gremlin

Introduction

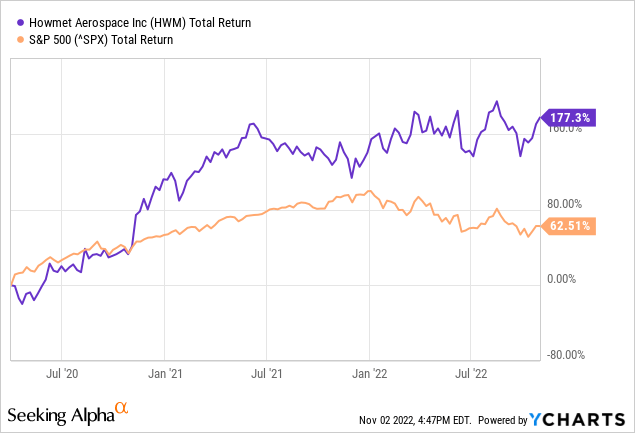

Howmet Aerospace (NYSE:HWM) has been a spin-off from Arconic (ARNC) since April 2020. Arconic will focus on rolled aluminum products and Howmet Aerospace on engineering products. Since the split-off, Howmet’s share price has risen sharply. Investors picked up on the split-off very positively, increasing the share price from $13 in April 2020 to $35 currently. Their positivity may be due to the positive free cash flow and growth outlook since the split-off.

Howmet pays a dividend and repurchases shares, which means that the dividend per share will increase each year. The outlook for growth in earnings per share is very strong, making the stock worth buying.

Third Quarter Earnings Came In Strong

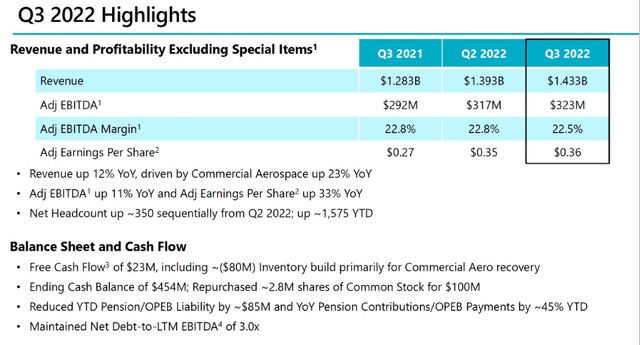

Third quarter 2022 figures were strong with revenue growth of 12%. This strong growth was mainly driven by the commercial aviation segment, which grew 23% year over year. Adjusted EBITDA grew 11% and adjusted earnings per share increased 33% year over year. And during the third quarter, Howmet repurchased $100M worth of shares.

3Q22 Financial Highlights (Howmet’s Investor Relation Website)

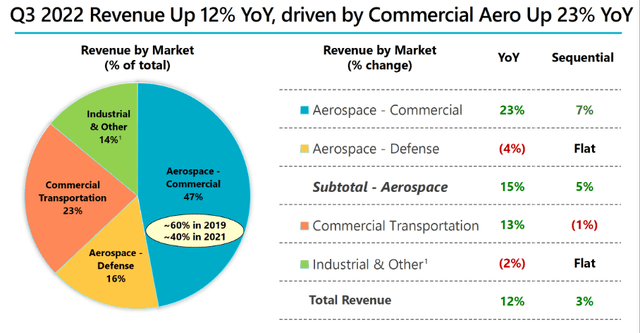

Commercial Aerospace accounts for nearly half of total sales. It made up a larger share of sales before the corona crisis in 2019. This segment grew 23% year-on-year in the third quarter thanks to strong demand for commercial aerospace products.

Revenue by market (Howmet’s 3Q22 Investor Presentation)

Howmet’s products include Engine Products (48% of sales), Fastening Systems (20% of sales), Engineered Structures (14% of sales) and Forged Wheels (18% of sales). Sales growth was strongest for both Engine Products and Fastening Systems (15% sales growth year-over-year). Sales grew strongly for every segment except Engineered Structures. Here, sales were down 3% year-on-year due to delays in production of the Boeing 787. Lower Defense Aerospace sales also affected Engineered Structures sales growth. Engine Products achieves the highest adjusted EBITDA margin of a whopping 27%. Forged Wheels comes in second with 24% adjusted EBITDA margin. Here, adjusted EBITDA fell sharply from 31% last year to now due to sharply increased aluminum material costs.

Howmet’s guidance is strong: they expect revenue in the fiscal year 2022 to increase 13% over last year and adjusted EBITDA to increase 12% over the same period. Earnings per share are expected to increase by 39% and free cash flow conversion will be 95%. Howmet expects preliminary sales growth of about 10% (+/- 2%) for 2023. These are strong prospects.

Dividends And Share Repurchases

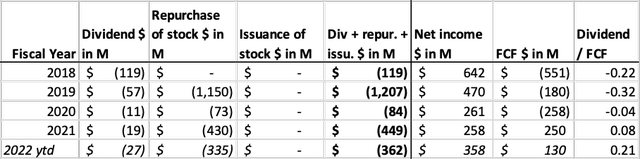

Howmet has been producing positive free cash flow since the split-off in 2020. The company remains shareholder-friendly by both paying dividends and buying back shares. The dividend yield is currently listed at 0.22% and total dividend payments are about one-fifth of their free cash flow. In 2021 Howmet repurchased $449M of shares, this represented a 3% repurchase yield and is a tax-efficient way to return cash to shareholders.

Dividends And Share Repurchases (SEC and Author’s Own Calculations)

The dividend payments and the share repurchase program together are not sustainable in the long run because Howmet returns currently more cash to shareholders than it generates in free cash flow. When profitability increases, this will not be a problem. Their positive outlook provides more certainty about the continuation of the share repurchase program.

Howmet’s EV/EBIT Ratio Is High, But Forward PE Ratio Looks Favorable

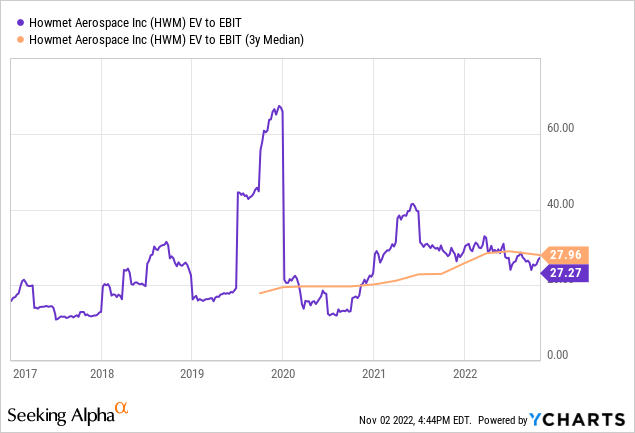

Howmet Aerospace has been split off from Arconic since April 2020. Investor confidence in the share price has risen sharply, causing the EV/EBIT ratio to peak at 40 in mid-2021. The EV/EBIT ratio has fallen slightly to a more acceptable level of 27 but is still very high overall. Despite the increased stock valuation, I see no reason for pessimism.

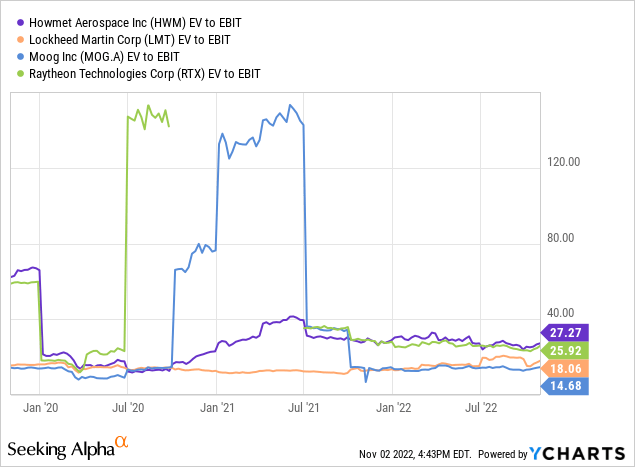

To get a better idea of Howmet’s stock valuation, other companies in the aerospace and defense sector were examined. Lockheed Martin (LMT), Moog (MOG.A), and Raytheon Technologies (RTX) were examined in more detail and the EV/EBIT ratio is shown graphically in the chart below.

Howmet stands out as the most expensive valued stock. In general, smaller growing companies such as Howmet and Moog have higher valuations than established large companies such as Lockheed Martin and Raytheon.

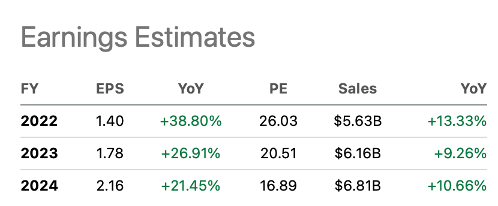

Strong projected EPS growth over the next few years makes the PE ratio attractively valued. For FY2024, analysts expect a forward PE ratio of 16.9 at current price levels, lower than that of the S&P500 with a PE ratio of 19.4.

Earnings Estimates (SA HWM Ticker Page)

Conclusion

The split-off of Howmet from Arconic in April 2020 was a strategic move. The stock has since risen from $13 in April 2020 to $35 currently. Howmet focuses on engineered products in the aerospace industry. The company is divided into the following business segments: Engine Products (48% of sales), Fastening Systems (20% of sales), Engineered Structures (14% of sales), and Forged Wheels (18% of sales). Third quarter figures were strong with 12% revenue growth driven by strong growth in the Commercial Aviation segment. Adjusted EBITDA rose 11% and adjusted earnings per share increased 33% year over year. Howmet both pays a dividend and repurchases its own shares. The buyback yield is a strong 3% and provides a tax-efficient way to return cash to shareholders. The guidance is very strong, with revenue growth of 13% expected for FY2022 and adjusted EBITDA growth of 12% over the same period. Earnings per share are expected to increase by 39%. For 2023, Howmet expects strong revenue growth of up to 10%. The share valuation by EV/EBIT ratio is slightly on the high side, but analysts expect strong EPS growth for the next few years. The projected PE ratio for the fiscal year 2024 is 16.9, below the S&P500’s PE ratio of 19.4. The strong outlook, strong growth in both revenue and earnings, and earnings per share make the stock worthy of buying.

Be the first to comment