ismagilov

Introduction

In early August 2022, I wrote a bullish article on SA about total talent solutions provider Hudson Global (NASDAQ:HSON) in which I said that demand for its services was looking strong and that I wouldn’t be surprised if EBITDA topped $20 million in 2022 unless a global recession hurt the labor market in the developed world.

Well, Q2 2022 revenue inched down by 1.8% and I find this disappointing considering there is some seasonality here and Q4 and Q1 tend to be the weaker quarters. However, the company said during its earnings call that demand from its three main sectors ( healthcare, financial services, and tech) continues to be strong. In addition, Hudson Global recently announced the purchase of India-based recruitment services provider Hunt & Badge which should provide a small boost to Q3 revenue. Let’s review.

Overview of the recent developments

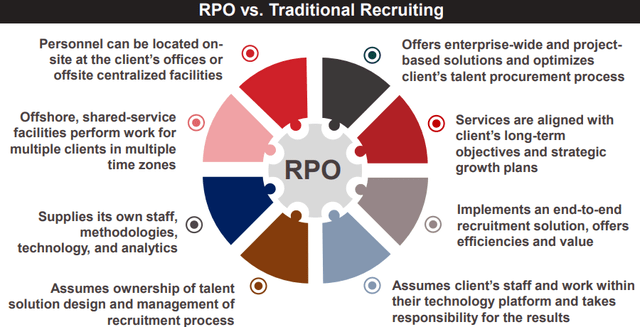

In case you haven’t read my previous article about Hudson Global, here’s a short description of the business. The company is involved in the provision of recruitment process outsourcing (RPO) permanent recruitment and contracting outsourced recruitment solutions and currently operates directly in fourteen countries. It has about 1,300 employees.

Hudson Global is not the most expensive RPO firm on the market, but also not the cheapest. The majority of its clients are large Fortune 500 companies and the Asia-Pacific regions (mainly Australia) and Americas regions account for about 60% and 30% of revenues, respectively. The remainder comes from Europe.

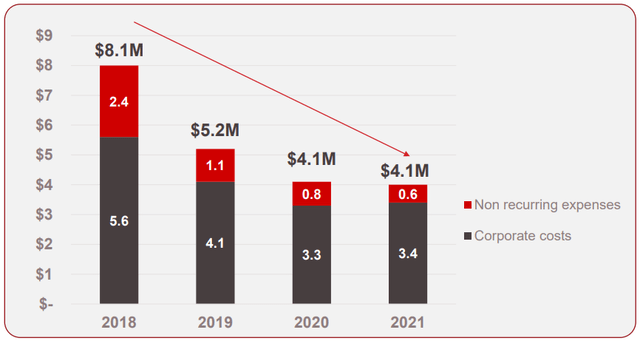

Besides organic growth, the company has been relying on bolt-on acquisitions to expand its business. It has also significantly cut corporate costs over the past few years in order to improve its margins.

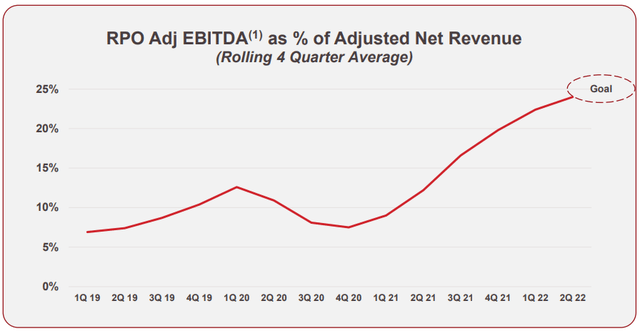

Hudson Global’s margins are also improving rapidly thanks to economies of scale as well as a rapidly growing global RPO market. According to data from Research and Markets, the recruitment process outsourcing market worldwide is forecast to expand with a CAGR of 13.9% between 2022 and 2030.

The number of Hudson Global’s shares outstanding has declined by 12% since the end of 2018 thanks to several purchases of blocks held by large shareholders and the company has a $340 million net operating loss (NOL) carryforward in the USA that could save it about $66 million in taxes in the future (this is equivalent to over $23 per share).

Overall, I view Hudson Global as a growth stock with improving margins that is led by a conservative management team focused on boosting book value per share. There is no dividend here at the moment.

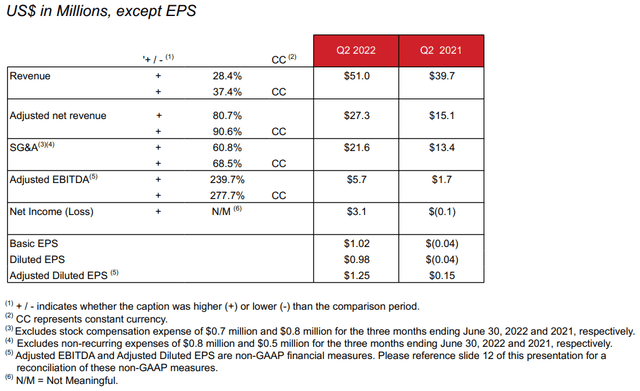

Turning our attention to the Q2 2022 financial results, revenue increased by 28.4% to $51 million while adjusted net revenue (revenue minus direct contracting costs and reimbursed expenses) soared by 80.7% to $27.3 million. Adjusted EBITDA, in turn, more than tripled to $5.7 million.

However, I find these figures somewhat disappointing considering Q2 or Q3 are usually the strongest quarters of the year as there is typically less hiring activity in Q1 and Q4. Compared with Q1 2022, revenues decreased by 1.8%. Adjusted net revenue increased by 6.7% but you have to take into account that this includes the results of Chicago-headquartered recruiting services provider Karani, which was bought in November 2021. In Q2, this company contributed external revenue of $2.5 million (see page 9 here).

It seems that global macroeconomic headwinds could be starting to affect the RPO sector. Yet, this appears to have a limited impact on Hudson Global’s financial results for now as many of its clients are large Fortune 500 companies. During the Q2 earnings call, Hudson Global said that demand is still strong from its main sectors, especially the life sciences segment. This is good news as this is a segment that usually isn’t cyclical or sensitive to macroeconomic headwinds. In addition, Hudson Global said that there was no reason to think that the second half of 2022 would be radically different than the first half. Looking at what to expect from Q3 results, I think that revenues should be somewhat higher than the ones from Q2 as the company completed the purchase of Hunt & Badge in late August. This is a relatively small company focused on APAC and data from Apollo.io shows that it has about 25 employees. Annual revenue should be around $13 million. I think it seems like a good bolt-on purchase as Hudson Global already has a strong presence in this region. However, I want to know the purchase price as well as the net income contribution before saying it makes sense from an economic standpoint.

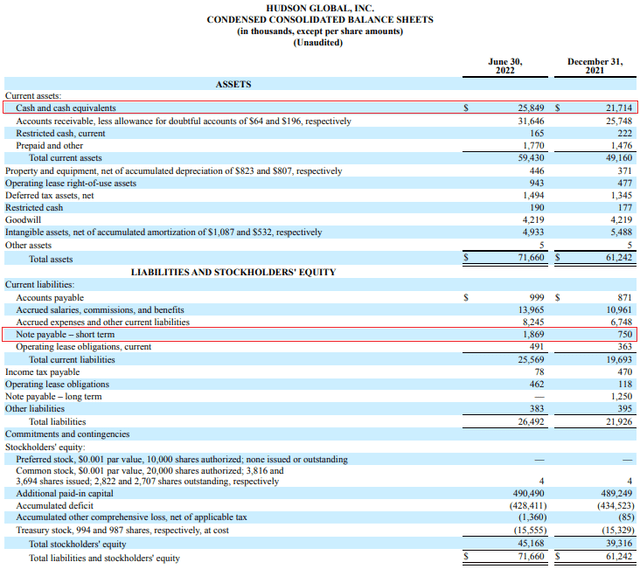

Turning our attention to Hudson Global’s balance sheet, I think the situation looks good as cash and cash equivalents rose by $6.7 million during Q2. The company has barely any debts and net cash increased by $6.8 million to $24 million between April and June.

Overall, I continue to think that Hudson Global looks cheap but I’m less bullish compared to August as Q2 revenues were soft and the share price has increased by 21% since my first article as of the time of writing.

Looking at the risks for the bull case, the major one seems to be a prolonged global recession which would hurt growth in the RPO sector as companies around the world limit hiring. According to a KPMG survey of 1,325 CEOs between July 12 and August 24, about 91% of U.S. CEOs think that we are heading toward a recession in the next 12 months (slide 4 here). Only 34% of them believe that it will be mild and short.

Investor takeaway

Hudson Global says that demand for its services is still strong but the global macroeconomic environment continues to worsen and I find it concerning that Q2 revenues were lower compared to Q1. However, many large U.S. companies still aren’t putting the brakes on hiring and Hudson Global strengthened its balance sheet between April and June. In addition, the value of the NOL carryforward in the USA is almost as high as the company’s enterprise value at the moment.

I continue to think that Hudson Global should be trading above $40 per share.

Be the first to comment