Panuwat Dangsungnoen/iStock via Getty Images

Intro & Thesis

Hudson Technologies (NASDAQ:HDSN) is a $460-million refrigerant services company that provides solutions to recurring problems within the refrigeration industry primarily in the United States.

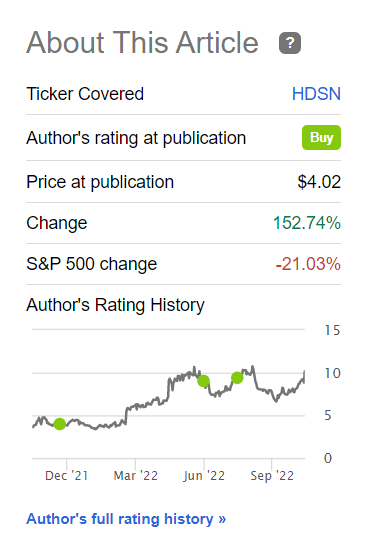

I initiated coverage of Hudson Technologies stock in December 2021 and have since published 3 articles on Seeking Alpha encouraging readers to take a closer look at this interesting small-cap company. According to TipRanks, this was my best call ever.

Seeking Alpha, author’s first take on HDSN

Yesterday, the company released its Q3 2022 results, beating analysts’ EPS and revenue forecasts for the 7th consecutive quarter. I believe the stock still has significant upside potential in 2023 – the combination of stable FCF, high margins, and strong demand in the end market, where the company is the undisputed leader, will attract more investors. While the valuation is still quite modest, I see no reason not to stay bullish.

Q3 Earnings Overview

According to TradingView data, Hudson beat analysts’ EPS and revenue estimates by 138.46% and 12.31%, respectively. This kind of a beat and subsequent market reaction (the stock is up >14% in just 1 day) is nothing unusual for HDSN – we saw it in March and May 2022 when the market had to adjust to real data it did not expect.

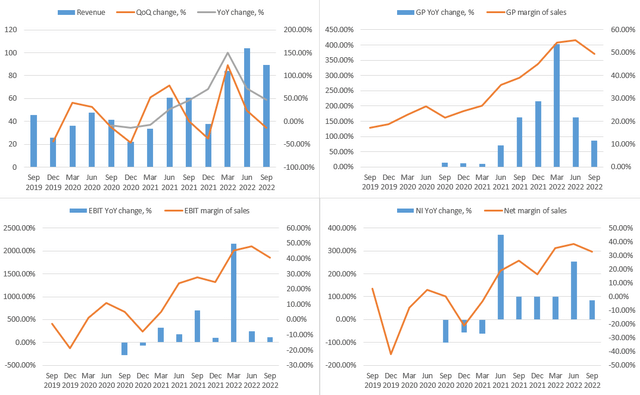

What was left out of the broader market’s reach is that refrigerant prices have risen sharply, but costs for manufacturers have barely changed, resulting in higher growth in Hudson’s gross margin (49.4% in Q3 2022 compared to 39.1% in Q3 2021).

If you read my article on the company’s Q2 2022 results from August, you probably remember that the CEO was just saying that the gross margin would probably be in the mid-40% range, so I was expecting about 44-46% in Q3 2022. The actual 49.4% was a complete surprise for me – suggesting that demand for refrigerants is even higher (in historical terms) and thanks to it the company has been able to pass on cost inflation to end users quite easily.

Gross profit increased in Q3 2022 by 86.5% YoY, but since S&G expenses got up by just 17% amid flat D&A, HDSN’s operating income more than doubled (+114.79%, YoY).

There was no “Other Income” this quarter (last year HDSN had a one-time gain of $2.5 million), and taxes increased dramatically (about 6-fold), so the basis of comparison for net income became higher (unlike what we saw with gross profit comparison). Nevertheless, Hudson managed to increase net profit by almost 85% year-on-year, with its net profit margin remaining above 30%, which is historically amazing considering the seasonality.

