Igor Kutyaev

Thesis

Buying China-based equities can give investors some serious headache, I get it. China bulls lost more than 30% of their equity five times since 2000 (Reference Hang Seng (HS) drawdowns as a percentage from all time highs). This compares to two times for the S&P 500 (SPY).

The latest bear market is especially hard – with the HSI down some 50% from all time highs. And on Monday October 24th alone, the HSI lost 7% in one day – with leading tech giants such as Baidu (BIDU), JD (JD), Alibaba (BABA), Tencent (OTCPK:TCEHY) and NetEase (NTES) all losing more than 10% in US trading hours.

Personally, I believe there is a good argument to be made for taking a speculative equity position in the HSI, and perhaps also other China equity instruments: (1) the valuation is too cheap to ignore, (2) pricing of political risk has taken an excessively negative color, (3) and China’s economy might be in a better shape than what the narrative implies.

Multi-Decade Low Valuation

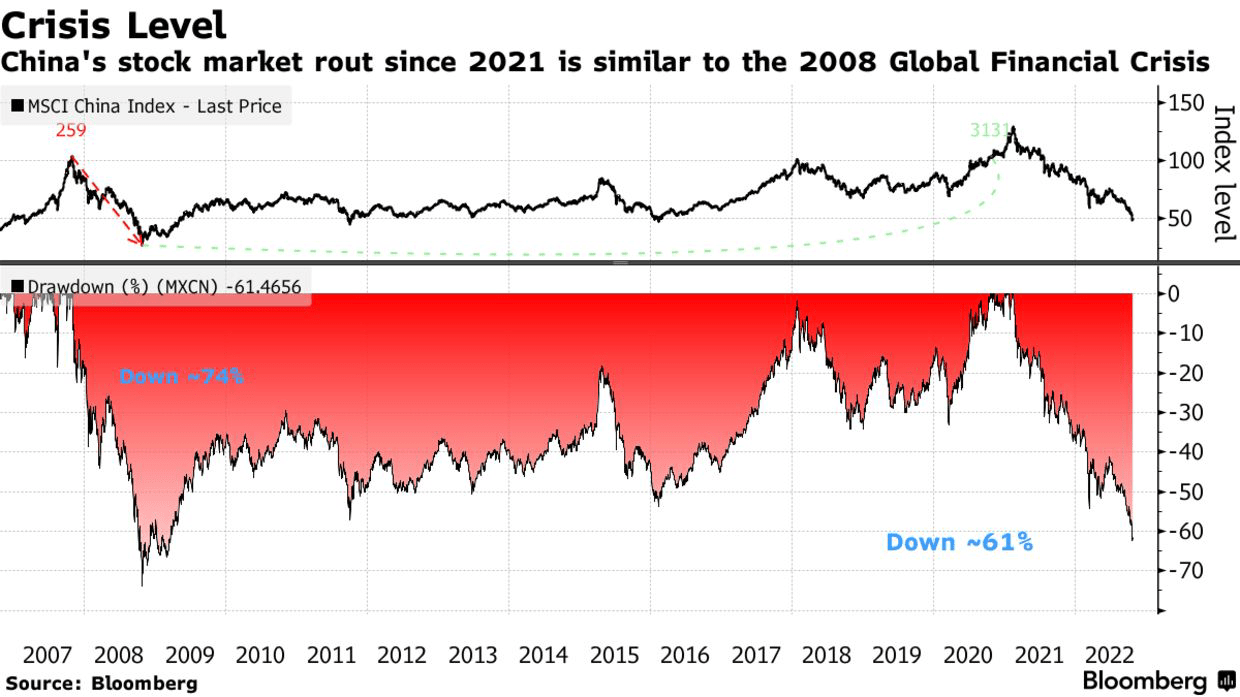

The first argument I would like to make for investing in China is simply a function of an ultra-cheap valuation – an opportunity not seen since the financial crisis. The MSCI China Index, for reference, is down more than 60% from all time highs and is only 8 percentage points away from the lows touched during the great financial crisis. But comparing the MSCI China Index in 2008/2009 with today is irrational, because since the financial crisis, China has enjoyed more than a decade of strong revenue/GDP growth and value accumulation.

Bloomberg

In a tweet from October 25, one day after the sharpest one day sell-off for the Nasdaq Golden Dragon on history, Michael Burry summarized the ridiculously cheap valuation in a tweet:

The Hang Seng recently hit 1997 levels. 25 years. Yet GDP multiplied 18 times during that time. 1997 valuations were 20 Earnings, 10x EV/Sales, 3x Tangible book. Now 7/1/1.

Although Michael Burry doesn’t directly say that he is bullish, it is clear that Dr. Burry is fascinated by the attractive valuation level. Notably, despite a depressed numerator (earnings), the HSI’s TTM P/E is now as low as x8.5.

Thoughts On Political Risk

It is obvious that investors are concerned about the political risk of investing in China – and there are a few points to highlight:

ADR delisting: The China Securities Regulatory Commission and U.S. Public Company Accounting Oversight Board have argued about on-premise audit inspections for multiple years. But the discussion heated up in late 2020/early 2021, and ADR investors got spooked. Although a pre-liminary agreement has been reached, the good news has failed to calm sentiment.

Taiwan tension: After Russia’s invasion of Ukraine, investors started to be concerned that China would invade Taiwan. The negative implication for China’s equity markets would be obvious.

Trade tensions/Semi-export restrictions: The trade tensions and the tech war has expanded to semiconductors, as the US government has imposed hard export restrictions on US chip technology. Investors now fear that such a move will cripple China’s AI emotions.

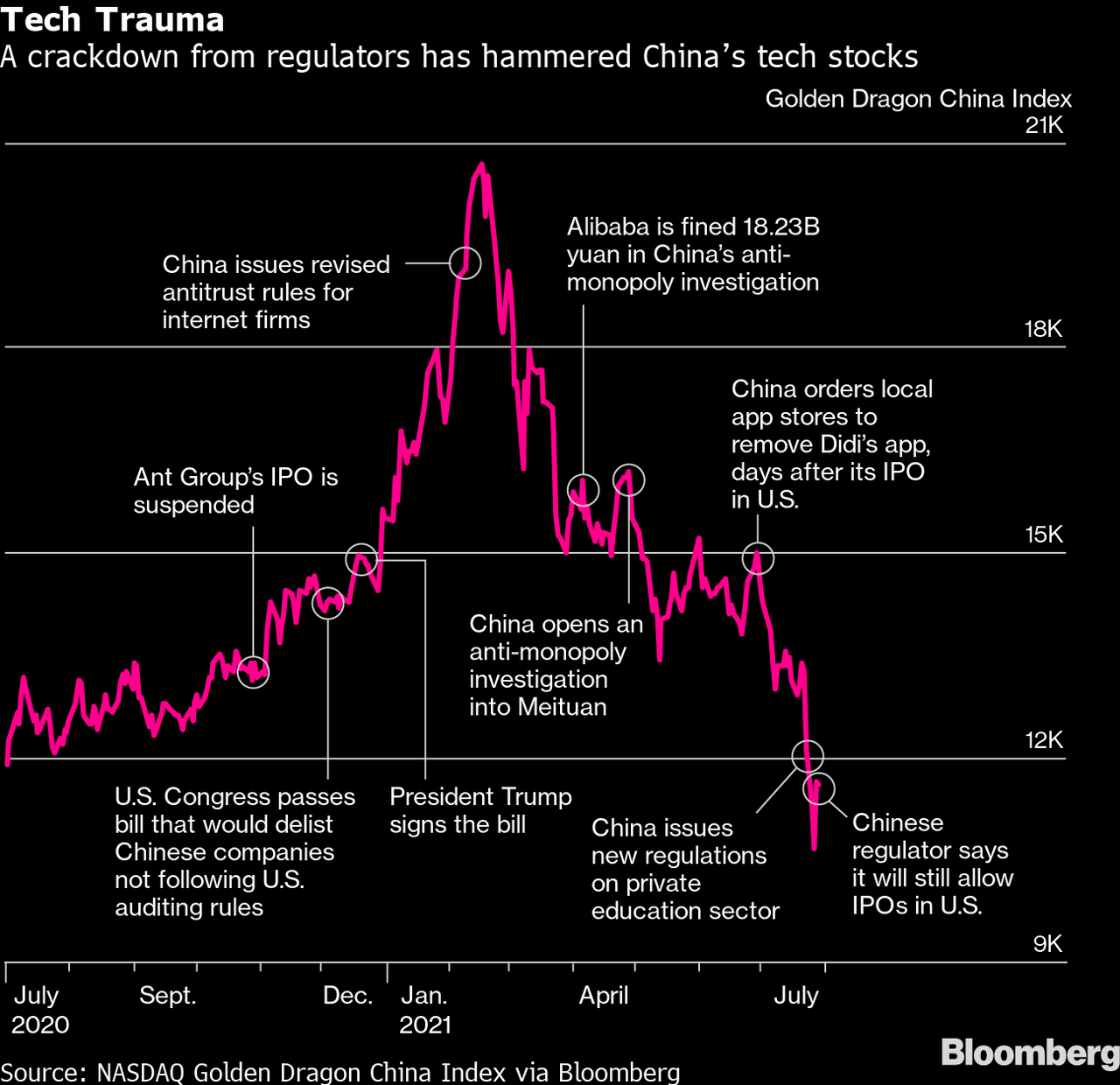

Internet/tech sector crackdown: From late 2020 and early 2022, China’s internet/tech companies such as Alibaba, Tencent and Meituan (OTCPK:MPNGF) have suffered from strong regulatory tightening. While the worst seems to be behind – given that no major action against tech/internet giants has been taken since months – investors remain spooked.

Bloomberg

However, what really scared the markets lately was the news surrounding Xi’s tightening grip on China – after being confirmed for a third term as the country’s president. But here I feel the markets have overreacted (remember the +10% sell-off): Did anybody not expect that Xi will claim a third term? And who did not expect that he will fill important political positions with allies?

Michael Burry pointed out the irrationality:

Meet the new boss. Same as the old boss.

He added:

3 of the last Premiers served 3 terms.

With regards to political risks, somehow markets either fail to ignore the good news, or they (correctly) disbelieve the integrity official statements from the Chinese government.

For reference, with regards to the internet/tech crackdown, premier Liu He pledged multiple times that the CCP is actively aiming to ‘support the healthy development of the platform economy’ (here, here, here). At the same time, China’s central bank and China’s foreign-exchange regulator commented that they would ‘support the healthy development of stock and bond markets’, as well as strive to ‘develop regulated, transparent, open, robust and resilient markets.’

How Is The Economy Doing?

China’s economy has most certainly seen better days – pressured by the country’s (1) real estate crisis, (2) persisting Covid-19 lockdowns, (3) trade tensions, (4) depressed entrepreneurial sentiment and (5) raw material price inflation.

But investors should consider if the above headwinds are temporary, or forever. Personally, I believe the former is the case. And star investor Ray Dalio appears to agree, as he commented in a recent interview: (emphasis added)

I want to make clear, from me knowing the leaders (in China), that they are reasonable people … but there is a lot of uncertainty and a lot of problems … that are temporary. They are temporary but could be longer-lasting.

… There is also the question: are they still in favor of free market and free enterprises? From my understanding, they do not want to mess with that system very much …

… I think the longer term picture in China is still bright.

Investors should also note that China’s mid-term growth rate is still far above the estimated global nominal GDP expansion. As of October 2022, economists calculate that the Chinese economy will grow at a CAGR of about 5% through 2027.

Moreover, there are very good reasons to believe that China may already be in an economic recovery. In a press release commenting on Q2, Alibaba management commented that: (emphasis added)

Following a relatively slow April and May, we saw signs of recovery across our businesses in June … We are confident in our growth opportunities in the long term.

And in the analyst call, Chief Financial Officer Toby Xu added, that Alibaba’s business sees…

… [a] positive trend of recovery continuing through July

Similar statements have been made by Baidu and JD. Thus, I believe that Q3 earnings season might bring some upside surprises.

Is China A Buy?

Investing in China is risky, and investors are – rightly so – ‘extremely fearful’. But the truth is, ‘extreme fear’ opens enormous opportunity, if the contrarian bet against the fear plays out positively. That said, some of the world’s most successful independent thinkers, including Charlie Munger, Michael Burry, and Ray Dalio, have directly or indirectly highlighted that the markets are acting irrationally concerned with regards to investing in China. And accordingly, by buying China stocks there might be an opportunity to capture significant alpha.

I argue that if an investor thinks about investing in China like a ‘bet’ – without an excessive capital allocation and emotional involvement – then the risk/reward looks most certainly attractive. To get exposure, I personally like and advise to pick the HSI.

Be the first to comment