Michael Vi

Investment Thesis

“I believe we’re acting with urgency to recalibrate the business and leverage our strong foundation to adapt to the evolving business landscape and the changing and challenging macro environment. These efforts will take time, and they represent a continued evolution for DocuSign. However, I am fully confident that the opportunity is here for DocuSign and is within our reach with a clear strategy, focus and execution.” – DocuSign fiscal Q3 2023 conference call.

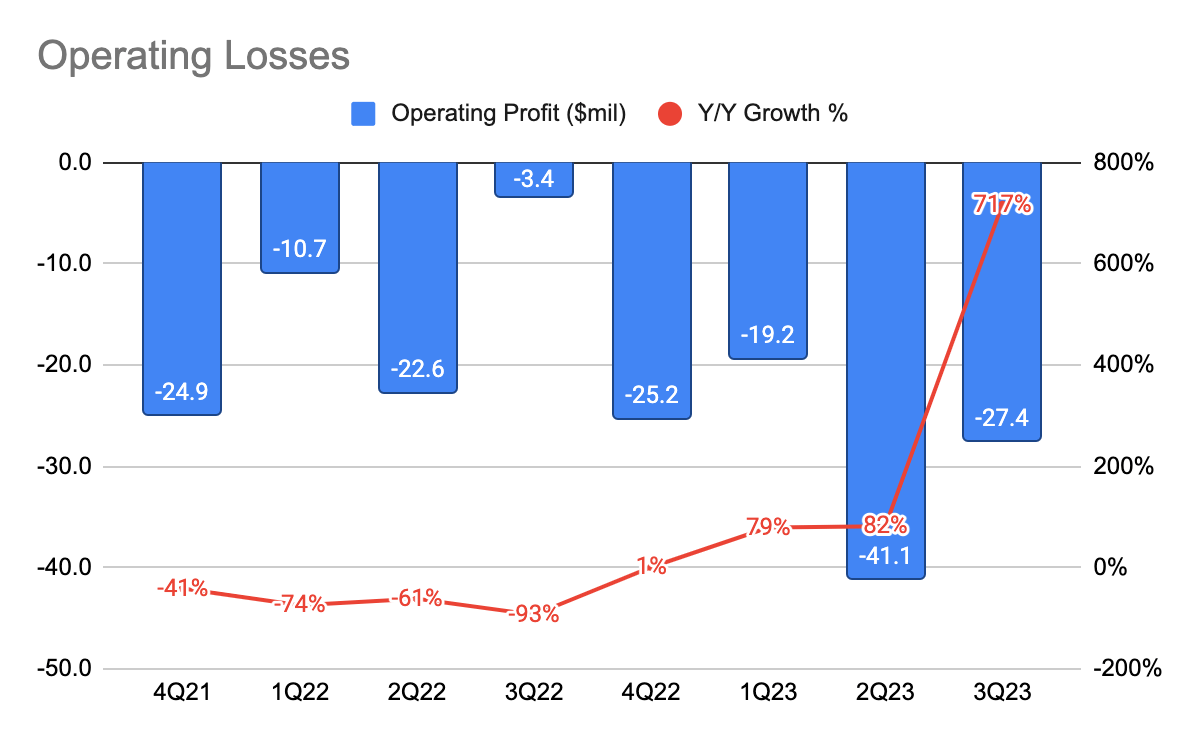

This sounds almost like a broken record for DocuSign, Inc. (NASDAQ:DOCU). It has been over 2 years (or maybe close to) since it initiated a turnaround. At least to say, it has been pretty disappointing, and the uncertainty continues to linger around. DOCU FY24 guidance certainly does not indicate one. Sales execution was also weak, although, on a positive note, operating losses have improved sequentially as a result of cost reduction.

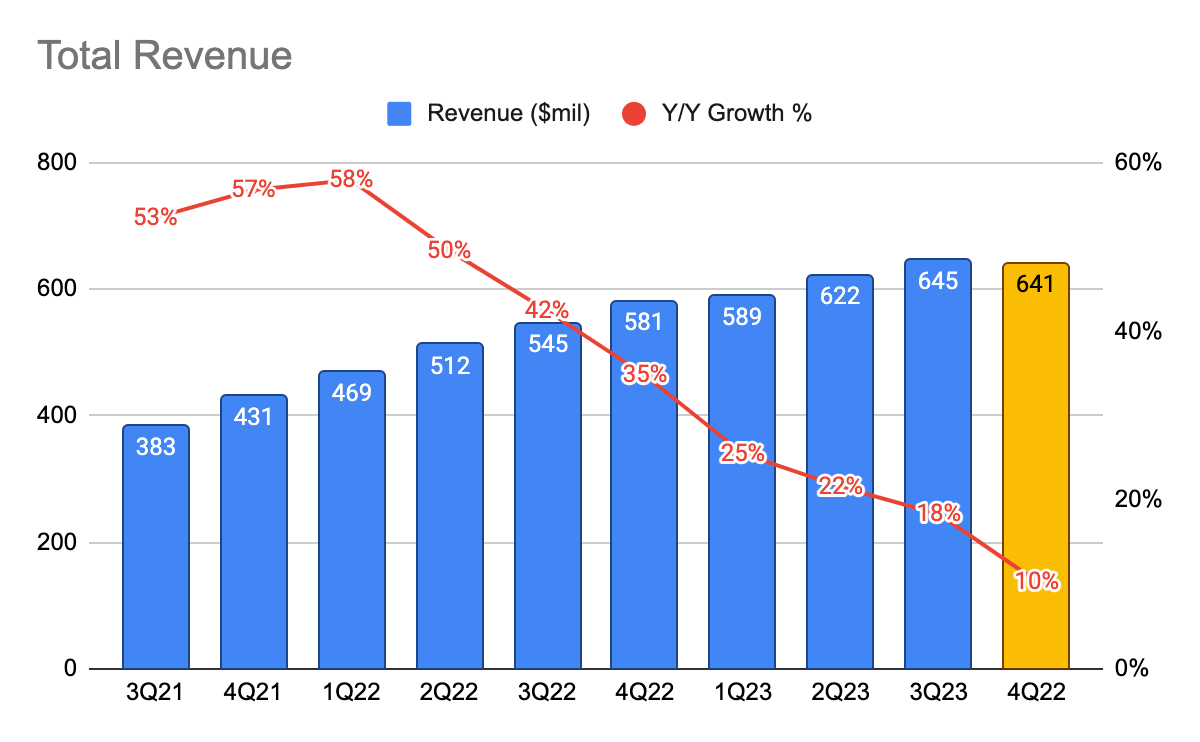

Consecutive Decline of Growth Deceleration

DOCU 10-Q

Unsurprisingly, DocuSign’s revenue declined by 18% Y/Y, and 4Q23 revenue guidance implies a 10% growth rate. This was a result of the slower expansion in customers’ usage, and more so, the management’s consistently poor execution.

During the earnings call, here’s what the new CEO Allan Thygesen has to say:

“…it’s important to acknowledge where we have not executed as well…we did not pivot quickly enough and we were slow to make changes. As we experienced tremendous growth during the pandemic, we did not scale the team properly. We lost some innovation velocity. We didn’t fully address the changing market dynamics nor mature our operations and systems sufficiently. We understand those gaps, and we’re committed to moving forward with more transparency.”

As eSignature increasingly becomes a commodity product, and along with the absence of Covid, it is not hard to see why they are struggling to reaccelerate its growth since its core revenues are still coming from eSignature. Furthermore, its net dollar retention has continued to decline consecutively from 114% in 1Q23, to 110% in 2Q23, to 104% this quarter. This makes me question if they were gaining any traction in their other agreement cloud offerings.

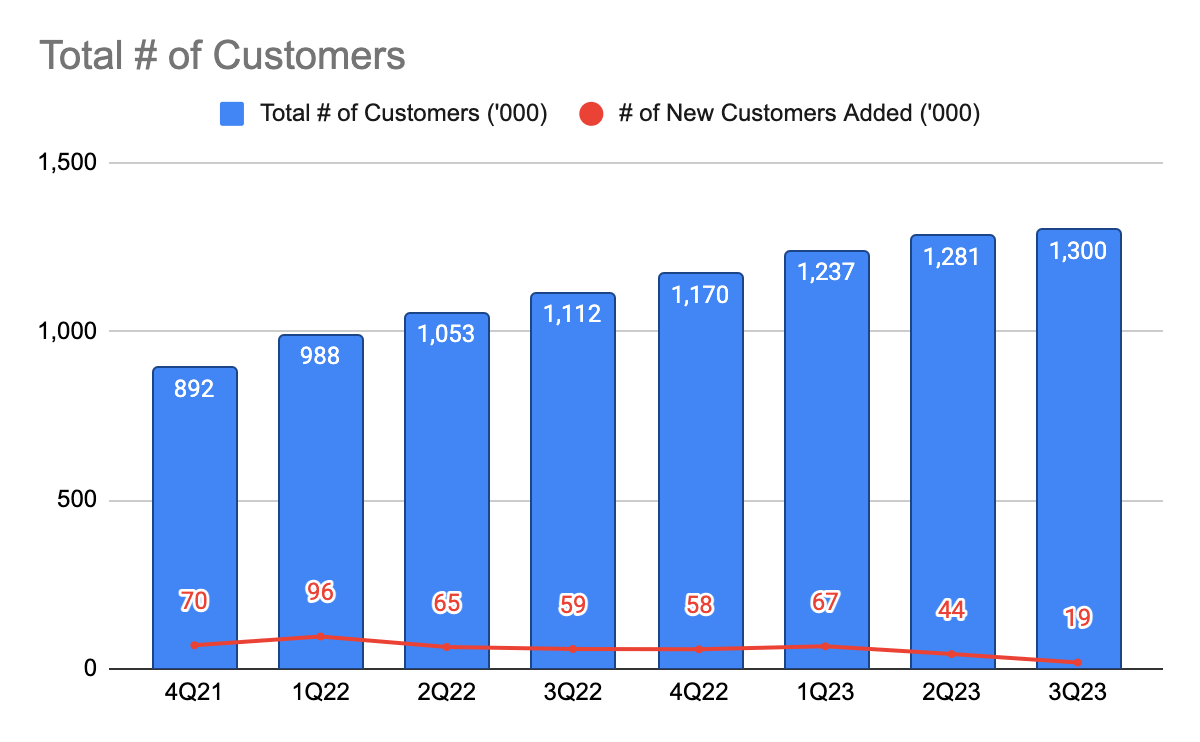

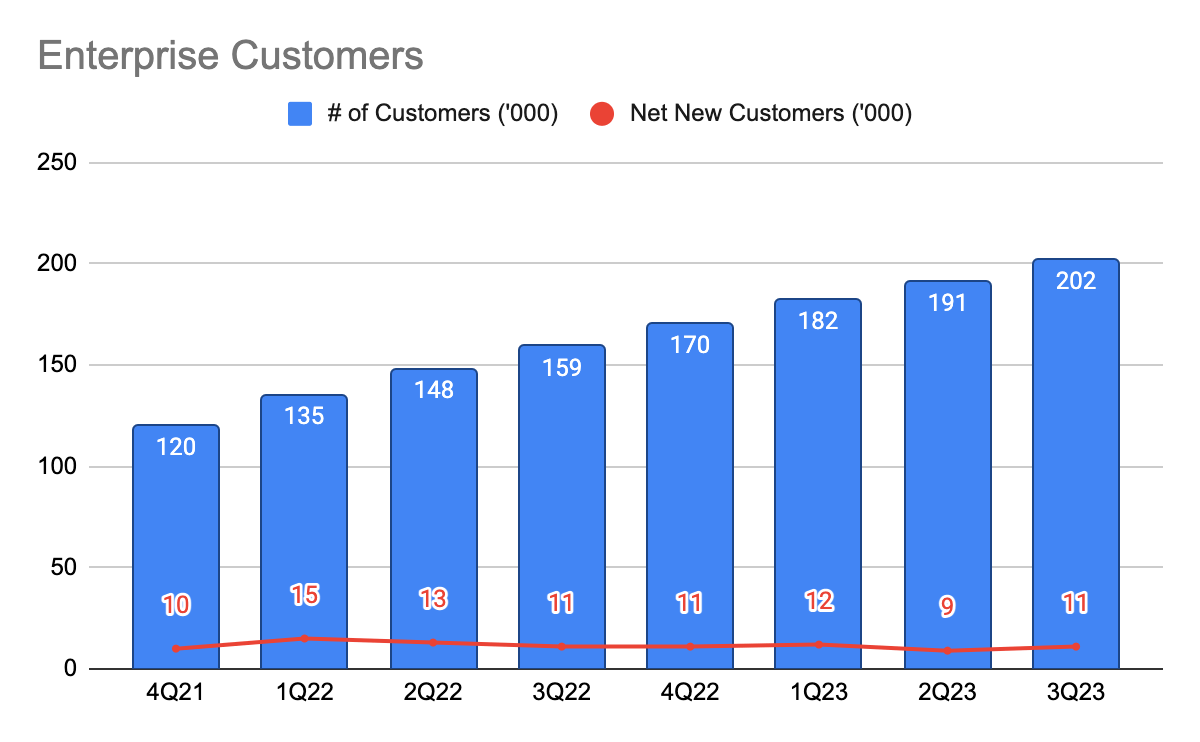

Weak Customer Acquisition

DOCU 10-Q DOCU 10-Q

In contrast to what the management said, I do think the sales execution was rather weak. This quarter, they onboarded 19,000 new customers, reaching a total of 1.3 million customers. This is a consecutive decline from the previous quarters. They added 11 new customers, bringing it to total enterprise customers of 202,000. This is a red flag in my opinion.

