wildpixel

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 18th.

Inflation has raged all year, reaching 8.2% this past September. Lots of investors had the foresight to position their portfolios to profit from / reduce their losses from increased inflation. There are several ETFs which are meant to do just that, including commodity ETFs, energy ETFs, and multi-asset class ETFs. As inflation has been elevated for quite a while now, I thought to do an article analyzing the actual performance of these funds these past few months, to see if they were actually successful at their task.

In general terms, most inflation-hedge ETFs have outperformed YTD, seeing either below-average losses, or small gains. Energy ETFs have seen strong gains, while most commodity and diversified ETFs have seen slight gains, due to their energy exposure. Other ETFs, including those focused on materials, mining, gold, silver, and inflation-protection bonds, have seen moderate losses, but still outperformed relative to their peers. Excluding leveraged funds, one of the best-performing ETF YTD has been the Invesco Dynamic Energy Exploration & Production ETF (PXE), a smart-beta U.S. energy index ETF.

In my opinion, several of these ETFs still offer investors very compelling value propositions, at attractive entry points. Of these, two stand out.

The Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) which invests in short-term treasury inflation-protected securities, or TIPs. VTIP offers investors a strong, covered, inflation-protected 7.6% dividend yield, but should see declining dividends as inflation normalizes. A very safe fund, but one with low expected long-term returns, present dividends notwithstanding. I last covered VTIP here.

The iShares MSCI Global Metals & Mining Producers ETF (PICK), which invests in global mining companies. PICK offers investors strong dividends, and the possibility of significant capital gains if economic conditions improve. PICK is also a relatively risky fund, with volatile dividends and share prices. I last covered PICK here.

Inflation-Hedge ETF Performance Overview

Inflation-hedge ETFs have outperformed their peers YTD. I’ve seen no exceptions, but do imagine there have been a few, as there are dozens, perhaps hundreds, of these ETFs out there.

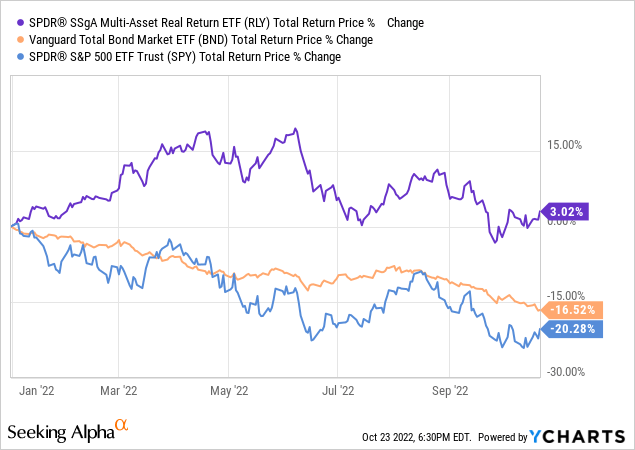

In general terms, these ETFs were successful in minimizing or reducing losses, less so in delivering positive returns to shareholders. The clearest evidence of this is the performance of two diversified inflation-hedge ETFs.

The SPDR SSGA Multi-Asset Real Return ETF (RLY) is a fund of funds, investing in several broad-based index ETFs which are effective inflation hedges. It is a multi-asset class fund, with investments in equities, commodities, real assets, bonds, and more. RLY’s diversified holdings means it functions as a benchmark for inflation ETFs, in my opinion at least.

RLY has significantly outperformed relative to most asset classes YTD, due to the strong performance of its energy investments. On the other hand, RLY’s absolute returns have been very low, as most of the fund’s investments have posted lackluster returns, even losses. RLY’s investments were generally successful in minimizing or reducing losses, but only a few delivered strong, positive returns to shareholders.

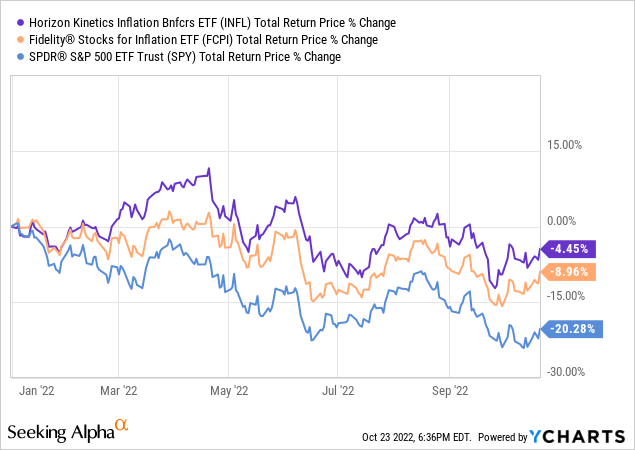

Looking at equities specifically, we have the Horizon Kinetics Inflation Beneficiaries ETF (INFL) and the Fidelity Stocks for Inflation ETF (FCPI). Both invest in companies with above-average inflation exposure, which see strong revenue and earnings growth when inflation is high and rising. Share prices should follow suit, in theory at least.

Both funds have outperformed YTD, in large part due to the strong performance of their energy holdings. Both funds are still down YTD, due to the breadth and severity of the current equity bear market: stocks are down, with few exceptions.

As mentioned previously, inflation-hedge ETFs have been broadly successful at reducing losses YTD, less successful at delivering positive returns for shareholders. With one important exception: energy.

Energy Equity ETFs – Best-Performers

Energy investments tend to be relatively effective inflation hedges, for obvious reasons. Energy investments perform extremely well when (energy) prices are high and rising, which almost always happens during periods of heightened inflation. This is because energy resources underpin most manufacturing and industrial processes, so you are unlikely to see broad-based inflation without also seeing rising energy prices. Both times inflation skyrocketed in the developed world, these past few months and during the 70s, oil prices skyrocketed as well, and were the main culprit. As such, energy investments tend to be effective inflation hedges, and energy equity ETFs are no exception.

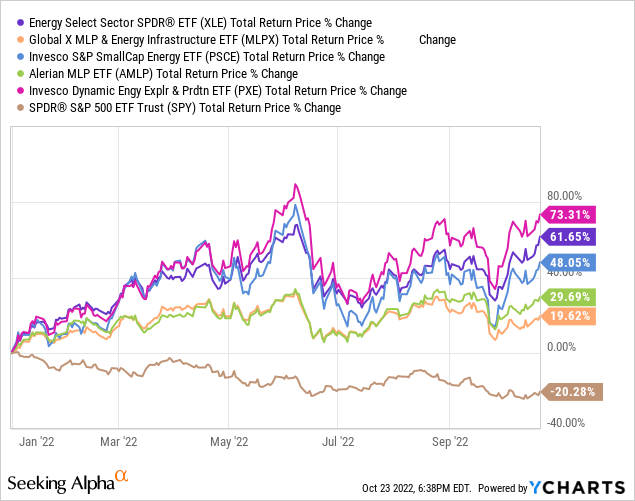

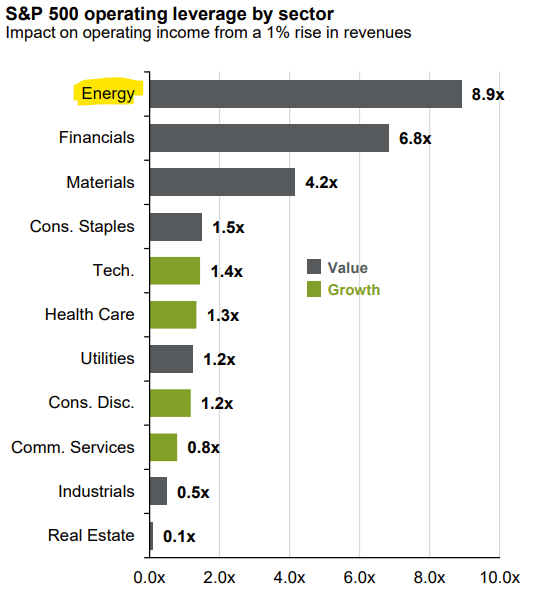

Energy equity ETFs have seen strong returns YTD, as expected. The Energy Select Sector SPDR ETF (XLE), the industry benchmark, has seen returns of 62% YTD, versus losses of 20% for the S&P 500. That is a massive 72% performance differential.

Other energy sub-segments / ETFs have seen strong returns too. MLPs are up 30%, small-cap energy stocks are up 48%. Midstream energy companies have seen returns of only 20%, lowest of the bunch, but saw much stronger relative performance in prior years, when energy prices were weaker. PXE, a smart-beta energy ETF, has seen the strongest returns of the bunch, at 73%.

Energy outperformance was due to improved fundamentals, centered on rising energy prices, improved investor sentiment, from rock-bottom to slightly bearish, and due to starting from a very low base valuation / share price. Energy was more or less left for dead in the aftermath of the coronavirus pandemic, so improved conditions would have meant significant gains, to recover lost ground.

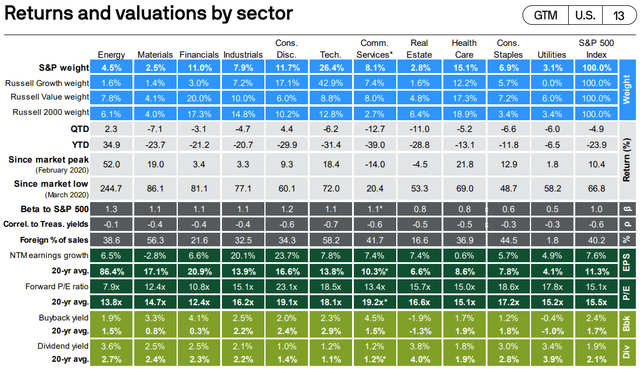

Energy stocks remain cheaply valued, with the cheapest valuations out of all U.S. equity industries. As such, energy stocks remain strong investment opportunities, in my opinion at least.

J.P. Morgan Guide to the Markets

Commodity ETFs – Strong Returns

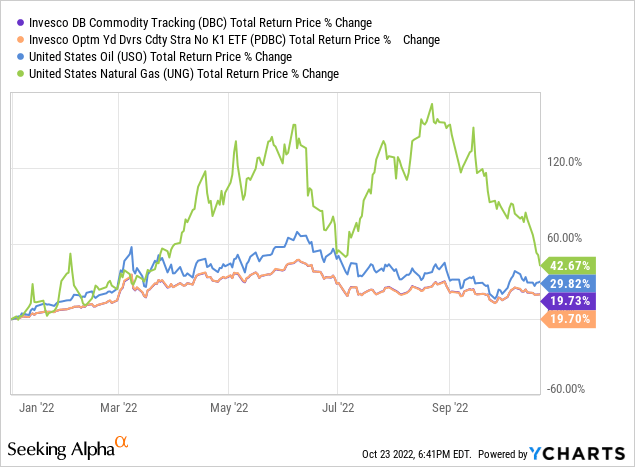

Commodity ETFs have generally seen strong returns YTD, although lower than energy. Returns were in large part due to the strong performance of energy commodities, meaning oil, natural gas, and the like.

Diversified commodity ETFs have generally seen double-digit returns YTD. These include the Invesco DB Commodity Index Tracking ETF (DBC), and the Invesco DB Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC). Commodity ETFs focusing on energy products, especially natural gas, have seen even stronger returns. These include the United States Oil ETF (USO), and the United States Natural Gas ETF (UNG).

Diversified commodity ETFs have outperformed due to rising commodity prices. Prices have risen due to higher demand and improved economic fundamentals following the pandemic, supply chain disruptions, and decreased supply as a result of the Ukraine war.

Energy commodity ETFs have seen even stronger performance, as these commodities have seen above-average increases in price, quite a bit higher than their peers. Prices have risen for the same reasons as above, and due to Western sanctions on Russian oil, OPEC production cuts, and environmental and regulatory concerns surrounding fossil fuels, energy exploration and transportation, etc.

Commodity ETFs generally invest in futures contracts, financial derivatives that do not entitle investors to any underlying cash-flows, unlike equities, bonds, and most other asset classes or investments. Due to this, commodity ETFs have extremely low long-term expected returns, barring significant, sustained increases in commodity prices. Commodity prices are already quite elevated, and further increases seem unlikely: the Federal Reserve is committed to crushing inflation. Under these conditions, investing in commodity ETFs seems unwise, although the funds might be appropriate as short-term trading vehicles, in my opinion at least.

Other Equity ETFs – Subpar Returns

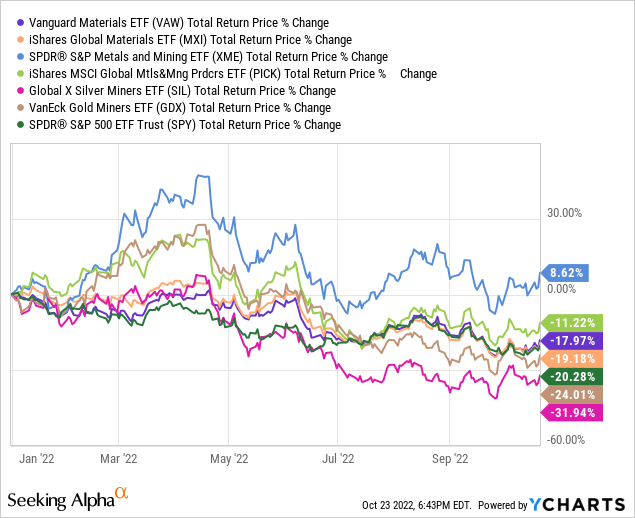

Energy equity ETFs have seen strong returns YTD, due to rising oil prices. On the other hand, equity ETFs focusing on other industries, including gold, silver, materials, and mining, have seen very subpar returns during the same. Silver miners have been the worst performers, while broader mining indexes have performed comparatively well.

These other equity ETFs have underperformed expectations due to the breadth and severity of the current equity bear market.

Energy managed to outperform due to starting from a much lower base, remember negative oil prices in early 2020, and as energy companies have very high operational leverage, meaning they see outsized earnings growth from even minor increases in prices. Companies in other industries do benefit from rising prices too, but less so, and the broader economic / market situation outweigh these benefits.

J.P. Morgan Guide to the Markets

Some of these equity ETFs still provide compelling valuations and some measure of inflation protection. The iShares MSCI Global Metals & Mining Producers ETF, PICK, investing in a diversified portfolio of global miners, stands out. PICK currently yields 9.8%, although yields seem to be higher than expected due to volatility and exceptional results earlier in the year. PICK also offers investors the potential for strong gains if economic conditions improve, although losses could mount if conditions worsen. PICK is a strong, but risky, fund. I last covered PICK here.

Inflation-Protected Bonds – Subpar Returns

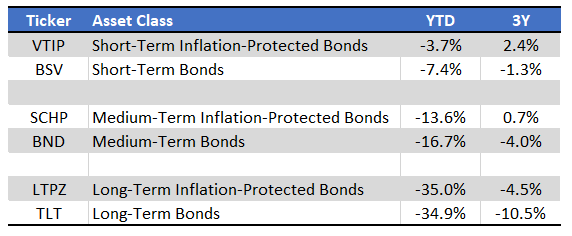

Inflation-protected bond ETFs have seen much lower losses relative to their fixed-rate peers, at least once you account for maturity and duration. On the other hand, performance has been broadly negative, and worse than expected. Approximately all these ETFs are down YTD, although performance is materially stronger at the 3Y mark.

SeekingAlpha – Chart by author

Inflation-protected bond ETFs outperformed relative to their peers due to being hedged against inflation: prices increased, dividends increased too, and these helped to reduce losses from rising interest rates.

Inflation-protected bond ETFs underperformed relative to expectations, as rising interest rates led to lower bond prices and capital losses, and as investors are pricing these securities assuming inflation should normalize relatively quickly. Insofar as inflation remains elevated, these ETFs should outperform their fixed-rate peers, but interest rate risk remains an important consideration.

Short-term ETFs have also performed much better, due to focusing on bonds with shorter maturities and less interest rate risk.

From these ETFs, VTIP stands out, due to its low interest rate risk, and strong, covered 7.6% dividend yield.

Conclusion

Inflation has skyrocketed all year.

Inflation-hedge ETFs have generally been successful in minimizing losses YTD, less so in generating positive returns. Several of these offer investors compelling value propositions, including VTIP, for more risk-averse investors, and PICK, for more aggressive investors.

Be the first to comment