kyoshino/E+ via Getty Images

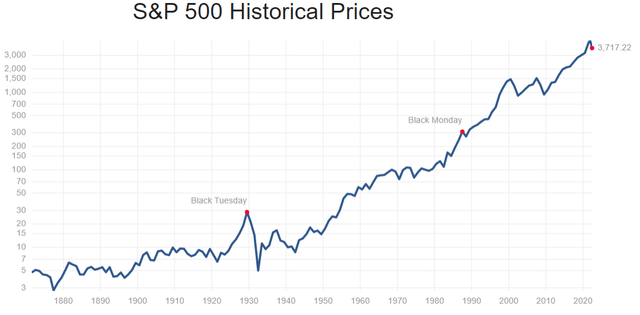

If one simply held onto a decently diversified portfolio of average or better quality stocks they would have profited in every crash in modern stock market history. The key is not selling at or near the bottom. I admit that I cannot predict when the bottom will be, and I suspect that few or nobody can.

So how does one not sell at the bottom if they don’t know when the bottom is?

It’s easy, just don’t sell.

Or a less glib way of phrasing it is that one needs 3 things to not sell at the bottom of a market crash

- An intellectual understanding of why the market is almost certainly going to recover and eventually get to all-time highs.

- The emotional equanimity to stomach the volatility without losing one’s bearings

- A long investment horizon

I can’t help you with the 2nd one, but I can share how I know the market will recover. It comes down to systems analysis which may seem abstract at first but bear with me and I think you will agree it makes sense.

In brief, the economy/market is a marginally stable system in which negative feedback loops are substantially more powerful than positive feedback loops, which causes it to be mean reverting and long lasting.

A brief overview of system types

For this discussion I am borrowing terms from other fields of study so if you are an expert in mathematics or engineering, know that I will be misappropriating some terms. The concept, however, applies with fidelity.

Let us consider 3 system types:

- Stable system

- Marginally stable system

- Unstable system

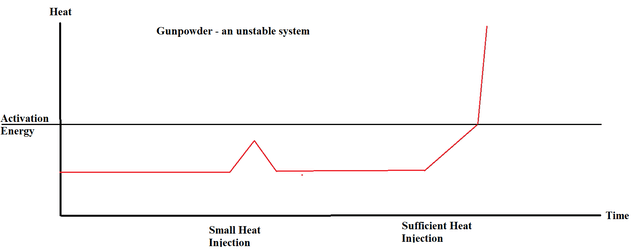

The differences will become clear with a couple examples. If we consider a pile of gunpowder in the presence of changing heat inputs, it is a clear unstable system.

When the heat drops or increases mildly, nothing happens. The ambient air simply returns the gunpowder back to room temperature. This can give the temporary appearance of being a stable system because as the input changes the output is flat.

Author generated

However, if enough heat is applied to get past the activation energy we all know that it will explode. This is a classic positive feedback loop in that a sufficient amount of heat causes an exothermic reaction that produces yet more heat leading to the chain reaction.

Positive feedback loops are characteristic of unstable systems.

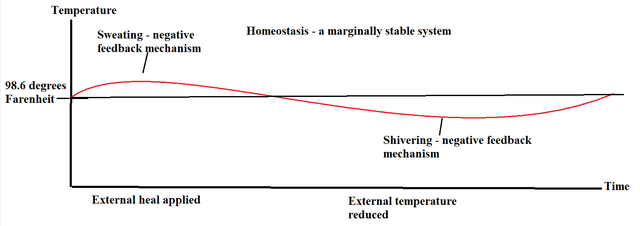

In contrast, stable or marginally stable systems will be dominated by negative feedback loops. Homeostasis is a classic marginally stable system.

Author generated

As external heat or cold is applied, the body has negative feedback mechanisms in the form of sweating and shivering to bring it back to homeostatic temperature.

Negative feedback mechanisms are characteristic of stable and marginally stable systems.

Such systems tend to persist for long periods of time and when graphed over time, tend to have flat or sinusoidal output. The market is not a perfect sine wave, but it approximates an upward sloping, mean reverting, range-bound graph.

Multpl.com

Inductive reasoning would suggest that if the market has behaved like a marginally stable system for well over 100 years it is probably going to continue behaving in such fashion.

Therefore, it will remain in the upward sloping, range bound formation over the long term which means it will bounce back up toward trend line.

This historical tendency to act like a marginally stable system is backed up by the presence of powerful negative feedback loops that are present in both the economy and the market.

Negative feedback loops of the economy

As economic activity slows, supply of goods and services is reduced. With less competing supply, the marginal profitability of supplying said good or service is increased. The greater the magnitude of initially slowed economic activity, the greater the incentive for self-interested businesses to come in and provide that supply.

This is the basic mechanism by which the American economy converts self-interest into productivity. As long as profit motive is retained, the negative feedback loop will cause recessions to be temporary. Historically, most recessions have been V-shaped. This is because the deeper the recession the more powerful the incentives to produce become.

The opposite is true when the economy gets overheated. When too much is being produced, competition increases until the weakest marginal producers go out of business and equilibrium is restored.

These negative feedback loops are essentially homeostasis for the economy and keep GDP in its upward sloping, range-bound trajectory. As you know, the market is not always reflective of the economy, so what is keeping the market in check?

Negative feedback loops of the stock market

Market prices have come down materially in 2022:

- Nasdaq: -31.3%

- Dow: -16.8%

- S&P: -21.7%

As prices get lower, forward returns get higher. This is not an opinion; it is a mathematical fact. Dividend yields and earnings yields automatically increase as market prices fall. This increases the incentive for investors to buy stocks.

The lower the market goes, the stronger the incentive to invest until such a point that the incentive outweighs fear and a sufficient number of investors come in and stocks bounce back up.

Any individual stock can permanently fail, but the only mechanism by which the stock market as a whole can permanently stay down is if the economy permanently stays down. Given the strong negative feedback loops of the economy, I don’t think that is likely.

Why this time it is NOT different

A truly stable system in the academic sense can return a stable output for any bounded input (negative infinity to positive infinity). In real life, systems rarely have this kind of stability. Homeostasis, for example, will fail if the input conditions are too extreme – sweating is not going to save someone from a burning building.

Similarly, the economy and the market can fail if the input is so extreme that the feedback mechanisms are not powerful enough to restore equilibrium. Mass nuclear war, Armageddon or a zombie apocalypse could certainly be the end of the market, but I don’t think that is the scenario we are approaching.

In fact, each of the scary input variables the market is facing now has already been tested in a far more severe fashion.

- 8% inflation is high, but the market survived far higher in the past

- The Ukraine/Russia war is tragic and disruptive to supply chains, but the market survived WWII and WWI

- There might be a recession in 2023, but every indication is that it will be far milder than 2008 or 2001 (if there even is a recession).

The economic system has already tested input variables from negative 80 to positive 80 and remained stable. In comparison, the current inputs are more like negative 35 (numbers just represent relative magnitude).

Everything is going to be fine. Just stay diversified in high quality companies. Tomorrow is a brighter day.

Be the first to comment