J. Michael Jones

Operationally speaking, one of the better small commercial REITs on the market today is Alpine Income Property Trust (NYSE:PINE). This enterprise, which has a portfolio of 129 properties that are 100% occupied, has done well to grow its operations in recent years. In most respects, shares of the business do look cheap. But when you consider how high leverage currently is, and factor in management’s plans for the current year that will almost certainly require additional leverage to come into play, the picture for the company does not look quite as great. While I suspect the future for the business will be fine, I do not like buying into companies with high amounts of debt, even if they are attractively growing and cash flow positive REITs. Until we see the company’s price come down further or see its fundamental condition get even better, I cannot help but to keep my ‘hold’ rating on the business.

Growth continues

Back in March of last year, I wrote an article discussing whether or not Alpine Income Property Trust made for an attractive opportunity for investors. I said that the company was healthy from a cash flow perspective and that it represented a reasonable prospect for long-term investors. I found myself thinking that it could be a good play for the long haul. But at the same time, shares of the business were not exactly cheap. I said that they were probably fairly valued, though I did mention they might be slightly undervalued. Due to how shares were priced and the high leverage the company had on its books, I ultimately rated it a ‘hold’, reflecting my belief that the company’s returns would likely more or less match what the broader market would for the foreseeable future. Since then, the company has actually fared Better than I would have anticipated. While the S&P 500 is down 2.7%, shares of Alpine Income Property Trust have generated a profit for investors of 4.8%, thanks entirely to its distributions.

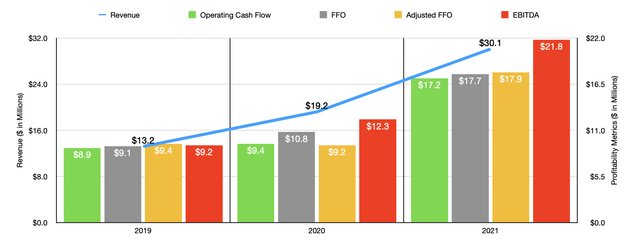

To best understand why shares of the company have risen, it would be hopeful to discuss recent financial performance. For starters, let’s consider the 2021 fiscal year. During that year, the company generated revenue of $30.1 million. That represents a significant improvement over the $19.2 million in revenue generated in 2020. This upside was driven in large part by a significant increase in the number of properties the company has in its portfolio. At the end of 2020, it owned 48 properties that had a combined 1.6 million square feet of gross leasable area to them. By the end of 2021, this number had grown to 113 properties and 3.3 million square feet. Of course, this expansion did not come cheap. During the year, the company acquired 68 properties for a combined $260.3 million. By comparison, it sold only three properties for a combined $28.3 million, in that same year.

Profitability for the company has also been positive. Operating cash flow in 2021 came in at $17.2 million. That compares to the $9.4 million reported for 2020. FFO, or funds from operations, went from $10.8 million in 2020 to $17.7 million last year, while the adjusted FFO number increased from $9.2 million to $17.9 million. Another profitability metric to pay attention to is EBITDA. According to the data provided, EBITDA increased from $12.3 million in 2020 to $21.8 million in 2021.

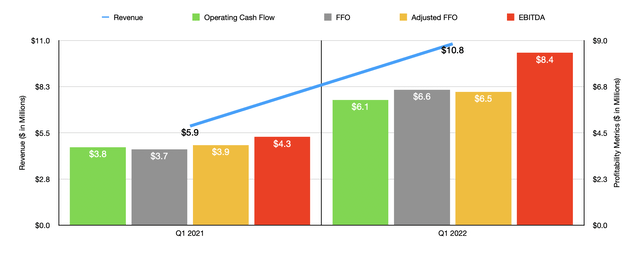

Growth for the company has continued into the current fiscal year. Revenue of $10.8 million for the first quarter of the year is nearly double the $5.9 million reported for the same time one year earlier. This came as the number of properties the company has ballooned to 129, with a total of 3.5 million gross rentable square feet in the company’s portfolio. Profitability has also risen. Operating cash flow went from $3.8 million to $6.1 million. FFO improved from $3.7 million to $6.6 million, while the adjusted FFO metric increased from $3.9 million to $6.5 million. And EBITDA increased from $4.3 million to $8.4 million.

When it comes to the 2022 fiscal year as a whole, management expects FFO per share to be between $1.55 and $1.60. At the midpoint, this would translate to FFO of $24.8 million. Meanwhile, their forecast for adjusted FFO would see that metric increasing to $24.5 million. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that adjusted FFO will, we should anticipate operating cash flow of $23.5 million and EBITDA of roughly $29.8 million. This further upside would be driven in large part by continued acquisitions made by management. In all, the company expects to spend between $215 million and $250 million on asset purchases. That compares to between $75 million and $100 million in asset sales. When it comes to sales, the company is already well on its way. Its latest sale was of a single-tenant office property for $38.8 million, booking a $7 million profit on the asset. More likely than not, this chunk of capital will come from a combination of factors, including additional debt issuances and the issuance of more stock. However, leverage for the company is already high, with net debt as of this writing totaling $315.9 million.

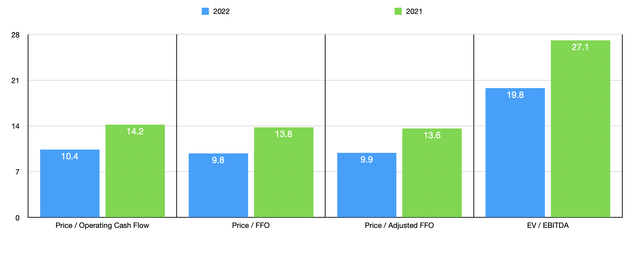

Using the aforementioned estimates, it’s not difficult to value the company. The price to operating cash flow multiple comes in at 10.4. That’s down from the 14.2 reading that we would get if we use 2021 figures. The price to FFO multiple should drop from 13.8 to 9.8, while the adjusted figure for this should drop from 13.6 to 9.9. And finally, the EV to EBITDA multiple of the company should fall from 27.1 to 19.8. To put the pricing of the company into perspective, I decided to compare its 2021 multiples to five similar firms. On a price to operating cash flow basis, these companies range from a low of 10.2 to a high of 11.7, with one of the five companies not having a positive reading. In this case, Alpine Income Property Trust was the most expensive of the group. And when it comes to the EV to EBITDA approach, the five companies ranged from a low of 10.9 to a high of 28.2. Only one of the five firms was more expensive than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Alpine Income Property Trust | 14.2 | 27.1 |

| CTO Realty Growth (CTO) | 11.2 | 12.7 |

| Presidio Property Trust (SQFT) | 11.7 | 10.9 |

| Medalist Diversified REIT (MDRR) | 10.2 | 13.6 |

| Generation Income Properties (GIPR) | N/A | 28.2 |

| One Liberty Properties (OLP) | 11.3 | 10.9 |

Takeaway

All the data provided right now suggests to me that Alpine Income Property Trust is a rapidly growing company with attractive fundamentals. Having said that, I am concerned about how much debt it has on its books. But outside of that, I like pretty much everything I am seeing. That does not mean that the company makes for a compelling opportunity at this time, however. Because at this moment, the stock is rather pricey relative to similar firms. So between that high price and the debt on its books, I have decided to keep my ‘hold’ rating on the company for now.

Be the first to comment