onurdongel/E+ via Getty Images

Investment Thesis

Hudson Pacific Properties, Inc (NYSE:HPP) deals in the real-estate business, which mainly includes office and studio properties. The company has recently announced the acquisition of Quixote Studios, which I believe can accelerate the company’s growth, and this growth can further be sustainable by a solid tailwind in the content production industry. The company also has a high dividend payout rate, making it an attractive investment opportunity for risk-averse and retired investors.

About HPP

HPP is a real-estate business that acquires, develops, and operates office & studio properties in a high-growth market throughout Northern and Southern California, Western Canada, Greater London, the Pacific Northwest, and United Kingdom. As of December 2021, the company’s portfolio consists of office properties which comprise an aggregate of approximately 15.8 million square feet, whereas the studio properties comprise 1.5 million square feet, which include a sound stage, office, and supporting production facilities. The company’s major tenants include Google, Netflix, and Amazon, which together contribute 20.2% of the annualized rent generated through office properties. The company invests in Class-A and studio properties which are located in markets with solid entry barriers giving the company a lot of growth potential and a strong economic moat. The company’s customers are primarily from technology, media, and the entertainment sector. The company experienced demand recovery in tenants in the second quarter, which was reflected in the company’s leasing pipeline, which has remained constant at 2 million square feet. Its increased focus on leasing activities has resulted in a 6% growth in the cash rent during the second quarter.

Acquisition of Quixote Studios

The company has announced the acquisition of Quixote studios, which mainly provides sound stages and production services in the entertainment industry. Its major clients include HBO, Sony, Paramount, ABC/ Disney, Warner Bros, and NBC Universal. As per the acquisition deal, the company will be securing leasing rights to 530,000 square feet, which will include 26 sound stages, a production office, and support space which has the potential to generate strong cash flows. This acquisition can create solid synergies and increase the company’s ability to capture the growing demand in the market, as Quixote is a leading company with high-quality customers in the entertainment industry.

The demand in the Content Production market is rising, which has made content providers increase their production and expand their areas of operations. I believe this acquisition can significantly increase the revenue and profits of the company in the coming years, as Quixote can help the company to capture the rising demand for studios and related assets in the Content Production market and the excess demand at Sunset Studios locations. According to the management, the acquisition of Quixote can help the company to diversify its client base and achieve economies of scale, which I think can result in margin expansion and a significant rise in the company’s earnings. The company’s earnings growth can boost the dividend payment in the coming years.

High Dividend Yield

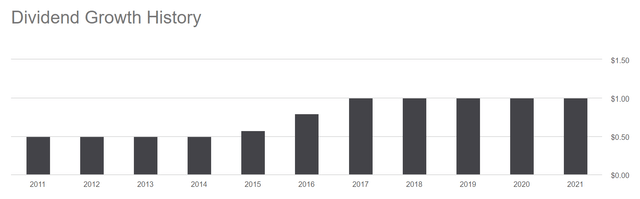

Dividend Trend (Seeking Alpha)

The company significantly increased its dividend payout in 2017 and has maintained consistent dividend payments since then. This regular dividend payment reflects the good position of the company. The company has announced a quarterly dividend of $0.25 per share. After considering the effects of the acquisition of Quixote Studios which can generate strong cash flows in the future, I think the dividend payment might rise in the coming years. But to keep my analysis conservative, I estimate a constant dividend payment in the coming years. That is why I estimate that a dividend of $0.25 can remain constant in the coming quarters, which is equivalent to an annual dividend payment of $1.00. At the current share price of $10.90, an annual payment of $1.00 represents a strong dividend yield of 9.17%. I believe the dividend yield of 9.17% is an attractive investment opportunity for risk-averse and retired investors in the current market volatility.

What is the Main Risk Faced by HPP?

Volatile Interest Rate

HPP has $1.6 billion in variable interest rate loans, of which $475.0 million is subject to interest-rate swaps. The company may take on future variable-rate debt. Interest rates are susceptible to various outside influences, such as general economic conditions, the decisions made by various governmental & regulatory bodies, and the Federal Reserve Board. Interest rates will probably increase if the Federal Reserve Board raises the federal funds rate. Increased interest rates would result in higher interest expenses on the company’s unhedged variable rate debt, which could negatively impact cash flow and the ability to repay the debt on principal and interest. Rising interest rates may also make it more difficult for the business to refinance existing debt when it comes due. HPP uses interest rate hedging arrangements that carry risk, including the risk that counterparties may not uphold their obligations under these arrangements and that these arrangements may not be successful in reducing the company’s exposure to interest rate changes in order to manage its exposure to interest rate volatility. Ineffective interest rate hedging could have a materially adverse impact on HPP’s financial situation, operational results, cash flow, and per-share trading price.

Valuation

The strong tailwind in the content production market has created potential growth opportunities for the company. Identifying these opportunities, the company has announced the acquisition of Quixote, which can benefit the company in capturing the rising demand and achieving economies of scale to expand the profit margins. After considering all these factors, I am estimating an FFO per share of $2.04 for FY2023 which gives the forward P/FFO ratio of 5.34x. After comparing the forward P/FFO ratio of 5.34x with the sector median of 12.98x, I think the company is undervalued. I believe the share might fail to gain significant momentum and trade below the sector median due to the rising interest rates. Hence, I estimate that the company can trade at a P/FFO ratio of 7.5x, which gives the price target of $15.30, representing a 40.4% upside from the current share price level.

Conclusion

HPP has recently acquired Quixote Studios, which can help it to capture the rising demand and achieve economies of scale that can offset the effects of rising interest rates. The company is exposed to the risk of volatile interest rates, which can affect the company’s financial cost and contract the profit margins in the coming years. HPP pays a high dividend yield which makes it an attractive investment opportunity. After comparing the forward P/FFO ratio of 5.34x with the sector median of 12.98x, I believe the company is undervalued. After considering all these factors, I assign a buy rating to HPP.

Be the first to comment