Justin Sullivan/Getty Images News

It’s been a rough start to the year for the major market averages (SPY), and restaurant stocks (EATZ) haven’t escaped the selling pressure, on track for another year of underperformance. However, McDonald’s (NYSE:MCD) has held up exceptionally well amid the turbulence. This outperformance can be attributed to its best-in-class business model and recession-resistant status, with MCD being a beneficiary of a “trade-down” among consumers. Given that McDonald’s is one of the best-positioned brands to wade through the difficult macro backdrop due to its value proposition and strong operating margins, I would view any pullbacks below $218.50 as low-risk buying opportunities.

McDonald’s – Delivery & Digital (Company Annual Report)

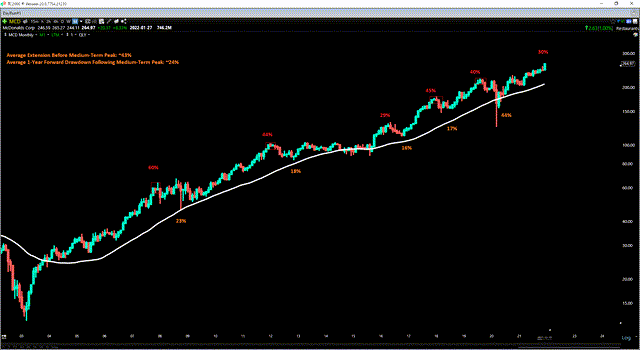

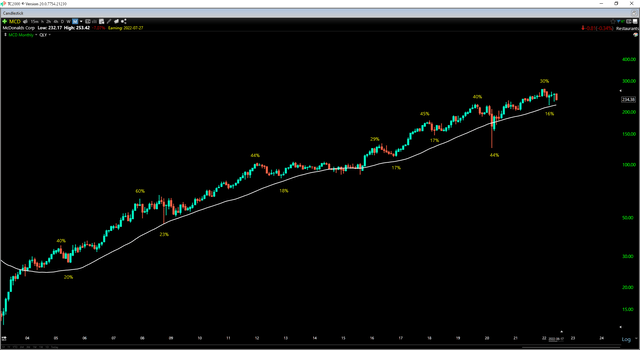

Just over four months ago, I wrote on McDonald’s, noting that while the company was continuing to put up solid results and looked better positioned than its peers if consumer strength waned, paying up for the stock above $265.00 was a bad idea. This is because the stock was the most extended it had been since September 2019, and previous extensions had led to an average one-year forward drawdown of ~23% (post-2009). Since then, the stock has slid 12% but has held up well considering the carnage in the S&P-500 (SPY) and other restaurant stocks. Let’s look below to see if this has set up a buying opportunity.

MCD Monthly Chart – 2003-2021 (TC2000.com)

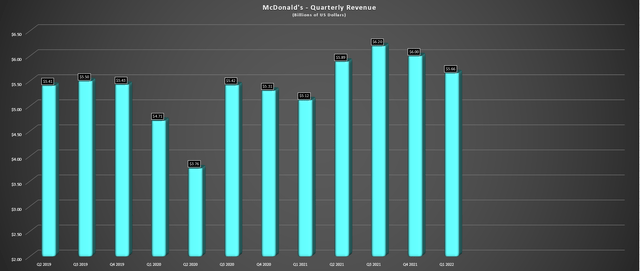

Q1 Results

McDonald’s released its Q1 results last month, reporting quarterly revenue of ~$5.66 billion, an 11% increase over the year-ago period (14% growth from a constant currency standpoint). This was driven by steady unit growth (~40,300 restaurants vs. ~39,200 restaurants) and double-digit global comp sales growth (11.8%). Meanwhile, despite the inflationary headwinds sector-wide that have impacted several brands, McDonald’s reported a respectable 43.1% adjusted operating margin and is guiding for low to mid 40% operating margins for FY2022. The margin performance was helped by its mostly franchised model, with less than 7% of stores being company-owned and an even lower percentage after its recent Russia exit.

McDonald’s Quarterly Revenue (Company Filings, Author’s Chart)

During the company’s prepared remarks, McDonald’s noted that its International Operated Markets [IOM] segment had returned to pre-COVID-19 average unit volumes [AUVs], with the segment made up of Australia, Canada, France, Germany, and the United Kingdom. Meanwhile, the company continues to see delivery strength despite the more normalized environment relative to 2020/2021, with delivery now available in 33,000 restaurants. Elsewhere, digital is performing extremely well. The latter is evidenced by adding 26 million loyalty members (MyMcDonald’s Rewards) in the past nine months alone in the US. To put this in perspective, this is in line with what it took Chipotle (CMG) three years to accomplish.

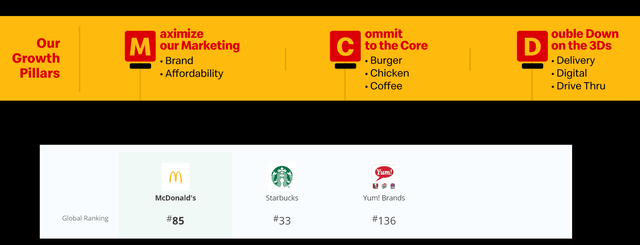

The McDonald’s Advantage

In a period where the restaurant space is contending with several headwinds, with one being a shrinking discretionary budget due to higher food/gas prices, McDonald’s has a clear advantage. This is because it continues to deliver successfully on its growth pillars, which include [M]aximing its Marketing, [C]committing to its Core Menu, and [D]doubling Down on the 3 Ds (Delivery, Digital, Drive-Thru). Not only is marketing to build trust and ensure great taste contributing to strong NPS scores, but McDonald’s has maintained an aggressive media budget while some restaurant brands like Darden (DRI) have pulled back, keeping McDonald’s top of mind.

McDonald’s Marketing (Company Video, Youtube.com)

Digging into these growth pillars a little closer, McDonald’s is ensuring that it continues to be the market leader in quick-service and can continue to grow market share if its peers make missteps by driving to boost sales short term. For starters, the company has shed non-core items from its menu. A simpler menu means better drive-thru times and exceptional training on its core items, which ultimately boosts customer satisfaction (correct and quicker orders) as part of the [C] of its growth pillar. An example is dropping salads, which is not what McDonald’s is known for (burgers, fries, shakes), and not restarting its all-day breakfast.

McDonald’s Growth Pillars, NPS Scores (Company Website, Comparably.com)

As part of its third growth pillar, McDonald’s has now extended delivery to more than 80% of its store base and has rolled out loyalty across a large portion of its system (40 markets), with a full launch expected in the United Kingdom. This new initiative with MyMcDonald’s Rewards is a big deal for the company, given that McDonald’s already serves 80% of US consumers in a given year, meaning that there’s a limited opportunity from a brand awareness standpoint to grow. However, with the loyalty program, McDonald’s can gain insights into its massive customer base, potentially driving higher frequency which is what it’s seeing from loyalty members to date.

In addition to this, the company has the opportunity to improve the customer experience with options like order-ahead and pick-up, further reducing wait times for customers. On top of this, while many casual dining brands are juggling the balance of holding the line on margins vs. potentially pricing their customers out of casual dining, McDonald’s is in a sweet spot. This is because it can price below the level of inflation if it wants to, providing an even greater value proposition for customers as they see “food away from home” prices increase and most other brands’ menu prices increases, making McDonald’s an obvious trade-down option.

McDonald’s Menu (McDonald’s, Youtube.com)

Last but not least, fast-food restaurants like McDonald’s with simple menus will not be able to claw back all of the lost margins due to inflationary pressures immediately. However, they’re better positioned to accomplish this long term. This is because we could see more automation in the kitchen over the next decade in the quick-service space, and we’re already seeing improved efficiency within restaurants post-pandemic as all brands have been forced to be as efficient as possible. So, from a long-term standpoint, while casual dining doesn’t have a clear path to reclaiming pre-COVID-19 margins with higher commodity costs, higher labor costs, and a large set roster, fast-food restaurants like McDonald’s look to be good candidates for further cost improvements from technology/automation.

To summarize, McDonald’s checks nearly all the boxes when it comes to appealing to consumers, even in a recessionary environment.

- It’s a clear leader from a value proposition standpoint.

- It’s working to create less friction for consumers from an ordering standpoint.

- Its marketing budget is highly effective and exceeds that of its peers, and is able to drive home its value proposition.

- It’s creating another reason to order between regular visits with its loyalty program, potentially boosting visit frequency.

Hence, if we do slip into a recession and consumers are forced to pare back a little, it’s hard to find a company better positioned than McDonald’s.

