SolStock

Published on the Value Lab 21/9/22

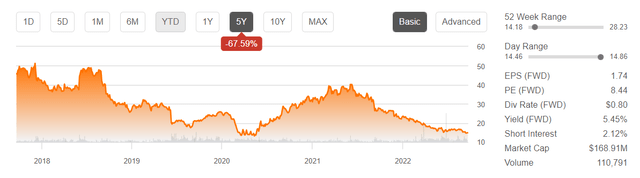

Hooker Furnishings (NASDAQ:HOFT) is pretty interesting. The multiple is low, there are some mitigants against declines in its market, and there are comp tailwinds for the second half of the year starting after this last earnings report due to total shutdown in Asia in H2 2021. The dividend yield is really solid, and the vertically integrated manufacturing businesses are the ones growing, and their margins are very advantaged due to the cost of long distance freight. End-markets are digesting a pull-forward into retail related to COVID-19, and while macro is a problem for the company, there’s a decent backlog and velocity can’t fall that much more than where it is already due to the quite extreme inventory buildup at retailers. Could be an interesting small-cap dividend play in a pretty easy to understand market.

Broad Note on HOFT

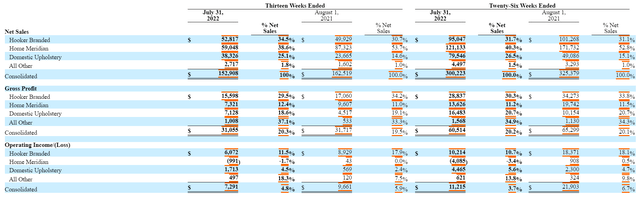

Let’s start with the segment split from this Q2 2022.

The important thing to note is that all businesses other than domestic upholstery rely heavily on import from Asia, with 88% of imports being from either China or Vietnam as of the 2021 FY, and five suppliers accounting for 42% of supply. In other words, the zero COVID ambitions of China are a major problem as it causes frequent disruptions and supply chain issues, and we have portfolio companies that have entirely moved production out of China for this reason.

Those disruptions have hampered those import-based segments up through Q1 2022, and got better in Q2 2022, the current quarter. Since they started August 2021, the next quarters will have easier comps in those segments.

Domestic upholstery which is not import based grew by 33% organically, and 62% comprehensively on a YoY basis. HOFT has its own manufacturing here. That vertical integration means this segment is the one where they aren’t just an importer and distributor. Basically, it’s the only interesting segment. And the closer positioning has shielded it from logistic inflation, and it’s only really getting affected by general raw material inflation. It’s achieving scale, and therefore operating margins which will reflect that operating leverage has doubled. While GMs have fallen, its monumental growth and relatively stable GMs all things considered, make it a welcome gross profit contributor, and therefore has stemmed overall gross profit declines despite the precipitous GM declines and limited sales growth in Hooker Branded, and the sales declines in Home Meridian, the furniture line acquired in 2016.

We should make a note on Home Meridian. Its current problem isn’t from production difficulties. Indeed, neither is Hooker Branded which started to recover in the latest quarter. The problem persisting in Home Meridian is that retailers are still working through their inventory from the revenue pull-forward due to COVID-19 and WFH. They aren’t restocking yet. Sales declines were big there, 32% declines YoY.

Conclusions

Home Meridian and Hooker Branded will benefit from easier H2 2021 comps that got gimped by production difficulties in Asia. This mitigates the inventory glut issue in HMI which is the biggest segment by revenue, and helps Hooker Branded which is by far the biggest segment by gross profit at around 50%.

What’s more important is the growth in domestic upholstery. Proximity is important now that logistics is more expensive. And US-based on-shored production is more defensible from disruption. They’ve grown meaningfully in the mix and have single-handedly reduced import and China exposure, going from being half the size of HMI in gross profit to almost matching it in one year, also thanks to the Sunset West acquisition which made 50% of the growth inorganic. Still, already on an organic basis, the growth in the mix has been formidable. This advantaged segment growing in the mix and achieving operating leverage and scale should be followed by investors.

Inventory glut is pretty bad right now, so could a worsening macro situation, which is a legitimate concern, really create that much worse of an environment in terms of sales velocity? Backlog covers a trimester for the company, so there’s a cushion there, and if sales and gross profits hold, HOFT is valued at about 5.5x EV/EBITDA on annualised EBITDA from this H1 2022. The payout coverage is about 2x of the dividend with net income, and the yield is between 5-6% which is pretty high.

We see the business becoming more resilient. While the fervour is gone, we don’t foresee total disaster for the business. Perhaps some years of no growth or modest decline.

We don’t think trading at the absolute worst COVID-19 depths makes sense. The share count is the same as before by the way. Probably a buy especially with minimal interest rate risk to speak of (look at lack of interest expense), and a strong dividend pick.

Be the first to comment