Tomwang112/iStock via Getty Images

Regarding trading right now: patience, patience, patience in the midst of global economic uncertainty, bearish chart patterns in some commodities, a stronger dollar, the Russian-Ukraine war, and mixed weather signals.

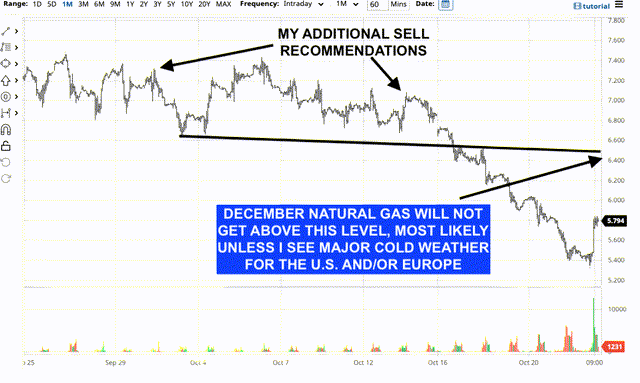

However, two trades have been home runs recently for clients of my Weather Wealth newsletter, potentially yielding thousands of dollars per contract profit since mid-September, and my most confident in my weather spiders for the last 4 weeks. They were natural gas (UNG) and coffee (JO).

Jim Roemer’s call last September of a sell-off in natural gas prices (Weather Wealth Newsletter)

1) I’m no genius, I’m smart in spots and I stay around those spots:

I want to lend you my insight from 38 years of experience watching markets and how they react to the weather at “certain times of the year.”

For example, my highest confidence trades in corn (CORN) and soybeans (SOYB) are almost always during the late spring and summer and during the North American crop season. I also like to recommend grain markets during December-February when I know traders watch South American weather very closely.

For markets such as coffee, the weather is a critical time (now) during the early stages of the Brazil crop cycle: usually between October and December.

That is why, a month or so ago, I went against the bullish crowd in coffee. Take a look at the great early coffee bloom in Brazil due to the rain I forecasted for the Brazil spring, three months ago.

2) Be wary of over-hyped markets:

Some of the most successful investors like Warren Buffett and Ray Dalio are looking for opportunities that others are not.

In other words, catching certain industries early before the crowd and selling into panic and greed.

Here, too, in the case of the soaring natural gas (KOLD) and coffee markets on past fundamentals, it was important for me to look into the future and anticipate a “change in the fundamentals” ahead of time. This is what I do best.

Could this trade be the next home run?

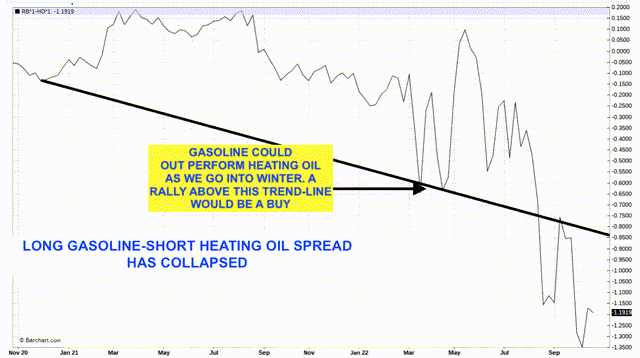

This may be a potential “Home Run” trade this winter if both U.S. and European weather is warmer than normal. That would be buying gasoline and selling heating oil against it. In winter, a lack of snowfall and the holiday seasons coming up would allow for more driving (gas demand), while warm weather hurts heating oil demand.

However, right now amidst the geopolitical situation, ideas of a release in the oil reserve, and various reports about OPEC cuts in order to “stick it” to the U.S. – all are major factors in gasoline price volatility.

Unfortunately, due to privacy concerns for a couple of major clients, I will be unable to advise in this market this winter.

Gasoline-heating oil spread (barchart.com)

Conclusion:

There are still many trading opportunities in commodities that La Nina and global weather patterns will present this winter for both experienced, as well as novice investors. Most recently, on all the bullish hype, two of my best trades were short both coffee and natural gas with potentially huge profits for clients who listened to my advice.

I continue to see a warm early winter (globally) and improving weather patterns for Brazilian coffee. However, selling in the hole right now is not advised, unless one uses a variety of option strategies.

The most important thing is to always look for markets that are over-bought or over-sold when speculators lean too much in one direction. That is when you can potentially hit a home run, as my recent gold blog in my newsletter teaches traders.

Jim Roemer’s gold blog in Weather Wealth (www.bestweatherinc.com)

Be the first to comment