time99lek/iStock via Getty Images

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” ‐ Seth Klarman

Closing The Book on 2022

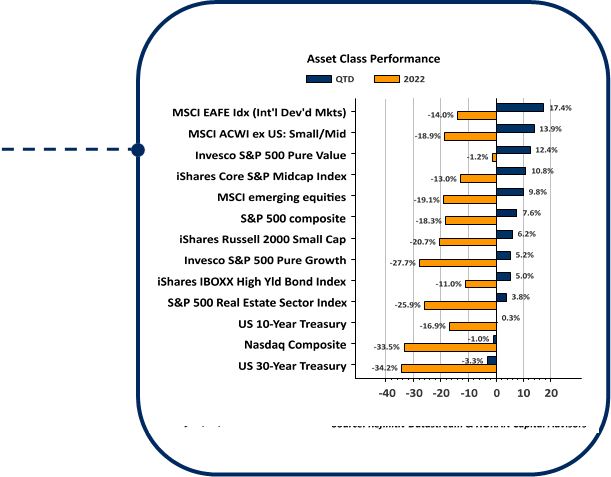

“A Bear of a Market” and “Nowhere to Hide.” These were a few of the headings from our Investor Letters last year, so along with most investors we are happy to close the book on 2022. The asset classes seen in the chart all generated a negative return last year. In fact, it was one of the worst years ever for the classic balanced investment portfolio of 60% stocks and 40% bonds.

|

As of 12/30/2022 – Sources: Refinitiv Datastream & HORAN Capital Advisors |

A catalyst for the broad decline in stocks and bonds last year was the Federal Reserve’s aggressive push higher in short term interest rates beginning in March of 2022. From a starting Fed Funds rate of 25 basis points or 0.25% at that time, the Fed’s target rate closed out 2022 at 4.50%. This is the fastest pace the Federal Reserve has increased short term interest rates.

Also, the Fed’s Quantitative Tightening (QT) program, i.e., the shrinking of Fed’s balance sheet by $90 billion a month, is estimated to be equivalent to an additional 200 basis points added to the Fed Funds rate according to a paper from the Federal Reserve Bank of San Francisco. If you add that to the current 4.5% funds rate, the effective rate would be more equivalent to 6.5% for overnight rates. The most restrictive rates we have seen in 20 years.

Despite declines in December, most asset classes were positive in the 4th quarter as illustrated in the chart above. The rally was also noteworthy because international stocks outperformed U.S. stocks in the final three months of the year after underperforming for some time. The international leadership was due in part to China easing some of their COVID‐19 restrictions and therefore an expectation of stronger growth from the world’s second largest economy. Another contributor to the international strength was the weakening of the U.S. Dollar in the 4th quarter. As we discussed in our last Investor Letter, a strong Dollar negatively impacts the return U.S. investors receive on their foreign investments, while a weak Dollar positively impacts the return. In September, the Dollar strengthened to near a level last seen in 2001 and subsequently declined over 7% in the final three months of the year and served to boost foreign investment returns for U.S. investors.

Last Call Was Last Year

The tools the Fed employs to keep interest rates low can create excess liquidity and tends to promote outsized risk taking when interest rates are near zero and liquidity is high. The Fed’s draining of liquidity that began last year has introduced an element of sobriety markets have not experienced since prior to 2020. The removal of the proverbial “punch bowl” by the Fed has resulted in a 180‐degree shift in investor risk taking.

One such area of excessive risk taking was called SPACs, or Special Purpose Acquisition Companies, which we wrote about in our Spring 2021 Investor Letter. A SPAC is a shell company that raises cash via a public stock sale and the cash is used to purchase a private company, essentially taking the private company public through the SPAC purchase. Sometimes the intended purchase target is known, other times it is not. Typically, the SPAC must acquire a business within 24 months of raising the capital, and if not, return the cash back to its shareholders. This return of cash is handled by repurchasing or buying back the stock that was issued. With fewer companies wanting to sell since interest rates have increased and the economy has slowed, a number of SPACs are unlikely to meet the two‐year purchase requirement. It is estimated that investment losses in SPACs will exceed $2 billion.

Crypto currency investments are another area that attracted investment dollars while interest rates were near zero percent and excess liquidity was working its way into the market. The biggest crypto currency meltdown occurred with a company called FTX that filed bankruptcy late last year with liabilities equaling as much as $8 billion. FTX’s growth strategy, in part, was driven by the company’s propensity to acquire failing crypto firms. Crypto investments remain in their infancy and the blockchain technology behind these currencies remains immature. Readers may know the most common cryptocurrency is Bitcoin and this currency is down over 75% from its 2021 high of $69,000 to its current level of $16,940 at the time of this writing.

Another area that experienced a reversal of fortune last year are many of the stocks that benefited from the pandemic shutdown, also known as Work From Home stocks. Stocks such as Amazon (AMZN) and Zoom Video Communications (ZM) saw their share prices decline 65% and 63% respectively last year. The Direxion Work From Home ETF (WFH) is an index that tracks stocks benefiting from a work from home environment and the index was down ‐45.3% for 2022. While painful to investors allocated to these areas, we view the moves as “rational” given the economic and monetary policy environments have shifted dramatically.

Value Led Growth In 2022

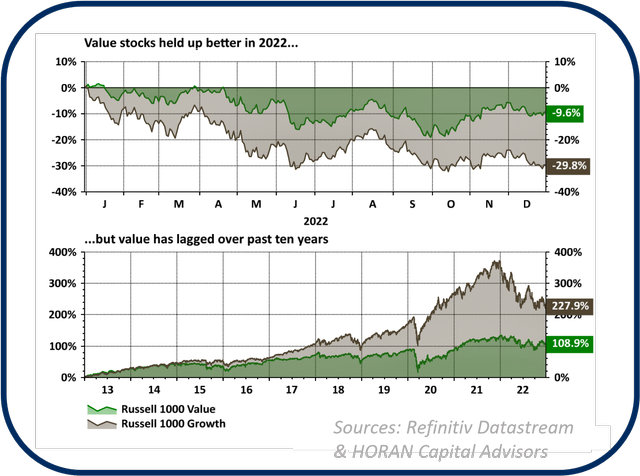

One common factor with the Work From Home stocks is these types of stocks have characteristics common to the growth style, i.e., higher valuations, higher price to book ratios, etc. As the chart on the next page shows, growth stocks underperformed value stocks by a wide margin last year, ‐29.8% versus ‐9.6%, respectively.

Higher interest rates serve as a strong headwind for growth stocks as higher rates reduce the value of future earnings of growth stocks. This discounting of future earnings places downward pressure on the valuation of growth stocks by pushing the price of the stocks down. A few favorite stocks of investors that experienced significant declines last year were Amazon (AMZN), down ‐49.6%, Tesla (TSLA), down ‐65.0% and Facebook Parent, META Platforms (META), down ‐64.2%. Widely followed growth manager Cathie Wood and her flagship ARK Innovation Fund (ARKK) lost 67% of its value in 2022 following a 24% drop in 2021. She was considered one of the hottest hands on Wall Street and owned many high‐profile growth stocks such as Tesla, Zoom (ZM), Teladoc (TDOC) and Nvidia (NVDA).

Value stocks are not immune to this valuation compression, but higher rates are less of a headwind to them. An offsetting characteristic for many value stocks is the fact they tend to have higher dividend yields and these dividends account for a larger portion of the stocks total return. Over the last ten years though, growth type stocks have far outpaced value by generating more than twice the return versus value type stocks as seen in the bottom panel of the above chart. If interest rates continue to drift higher in the first half of the year, growth stocks could remain under pressure, resulting in continued outperformance of value stocks.

Earnings & Inflation

|

Sources: Refinitiv Datastream & HORAN Capital Advisors |

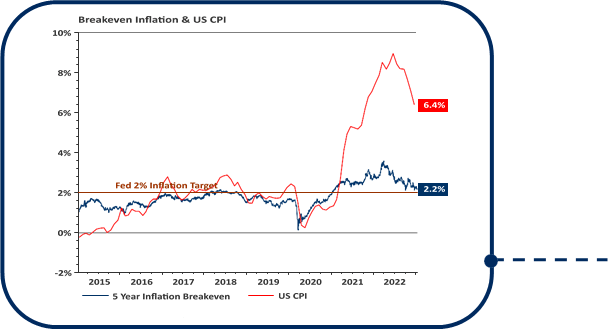

The Federal Reserve’s stance on aggressively pushing short term interest rates higher is their effort to stem the rise in inflation. Their efforts appear to be having some success in reigning in inflation as the Consumer Price Index (CPI) reached an annual rate of 9% in June of last year and is now down to 6.4% as seen on the near chart. Also included on the chart is the 5‐year breakeven inflation rate which is down to 2.2%. The breakeven inflation rate represents the difference between the nominal yield on a 5‐year Treasury bond and the 5‐year TIPS yield. It is called the breakeven inflation rate because one would receive the same total return on TIPS as they would a nominal Treasury if CPI inflation averages that level over the next 5 years. In other words, bond investors are expecting inflation to be brought under control, at least over the course of the next 5‐years.

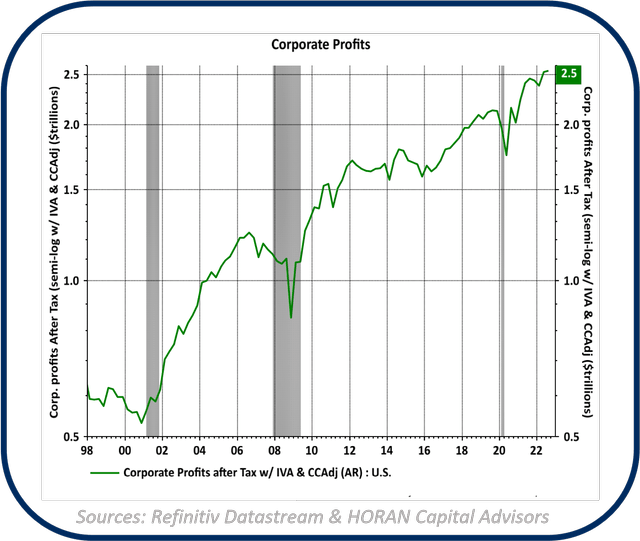

For stock investors, company earnings matter and inflation places upward pressure on a business’ cost. Over time, businesses and therefore company stocks, can serve as an inflation hedge as companies generally are able to pass along the higher cost through price increases, as well as the ownership of assets that are inflating in value. The latest earnings reporting season ending in the third quarter of 2022, S&P 500 companies reported year over year revenue growth of 11.7%. Near term, all higher costs may be difficult to fully pass on and this is evident in 2022 third quarter earnings being reported at a 4.4% increase. Earnings for the S&P 500 are entering a period where the next three quarters, through the second quarter of 2023, analyst expectations are S&P 500 quarterly earnings will be lower on a year over year basis. However, with earnings expected to bottom in the second quarter of 2023, the market will begin looking out towards the end of 2023 where earnings are expected to resume their growth, all else being equal.

Rationality Or Overreaction

In 2022 the U.S. economy experienced a “technical” recession with real GDP contracting in both the first and second quarter. While some strategists are predicting a recession in 2023, maybe we are already in one and will be exiting it this year. There are many conflicting economic signals making it hard to determine where the economy is within the business cycle. Peter Lynch, the well‐known former portfolio manager at Fidelity once said in an interview, “If you spend 13 minutes a year on the economy, you’ve wasted 10 minutes.” He went on to say, “I don’t remember anybody predicting 1982 we’re going to have 14% inflation, 12% unemployment rate, a 20% prime rate, you know, the worst recessions since the Depression.”

He further implied the economic environment provided investors an opportunity to invest in the stock of some great companies whose share prices fell due to the uncertain environment.

One cannot predict stock market bottoms, but the market pullback in 2022 is creating an environment maybe like 1982, i.e., an opportunity to invest in some good companies at reasonable prices. The Fed’s push to move interest rates higher is necessary to reduce the pressure from inflation. Higher rates are helping return rationality to the market and squeezing out some of the speculative investment activity.

Thank you for your continued confidence and support in HORAN Capital Advisors.

Respectfully,

HORAN Capital Advisors

|

HORAN Capital Advisors, LLC is an SEC Registered Investment Advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Capital Advisors, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/152888. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment