ViewApart

Apple (NASDAQ:AAPL) has demonstrated the most resilience amid this year’s bear market selloff. The stock has traded down about 17% this year, outperforming both the S&P 500 (SPY) and tech-heavy Nasdaq 100 (QQQ), as well as its FAAMG megacap peers which have collectively lost more than 60% on average YTD. Apple has also been a consistent harbinger of big gains whenever sentiment turned risk-on, with the stock adding more than $190 billion to its market cap on Thursday (November 10) on the release of a softer-than-expected inflation print for October. It was also the only big tech stock in the FAAMG megacap peer group that staged a modest rally during the latest earnings season, despite showing increasingly prominent susceptibility to growing macro pressures ahead.

Admittedly, the stock’s resilience demonstrated this year also escalates its risks of becoming next on the chopping block as macro conditions continue to deteriorate. Although management has prudently tempered expectations about this year’s holiday quarter sales, materializing macro headwinds and then some observed over the first six weeks of the final three months in the calendar year is starting to send investors to the edge of their seats.

On the fundamental front, Apple – like its peers – has become victim to growing macro pressures to some extent this year. As mentioned in our recent quick take on Apple’s F4Q22 performance, FX was a substantial headwind, though demand remained largely resilient with quarterly and all-time sales records maintained across major product categories and geographic segments. But the story is quickly changing. Being halfway through the December-quarter – Apple’s best-selling season of the fiscal year – challenges in the operating environment have only increased.

China’s stringent COVID Zero policy continues to shed uncertainties to the production outlook of Apple’s iPhone 14 Pro and Pro Max handsets, which are core to its product sales growth and maintaining the segment’s margins ahead of the busy holiday season. Meanwhile, decreasing consumer spending on discretionary goods are weighing on demand for the less-expensive standard iPhone 14 handsets. Mac also faces tough PY comps, with additional macro pressures spanning FX headwinds and a global decline in PC shipments due to consumer weakness. Services is also expected to experience some near-term softness due to the inherently macro-sensitive advertising industry, which is further corroborated by the recent downward adjustments made to global ad spending forecasts for the year.

The evolving backdrop for Apple continues to be priced into the stock’s performance as analysts lower near-term expectations across the board, while multiples continue to adjust for changing macroeconomic factors. While the stock has continued to outperform the broader market and its peers, to think it has successfully dodged the 2022 bear run remains premature. Consumer weakness has only just started to hit real spending (previous deterioration was largely on consumer sentiment), with budget cuts being observed across both retail and enterprise sectors, and household savings headed for declines while credit card debt racks up.

While Apple remains an attractive long-term investment opportunity based on its robust balance sheet and sustained long-term growth trajectory, the stock still faces choppier waters ahead given the increasingly challenging macro environment. Based on Apple’s 10-year average trading P/E ratio of 17x – which factors into consideration the stock’s performance during historical bear markets – the stock faces a reasonable risk of reaching the $110-level, especially with escalating recession fears. There is potential for Apple’s stock to contest said bear case level over coming months, which would create a compelling opportunity for a company with a strong and still-growing checkbook capable of delivering consistent shareholder returns and sustaining market share gains across both existing and nascent technology trends.

China’s COVID Threat

New and rapidly spreading COVID variants are upending China’s economy, with ongoing pandemic control efforts restricting mobility across major cities in the country. Daily new case counts are reaching 20,000, the highest tally since Shanghai was placed on a monthslong lockdown earlier this year. Although China has recently tweaked its COVID Zero policy playbook to place emphasis on more accommodating rules, mobility restrictions remain in full force across major GDP-contributing cities across the country as cases surge.

Key manufacturing hubs Guangzhou and Zhengzhou were the latest economic epicentres hit by sprawling infections and city-wide lockdowns. Zhengzhou is where Foxconn’s largest facility for iPhone assembly is located, accounting for 80% of iPhone 14 Pro productions. Meanwhile, Guangzhou is home to critical component manufacturers. In the latest round of lockdowns imposed across various districts within the two manufacturing hubs, Foxconn indicated there is still sufficient inventory to fulfill iPhone orders for weeks, but whether there is sufficient labour and logistics capacity to deliver finished products to Apple remains in question. The “iPhone city” also faces an increasing “wave of fear and unrest” among workers concerned over the potential worsening of lockdown conditions.

The iPhone 14 Pro and Pro Max models have been the spotlight for Apple’s newest line-up of handsets. Despite a heftier price tag, the Pro and Pro Max variants of the iPhone 14 are where the latest chip and performance upgrades are at, playing to the likes of affluent consumers looking to upgrade their devices.

Yet, the devices in higher demand are what is giving Apple its latest headache. As mentioned in the earlier section, the Foxconn facility in Zhengzhou that is currently operating under a closed loop system within a city filled with COVID-induced mobility restrictions is responsible for the output of more than 80% of global iPhone 14 Pro and Pro Max units. And the other 20% likely comes from alternative sites, such as Apple’s supply chain in India, which is not immune to China’s sprawling COVID restrictions either given its reliance on key components imported from China. This implies a constrained environment for Apple’s better-selling and more profitable handsets ahead of its holiday quarter, which potentially points to more deceleration for the product category than previously expected and added pressure on margins on top of FX headwinds.

Meanwhile, production of the weaker-selling iPhone 14 standard models have been shifted to Foxconn’s smaller manufacturing facilities across China to avoid material disruptions to output levels. However, take-rates on the standard iPhone 14 models have been relatively muted compared to their Pro and Pro Max counterparts, as mass market consumers engage in further belt-tightening with surging inflation and rising interest rates. Reports that Apple will be cutting productions of the standard iPhone 14 models by as many as three million units have been circulating as of late, putting the total annual output to about 87 million units. This is consistent with the global slowdown in smartphone demand, with related shipments falling to levels not seen since 2014. While key iPhone chip supplier Qualcomm (QCOM) had previously pointed to relative resilience in demand for premium devices over “low-end and mid-tier phones running on Android”, the recently observed softening in iPhone 14 take-rates corroborates that even Apple is not immune to impacts of the looming economic downturn. And China’s ongoing adherence to COVID Zero is not helping either, with the nation’s ensuing economic deterioration stifling iPhone sales in the region too despite Apple’s offer of rare discounts.

In addition to COVID Zero’s impact on iPhone sales, related disruptions are also expected to weigh on the product category’s margins in the near-term. CEO Tim Cook’s remarks last year on how Apple has been “paying more for freight than [he] would like” is likely going to find its way back to haunt the company’s near-term profit performance due to COVID-induced logistics bottlenecks in China. Less iPhone 14 Pro/Pro Max sales than expected in the current holiday quarter will likely impact the product category’s overall profitability as well due to the shift in mix to standard iPhone 14 models with slimmer margins and lower overall demand.

With macro challenges weighing on iPhone 14 sales and COVID Zero severing the iPhone 14 Pro/Pro Max lifeline, Apple is looking at a weaker-than-expected December-quarter for its best-selling product category. Paired with rapidly deteriorating macro sentiment, said risks of underperformance could potentially eat away at the stock’s relative premium to peers observed today.

Yet, we see this as an opportunity for value, as resilient demand for the iPhone 14 Pro/Pro Max models will likely flow through the historically weaker fiscal second quarter’s P&L, boosting sentiment for the stock heading into CY/2H23 when macro conditions are expected to see more stability. This is consistent with the impressive record quarter observed for Mac sales during the three months through September, when the product category benefited from additional sales on backlog orders received during the June-quarter that were not fulfilled until the following period due to supply constraints.

The Inherently Macro-Sensitive Ad Industry

The rising risks of recession within the next 12 months has forced a slowdown in global ad spending given the inherently macro-sensitive nature of the industry. And Apple has faced its fair share of said impacts on its Services segment’s performance during the fiscal third and fourth quarters:

When you then look at Services, there were some Services that were impacted, for example, like digital advertising was clearly impacted by the macroeconomic environment.

Source: Apple F3Q22 Earnings Call Transcript

Specifically on Services, we expect to grow but to be impacted by the macroeconomic environment increasingly affecting foreign exchange, digital advertising and gaming.

As discussed in detail in our latest ad-tech round-up, global ad spending is expected to advance 9.2% y/y to $816 billion in the current year due to deteriorating macro conditions. Specifically, ad spending is expected to decrease from 14% y/y growth observed in 1H22 to 8% y/y growth in 2H22.

For Apple, the company is estimated to generate annual revenues of about $4 billion from direct ad sales through some of its branded apps like App Store and Apple News, which represents a mere 5% of its annual total Services sales. Although Apple’s advertising business is relatively nominal when compared to industry leaders like Google (GOOG / GOOGL) and Meta Platforms (META), the company has always held a policing grip over the growing digital advertising landscape, cashing in on indirect benefits as well. And the looming ad slowdown is poised to be a near-term roadblock for both the company’s direct and indirect ambitions in capitalizing on opportunities in the high-margin industry.

But Apple has long been a gating factor in the rapidly expanding digital advertising world, which has improved its competitive advantage in the space. Its implementation of the App Tracking Transparency feature last year through the roll-out of iOS 14.5 roiled the digital advertising industry by severing a critical data pipeline for app-based targeted ad formats, including Meta’s Facebook, Instagram, as well as Google’s YouTube, Snapchat (SNAP) and Pinterest (PINS), among others. The roadblock is estimated to have wiped out about $16 billion in app-based ad spending over the past year, with less than a quarter of global iOS users that have updated to iOS 14.5+ providing tracking permission to apps. This has effectively turned social media into the slowest growing ad platform this year as it suffers a double-whammy from ATT signal loss and cyclical weakness in ad spending:

The [social media ad] format has already demonstrated relatively muted growth compared to the rest of digital advertising channels in the first half of the year with a mere 3% y/y growth – a far cry from the 38% y/y growth in social media targeted advertising demand observed in 2021…ad spend on social media channels this year is expected to slow to 4%, and improve in 2023 with forecast 6% growth.

Source: “Ad-Tech Round-Up: Why We Think Google and Amazon Will Rise On Top”

This effectively disperses social media ad dollars to other avenues such as search, retail media, and video streaming, which benefits Apple’s longer-term direct ad sales aspirations. Specifically, Apple currently generates ad revenues from the sale of ad placements within its branded apps like App Store and Apple News, which fall under retail media ads – a key cannibal for dispersing social media ad dollars, with anticipated growth of more than 35% y/y in 2023. The company likely benefits from some degree of first-party data generated from its branded apps, and uses them to tailor the delivery of ads to users to improve effectiveness and performance (i.e. engagement and conversion rates) of said ads to attract advertisers:

Apple collects information about how you use Apple News in order to tailor features to your personal interests. For example, the Today feature provides you with a personal newsfeed that highlights the best stories for you from your favorite channels and topics. Apple is able to make these features possible by collecting information about your interactions with Apple News, including which stories you read, save, or share, and the topics and channels you follow…We may collect, use, transfer, and disclose non-personal information for any purpose. For example, we may aggregate your non-personal information with that of other Apple News users in order to improve the service… We do not share any of your individual data with third parties.

Source: Apple News & Privacy

With a device installed base of approximately two billion, and paid subscriber count of more than 900 million, Apple continues to benefit from a massive trove of valuable 1P data that can bolster its competition for the growing pool of digital ad dollars despite near-term macro headwinds. It also aids Apple’s growing ambitions of spreading its digital ad sales from App Store and Apple News to other branded apps like Maps, as well as its growing Apple TV streaming business. The company is reportedly working on the implementation of ad delivery via its recently forged “global partnership with Major League Soccer” to stream matches via the Apple TV app next year. The efforts will likely expand Apple’s foray in the accelerating digital ads landscape, and open opportunities for the Services category to reach “double-digit billions of dollars” in annual sales over the longer-term.

Paired with impressive long-term growth trends for digital ad placements in search and streaming channels, Apple’s ad business is well-positioned for further expansion, which corroborates to the increasing importance of its broader Services segment to the company’s consolidated growth and profitability profile:

Online search engines are currently the most popular digital advertising platforms, boasting 19% y/y growth in the first half of the year. And the trends are expected to extend into the foreseeable future, as search ads approach the end of 2022 with at least 17% y/y growth…And looking forward to 2023, demand for search ads is expected to grow by about 13% y/y…AVOD is another emerging high-demand ad format that follows the secular transition in consumer preference from linear TV to on-demand video streaming. Demand in the ad format is expected to accelerate over the longer-term as the increasingly saturated video streaming sector consolidates and improves monetization of their respective subscriber bases with advertising.

Source: “Ad-Tech Round-Up: Why We Think Google And Amazon Will Rise On Top”

Materializing Consumer Weakness

The December-quarter has historically been Apple’s best-selling season of the year given high demand holidays like Black Friday and Christmas. This year will likely be no different, with many expecting Apple to forge a new quarterly record. Yet, the rapid transition from deteriorating consumer sentiment to now unravelling consumer spending power observed in the first six weeks of the December-quarter underscores how Apple’s coming performance will likely end up being weaker than expected.

Payment processing giant Visa (V) had recently noted that while aggregate consumer spending has remained resilient and consistent throughout the year, buying behaviour has rapidly evolved as a result of deteriorating financial conditions and surging inflation, with data showing a decrease in purchasing power. Average U.S. household savings have also declined from an average of 3.5% in the second calendar quarter to 3.1% in the third calendar quarter, which is a significant downward adjustment from the “five-year pre-COVID average of [approximately] 7.7%”. Credit card debt is also racking up, “approaching the pre-pandemic peak of $916 billion in September”.

As mentioned in our previous coverage, we expect Apple’s Mac sales to see the biggest shortfall from weakening consumer spending ahead of the holiday season:

In our view, we believe Mac and iPad sales are most susceptible to the near-term consumer slowdown, despite better-than-expected performance in the fiscal fourth quarter. First, the segments have already benefited from pulled-forward demand in the pandemic era, meaning forward momentum will likely remain moderate, especially with the looming economic downturn. Second, lost sales driven by supply chain constraints (most prominent in iPad segment) will likely see some of it becoming permanent instead of delayed due to consumers dialing back on discretionary spending amid deteriorating economic conditions. Lastly, previous expectations for stronger commercial IT spending that have benefited enterprise demand for Apple devices will likely moderate as well as budgets pullback to brace for near-term macroeconomic uncertainties.”

Source: “Is Apple A Buy After FQ4 2022 Earnings? Keep Your Eyes On Services”

Management has also cited the tough PY compare as mean to temper investors’ expectations for potential declines in the segment over the December-quarter, which does not benefit from added demand for the newly launched MacBook Pro fitted with the M1 chips during the same period last year. The company’s recent aims to bolster the segment’s appeal to the enterprise sector also underscores its eagerness to compensate for the near-term shortfall in retail demand for Macs.

Specifically, Apple has recently extended bulk buying discounts offered to its biggest enterprise clients to small- and medium-sized businesses. The promotion, which lasts until December 24, will extend markdowns of as much as 10% for SMBs buying 25+ units of the 14” and 16” M1-powered MacBook Pros. This will likely pull forward demand from the relatively recession-prone cohort within the enterprise sector, and help Apple offload some of its inventory in advance of the upcoming release of the M2 Pro- and M2 Max-powered MacBook Pros.

The efforts are also expected to bolster Apple’s growing presence in the commercial sector that had previously been dominated by PCs running on Windows and other operating systems. The company’s transition to more powerful, in-house designed silicon has opened doors to greater commercial opportunities in recent years. This is further corroborated by Apple’s recent expansion of its partnership with Cisco (CSCO) on the provision of Macs in the workplace, underscoring the company’s growing reputation as a key supplier of corporate workstations beyond capacities in design and creativity:

And Cisco expanded its Macs as a choice program and is now offering it to all its employees to help attract and retain top talent. And when given this choice, employees have chosen Macs twice as often as other options.

Revisiting Apple’s Fundamental and Valuation Prospects

Drawing on the foregoing analysis of near-term headwinds facing Apple’s consumer-centric business, we are reasonably expecting a moderation in consolidated sales over the coming two to three quarters as spending continues to adjust to an unravelling economic backdrop. New product releases will likely be crucial to drawing up any welcomed boosts to sales in the near-term, as it would attract product upgrades/switches from relatively affluent retail consumers and/or corporate buyers, but any signs of sustained acceleration or margin expansion will likely not make a return until at least fiscal 2024 – the anticipated timeline for when monetary policy tightening is expected to peak/pivot and recession headwinds dissipate.

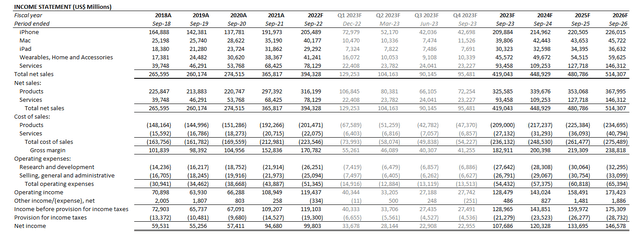

Apple Financial Forecast (Author)

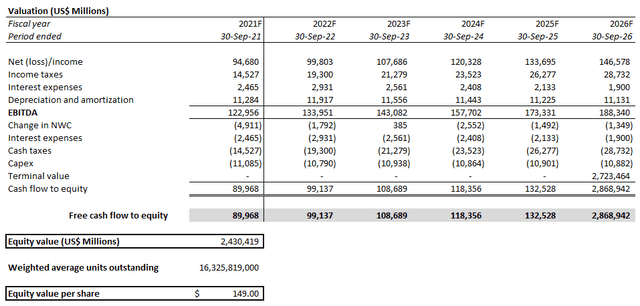

On the valuation front, we are revising the near-term base case PT for Apple to $149 due to near-term operating challenges as well as broader market contraction. This would approximate the stock’s current trading price of $150.04 (November 15 close) following the broader market rally in recent sessions. The base case PT is derived from a discounted cash flow valuation analysis. A 3.5% perpetual growth rate is applied to reflect expectations for Apple’s sustained growth trajectory buoyed by its expanding share of opportunities in key technology trends, offset by considerations of near-term multiple contraction due to tightening financial conditions, and is consistent with the longer-term rate of economic expansion across its core operating regions.

Apple Valuation Analysis (Author)

Apple_-_Forecast_Financial_Information.pdf

In gauging where the Apple stock could potentially bottom, we have turned to its 10-year average forward P/E of 17x, which considers the company’s performance in previous market downturns. At 17x forecast forward earnings, Apple would trade closer to the $110-level, which we view as probable as near-term sales and earnings margins get challenged, while broader market valuation multiples continue to adjust for increasing borrowing costs and rising risks of recession.

Final Thoughts

While remain positive on Apple’s longer-term prospects, the near-term headwinds will be hard to dodge and fraying investors’ sentiment due to deteriorating macro conditions are also not boding well for the stock’s lofty valuation premiums. On a relative basis, Apple’s valuation has continued to diverge from peers’, sustaining its elevated premium while others succumb to contraction ahead of looming macro impacts on both their fundamental and multiple prospects.

To think that the market is gradually starting to “get its act together” following the release of softer-than-expected consumer and producer price increases in October remains premature in our opinion, given the Fed remains fixed on driving rates higher until there is structural evidence that inflation will fall back in line and stay in line with the 2% target. This will inevitably slow demand, and expose Apple’s consumer-centric business to greater macro risks in the near-term ahead of a difficult market backdrop. With slowing growth and pressured margins as a result of protracted macro deterioration over coming months, the stock will likely see a further downtrend. Ensuing turbulence will likely create an attractive opportunity to buy into longer-term upside potential given Apple’s robust fundamental prospects.

Be the first to comment