wdstock

It is not an understatement to say that AT&T Inc. (NYSE:T) investors have been through a lot in the last decade, or even two. Bad M&As, inept management, and ballooning debt led to terrible stock performance and eventually a dividend cut masqueraded as a spinoff. We’ve stayed with the stock because of sunken cost fallacy and the fact that even the reduced dividend was handy enough to leave some hope for at least recouping the losses in the future.

Many times, we’ve seriously considered selling out the entire position but resisted for the reasons mentioned above. But as the adage goes, “fool me once, shame on you; fool me twice, shame on me.” We’ve written in some of our AT&T articles, that taking on additional debt will be the last straw that broke the camel’s back. On the back of this, we read this news on Seeking Alpha and it immediately raised a few red flags. Before we get into the red flags, let’s get a couple of things out of the way:

- The fact that AT&T renewed the revolving credit is not the issue here as the existing agreement, dated December 11, 2018, has been terminated.

- A credit facility agreement does not by itself increase AT&T’s debt. That happens only when they start drawing against the credit.

The issues are with the following:

- The issue is with the fact that the credit limit has gone up from $7.5B to $12B. That means, the company felt a need to increase its room to borrow by about $1B per year. For a repeat offender like AT&T, this becomes more of a concern when rates are as high as they are, no matter the “deals” they may be getting with the rates.

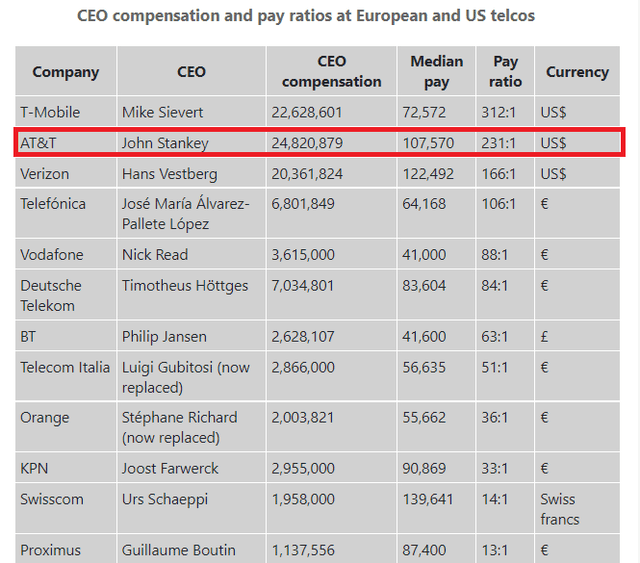

- The stated purpose of this is to fund “general corporate purposes.” There is not a word mentioned about investments. “General corporate purposes” brings bad vibes with it given AT&T’s history of rewarding the management to continue under-performing for the investors. In a study done on U.S. and European telecoms, the “Big 3” U.S. companies topped the list when it came to pay disparity between the CEO and the average worker.

Telecom CEO Comp (lightreading.com/)

- During the Warner Bros Discovery, Inc. (WBD) spin off, one of the biggest selling points for the stand-alone AT&T was debt reduction. Now, with the spinoff behind us and the stand-alone AT&T reporting pretty strong free cash flow in most of the recent quarters, a 60% increase in ability to borrow needs to be scrutinized carefully. Once again, having access to credit facility does not immediately equate to debt but this scenario is analogous to a kid in a candy store. The big question is, is AT&T doing this to have access to funds for a rainy day? Or to continue raining the management with cash? Until proven otherwise, we believe it is for the latter and will be watching things closely.

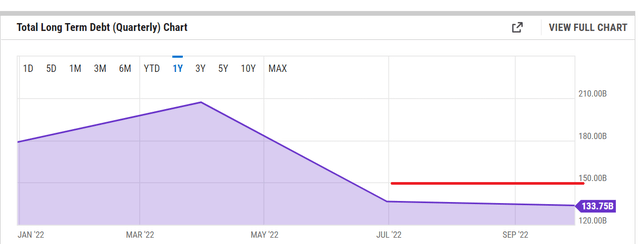

So, what do all these mean for invests here? As stated in previous articles, please be mindful that the fall in debt from about $210 B to $133 B shown in most places is just due to the spinoff. For the stand-alone AT&T, anything above $140B in the chart below will be a confirmation that the kid has started dipping his or her hands into the candy jars. The red line, at $150B, is our line in the sand, and if AT&T’s debt goes beyond that without meaningful and related investments, we will likely be out.

Conclusion

On the surface, it may seem rash to accuse or even being skeptical of just an “innocent” renewal of access to credit facility. But, AT&T investors have every right to be skeptical of any debt-related move the management makes.

Borrowing to spend on general expenses in this environment is a no. Borrowing to spend on unrelated acquisitions (especially media) is a bigger no. Borrowing to throw more money at the management is the biggest no.

With Football (or Soccer in North America) fever running high, we are flashing the yellow card at AT&T, and we also know when to flash the red card as covered above. What about you?

Be the first to comment