Osarieme Eweka/iStock via Getty Images

All values are in CAD unless noted otherwise.

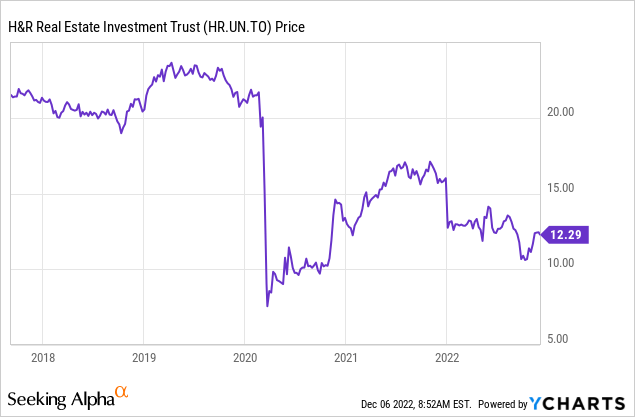

We have been bullish on H&R Real Estate Investment Trust (OTCPK:HRUFF) (TSX:HR.UN:CA) each of the nine times we have covered it on this platform since 2017. The price ride has been nothing short of a rollercoaster with the COVID-19 decline akin to the first drop associated with the amusement park attraction. It gave its investors the same sinking feeling, absent the exhilaration.

In our most recent piece from August of this year, we acknowledged the two negatives facing this REIT.

There are two negatives here and investors should be aware of these before they jump in. The first being that the weighted average debt term is excruciatingly small at 3.6 years. So this fits better with those thinking 2% interest rates being the norm longer term, rather than for those thinking we are going to 6%. The other negative here is that a lot of H&R’s outperformance and NAV jumps can be traced back to the USD strength. If that reverses, there will be a huge lead balloon to deal with.

Source: H&R REIT: Residential Properties Power NOI Growth

The positives we discussed in that piece outweighed our concerns and we remained bullish with a price target of $16.

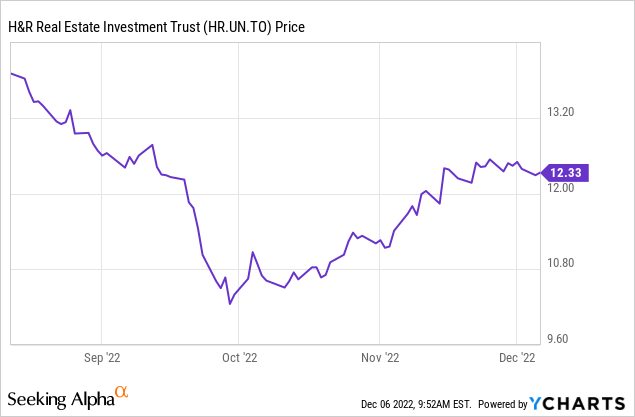

The price trend has not been our friend. With the Q3-2022 results out, we review this REIT once again to see if this under performance has a fundamental basis to continue.

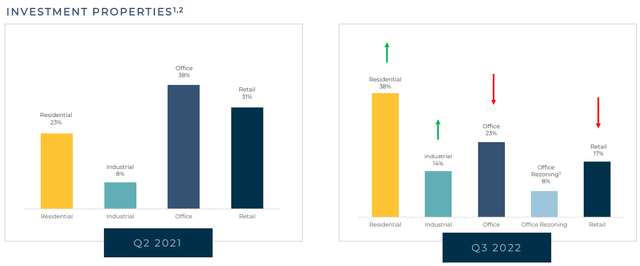

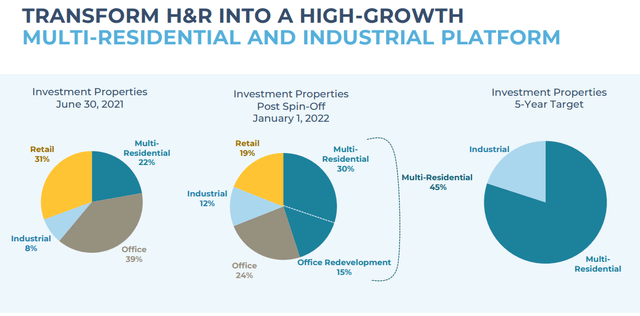

Repositioning Plan

The precipitous drop we see in the first chart of this article was seen almost across the board when COVID-19 hit. While most stocks did recover, REITs holding office properties, like H&R, failed to reclaim their former glory due to the continued strength in the WFH movement. In 2021, the REIT put into play a strategic plan to move away from its office and retail properties and correspondingly aim to increase its exposure to the residential and industrial sectors. It has already made quite a headway into this. This has been going nicely.