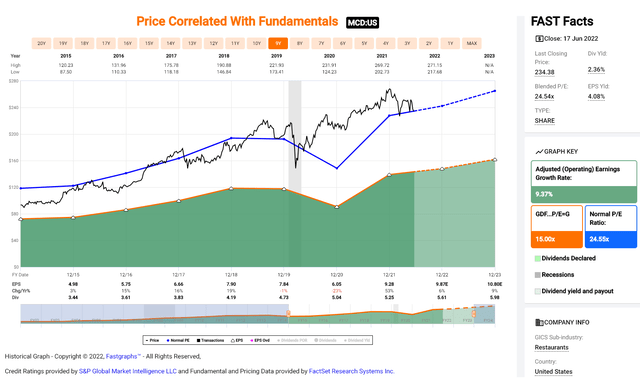

Valuation

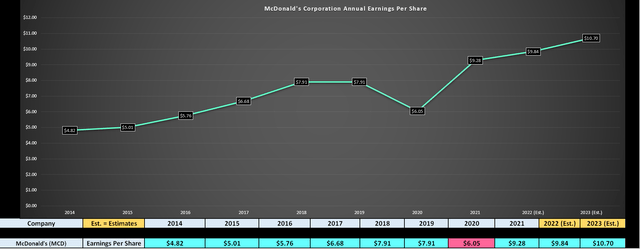

Looking at the below chart, McDonald’s has traded at an average earnings multiple of ~24.5 over the past decade and currently trades at 24x FY2022 earnings estimates and ~22.1x FY2023 earnings estimates. This suggests that the stock is not all that cheap relative to its historical average, trading at only a 10% discount to its historical multiple on next year’s earnings. Having said that, it’s rare that McDonald’s trades at a deep discount given its best-in-class business model, evidenced by its scale and its strong net promoter scores. Just as importantly, McDonald’s can weather recessions better than industry peers, being a clear beneficiary of trading-down within the food category.

MCD Historical Earnings Multiple (FASTGraphs.com)

Based on what I believe to be a fair earnings multiple of 25.5 and FY2023 annual EPS estimates of $10.70, I see a fair value for McDonald’s of $272.90, translating to a 15% upside from current levels. This earnings multiple is a slight premium to its historical multiple but is justified by McDonald’s being much better positioned than industry peers in the current macro environment and the potential to see further benefits from efficiency/sales as its loyalty program grows. Not only could this drive additional frequency, providing a meaningful boost to same-store sales, but it also could lead to more efficient operations as McDonald’s gains significant insights into its massive customer base.

McDonald’s Earnings Trend (Company Filings, FactSet.com, Author’s Chart)

While a 15% upside to fair value combined with a ~2.3% dividend yield translates to a more than 17% total return, I prefer to wait for a larger margin of safety to justify starting new positions. In the case of large-cap stocks, I prefer a minimum 20% discount to fair value, which would translate to a low-risk buy zone of $218.30. Obviously, there’s no guarantee that the stock will get this low, especially considering its impressive outperformance to date after a violent drop in the major market averages. However, I prefer not to chase stocks in a cyclical bear market for the S&P-500, and this level is where the reward/risk would improve substantially for owning MCD.

Technical Picture

Moving over to the technical picture, we can see an updated monthly chart below, with McDonald’s ending its Q4 2021 rally with a 30% extension above its monthly moving average (white line) vs. an average extension before a medium-term peak of 43%. The stock has since seen a 16% drawdown from its peak, and if history were to repeat itself, the stock would see a drawdown of ~23%, translating to a low of $208.80 (swing high: $271.20). Of course, history doesn’t have to repeat itself, but it often rhymes, and at least based on post-2009 drawdowns from 25% plus extensions above this moving average, it would appear that we should see a lower low in MCD by December 2021, closer to the $210.00 range.

MCD Monthly Chart – 2003-2022 (TC2000.com)

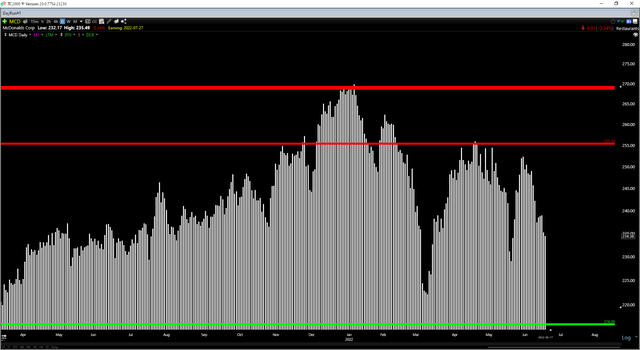

If we zoom in on the daily chart of McDonald’s, we can see that the stock has a new resistance level at $255.40 and strong support at $216.00. From a current share price of $236.00, this translates to a reward/risk ratio of 0.97 to 1.0, which is well below a preferred reward/risk ratio of 4.0 to 1.0 to justify entering new positions. So, similar to the outlook from a valuation standpoint, I do not see McDonald’s at a low-risk buy point just yet, even if the stock looks to be one of the safest places to park one’s money in the Retail Sector (XRT). The reward/risk ratio is based on $19.40 in potential upside to resistance ($255.00) and $20.00 in potential downside to support ($216.00).

MCD Daily Chart (TC2000.com)

Summary

With a simplified menu, a near unrivaled valued proposition in the food category, and a new loyalty program that’s off to a solid start, there’s a lot to like about the McDonald’s investment thesis, even if the sector itself remains in rough shape. Therefore, I believe the stock should be at the top of one’s watchlist as a potential buy-the-dip candidate, assuming this cyclical bear market in the S&P-500 continues. However, I see the ideal buy point in the stock being $218.50 or lower, where MCD would trade within 2% of support and at just ~20x FY2023 earnings. For this reason, I remain on the sidelines for now.

Be the first to comment