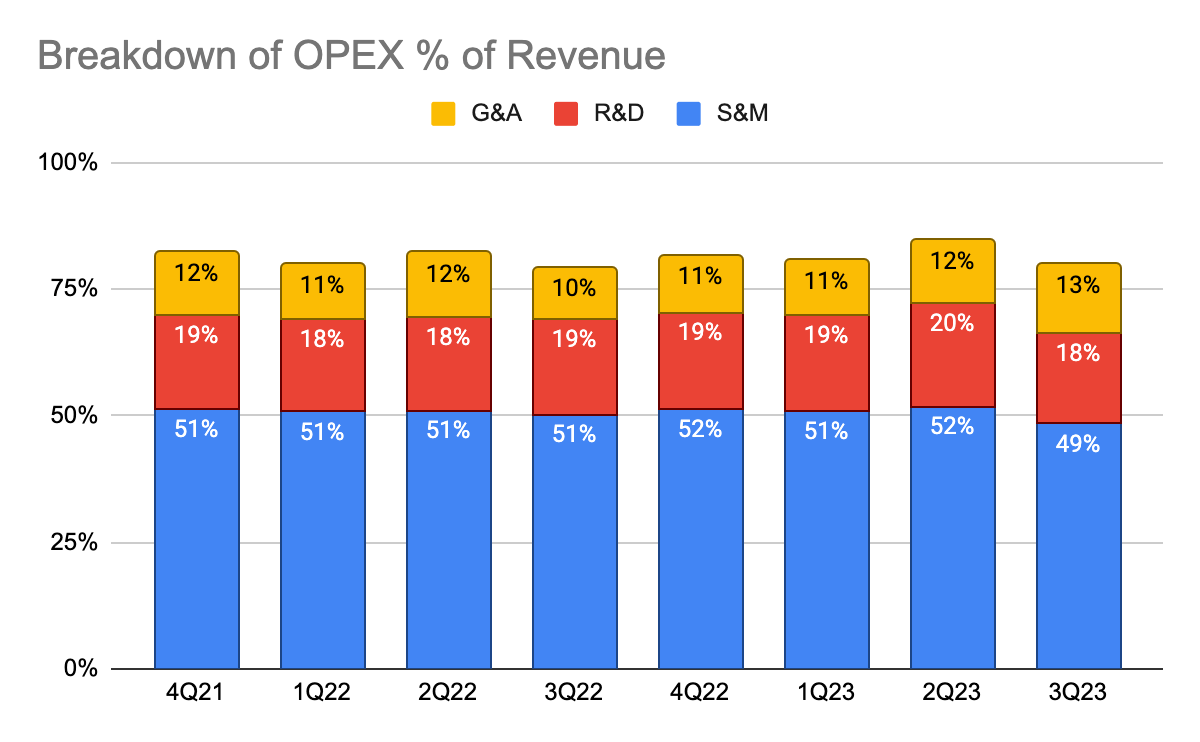

Cost Reduction Led To Margin Improvements & Improving EPS

DOCU 10-Q

DOCU 10-Q

DOCU 10-Q

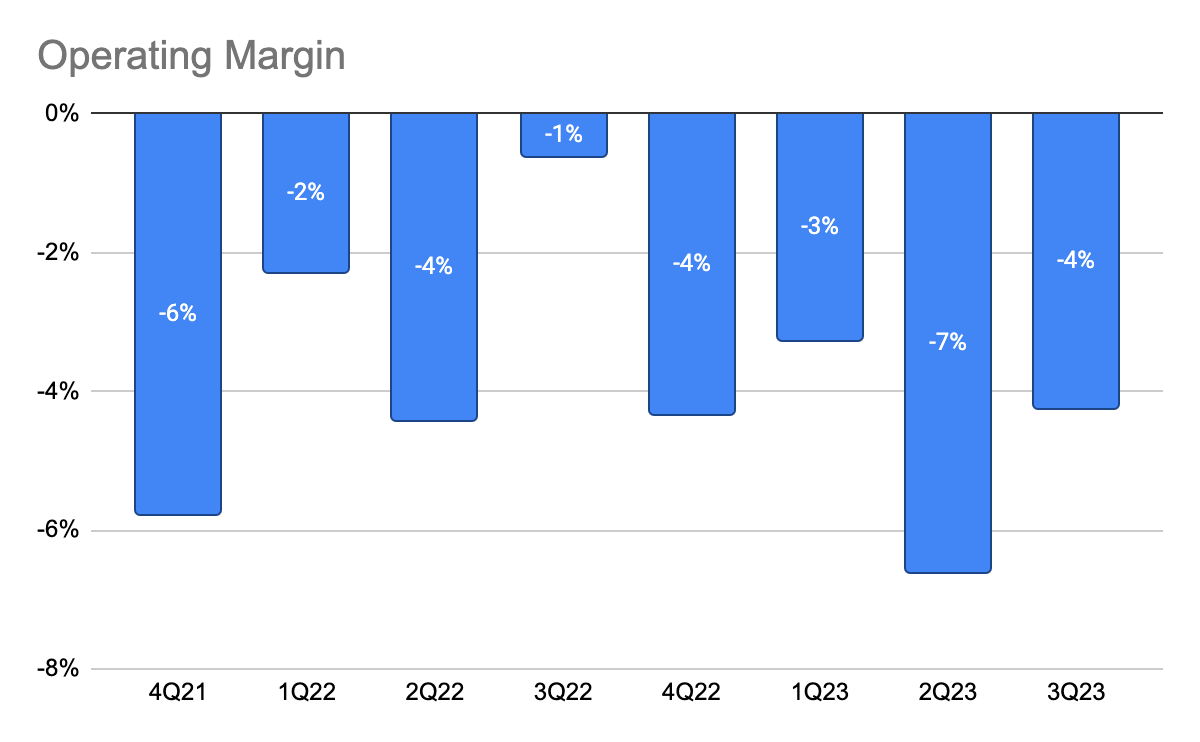

In terms of operating expenses, it has come down sequentially from 2Q23 as a proportion of total revenue, particularly for S&M and G&A. This is the result of the management slowing down its hiring, leading to a sequential improvement in an operating margin of -4% in 3Q23 from -7% in 2Q23. On a positive note, this is something that I personally like to see as they are undergoing changes in their go-to-market strategy.

DOCU 10-Q

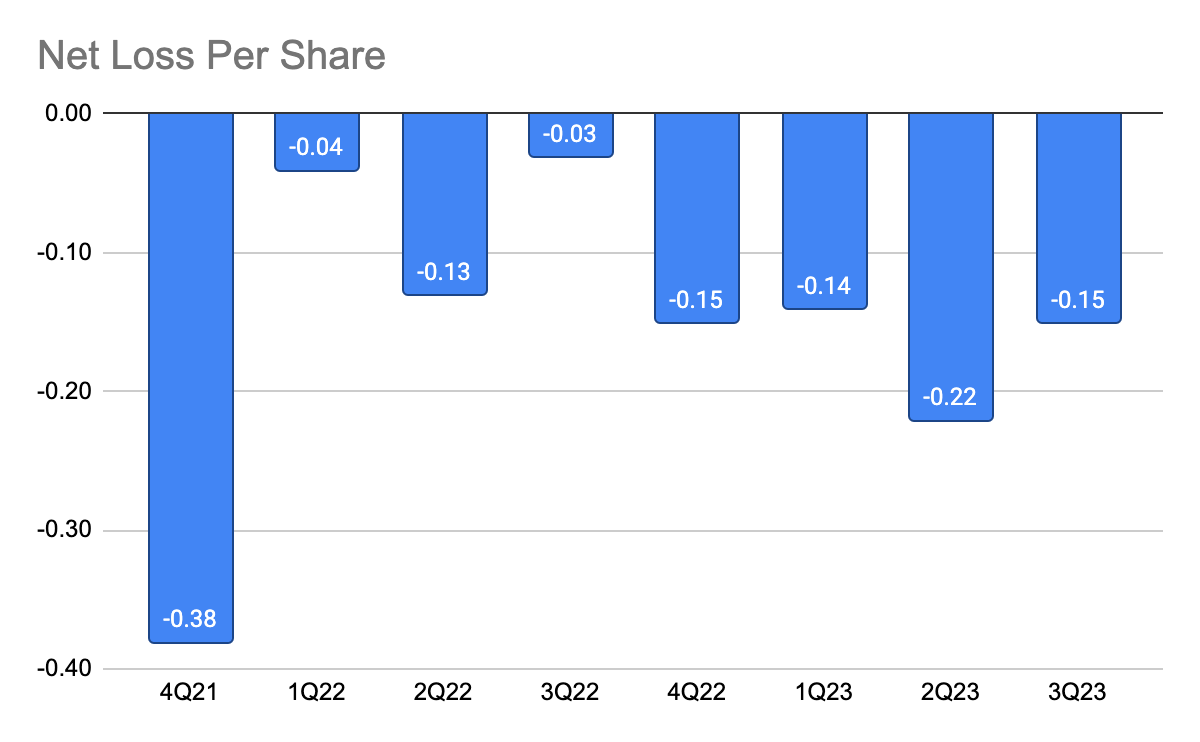

On a per-share basis, its net loss per share (“EPS”) has also improved sequentially from -0.22 in 2Q23 to -0.15 in 3Q23. Ideally, as the management continues to prioritize profitability, we want to see further improvement in EPS.

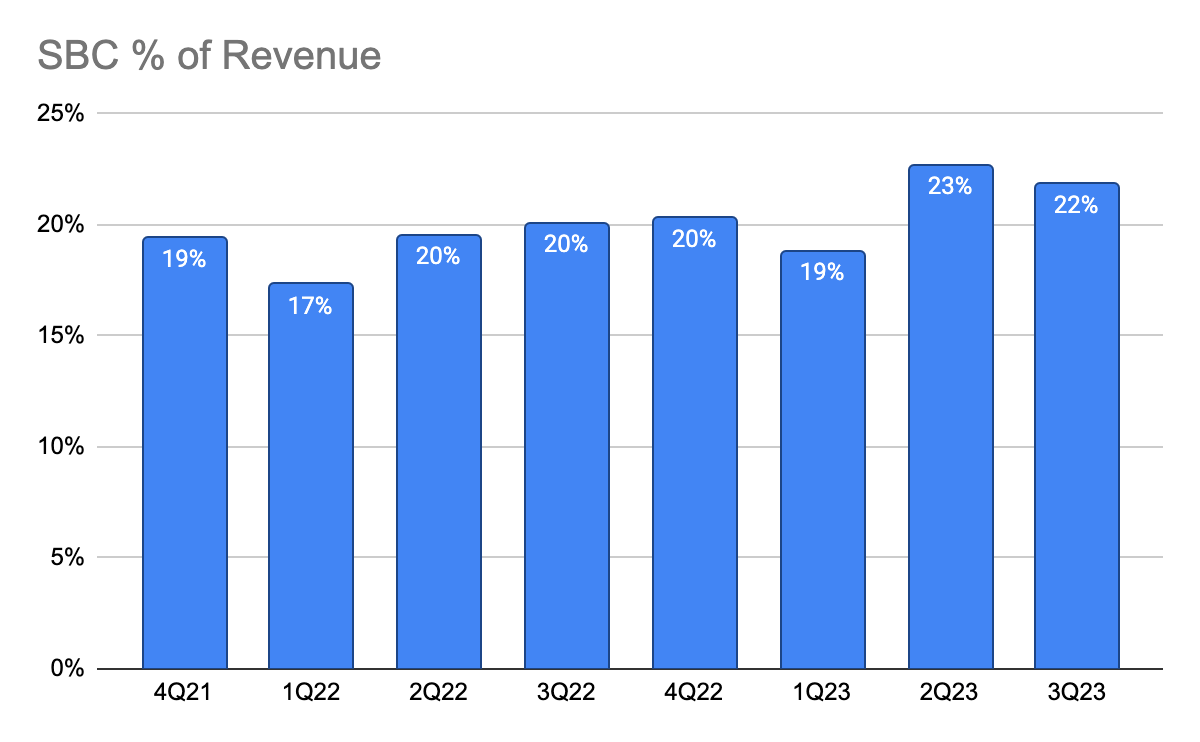

However, if the company continues to incur large stock-based compensation (“SBC”), this will lead to more shares dilution, and net out the improvements made in its operating losses.

Impact of Stock-Based Compensation

DOCU 10-Q

DocuSign SBC expenses make up 22% of its total revenue, which is still elevated based on its historical trends. As I have touched on the topic of SBC and its impact on companies, it will be key to monitor if this proportion tunes down.

DOCU 10-Q

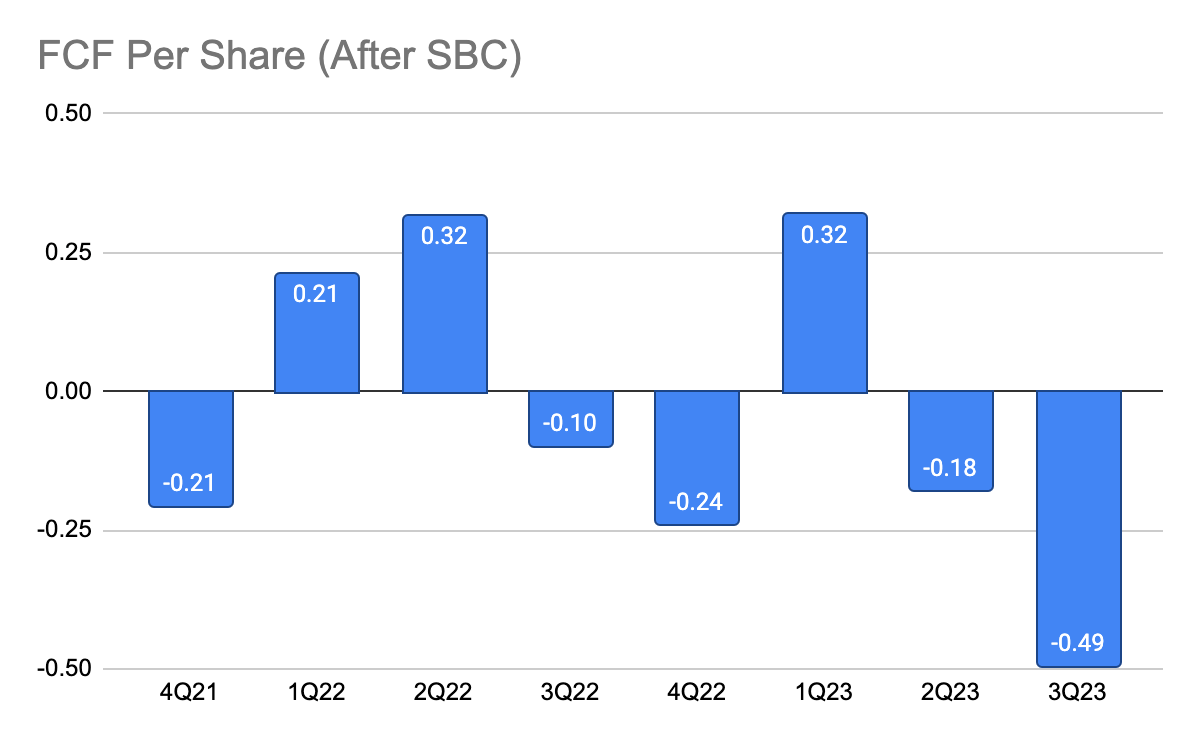

As investors, I believe we should be accounting SBC by netting it out from its FCF. Hence, taking its re-adjusted FCF and shares outstanding, it is obvious that its FCF per share has been deteriorating on a Y/Y and sequential basis.

Per-share metrics are arguably the most important metrics to look at as it serves as an indication of how management is creating shareholders’ value. Clearly, for DocuSign, there is still a lot of work to do in terms of per-share metrics due to the need to balance both profitability and growth.

Conclusion

CEO Allan during the earnings call:

“Obviously, I didn’t join to run a low or mid-single-digit revenue company. So, I’m pushing very hard to get us to a different place, and we’re — we hope to have a lot of news to report on that over the next few quarters.”

The company has definitely taken longer than anticipated to turn around, and it is unlikely to happen so in the next 1 year or so given the FY24 revenue guidance by the management. Although, there is a possibility it might happen. I reckon the turnaround is not going to be easy, and I would imagine how frustrated existing shareholders are.

As the company is currently undergoing restructuring and key management changes, it will be interesting to monitor the state of the company. At this moment, the uncertainty lying around DocuSign, Inc.’s future makes it prudent for investors to stay on the sidelines.

What are your thoughts on the quarter? Let me know in the comment sections below.

Be the first to comment