sarawuth702

This is the first piece in the Let’s Talk Mobility series from Mobility Matters research, a series exploring key facets of the EV and mobility landscape, its opportunities and risks. The series is meant to foster discussion and a deeper thinking of these potential opportunities and risks to the industry and its players.

Tensions between China, Taiwan and the U.S. have flared up following House Speaker Nancy Pelosi’s visit, raising the risk of Chinese military demonstrations escalating further into a potential invasion. While heightened risk and increased military presence at the moment have impacts on the electrical vehicle (“EV”) industry, such as delaying chip shipments via ocean freight delays, escalation of the conflict, such as in a full-scale invasion, would likely spell serious trouble for the EV industry as a whole. Let’s break down possible impacts to the EV industry and supply chain, as well as individual manufacturers, to assess and understand the risks involved from tension escalation.

China Dominates The EV Supply Chain

While this is quite widely known in the industry, China is the dominant player across much of the EV supply chain; however, having exact figures across the chain can help demonstrate where impacts could be felt.

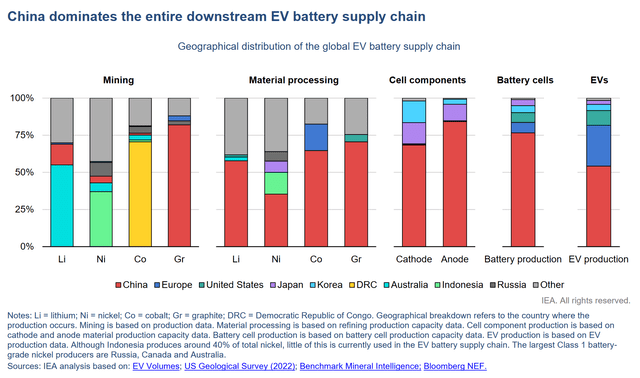

As EV sales pushed to records in 2021, the market was reliant on China, which drove “half of the growth” in the industry last year. China is also the dominant player across the battery supply chain, and the IEA forecasts that “the majority of the supply chain is likely to remain Chinese through 2030. For example, 70% of battery production capacity announced for the period to 2030 is in China.”

The above graphic from the International Energy Agency (“IEA”) demonstrates just how reliant multiple facets of the EV supply chain are on China:

- nearly 80% of graphite mining

- over half of lithium, cobalt, and graphite processing (and just over one-third of nickel

- over 70% of cathode and anode component production

- over 75% of battery production

- over 50% of EV production

It’s clear that China is critical for the EV industry, and for its advancement over the course of the decade as OEMs and nations begin to prioritize sales of EVs to meet net-zero ambitions.

However, the growth and success of a blooming EV industry rely on two major factors:

- a “tenfold” expansion of the battery and materials supply chain

- ensuring a “secure” and “resilient” supply chain to accelerate global adoption

The ten-fold expansion of materials and batteries supply is critical to boost production levels high enough to meet net-zero targets and accelerate EV adoption to >50% in the U.S., across the EU and in China. A secure and resilient supply chain is crucial in ensuring that EV production is not limited by delays in chips, metal mining, or any related supply bottlenecks. The Russian invasion of Ukraine, for example, highlighted both of these factors, sending fragile battery supply chains in a loop with nickel prices soaring while also impacting the chip supply chain.

While the EV supply chain is indeed much more complex and intertwined internationally than this brief overview provides, the key takeaway here is the over-reliance of the industry on China for multiple key inputs for EV production – materials processing, battery production, etc. In the case of an invasion, should that occur, possible retaliatory effects such as sanctions or tariffs will likely increase prices, decrease materials and battery supply, or increase lead times, all factors which will challenge EV production and ultimately the rate of EV adoption.

Chip Supply Chains

Along with materials and batteries, semiconductor chips are vital for EV production – the chip shortage that began in 2021 forced many major OEMs to announce “significant rollbacks in their production, lowering expected revenue for 2021 by billions of dollars,” with AutoForecast Solutions placing the production loss at an estimated 11.3 million units worldwide. According to IHS Markit, the impact to production from the persisting chip shortage “could be another 7 million units in 2022 and 1.6 million in 2023.”

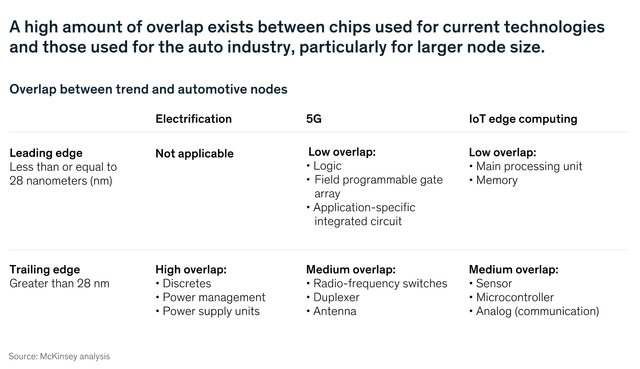

The chip shortage has yet to clear, with firms such as BMW (OTCPK:BMWYY) and Bosch seeing the shortage lasting into 2023 and Volkswagen (OTCPK:VWAGY) and Continental (OTCPK:CTTAY) seeing the shortage lasting into 2024. Chip scarcity also may continue as auto chips face overlap with other expanding technologies including 5G and IoT.

McKinsey sees a high overlap in 28nm or larger chips needed for electrification with power management and power supply units, as well as overlaps for sensors, microcontrollers, antennas and more for 5G and IoT edge computing, technologies necessary to accelerate and enhance ADAS developments and vehicle communication.

Because of this shift to ADAS and improved in-vehicle tech, along with the volume of chips needed to power this transition, McKinsey’s “analysis suggests that chip capacity won’t catch up with demand in the short term for the auto industry.”

McKinsey & Co.

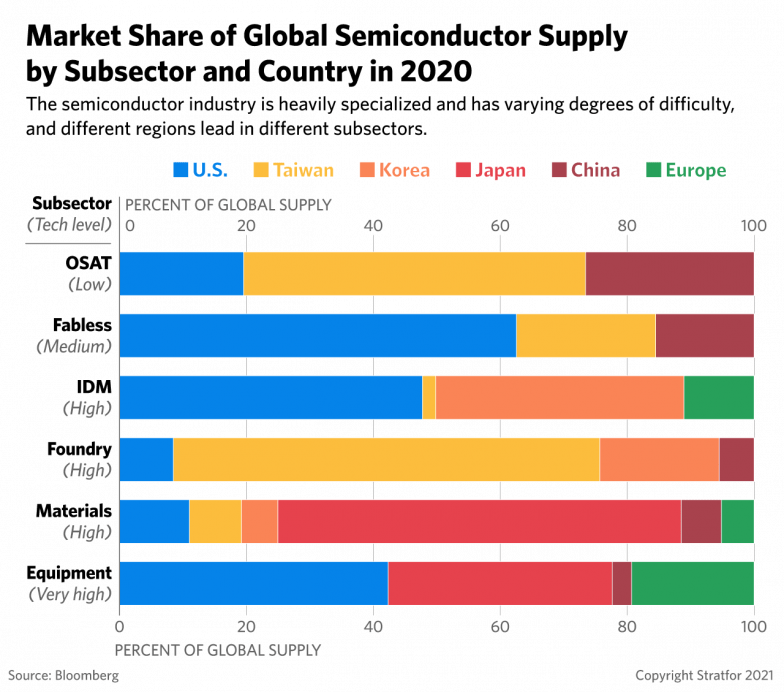

The chip supply chain features different pathways from supplier to vehicle integration, with IDMs and foundries prominent in the traditional value chain and shallow verticalization. Although the U.S. controls nearly half of IDM market share, Taiwan is the major dominant player in foundries, controlling nearly three-fifths of the market.

Stratfor

As the chip requirements per vehicle will only increase as vehicles become more intelligent, autonomous and electrified, the broader chip supply chain’s reliance on East Asian nations – Taiwan, Korea, Japan, and China – enhances risks to further delays and shortages in the case of enhanced military presence in and around Taiwan, and more so in the case of an invasion.

Major Players Across The Industry

EV OEMs: Tesla (TSLA), BYD (OTCPK:BYDDY), Geely (OTCPK:GELYF), NIO (NIO), XPeng (XPEV), GM (GM), Ford (F), Volkswagen (OTCPK:VWAGY), Stellantis (STLA), Hyundai (OTCPK:HYMTF), Toyota (TM), Lucid (LCID), Rivian (RIVN), more.

EV Batteries/Components: Panasonic (OTCPK:PCRFY), CATL, Samsung SDI (OTCPK:SSDIY), LG Chem (OTCPK:LGCLF), LG Energy Solutions, Continental (OTCPK:CTTAY), Magna (MGA), QuantumScape (QS), Microvast (MVST), Solid Power (SLDP).

Charging/Infrastructure: EVgo (EVGO), Blink Charging (BLNK), Tritium (DCFC), Wallbox (WBX), Volta (VLTA).

Auto Chips: NXP Semiconductors (NXPI), Infineon (OTCQX:IFNNY), onsemi (ON), STMicroelectronics (STM), Texas Instruments (TXN), NVIDIA (NVDA), Qualcomm (QCOM), Analog Devices (ADI), Renesas (OTCPK:RNECF).

Although any instances of increased military presence around the Taiwan Strait are likely to lead to impacts via delayed shipments in and out of Taiwan, China, and potentially Korea and Japan via ocean freight crunches, an escalation of tensions into an invasion would spell substantial trouble across the entire industry. Some of the major players across the industry and potential effects will be highlighted and discussed below.

Potential Impacts And Areas To Watch

Should China decide to invade Taiwan in an effort to reunify the island, it would draw similar responses to Russia — from sanctions to potential military support. In April, Treasury Secretary Janet Yellen “said the Biden administration would be prepared to use all its sanctions tools against China if Beijing moved aggressively toward Taiwan.” Yellen also “said the measures against Russia showed the U.S. can impose significant pain on aggressive countries and was prepared to do the same ‘in other situations.'”

For the EV industry, sanctions are among the worst-case scenario, given the industry’s heavy reliance on China for a majority of the supply chain, in addition to its surging NEV market. Sanctions could cripple the EV supply chain, increase lead times for materials/batteries/chips, increase metals/battery prices, limit exports/imports to the Chinese market, force exits from the nation, to name a few of the potential impacts.

Established EV manufacturers such as Tesla and budding GM and Volkswagen would potentially lose crucial Chinese revenues and volumes, while budding manufacturers such as Lucid and Rivian could see further struggles sourcing chips, thus hindering production ramp-up.

Let’s dig into a few of the major players across the industry and areas of issue.

Tesla: Of some of the leading EV manufacturers, Tesla has among the highest exposure to China – nearly 25% of automotive revenues ($8.4 billion for 1H) with Gigafactory Shanghai becoming a major export hub. Tesla sold approximately 295,000 made-in-China vehicles during 1H (domestic & export), accounting for over 50% of total unit volumes. Sanctions (or even tariffs) would most likely lead to increased vehicle prices for U.S./EU manufactured vehicles, while China operations could face significant difficulties with exports as well as domestic sales, cutting off a chunk of China’s 25% revenue contribution and 53% vehicle production contribution. As such, the results for Tesla could be dramatic, and substantially impact both revenues and deliveries, leading to material downside in shares.

VW: China is also a segment of growth for VW – for 1H, VW’s “China BEV sales saw a more than three-fold increase from last year to 63,500 units, the company reported.” With BEV sales of ~217,000, China contributed about 30% of total deliveries – a similar situation with similar possible fallout to that of Tesla. With of goal of 150,000 to 200,000 of ID unit sales in China, VW is targeting a ~100% or higher growth rate y/y – meaning VW could lose out in a high-growth market against domestic rivals such as XPeng, Nio, and BYD, among others. Any sanctions also raise the risk that VW loses its ability to scale EV production due to its main supplier being CATL.

BYD/NIO/XPeng: Among the closely followed in China’s domestic EV market, the three OEMs are targeting European expansion via Norway, Germany, Sweden, and other countries. While overall contribution outside of China is still limited for the three, expansion plans are likely to be threatened or put on hold should an invasion lead to sanctions.

NVIDIA: Many top OEMs choose NVIDIA for NVIDIA Drive to power semi-autonomous capabilities, including BMW, Mercedes, SAIC, Vovlo, Audi, Tesla and others. A Chinese invasion would threaten the chip industry worldwide, likely leading to substantial chip shortages especially as the growth of intelligent vehicles and higher chip requirement per vehicle boosts chip demand. NVIDIA has a huge >$11B pipeline in the auto industry, and a combination of decreased production in EVs/intelligent vehicles from potentially surging increased materials and battery prices and/or shortages could impact the fulfilment of such orders.

Qualcomm: Similar to NVIDIA, a wide range of OEMs from GM, BMW, Honda, Volvo, Renault, and others rely on Qualcomm’s chips for connectivity and digital cockpits. A persisting chip shortage into 2023 along with heightened risks to chip shortages directly from increased military presence around Taiwan could fracture EV production plans as OEMs find difficulties sourcing chips. A >$16B auto pipeline for Qualcomm represents a significant opportunity at risk from increased tensions.

Industry Outlook

Aside from substantial impacts to production and revenues for individual OEMs with significant concentration in China, the EV (and broader auto) industry would face mounting hardships from increased Chinese actions or ultimate invasion of Taiwan. The EV supply chain is still heavily reliant on the nation, and sanctions placed on China as a result of military action would severely impact battery supply chains and likely send metals prices soaring, adding to OEM costs while hindering production. Translating these additional raw materials costs to consumers could see further price increases to already-less-affordable EVs while squeezing automakers’ margins as cost increases take time to reflect down the line.

Ocean freight and related logistics to ship necessary automotive chips and components from Taiwan, South Korea, and Japan would likely face long delays, again limiting production and hitting startups harder, who are most affected by dwindling supplies (supplies focus on high value, high quantity contracts). From a climate and policy standpoint, the U.S. and EU would be highly unlikely to build out domestic battery and components supply chains to a high enough degree to meet OEM EV targets and net-zero EV targets, either pushing government funding to a higher level or leading to delays in these targets.

Given that China still holds such dominance over the EV supply chain, it’s hard at the moment to see world powers cut off most access to critical tech, materials, and components that would threaten both private and public interests; however, even the slightest actions and disruptions could have long-lasting effects on the industry.

Be the first to comment