Justin Sullivan/Getty Images News

Thesis

Western Digital (NASDAQ:WDC) delivered an overall acceptable June quarter 2022 performance, but the stock did not react well to the results. The trading day following the announcement, WDC shared dropped by as much as 10% intermittently. I think this is a mistake. The company trades at deep value multiples, e.g., x6 Non-GAAP PE and x1.3 P/B. These multiples are not justified for a company that can deliver year over year revenue growth of 11% and gross margin of 32.3% (Reference: Fiscal FY 2022). In my opinion, a x8 Non-GAAP PE multiple would be justified. This would imply a more than 30% upside and a $60/share target price.

WBD is down by about 28% YTD, versus a loss of about 15% for the SPX.

WDC’s June Quarter Results

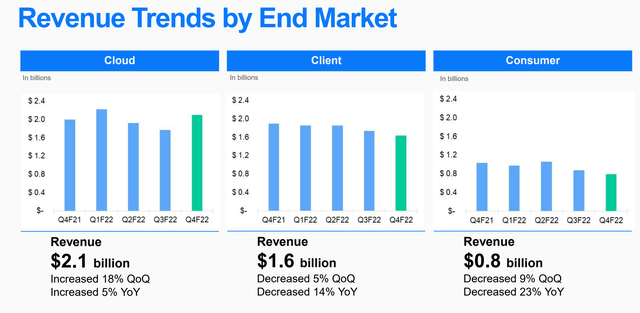

During the period from April to end of June, WDC generated total revenues of $4.5 billion, down 8% year over year. But not all segments performed equally: As compared to the same period one year prior, Cloud revenue increased 5%, Client revenue declined 14%, and Consumer revenue declined 23%. If we consider the FY 2022, revenue was $18.79 billion, which implies a proud 11% year over year topline increase.

Respectively, for the quarter operating income was $702 million, which is a decrease of 15% year over year. The loss of operating income was mainly driven by negative top line growth (remember 8%) and a small gross profit margin contraction of 60 percentage points. Non-GAAP earnings per share was $1.78.

Commenting the quarter, WDC’s CEO announced:

I am proud of our team for driving strong fiscal year 2022 performance, during which revenue grew 11% and non-GAAP EPS increased 81%, demonstrating progress in unlocking the earnings potential of our business

On a segment basis, cloud now represents approximately 46% of total revenue, up from 42% one-year prior. The company noted that the 18-terabyte and 20-terabyte drives recorded a 7% year over year increase, while enterprise SSD sales were up a strong 38% year-over-year. Client, 36% of revenues, was driven by a decline in HDD revenues, but Flash remained flat. Consumer now is about 18% of revenue and the company noted a material decrease retail products across both HDD and Flash.

Investor Implications

Western Digital’s quarter was acceptable. Even though the firm slightly missed analyst consensus estimates, and a negative growth in the June quarter, I think it is important to note that the company delivered a solid performance. Investors should note that the quarter over quarter topline decline was primary driven by a slowing IT demand hardware cycle, not by anything related to WDC’s business quality.

At this point I would be helpful to detach from the quarter results and take a high-level perspective. Let us consider WDC’s valuation. According to data compiled by Seeking Alpha, WDC is trading at a x6 Non-GAAP forward PE, a x1.3 P/B and x0.8 P/S. Most notably, all metrics consistently indicate a 60% undervaluation versus industry peers. For P/Cash Flow the undervaluation is as strong as 71%.

Given these valuation metrics, it is no wonder that activist investor Elliott Management has taken an interest to collaborate with WDC in order to release shareholder wealth. In the analyst call management said, that they are actively collaborating with Elliott Management to support value-enhancing options:

The Executive Committee of the Board, which I lead, continues to oversee the review and Elliott Management is participating alongside us under a non-disclosure agreement, along with other interested parties. We’re evaluating a range of alternatives, including options for separating our market-leading Flash and HDD franchises.

Recommendation

A value investor might definitely find potential in WDC stock as the company is trading very cheap on both a relative and an absolute perspective. With a x6 Non-GAAP forward PE, the company trades at a 60% discount to peers. With continued engagement from Elliott Management, I am confident that the company will be able to strategize in order to close (at least) a part of the valuation gap. Personally, I see a x8 Non-GAAP forward PE as justified. Accordingly, I estimate about 30% upside and a $60/share target price.

Be the first to comment