Galeanu Mihai

Annualized Performance (%) as of 12/31/22

| QTD | YTD | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception (12/30/99) | |

| Opportunity Equity (gross of fees) | 2.11 | -35.51 | -35.51 | -4.57 | 1.43 | 10.36 | 6.375 |

| Opportunity Equity (net of fees) | 1.85 | -36.18 | -36.18 | -5.52 | 0.41 | 9.27 | 5.69 |

| S&P 500 Index | 7.56 | -18.11 | -18.11 | 7.66 | 9.42 | 12.56 | 6.28 |

“Every new beginning comes from some other beginning’s end.”

– Seneca

A new year, a new beginning. People often appreciate the prospect of starting fresh, the possibility that comes with change. New Year’s resolutions bring hope and promise.

For most, the biggest challenge isn’t figuring out what to do, but doing it consistently. Resolutions are made, but not kept. We know we should eat healthy and exercise, be kind and patient with loved ones and buy low and sell high. Somehow, the knowing doesn’t easily translate into the doing.

Greatness can result from consistent execution of the enduring obvious. Jeff Bezos built Amazon (AMZN) into one of the most successful companies of all time by providing customers what they will always want: low prices and great service.

Morgan Housel, author of the fabulous book The Psychology of Money, tells a story on his blog about a friend’s conversation with Warren Buffett during the depths of the Financial Crisis in 2009. The friend wondered aloud how the economy could ever rebound from such damage. Buffett asked if he knew what the best-selling candy bar was in 1962? Snickers. And today? The same.

That somewhat cryptic response revealed a deeper insight: one of Buffett’s secrets to success has been capitalizing on the gap between what endures for businesses versus what’s ephemeral in markets and the economy.

You don’t need to be at the top of Forbes billionaires list, like Bezos and Buffett, to reap huge rewards from capitalizing on consistency. Stories abound regarding normal people who did just that.

I love the story about fellow-Vermonter Ronald Read. In 2014, the former janitor and gas-station attendant died at the age of 92. His $8M fortune shocked family and the charities to which he bequeathed his wealth. How did someone from such humble means amass such wealth? Read consistently spent less than he earned and invested in enduring blue-chip companies. Time, not timing was the secret to his success.

In his book and on his blog, Morgan Housel tells the contrasting stories of Grace Groner and Richard Fuscone. Grace was orphaned at age 12, never married, drove, or had children. She worked as a secretary and lived alone in a one-bedroom house. When she died at age 100, she left $7M to charity. How? Same cause: market compounding over time.

Fuscone, on the other hand, went to Harvard and University of Chicago. He became the vice-chairman of Merrill Lynch’s Latin America division before retiring in his 40s to pursue personal and charitable interests. His education and income didn’t protect him from the worst of financial outcomes. He declared bankruptcy, dealing with foreclosures on two homes (one was over 20K sq ft with a $66K/mo mortgage).

Housel points out that there’s no other field where this would be possible. Where a person with no education, resources or experience can so vastly outperform someone with all the advantages. I think there might be some parallels. We all know highly educated doctors without the healthiest habits. Or priests, reverends, or other spiritual leaders whose lifestyles don’t live up to their preachings.

The point remains: simple behaviors consistently practiced over time can be much more powerful than the most sophisticated knowledge and analysis. We understand this about health and morals but underestimate its application to wealth creation.

Grace and Ronald can teach us a thing or two. It’s crucial to remember the power of long-term compounding after a particularly dreadful year for markets. The S&P 500 ended down 19%, the seventh worst year since 1926, and a 60/40 stock-bond portfolio declined 17%, the worst since 1937.

After suffering losses for the past year, many investors’ first instinct is to run for the hills. Institutional investors show extreme bearishness across several measures. Equity market exposure has been at historic lows. There’s also research that suggests the average retail investor’s performance suffers more from poor timing decisions than other common detractors like poor fund choices or fund fees. Investors get spooked at exactly the wrong time.

Reversion to the mean is a powerful force in markets. Evidence suggests Morningstar’s ratings, which are heavily based on trailing performance, have no predictive value. When things look ugly, there’s a benefit in doing as Crosby, Stills & Nash recommends: love the one you’re with.

The best stocks, funds, economies, and markets all suffer periods of poor performance. Hendrik Bessembinder’s (Arizona State University) research demonstrates that the 100 most successful stocks of each decade had average drawdowns of 33% over an average of 10 months. In the preceding decade, those stocks suffered 52% average drawdowns lasting 22 months.

To be successful in investing, one must accept this pain as part of the process and focus on long-term prospects. The S&P 500 has compounded capital at a 9.4% average annual rate since 1927, despite many recessions, wars, bear markets, inflation-scares, Fed tightenings and other frightening events.

For the average investor, it’s surprisingly simple to do well with a long time horizon. Simple, but not easy. Dollar cost averaging, the practice of consistently buying equities over long periods of time, works! It’s much more difficult, if not impossible, to try to time markets.

Time is your biggest ally in this business, which is why I chose the name Patient Capital for the firm.

For us, 2023 brings a remarkable opportunity for reflecting on change. As Bill Miller steps off as portfolio manager of the Opportunity Strategy and we prepare for Patient Capital to take over that business, along with its supporting organization, much will change. Yet it’s what endures that’s likely more important.

Our philosophy and process, which have demonstrated success for over 40 years, won’t change. There will be continuity in both the investment and operational teams. Bill will remain an advisor, mentor, investor, and friend; we will continue to benefit from his valuable perspective. On a more mundane level, we will continue to go to the same office. From the perspective of us internally, it’s more a picture of continuity than change.

That’s not to say we underestimate the change. We have an amazing opportunity in front of us. We couldn’t be more excited about the future.

I feel extraordinarily grateful for my past 20-plus years under Bill’s tutelage, and for what lies ahead. I ended the year reflecting on the value of good mentorship. I sent Bill a thank-you note attempting to capture some of what I’ve learned:

I’ve learned so very much from you: the pursuit of excellence and high standards, the pursuit of knowledge and learning, the importance of communication and how to write and present effectively, that nothing is more important than character and ethics, the power of resilience and perseverance, the joy of finding a great investment and making others successful, the power and importance of positivity, a great sense of humor, open-mindedness, patience and loyalty…to name only a few.

It’s my responsibility and duty to make the most of what I’ve learned. I begin 2023 with an immense sense of purpose and promise. I feel honored to carry on our distinctive investment process. Our approach is characterized by long-termism, value-discipline, independent-thinking and flexibility/adaptability. I believe this combination is unique and valuable.

These days, the market is hyper-efficient at incorporating short-term data. There’s a reason why the Citadels and Renaissances of the world, who specialize in real-time algorithms, do so well. We believe it’s much less efficient over a longer time horizon. Only about 1/4 of active mutual funds hold stocks for 3 years or more. Hedge funds trade even more often. While divergences from intrinsic value can create excess short-term volatility, we believe it also creates heightened long-term opportunity.

Additionally, value discipline is increasingly rare. According to Morningstar, value-oriented funds account for only roughly 5-10% of money under management, down from closer to 25% in the mid-2000s. Yet, a long term, value approach has demonstrated success over many decades as Buffett recounted in his excellent article, The Superinvestors of Graham-and-Doddsville. While the last decade challenged value managers, we believe the reversal that’s occurred over the past year or two is likely to endure.

Our results have disappointed and diverged from most value managers recently. That’s primarily attributable to our willingness to invest early in companies we believe are long-term secular winners. These securities remain strong contributors to our longer-term results.

A small percentage of companies (4%) drive all the market’s wealth creation over long periods of time. It would seem sensible, then, to try to identify these opportunities. And we do. The very best value investors benefitted from investing early in companies that compound(ed) capital over long periods (eg- Buffett and Ben Graham with Geico; Bill Miller with Amazon). But many rule them out based on accounting metrics that appear expensive.

We explicitly look for these sorts of opportunities as part of our process. This has significantly enhanced our long-term performance. Amazon, RH and Farfetch (FTCH, given our sales at higher prices) are all top contributors over the last decade.

Over the past 12-18 months, early-stage opportunities have only hurt us (and anyone else who owned them). These companies have gotten crushed. The magnitude and length of this decline has now reached extremes. ARK Innovation ETF, which embodies early-stage, secular change investing, was down 80% from its peak at year-end, almost 2-years after its Feb 2021 peak.

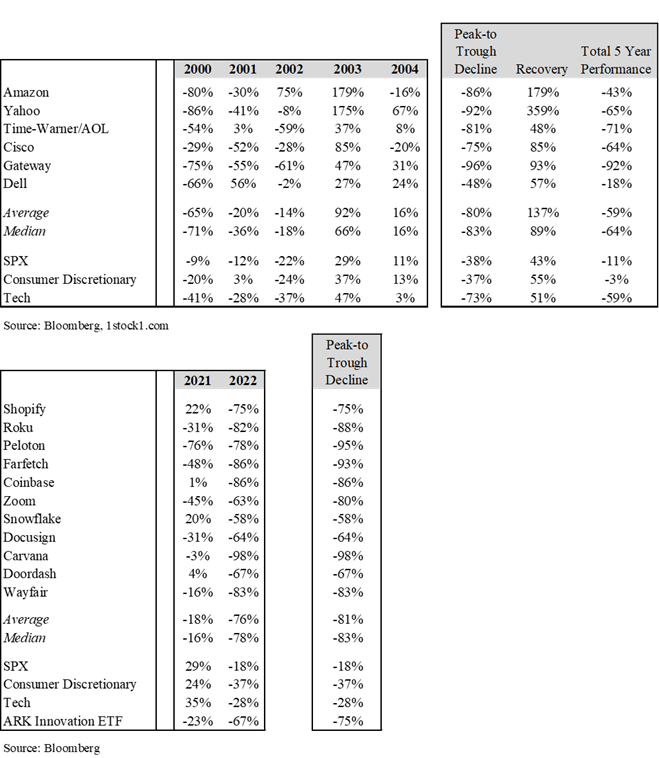

We are nearing the 2-year mark for the bear market in “innovation stocks.” The early-2000’s tech bear market lasted slightly over 2 years (a little closer to 3 for securities that peaked the earliest). We’ve nearly matched that worst-case scenario in duration. Since markets react much more quickly these days, the comparison is even more striking.

The source of the late-90’s bubble was the technology and telecom sectors. On an annual basis, the tech sector lost 73% over 3 years before recovering. The current bubble centered on innovation stocks. ARK’s 2021-2022 performance of -75% almost exactly matches the tech sector’s losses in the early 2000s. See Appendix 1 for more details on how 2000 losses compare to current ones.

This means we should be in the later innings of losses. One main difference between now and then is the profitability of companies at the center of the storm. We have more money losers these days. The market currently favors companies that pursue profits most aggressively. We expect this to continue, and it could take more pain for managements to adequately adjust. Another big wild card is recession. We had a mild one in the early 2000s. What transpires is sure to be a factor in the ultimate level of losses.

We believe many names price in a recession. Consumer discretionary stocks lost 37% in 2022 as valuations corrected, and the market discounted a looming recession. That loss equals the entire loss suffered by the group in the early 2000s. That recession was mild. The Financial Crisis recession of 2007-2009 certainly was not. During that bear market, consumer discretionary declined 42%1. We’re close to even that! We think this bodes well for our consumer and cyclical stocks, which account for a sizeable chunk of the portfolio.

As for “innovation stocks”, we believe selectivity is key. Most early-stage innovators fail to outperform. Yet some will likely be the biggest wealth creators. We continue to turn over stones in search of those opportunities.

As for value, we believe value discipline will matter more over the next decade than it did over the last. Value strategies faced headwinds in the 2010s. As interest rates fell, duration and growth were rewarded. Assets fled value in favor of growth. Many value stocks faced secular risk. Those forces have mostly all reversed, with rates up substantially and companies adapting to the new world. We believe we are early in what’s likely to be a lasting shift toward value.

We think our unique combination of a value-focus along with a willingness to look at potential compounders early in their lifecycle is an advantage. This process won’t change.

We think of the portfolio as a core of high conviction value names with a tail of mostly beaten down potential secular winners we believe have the potential to rise 5, 10, 50 or even 100 times.

The portfolio’s been dragged down by growth names and cyclicals. Both have reached extreme levels associated with the end of losses in past bear markets/recessions. We think there are good odds 2023 will be a strong year for us. A year where the market can focus more on company fundamentals than macro, which is helpful to our style. We couldn’t be more excited about the portfolio’s prospects, whatever ephemeral forces it faces.

Samantha McLemore, CFA

Appendix 1: Comparison of Post Tech-Bubble Losses vs. Current Post Innovation-Bubble Losses

Footnotes1Dec 29, 2006 – Dec 31, 2008 The 60/40 portfolio above is 60% in the S&P 500 and 40% in 10 Year Treasuries via data from NYU. Appendix 1 is based on internal Miller Value Partners analysis using the data sourced from the Bloomberg and/or 1stock1.com. |

|

The S&P 500 Index is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. References to specific securities are for illustrative purposes only. Portfolio composition is shown as of a point in time and is subject to change without notice. Portfolio holdings and portfolio discussion are for a representative Opportunity Equity account. Holdings discussed may or may not be included in all portfolios subject to account guidelines. Investors should carefully review and consider the additional disclosures, investor notices, and other information contained elsewhere in this document as well as the Offering Documents prior to making a decision to invest. All historical financial information is unaudited and shall not be construed as a representation or warranty by us. References to indices and their respective performance data are not intended to imply that the Strategy’s objectives, strategies or investments were comparable to those of the indices in technique, composition or element of risk nor are they intended to imply that the fees or expense structures relating to the Strategy or its affiliates, were comparable to those of the indices; since the indices are unmanaged and cannot be invested in directly. The performance information depicted herein is not indicative of future results. There can be no assurance that Opportunity Equity’s investment objectives will be achieved and a return realized. Returns for periods greater than one year are annualized. The views expressed in this commentary reflect those of Miller Value Partners portfolio managers as of the date of the commentary. Any views are subject to change at any time based on market or other conditions, and Miller Value Partners disclaims any responsibility to update such views. These views are not intended to be a forecast of future events, a guarantee of future results or investment advice. Because investment decisions are based on numerous factors, these views may not be relied upon as an indication of trading intent on behalf of any portfolio. Any data cited herein is from sources believed to be reliable, but is not guaranteed as to accuracy or completeness Click for more information on Opportunity Equity and the Opportunity Equity Strategy Composite Performance Disclosure. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment