Evgenii Mitroshin

As a Canadian investor, I spend a considerable amount of time looking at investment opportunities in the Oil and Gas space. Recently, I highlighted Woodside Energy Group (WDS) as an under-the-radar name with significant exposure to the booming LNG markets. In this article, I want to highlight a low-risk dividend paying name that I own personally in my portfolio. The company is called Freehold Royalties Ltd. (OTCPK:FRHLF).

Freehold Royalties, as the name implies, is a Canadian energy royalty company with assets in both Canada and the US. Although I am highlighting the US OTC ticker in this article, investors who are interested in Freehold should consider transacting in the Canadian markets where Freehold trades under the TSX symbol (FRU) and has significantly more liquidity.

Assets Overview

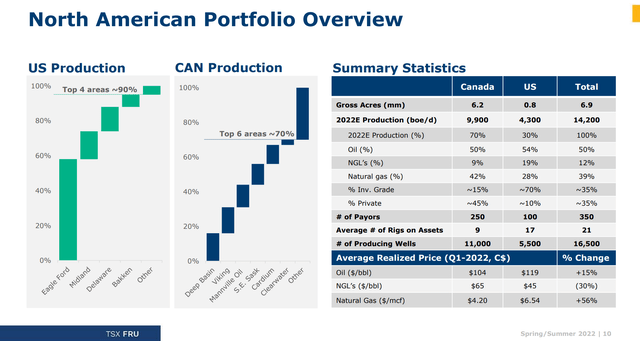

Historically, Freehold was a Canadian only royalty company. However, with depressed valuations post the COVID-19 crash, Freehold spent C$377 million in 2021 to acquire 4,400 boe of producing royalties in the US. Today, approximately 70% of Freehold’s production comes from Canada, while 30% comes from the US (Figure 1).

Figure 1 – Freehold assets overview (Freehold investor presentation)

Freehold’s large 6.9 million acre land position ensures a diversified roster of royalty payers. Figure 2 shows select top royalty payers to Freehold.

Figure 2 – Freehold has a diversified base of royalty payers (Freehold investor presentation)

Royalty Vs E&P

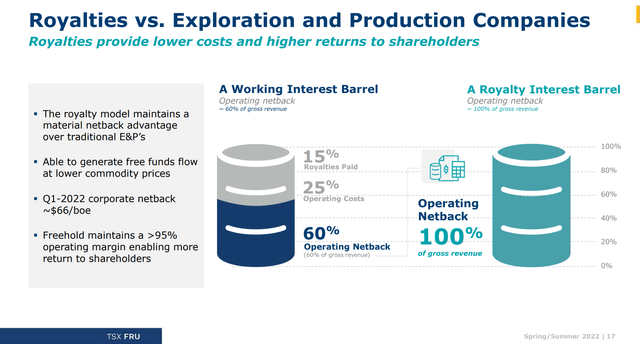

The main reason I like Freehold is for its defensive characteristics. As a royalty interest owner, Freehold does not pay any of the capital costs to drill and equip the wells for production, nor does it incur operating costs and ultimately environmental restoration costs. All of these costs are paid by the operator. Freehold receives royalty income from gross production revenue (revenue before any royalty expenses and operating costs are deducted) resulting in strong netbacks. Figure 3 is an illustration of the economics.

Figure 3 – Royalties vs. E&Ps (Freehold investor presentation)

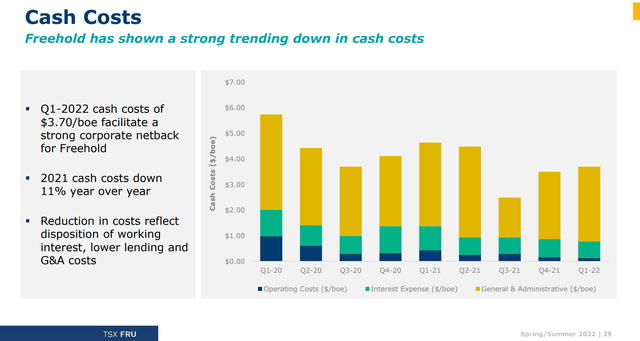

As Freehold’s production have no associated well-operating costs, its cash cost per barrel is essentially just corporate G&A and interest expenses. This makes Freehold one of the lowest cash cost ‘producer’ in the industry, with sub C$4 cash costs (Figure 4).

Figure 4 – Royalty model gives sub C$4 cash costs (Freehold investor presentation)

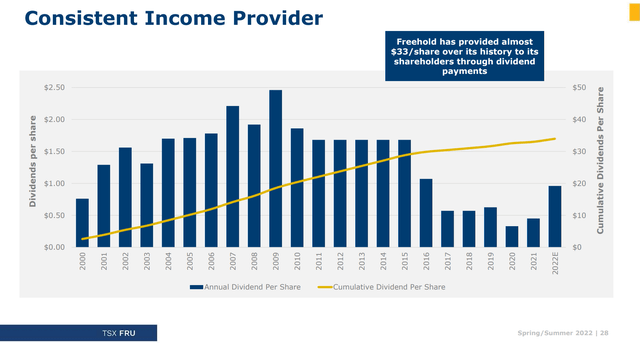

Low cash cost is the reason why Freehold was able to pay dividends even during the darkest days of the COVID-19 crash. When other energy companies couldn’t generate enough cash flows to keep wells operating, Freehold still paid an annualized C$0.18 dividend (Figure 5). In fact, since inception, Freehold has paid C$33 per share in dividends.

Figure 5 – Freehold has consistently paid dividends (Freehold investor presentation)

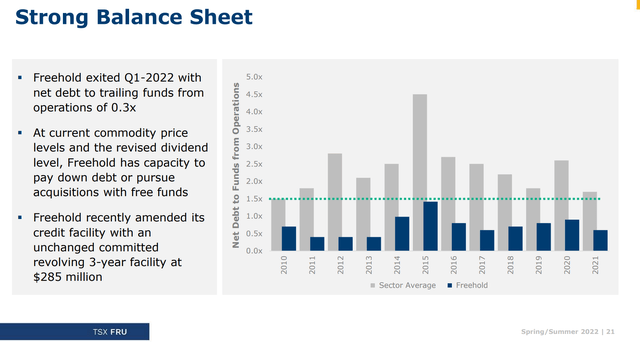

Another strength of the royalty business model is that when properly run, it does not require a lot of leverage. Figure 6 shows Freehold’s Net debt / FFO ratio. As we can see, Freehold has consistently been run at lower leverage than the sector, and the metric did not trade above 1.0x, even during the COVID-19 pandemic.

Figure 6 – Freehold has a conservative balance sheet (Freehold investor presentation)

My philosophy on investing in cyclical resource industries is to own the lowest cost / best managed companies ‘through’ a cycle, supplemented by adding or subtracting ‘beta’ at opportune times. With its superior cash cost profile, Freehold definitely fits the bill for a company to own through a cycle.

Recent Results Demonstrate Strength Of Business Model

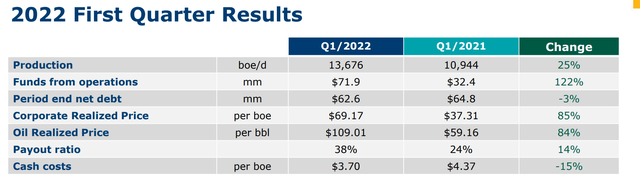

Freehold’s Q1/2022 results certainly demonstrated the strength of the business model. While the realized oil price only increased 84% YoY, Freehold was able to increase funds from operations (FFO) by over 100% to $72 million (Figure 7).

Figure 7 – Q1/2022 Results summary (Freehold investor presentation)

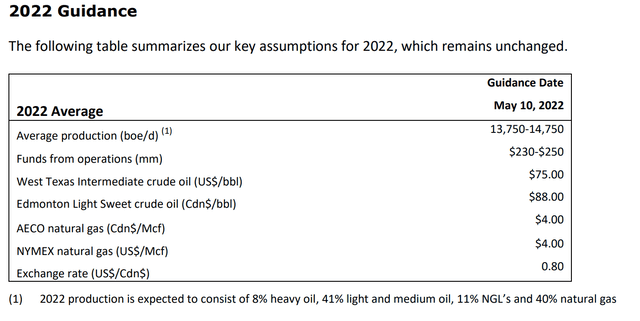

Furthermore, the company is guiding to C$230 to 250 million in FFO for 2022, using very conservative assumptions of US$75/bbl WTI and US$4.00/Mcf natural gas (Figure 8).

Figure 8 – 2022 guidance (Freehold Q1/2022 earnings release)

Valuation Remains Attractive

While valuation of energy companies is always a moving target due to the volatile nature of the commodity prices, the way I think about it is what is the free cash flow yield at various commodity price assumptions?

As Freehold has no capital expenditures, FFO is a rough proxy for free cash flow before dividends and M&A. So with total enterprise value of approximately C$1.9 billion, Freehold’s free cash flow yield is over 12%, at US$75/bbl WTI.

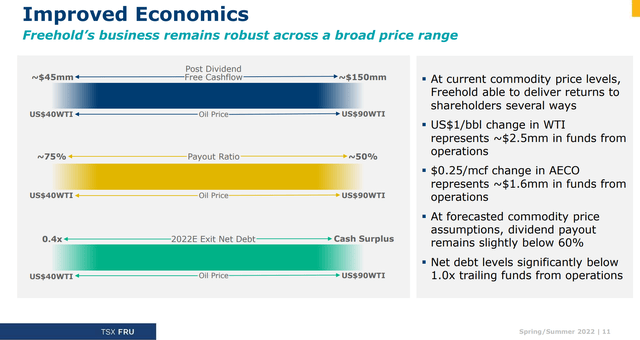

In fact, according to management estimates (Figure 9), Freehold will generate post dividend free cashflow of C$45 million at commodity price as low as US$40/bbl WTI.

Figure 9 – Freehold has plenty of margin of safety (Freehold investor presentation)

Risks To Freehold Story

Commodity Price Biggest Risk

The biggest risk to the Freehold story is obviously commodity prices. If the global economy slows down, there is room for energy commodity prices to fall. On this front, Freehold is more insulated than most producers as it doesn’t have production costs. Even the most bearish analyst on Wall Street is only forecasting US$65/bbl WTI in the event of a recession, while from Figure 8 above, we see that Freehold’s business plan should be safe down to US$40/bbl WTI.

On the flip side, there is a non-zero risk that the Russia/Ukraine conflict escalates further and western countries enact even more punitive sanctions against Russian energy production. In that scenario, some analysts predict oil prices spiking to over $380/bbl. Needless to say, even at $100 oil price, it will be a free cash flow bonanza for the company.

Freehold Could Lose Acquisition Discipline

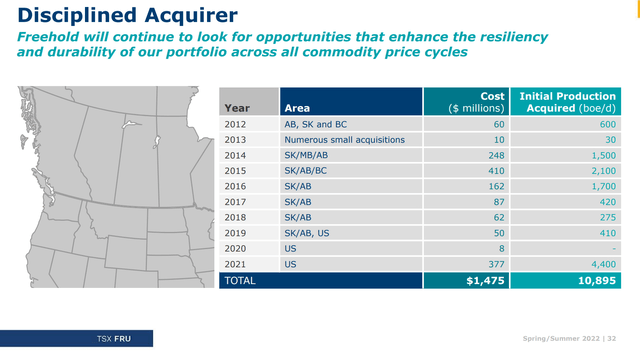

Another risk is that as Freehold expands into the US, it could lose its discipline and overpay for assets. Fortunately, that does not appear to be the case so far as debt has remained low and the price Freehold paid for its 2021 acquisitions was C$86K per flowing boe/d, below its historical average of C$135K (Figure 10).

Figure 10 – Freehold has been disciplined acquirer (Freehold investor presentation)

Technical Analysis and Recent Price Action

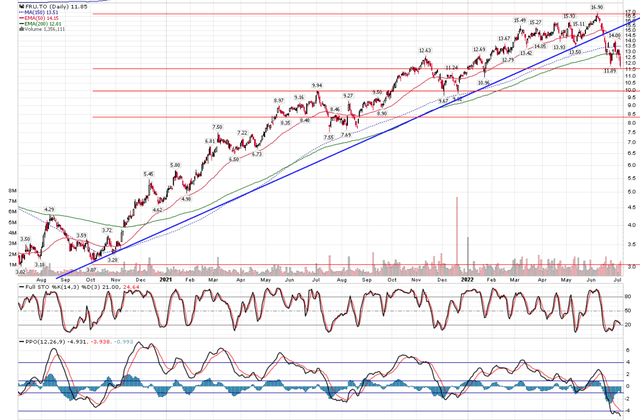

After peaking near C$17 a few weeks ago, Freehold has fallen by 30% to under C$12 a share as investors dump their energy holdings on recession fears (Figure 11). What we see technically is that it has decisively broken the uptrend in place since October 2020. However, on the positive note, MACD is very depressed and Freehold’s stock price is coming into a fibonacci support level around C$11.50.

In terms of dividend, Freehold is now trading at a 8.1% dividend yield, among the highest in the energy patch.

Figure 11 – Freehold stock has been hammered (Author created with data from stockcharts.com)

Conclusion

While the Freehold stock price has been hammered in recent days, Freehold’s defensive characteristics give me comfort in holding it through a cycle. Moreover, investors are paid an attractive 8.1% dividend yield at current prices.

Be the first to comment