funky-data/iStock Unreleased via Getty Images

Shares of American Express Company (NYSE:AXP) had lost about 20% of their value going into Q3 earnings, and the results added to the pain, with shares falling another 4% in early trading. While investors are focused on a larger jump in credit provisions, I am impressed by the tremendous growth in the business. This validates the view that American Express is one of the highest-value brands in financial services. At 14x earnings, AXP shares offer attractive value.

In the company’s third quarter, American Express generated EPS of $2.47, up 9% from last year and $0.06 ahead of consensus. Revenue rose 24% to $13.6 billion, which led to net income growth of 3% to $1.88 billion. Thanks to its buybacks, shares outstanding fell 5% to 749 million. These were solid results on revenue growth, with good pass-through to the bottom line despite a nearly 20% increase in card benefit costs. Higher rates are helping to fund these costs. Net interest rose $200 million from last quarter and $400 million from last year to $2.6 billion.

We saw AXP report strong revenue across the entire company. U.S. consumer profits rose to $1.31 billion from $1.25 billion last year. Its commercial services unit saw profits rise from $699 million to $774 million. International card services fell from $269 million to $166 million; foreign currency depreciations was a 15% impact on the segment’s top-line. Global merchant and network services rose to $792 million from $513 million. Overall, about 80% of network volumes are in dollars. While the weaker dollar hurts AXP’s international business, it is a manageable impact. Plus, a stronger dollar makes it easier for Americans to travel abroad, which provides an offsetting tailwind.

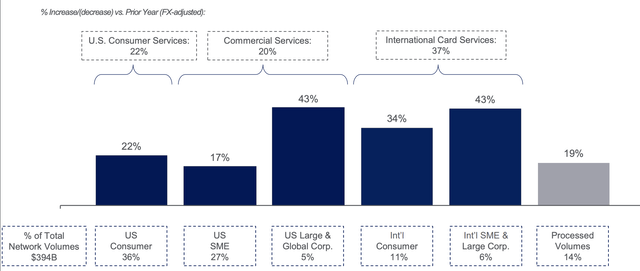

Network volumes were stable QoQ at $394 billion, but still up 23% from 2021. They are now up 29% from 2019. As you can see below, every customer segment is growing tremendously. I would argue highly that large companies are the standout, both domestically and abroad. In 2021, we saw consumers and small business start to travel again, but big business’s travel and entertainment (T&E) spending was slower to come back, particularly with remote work. Big business T&E spending is now normalizing, and that has helped create this last spurt of growth.

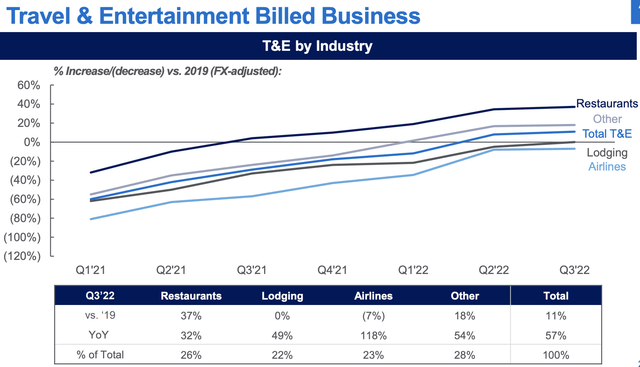

Travel and entertainment spending rose 57% over the past year. Relative to 2019, it is now running ahead of 2019 levels, with airline transactions nearly back to 2019, having more than doubled over the past year. I would note this is not inflation-adjusted, so given the price increases, overall volumes are likely still below 2019 levels. While this may provide some further upside, the bulk of the T&E gains have already occurred and will decelerate from here.

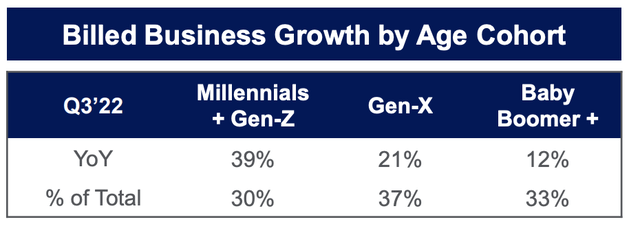

What I find most exciting about AXP is the inroads it has made with younger customers. For years, American Express has stood out as an aspirational, premium brand in financial services, an industry that is generally quite commoditized. There had been questions whether AXP would be able to retain its cache among younger consumers. While competitive pressures have increased, requiring the jump in cardmember benefit costs, the verdict is that American Express continues to win. Millennial and Gen-Z now represent 30% of its customer base, and they are growing the fastest, with business up 39% from last year. With a generation that values travel and services, AXP’s travel-oriented benefits, like access to airport lounges, has been a differentiator.

Because of the massive growth in its business, AXP’s loan balances continue to grow. Loans are up over 4% quarter over quarter and 31% from last year. This contributed to the primary negative point in the quarter. AXP provisioned $778 million for credit losses with a $387 million reserve build. Now, every time AXP make a loan, it has to reserve against it. Its larger loan book from Q2 alone required a ~$125 million reserve increase, or one-third of the build.

AXP does target a higher-income consumer, which should lead to better credit performance over the economic cycle. Moreover, even as it has grown among millennials, there is no evidence it is taking more credit risk. Loans 30+ days past due are just 0.9% of all loans, down from 1.5% pre-COVID. Due to lower loss rates, it has been holding lower reserves. AXP has $3.5 billion in reserves from $4.3 billion at the start of 2020, as such reserves as a share of loans is 3.2% from 4.6%. The combination of loan growth and lower starting reserves forced AXP to do a bit of “catch-up” on the reserves front, given a deterioration in the macro environment, but with delinquencies low and stable, I do not expect this to be the start of a spiral higher in credit costs.

Additionally, I would note that AXP is well-capitalized. Its CET1 ratio rose to 10.6%, safely inside the targeted 10-11% range. AXP also now gets 70% of its funding from deposits from 54% pre-COVID, leaving it with less reliance on capital markets. This is a positive structural shift that provides more certainty on the funding front.

Despite higher credit costs, management expects full year EPS to be above its $9.25-$9.65 range this year and that it will generate double-digit revenue growth next year. American Express is not only a premier brand, it is a quickly growing one. It is as relevant to U.S. consumers as ever, and the normalization of large corporate spending provides a further tailwind. With double-digit revenue growth next year, EPS should be safely above $10. It would be a mistake to sell AXP on credit concerns given its customer base and low delinquencies, and investors should be glad to see the growth it is generating, even as this growth mathematically requires holding more capital and reserves.

AXP has historically had an 18.4x forward P/E v the 13.5x multiple it has now. With the brand performing as well as ever, this is a chance to buy a great company at a discount. Given recession and credit worries, I do not expect it to return all the way to its average multiple, but it can trade back to at least 15-16x, providing upside past $150. Weakness is an opportunity in American Express.

Be the first to comment