Thomas Kelley

Healthcare spending is expected to take up 20% of the US economy by 2025 with expenditures growing at an annual average rate of 5.8%. However, this expansion rate is 8% lower than the earlier growth witnessed before the great recession of 2008. At the center of it, are health insurance companies such as Humana Inc. (NYSE:HUM), Elevance Health Inc. (ELV), UnitedHealth Group (UNH), and Cigna Corporation (CI). Among the issues facing these entities include the rising healthcare costs due to inflationary trends, the risk of a recession, and the looming cuts to reimbursements from both the commercial players and the centers for Medicare and Medicaid Services (CMS).

Thesis

Humana plans to build its pharmacy business to boost its organic and inorganic growth. As a well-being company, Humana introduced its brand to connect with its payer-agnostic healthcare service offerings as well with strategic acquisitions such as the Kindred at Home purchase and CenterWell. The company hopes to improve health outcomes, increase customer satisfaction and lower the total cost of care while increasing its profit pool. However, the company is still facing headwinds regarding Covid19 that have impacted its pharmacy outperformance. Humana is also facing an increase in expenses and operating costs that have eaten into the company’s profits leading to a decrease in liquidity.

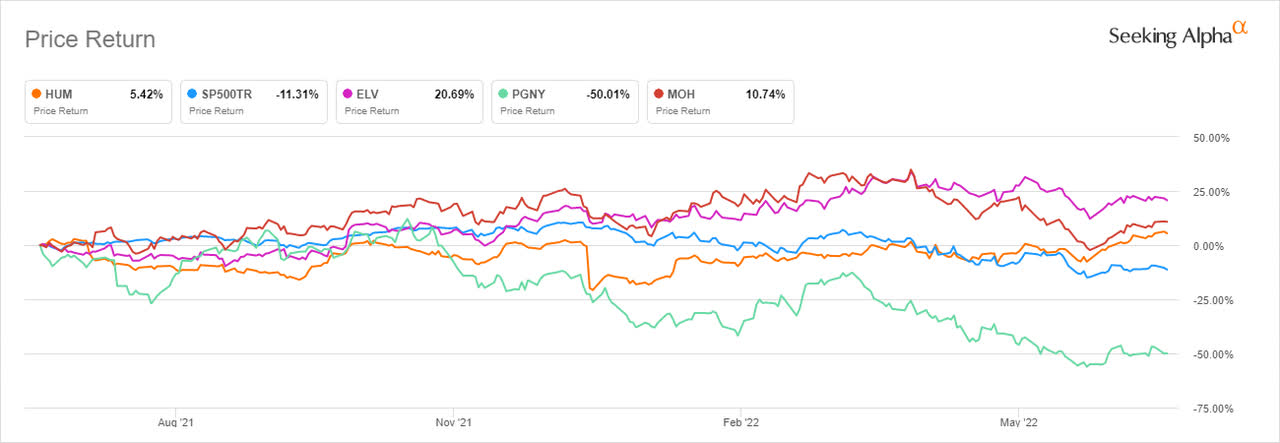

Humana Inc. recorded a 5.42% increase in its one-year share price analysis while trading at 1.55% below its 52-week high. In its regulatory filing posted in Q1 2022, the company expects weaker growth in net membership in the fiscal year 2022. It cut the membership growth of its individual Medicare Advantaged product from the earlier forecast range of 325,000 to 375,000 to the range of 150,000 to 200,000 members.

Seeking Alpha

Various names in the life, property, and casualty insurance segment outperformed the market with some putting up strong gains. Over the past year, the S&P 500 declined 11.31%, Elevance Health gained 20.69%, Molina Healthcare (MOH) added 10.74% while Progyny Inc. (PGNY) lost 50.01%.

The year 2022 is expected to witness an increase in terminations since it is an election period, but the company hopes to weather the storm by maintaining its pricing discipline. Investors should also expect the company to hit the low end of its adjusted earnings for 2022 with the growth rate set at 11% to 15%. Further, HUM’s EBITDA in the 12 months to March 2022 declined 14.25% (YoY) to $4.65 billion from a high of $5.423 billion.