Author’s calculations, based on Seeking Alpha

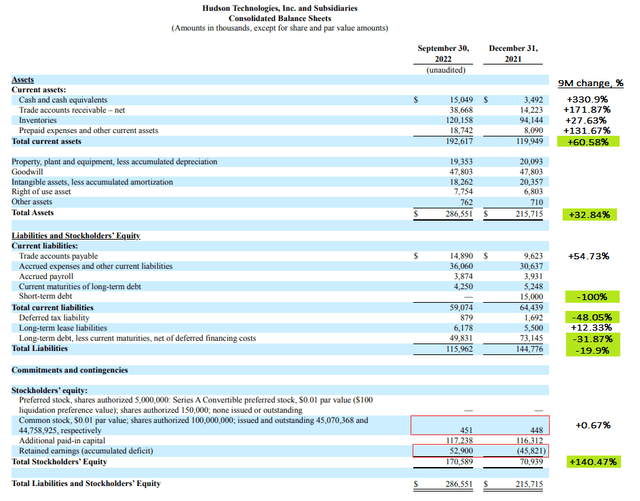

We do not have a full 10-Q yet to see the cash flow changes in more detail, but the recently released 8-K is already enough to see the value growth the company has achieved in 2022 just from the balance sheet.

HDSN’s balance sheet from 8-K, author’s calculations

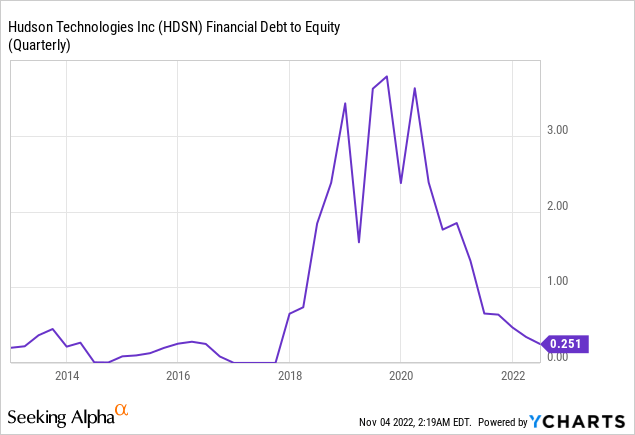

In three quarters of 2022, Hudson more than tripled its cash cushion. The 140.6% increase in working capital is primarily due to growth in current assets and a reduction of short-term debt. In terms of long-term liabilities, we see how the company’s debt has fallen by nearly 32%, and as the company has turned a $45.8 million capital deficit at the beginning of the year into a $52.9 million retained earnings, shareholders’ equity has increased by 140.5% in just 9 months. The ratio of financial debt to equity is now just 0.251x and is rapidly moving towards 0, as it was before the company’s crisis in 2018.

So from what I see in the balance sheet and income statement, Hudson Technologies continues to surprise not only the general market but also those who have been watching the company closely for more than the first quarter.

As is so often the case, the share price performance after the earnings report release depends on what and how management will comment on the near future of the company (the beat itself is not that important, but the subsequent earnings call). Here’s what Brian F. Coleman, President & CEO of Hudson Technologies told us on the earnings call:

We still feel very good about our long-term forecast and projections. We believe our Q4 for ’22 will have some similar relationship for Q4 of 2021. Certainly, Q4 2021, you saw a significant increase in gross margins in that quarter compared to the historical levels. As we reflected in Q3 of this year, we’re seeing a moderation of the gross margins which is what we expected that costs will begin to catch up. So we think Q4 ’22 is going to look a lot like — similarity to Q4 of 2021. But our long-term projections are still, we think, conservative and we ought to be able to get there.

Source: HDSN’s Q3 Earnings Call Transcript, CEO’s words [emphasis added by the author]

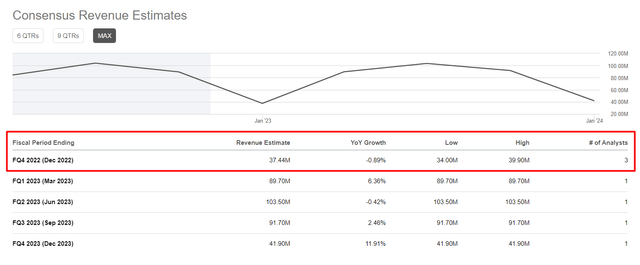

What gives? In Q4 2021 we saw a revenue of $37.8M with a gross margin of ~45%, which then translated to EBITDA of $10.9M and a net income of $6.2M (diluted EPS of $0.13). If we assume Q4 2022 will be exactly the same quarter as last year, even with a lower gross margin, Hudson Technologies will likely easily beat the EPS estimate given by only 1 analyst:

Seeking Alpha, HDSN’s Earnings Estimates, author’s notes

Also, according to the calculations of 3 analysts, sales are likely to correct a little YoY for some reason – and this is despite the new customers that Hudson is expected to gain by actively working in this direction.

Seeking Alpha, HDSN’s Earnings Estimates, author’s notes

In mid-September, we exhibited at The Food Industry Association’s Energy and Store Development Conference which focused on retail food, energy use and management, HVAC and refrigeration and sustainability. In October, Hudson presented a continuing education webinar around the AIM Act phasedowns and the importance of reclamation which was sponsored by the industry news magazine, ACHR News. With almost 500 live attendees and we anticipate another several interviews from registered participants.

This week, we’re exhibiting at the Greenbuild International Conference and Expo, introducing our products to attendees focused on creating greener buildings and communities throughout the use of sustainable solutions. And next week, we’ll be at the Institute of Heating and Air Conditioning Industry trade show. IHACI is a California HVAC industry organization focused on contractor training and with California’s role as an early adopter for certain reclamation activities. We look forward to showcasing our capabilities there.

In the past year, we’ve announced partnerships with AprilAire and Lennox, whereby Hudson will supply the reclaimed refrigerant needs for their new equipment. Likewise, there are many other states evaluating moving forward on regulations requiring the use of reclaimed HFCs. And we believe there’s a tremendous opportunity for us to grow our business as we help customers navigate the current and future regulatory environment.

Source: Author’s compilation [with emphasis] of Brian Coleman’s words [from the latest earnings call transcript]

I expect analyst forecasts for Q4 2022 (2 cents per share) to be beaten again if management’s words come true that “the operating line” will most likely look like last year. Also, I think management is being too conservative here – let us not forget how quickly and how much HDSN has been able to reduce its debt on the balance sheet – so the bottom line is likely to be even higher, in my view.

Valuation Still Looks Good

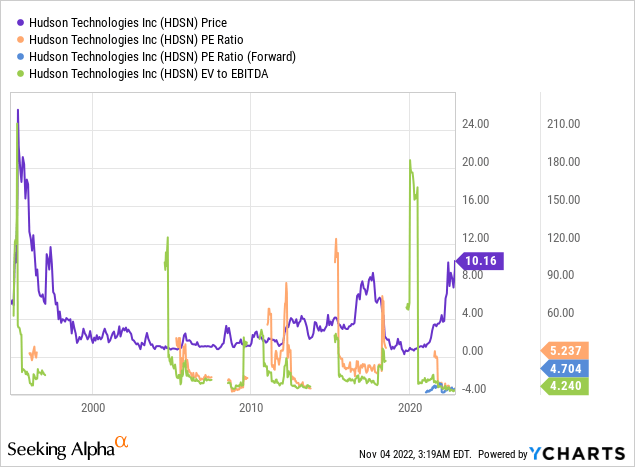

Hudson Technologies is a representative of a cyclical business with a fairly pronounced seasonality. However, 2022 and the next few years will be different from previous periods of ups and downs for the company. The AIM Act, which mandates a 10% reduction in the production and consumption of virgin HFCs in 2022 and 2023 and a 40% reduction in 2024, as well as the car regulations in California which require OEMs to use at least 10% recovered refrigerant in factory-filled charged equipment, will increase demand for the company’s products, extending the current bull cycle.

But the market seems to be expecting a cycle peak at the end of this year – there is no other way to explain such a low valuation of the company against the backdrop of such growth (both operationally and in terms of the price action).

HDSN is currently trading at just under five times earnings and has the highest return on capital employed in its history of 68.19% and net debt to EBITDA (TTM) ratio of just 0.33x (lower than in 2012, one of the strongest cycles).

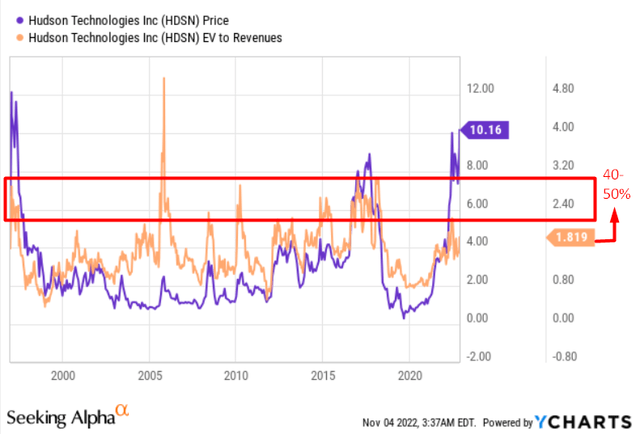

If we look at the EV to sales ratio – the most stable and uninterrupted valuation multiple of all – we see that despite the stock’s meteoric rise, HDSN still needs to rise at least 40-50% to reach the average peak of previous cycles:

This is my medium-term price target – 40-50% upside potential or $14.22-15.24 per share.

Bottom Line

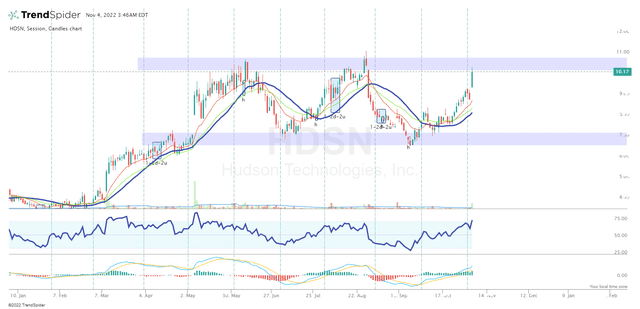

Of course, the stock has every chance of cooling off and falling back to where it was a month ago ($7-8 per share). Also, there is a strong resistance ahead that will be difficult to overcome – most likely a whole bunch of speculators and investors are dumping their volumes on it.

TrendSpider, HDSN, author’s note

In addition, a further slowdown in the U.S. economy would be a strong headwind for the company. Also, do not discount the cold spring and summer in the region – the colder, the worse for HDSN in the medium term.

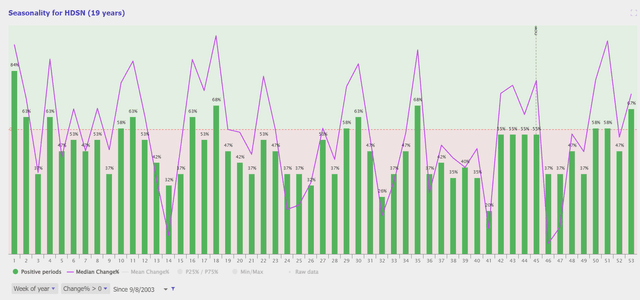

Seasonality also says that now it is better to wait for a better price to initiate a position:

TrendSpider, HDSN’s seasonality since 2003

In any case, despite all the risks, I look first and foremost at the fundamental profile, and at the prospects that the government is creating for the company. “Do not fight the Fed” has been heard a lot lately – I would say “Don’t fight the government” in terms of how new laws/acts are simply forcing end users to turn to Hudson Technologies’ products.

So I reiterate my earlier Buy recommendation and see an upside potential of 40-50% over the medium term for those who have been watching HDSN from the sidelines.

Thanks for reading!

Be the first to comment