bancha singchai/iStock via Getty Images

I generally try to avoid businesses that deal mainly with commodities, as the financial results are largely dependent on the prices of those commodities, which I have little ability to predict. However I am making an exception with Hudson Technologies, Inc. (NASDAQ:HDSN). Hudson operates in the refrigerant industry, which is experiencing a supply shock as governments all around the world are agreeing to cut the production and use of hydrofluorocarbons (HFCs), a widely used refrigerant.

This is similar to what the oil and gas market is going through, as an external shock to supply is keeping prices relatively elevated even when most commodities that are sensitive to economic weakness (aluminum, copper, lumber) have dropped greatly. This is a good thing for oil and gas businesses, but I’m avoiding the sector because there are still too many factors that can influence oil prices. There are economic questions such as what will happen with China’s economy, there are geopolitical questions as the war in Ukraine continues, there are longer term demand pressures as the world works to transition away from oil and gas consumption to renewable energies, and there are political questions as the U.S. continues to release barrels from the SPR.

I don’t see these types of variables at play in the refrigerant market. In fact, I see multi-year tailwinds that will keep refrigerant prices high, and Hudson is ready to benefit from this. Add to this a cheap valuation and Hudson looks like a buy to me.

A Rare Bipartisan Agreement

One can argue that politics are keeping the supplies of both oil and refrigerants low, but there is far more of a political consensus to keep the supply of refrigerants low. In 2020, congress passed the AIM Act, which empowers the EPA to enforce a phase-down of 85% of the production and consumption of HFCs over 15 years. Recently, the Senate had a rare bipartisan agreement when members voted 69-27 that the U.S. should join the Kigali Amendment, which is a global pact to sharply reduce the production and use of HFCs.

When there is global political consensus that the supply of a widely used refrigerant should be curtailed significantly, there is less risk that the supply induced upward pressure on the price of refrigerants will be short-lived.

Despite this, I think Hudson is being lumped in with other businesses that deal in commodities. Most commodities have plunged over the recent months as lower demand along with increased supply have taken prices down, as it’s usually the case that gluts follow shortages.

Take The Chemours Company (CC), for example. It deals with performance chemicals that are inputs to end products in a variety of industries. The business has three main segments: Titanium Technologies, Thermal and Specialized Solutions, and Advanced Performance Materials. In the Titanium Technologies segment, they manufacture and deliver Titanium Dioxide. This is a chemical compound that is used in a variety of consumer products. The Thermal and Specialized Solutions segment is a provider of refrigerants, thermal management solutions, propellants, foam blowing agents, and specialty solvents (this segment is why Chemours is relevant to Hudson). And the Advanced Performance Materials segments is a provider of high-end polymers and advanced materials.

Chemours common stock is down 27% year-to-date and 45% from its peak in June. This decline is not for a bad reason. Along with the general weakness in commodity prices, they recently lowered their FY 2022 adjusted EBITDA guidance. Chemours’ stock dropped quite a bit on the day of this announcement. Hudson’s stock was also down in what I believe was a move related to the Chemours guidance update as the stocks of these companies often move together.

But at a closer glance, the press release explains what is driving the lowered guidance. It reads, “Changes to the Titanium Technologies (TT) segment outlook drove the entirety of the change in the company’s full year guidance.” Comments from the CEO follow:

In our TT segment, we have experienced a continued decline in our demand outlook throughout the third quarter, most notably in Europe and Asia. Lower demand, coupled with continued high input costs, have impacted our projected results for the full year. In response, we will be extending a scheduled outage on one of our TT production lines, in addition to other cost actions. In our TSS (Thermal and Specialized Solutions) and APM (Applied Performance Materials) segments, we expect to drive 2022 earnings growth even as we enter the seasonally weaker second half. Our revised outlook assumes that the economic factors we’ve mentioned will not worsen or accelerate.

While this statement follows the general narrative that lower international demand is pushing commodities down I want to emphasize a line that I think is very important for Hudson:

“In our TSS (Thermal and Specialized Solutions) and APM (Applied Performance Materials) segments, we expect to drive 2022 earnings growth even as we enter the seasonally weaker second half.”

For a company like Hudson that operates primarily in the U.S. and only deals with refrigerants, this press release is a reason to be bullish. Along with Chemours’ TSS segment, Hudson could see further earnings growth as the year goes on. And when algorithms and flows take Hudson’s stock down, as I think they did with the Chemours’ stock, it provides an opportunity for investors.

Other Tailwinds

I believe a few more longer term tailwinds exist that will hold up demand for refrigerants and Hudson’s services. First, global temperatures are rising, which may lead to more record heatwaves across the U.S. If this trend continues over the next few years, it will increase demand for refrigerants for obvious reasons.

Second, in the past few quarters businesses have started to mandate that employees return to offices on a hybrid or full time basis. This will increase demand for refrigerants, as commercial HVAC systems will need to be turned up to account for more people in buildings. This trend will boost demand during the summer months over the next few years.

Finally, like it or not, the green/sustainability movement is here to stay and businesses will want to show that they are being environmentally friendly. One way that they can do this is by using reclaimed refrigerants for their HVAC systems. Recently Lennox International Inc. (LII) announced an alliance with Hudson to push the use of reclaimed refrigerants for the aftermarket support of their residential HVAC systems. AprilAire also announced an alliance with Hudson in which Hudson will supply reclaimed refrigerants for use in AprilAire’s products. These are mutually beneficial alliances; Hudson gets more business and the companies using Hudson’s reclaimed refrigerants get good press. I would not be surprised to see more alliances like these going forward.

Financials

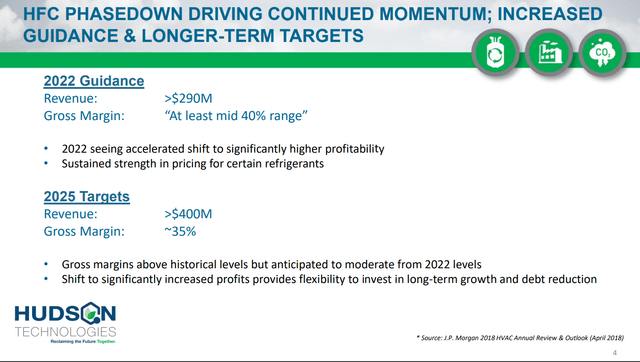

Hudson Technologies Long Term Financial Targets (Hudson Technologies August 2022 Investor Presentation)

Hudson’s 2025 targets are $400 million+ in revenue and 35% gross margins. Assuming SG&A expenses equal to 10% of revenue, operating income in 2025 would be $100 million. This means the stock could be trading at about 3x 2025 EBIT. Investors can get into trouble extrapolating 2022 earnings in future years especially when it comes to cyclical companies that sell commodities, but again, Hudson is operating with a commodity in which the consensus opinion is that supply should be kept sharply down.

The 2022 forecast calls for $290 million in revenue with about ~40% gross margin. Assuming SG&A expenses of 10% of revenue, although there is a good chance these expenses will be lower, 2022 EBIT would come out to about $90 million which puts the stock at a little over 3x 2022 EBIT. The lack of earnings growth between 2022 and 2025 would be due to lower gross margins as the prices of refrigerants moderate from the very elevated levels seen today.

Additionally, Hudson is an attractive investment because it is a relatively capital light business. Capex has historically been about $1-2 million per year. If this moves up proportionately with revenue, in 2025 capex will be about $4 million. This is very reasonable when compared to $100 million in potential operating income. I think a business that is not capital intensive like this should demand a higher EBIT multiple and if the next few quarterly reports show earnings growth, as I think they will, the market may catch on.

If these quick assumptions end up being true, the main question is what will Hudson do with all of the cash it generates? In the Q2 2022 earnings call, CEO Brian Coleman said that they are paying off debt and by 2024 they could be debt free. He then mentions that Hudson will have “cash flow available to look at acquisitions and other targets for investment in the business.” The refrigerant and HVAC industry is a very fragmented industry so it makes sense to consolidate and acquire if the price is right.

But if Hudson’s common stock continues to trade at depressed levels, it could also make sense to repurchase shares. Whatever the case may be, Brian Coleman has been at Hudson since the ’90s, so I’m sure he has a grasp on what will be best for the long-term prospects of the business. Shareholders should also be reassured by the fact that there is greater than 10% insider ownership of the business.

Risks

I see recent insider selling and general economic weakness as the two main issues to worry about. Between May and June, directors sold a bit more than 100,000 shares at prices above $9 per share. In hindsight this may have been a good indication that there would be a short term top, but the insiders that sold still retain large positions. Plus, one of the directors that sold above $9 per share also sold in March at about $5 per share, which in hindsight was a bad trade to make. There hasn’t been any selling since the May and June selling, however, and as I mentioned above, insider ownership is still greater than 10%.

And, of course, general economic weakness would hurt Hudson as it would hurt almost every business, although Hudson would have a few things going for it if we see a bad recession. As I wrote above, refrigerants will be supply-constrained for the foreseeable future which will lead to a higher floor on refrigerant prices regardless of demand. Additionally, Hudson operates primarily in the U.S so there will be no FX issues leading to lower revenue and for now, it’s looking like the U.S. will be in a better situation than Europe or Asia if central banks hike rates into a deep recession. Obviously this situation won’t be good for any business, but for a commodity business, I think Hudson is about as well-positioned as it can be for this risk.

Final Thoughts

Refrigerant prices should stay high for the foreseeable future because there is general political consensus that refrigerant supply should be kept artificially low. As a supplier of refrigerants and a market leader in reclaimed refrigerants, Hudson should benefit greatly from this supply/demand imbalance.

Based on 2022 earnings and what management is calling conservative longer-term guidance, Hudson is trading at a cheap valuation. The stock price is likely depressed due to general economic fears. But as seen from the Chemours press release, prices of refrigerants should stay elevated and should drive earnings up for businesses like Hudson that sell refrigerants.

On top of this it is a capital-light business, so there will be excess cash generated over the course of the next few years. Management has signaled that they will likely pay down debt and acquire other businesses in the industry, but beyond that I would hope they would return cash to shareholders. Just in the last year they have paid down some debt and added about $35 million to the cash balance and accounts receivables, all while SG&A expenses and capex have stayed flat. And with relatively high insider ownership, I trust that management will make shareholder friendly decisions with that cash.

Be the first to comment