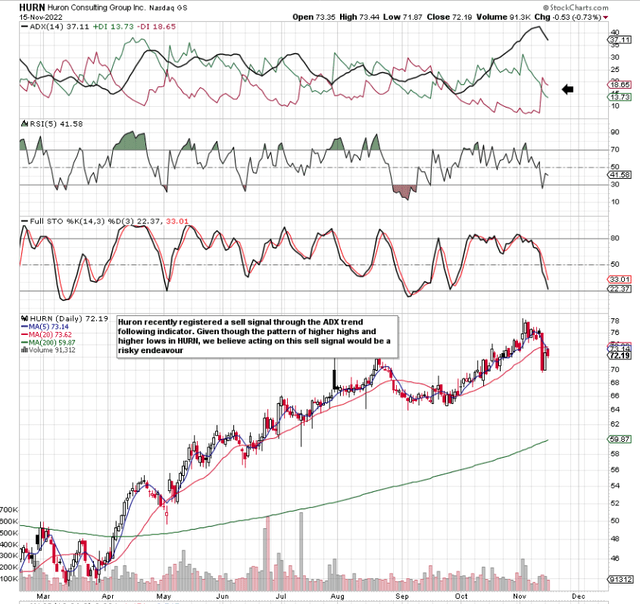

If we pull up a technical chart of Huron Consulting Group Inc. (NASDAQ:HURN), we see that shares recently registered a crossover of the popular ADX indicator, resulting in a short-term sell signal. Traders also will note the turning over of the indicator, which means the bullish trend-following strategy that participants have been using up to now in HURN may not work as well going forward. Further, as we see below, Huron’s five-day moving average has now crossed below its corresponding 20-day average. This in addition may bring trend followers into play here on the downside.

However, we would be cautious with respect to acting on Huron’s bearish short-term technicals for the following reasons. For one, shares of Huron, despite the very weak November thus far, remain in a bull market. In fact, the stock’s 200-day moving average of merely $60 a share demonstrates how well the stock has performed recently, particularly since January of this year. Furthermore, there were some really encouraging signs in the company’s recently reported third quarter earnings numbers. This is why we’re banking on a whipsaw here in the near term (sell signal turning back quickly to a buy signal) due primarily to the expectation of strong growth coming in the upcoming fourth quarter and beyond.

Huron Technical Chart (StockCharts.com)

Growth

Growth (Specifically sales and earnings growth) is specifically what drives shares higher on Wall Street. Huron recently reported $285 million in top-line sales in Q3, which was a 27% increase over the same period of 12 months prior. On the profit front, net earnings for Q3 this year came in at $17.7 million, which was a 29%+ increase over Q3 last year. All things being equal, sales growth is ramping up and margins are expanding. Furthermore, given how management increased the top-line sales estimate to $1.09 billion for the full fiscal year, there doesn’t seem to be a slowdown in sight at this stage.

Strong Fundamentals

Huron offers the investor the possibility of benefiting from sectors that are under pressure. Take the healthcare segment where reporting losses has become the norm for many companies due to inflation, lower patient volumes, and the clear lack of personnel to attend to these patients. Many outfits desperately need solutions, which is why the likes of Huron’s digital services in this space have been gaining traction. Suffice it to say, the longer hospitals have to deal with present macro headwinds, the more we see Huron’s products and services gaining traction in this space.

We see the same trend in the education segment, where the Q3 growth rate of 49% outperformed the health segment by some distance. The shift to digital solutions and capabilities for both students and education bodies means that this segment will remain in a growth phase for some time to come. Finally, the commercial segment reported sales of just under $60 million in Q3, where again we witnessed solid digital growth once more.

Suffice it to say, across all three of Huron’s industries, the company appears to have its finger on the pulse with respect to what its customers need. Whether this is streamlining operations in order to gain efficiencies, marketing, or simply enabling communication to take place in a more effective manner, Huron’s products and services remain in high demand.

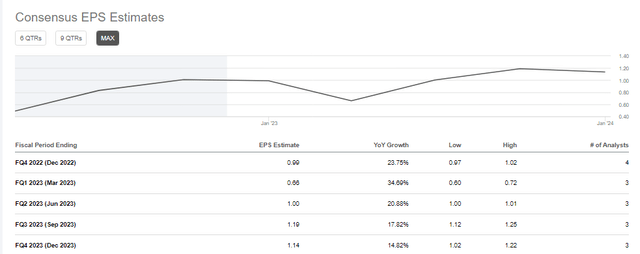

Investors who believe growth rates may be tapering off in Huron should look at what the consensus is expecting from this company going forward. As we see below, $0.99 in earnings per share is expected in Q4 this year which, if met, would be almost a 24% increase over the same period of 12 months prior. Furthermore, strong double-digit growth rates are expected in each of Huron’s quarters in fiscal 2023. Suffice it to say, not only are the growth rates there, but revisions also have remained bullish, which means analysts are essentially sticking to their guns.

Huron Earnings Projections (Seeking Alpha)

Conclusion

To sum up, from a long perspective, we would actually prefer if the shares of Huron were to drop down close to somewhere near their 200-day moving average in this present down move. Recent insider selling may actually facilitate this happening. Then, on a convincing swing, we would look to put long deltas to work in this play. We look forward to continued coverage.

Be the first to comment