Acquisitions and risk Aspects to consider

HUM has grown on the backdrop of strategic acquisitions, medical product expansions, and a robust Medicaid business. The U.S health care spending grew 9.7% in 2020 to reach $4.1 trillion or approximately $12,530 per person. At the time it took up 19.7% of the nation’s GDP. There has been a strong surge in demand for health care plans.

With a market cap of $61.61 billion, Humana operates as a payment solutions provider with headquarters in Louisville, Kentucky. It operates under the Health Maintenance Organization (HMO) which offers benefits in health insurance, private fee-for-service (PFFS), and plans for Preferred Provider Organizations (PPO). The company also offers benefits for other specialty products such as dental health, vision, and various supplemental benefits.

In Q1 2022, Humana announced that it had won a contract from the Louisiana Health Department to serve the state’s Medicaid members. Overall, HUM has expanded its Medicaid footprint to consist of other states, including Oklahoma, South Carolina, and Wisconsin. On quarterly analysis, HUM; s revenue has grown 13.85% to $23.970 billion (as of March 2021) and +15.98% from March 2021. Additionally, HUM’s net income (in the past 12 trailing months) has grown 3.5% with basic EPS up 3.9% to $23.68 over the same period.

As earlier stated, HUM is enacting an inorganic growth strategy with fundamental acquisitions. The health insurer bought out iCare, Family Physicians Group, Heal and Dispatch (home-based site of care innovators) Your Home Advantage, and Curo. In August last year, it acquired the remaining stake of 60% in Kindred at Home’s Hospice and Personal Care segment (a deal that valued Kindred or KAH at $8.1 billion). At the time, Humana’s existing share was valued at $2.4 billion.

Before the beginning of Q2 2022, HUM announced that it had sold its majority stake of 60% in Kindred at Home’s hospice and personal care segment to Clayton Dubler and Rice (CD&R) – a private firm. Humana’s divestiture of the 60% stake in its KAH subsidiary was exchanged for $2.8 billion in cash. This amount was less than anticipated. It is fair to say that Humana sold the stake at a loss. With the whole subsidiary valued at $8.1 billion, the least amount expected from the sale was $5 billion. However, the company needed the money for debt repayments and plan for its share repurchase program.

In the Q1 2022 guidance, the company stated that it expected its debt-to-capitalization ratio to be 40% by the end of 2022. This guidance is lower than the ratio posted for Q1 2022 which stood at 45%. At the moment, Humana’s total debt stands at $13.292 billion.

Valuation

Humana is slightly overvalued. It is trading with a P/E ratio of 17.49. Over the last 12 months, HUM recorded a Forward P/E ranging from 15.20 to a high of 22.63. The median point of this valuation was 17.64. HUM’s price-to-earnings growth (PEG) ratio also stands at 1.24 slightly lower than the industry’s average of 1.31.

Humana’s price-to-book (P/B) ratio stood at 3.77 compared to the industry’s average of 4.43. In the last 12 months, HUM’s P/B stood at a high of 4.08 and fell to a low of 2.90.

HUM’s enterprise/ firm value sits at a high of $70.06 billion against the market cap which is currently at $61.61 billion. This situation indicates that Humana has a positive debt balance, with its debt higher than the current cash balance. In the 12 months leading to March 2022, HUM generated $3.401 billion from operations, an increase of 50.35% from $2.262 recorded in the 12 months leading to December 2021. This growth was, however, canceled out by $5.716 in negative investment cash in the 12 months leading to March 2022. The balance had declined 12.81% from $6.556 billion used in the 12 months leading to December 2021.

Key Takeaway

Humana’s stable performance in Q1 2022 was overshadowed by its weak capital structure. Despite its huge share in the US health insurance market, the company is slightly overvalued. The capital structure metrics show that HUM’s enterprise value currently exceeds the market capitalization indicating a higher debt as compared to the cash balance. Still, the company has outperformed the S&P 500 as well as the industry average showing strong momentum into the end of 2022. Despite selling 60% of its majority stake in Kindred at Home for $2.8 billion in cash proceeds, Humana still recorded a loss since the entire entity was valued at $8.1 billion at the time of purchase. For these reasons, we recommend a hold rating for the stock.

Be the first to comment