Q3-2022 Presentation

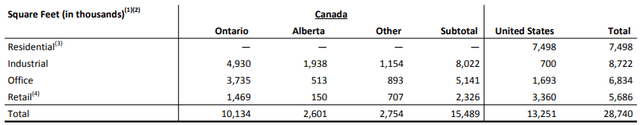

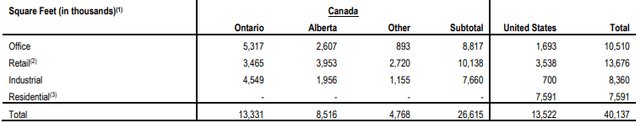

At last count, H&R had 24 residential, 73 industrial, 25 office and 284 retail properties in its portfolio, comprised of the following square footage.

Q3-2022 Financial Report

Which looked like this in the comparable quarter of 2021.

Q3-2021 Financial Report

The sharp drop in retail is in no small part due to the Primaris Real Estate Investment Trust (OTC:PMREF) (TSX:PMZ.UN:CA) spinoff. H&R aims to be wholly a residential and industrial REIT in five years.

H&R Strategic Plan

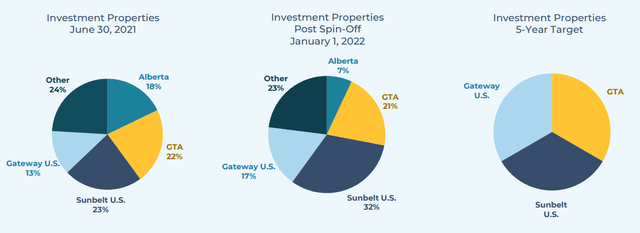

Geographically, the plan is to concentrate in the Greater Toronto Area [GTA] and the US.

H&R Strategic Plan

H&R initiated this plan during the quantitative easing era (aka Money For Nothing). It will be interesting to see how this plays out in more challenging times when cost of capital has gone up substantially.

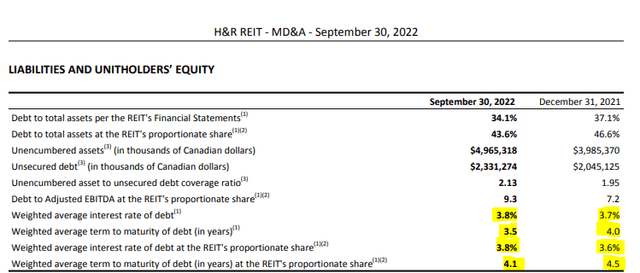

Liquidity and Debt

At the end of Q3, H&R had cash and cash equivalents of close to $66 million and a little over $646 million available under its lines of credit. Additionally, 118 of its properties were unencumbered, having a fair value of $5 billion. The REIT also maintains a sub 50% dividend payout ratio, which will aid it in building its cash buffer to meet its obligations.

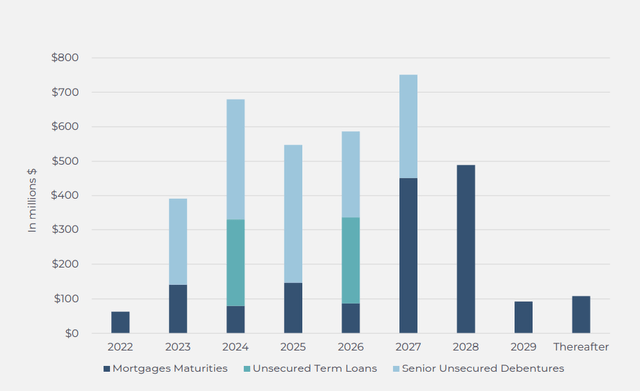

On the debt front, about $450 million in loans will be coming up for maturity by the end of 2023.

Q3-2022 Presentation

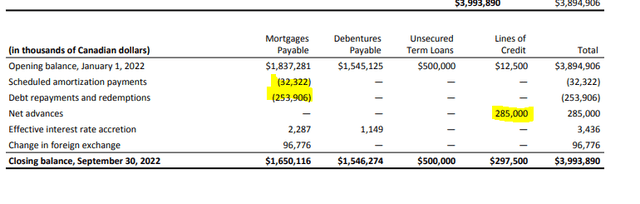

The weighted average term to maturity on these loans is 3.5 years with a weighted average interest rate of 3.8%. Investors will note the slight move up in interest rates over the last nine months, but so far this metric has been well behaved.

Q3-2022 Financial Report

A key reason for that is 2022 has been a time for switching maturing debt onto its low rate line of credit.

Q3-2022 Financial Report

Of course, as we get into 2023, some refinancing will have to be done and they will come at likely far higher rates.

Valuation

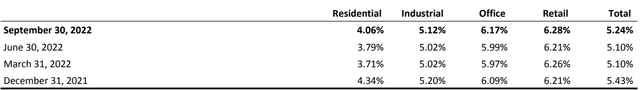

The REIT estimates its NAV at $22.58 based on the following capitalization rates at the end of Q3.

Q3-2022 Financial Report

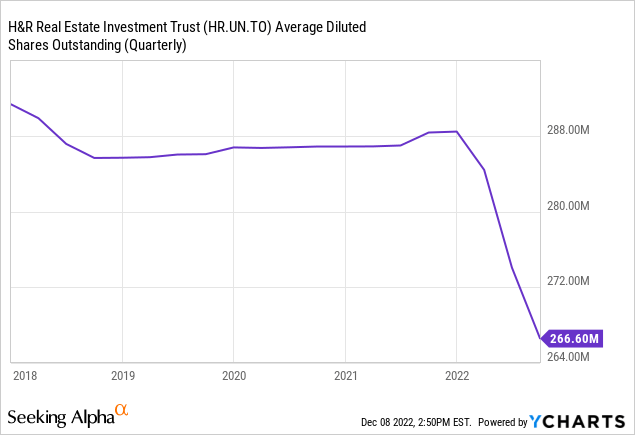

Of course the market is nowhere near that price. The implied capitalization rate the market is giving it is 7%. While most REITs are happy to present you a NAV far higher than the current price, H&R is actually doing something about this anomaly. H&R is taking advantage of this golden opportunity by buying back units rather rapidly this year. For the nine months ended September 30, it had repurchased 22.9 million units at an average price of $12.99. That is around a 42.5% discount to the net asset value per unit.

Mind you, we have not even taken into account that the REIT is in the midst of a repositioning which will get more accretive properties into the portfolio while offloading the lukewarm culprits.

Verdict

H&R announced a 9.1% dividend hike effective 2023.The monthly dividends from $0.0458/month to $0.05/month, making its yield 4.92% (price $12.18 at the time of writing this piece).

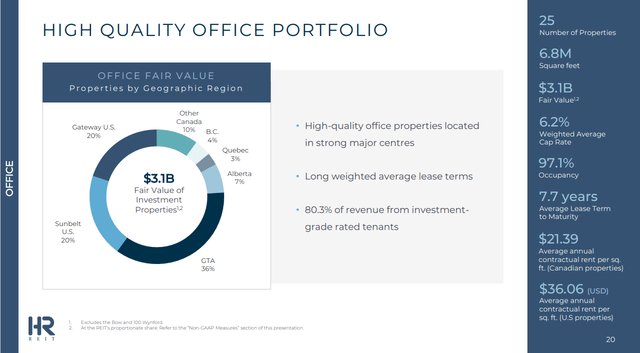

While we get that there is a bit of skepticism from investors regarding the timely completion of its repositioning plan. It was set into motion when interest rates were nominal. But to value its entire portfolio at 7% cap rates is ludicrous. H&R does not face the same threats as some other office property REITs like having extremely short leases for example or being geographically concentrated in a ghost town. A 7.7 year weighted average lease term diversified across multiple locations certainly gives it some stability.

Q3-2022 Presentation

There are of course challenges, and here is one they recently dealt with.

In Q3 2022, H&R entered into a lease amendment with Bell Canada to terminate their lease at 200 Bouchard Boulevard, Montreal, QC in December 2026. The previous lease term would have ended in April 2036. H&R will receive a lease termination fee of approximately $70.0 million in 2026. The terms of the rental payments to 2026 have not changed. IFRS 16 Leases (“IFRS 16”) requires revenue from leases to be recognized on a straight-line basis over the contractual term of the lease. As a result of this lease amendment, a non-cash adjustment to straight-lining of contractual rent of approximately $3.5 million was recorded in Q3 2022 and will continue to be recorded every quarter until the end of the lease. This resulted in a $3.5 million increase to net operating income and FFO. Same-Property net operating income (cash basis) and AFFO were not impacted as H&R deducts non-cash items, including straight-lining of contractual rent, in calculating these amounts. H&R is working with the city of Montreal as they update their master plan, and has provided a plan to convert this existing office property into approximately 850 residential units resulting in approximately 1.1 million square feet of new residential development. These plans will continue to evolve, along with the City’s master plan, with a targeted approval date of Q1 2024.

Source: Q3-2022 Financials

But the REIT remains positioned to succeed and we believe in the NAV supported by high quality residential and industrial properties. We are maintaining our price target at $16 as the two forces of higher cap rates and higher USD-CAD exchange rate, essentially cancel each other out.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment