JoeyCheung/iStock via Getty Images HK Land logo (HK Land 2021 Annual Report)

Investment thesis

It is no secret that I like to invest in real estate.

Hongkong Land (OTCPK:HKHGF) is one of the real estate companies in my portfolio. I initiated a position in this company in March 2020 and have gradually added to my stake.

In this article, I will explain why I invested in it and why I think it can be categorized as a kind of investment where you can truly Sleep Well At Night (“SWAN”).

I will also point out that there are a few exciting new developments in the pipeline that should enable the company to continue to deliver good returns to its shareholders.

Company background

For those that are not familiar with Hongkong Land, it was founded in 1889 and is 50% owned by Jardine Strategic.

It owns investment properties of prime office and luxury retail space with a total of 9.15 million square feet. These are located predominantly in Hong Kong, Singapore, Beijing, and Jakarta.

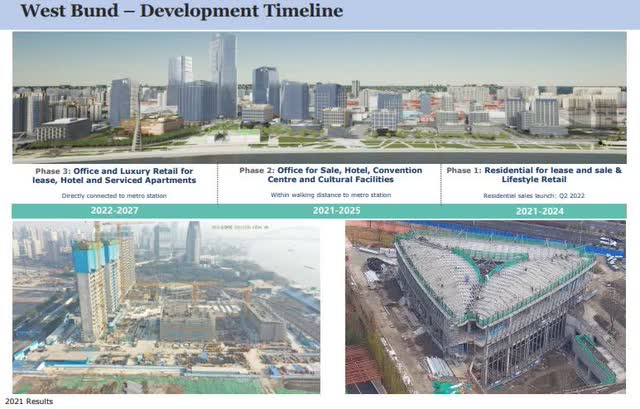

They are also a real estate developer and have a number of both commercial and residential developments across China and Southeast Asia, including an 11.8 million square feet mixed-use development project in West Bund of Shanghai.

West Bund Shanghai – development timeline (Hong Kong Land FY 2021 Presentation)

Hongkong Land’s plan is to develop West Bund into clusters of space positioned as a world-class development platform for the financial industry, a third-generation integrated financial city, and a global digital currency center.

Their total pipeline of real estate under development is very large at 57 million sq. feet. In addition to their exposure to development in China, they also have a large pipeline of projects in Southeast Asia.

HK Land – Pipeline of development in S.E.Asia (HK Land – FY 2021 Presentation)

Property development contributed USD 644 million to their operating profit.

2021 Financial Results

Underlying profit for 2021 came in at USD 966 million, which was just $3 million higher than the year before.

Property development contributed USD 644 million to their operating profit, whilst the investment properties contributed USD 973 million.

The underlying profit was still USD 110 million lower than it was in 2019, as a result of reductions in rent for the retail sector caused by the pandemic. I do believe we will see a return to higher rent in that luxury segment, but investors need to be patient, as China’s policy of a zero-Covid goal has put severe restrictions on people’s ability to travel.

I found it interesting that on Thursday, 14th April 2022, the language changed somewhat with regards to the “zero-Covid goal.” The Chinese president is now referring to it as a pursuit of a “dynamic” zero-covid goal. When any organization sets itself some KPI, it has to be realistic. It is unrealistic for a country of 1.4 billion people to have a zero-Covid goal.

The good news is that the vacancies for their retail space in Hong Kong are as low as 0.3%, so not a lot of empty shops there.

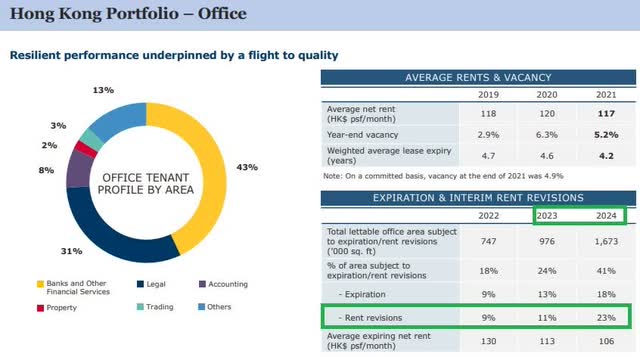

Let us look at their office portfolio. We will only focus on Hong Kong, as it is by far the largest component in their portfolio.

HK Office – rent revision going forward (HK Land – FY 2021 Presentation)

The vacancy rate is somewhat high. We can also see that the average rent has been sliding from HKD 130 PSF/month to what is expected to be HKD 106 in 2021.

Banks and other financials constitute almost half of the space. We do have some concern about communications that are coming out from all of the large banks which basically say that after having lived through two years of FWH and now starting to return to their offices, they realize that they need much less space than they did in the past. Aggressive digitization of many of their processes also means they will need fewer people to do the work.

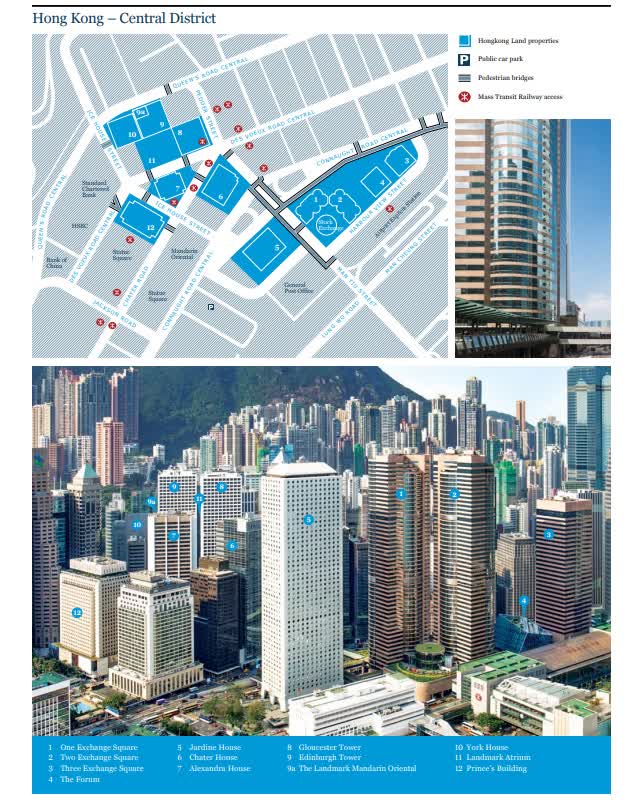

However, anybody who invests in real estate knows that the most important factor is location. It does not get much better than where Hongkong Land’s office and retail portfolio are located.

HK Land – Prime location (HK Land – 20221 Annual Report)

Accounting-wise, the group had a net non-trading loss of USD 1.32 billion in 2021 compared to a loss of USD 3.6 billion in 2020. These losses came primarily from decreases in the valuations of the Hong Kong office property portfolio.

The fair value assessment is done yearly by independent valuers Jones Lang LaSalle (JLL), based on an open market for existing properties using a calculation on a discounted net income allowing for reversionary potential.

For the properties in Hong Kong and mainland China, they use a capitalization rate in the range of 2.75% to 3.35% for office and 3.75% to 5% for retail.

One thing to take note of is that many of these properties are now old. Unlike their peer Sun Hung Kai (OTCPK:SUHJY), which has renewed large parts of its portfolio over the last 10 years, Hongkong Land has not been an aggressive bidder at land auctions in Hong Kong.

Many of the land plots were picked up by mainland Chinese companies, but we all know that many of them are not in a good financial position now.

Nevertheless, I believe that there are still many PRC companies that would love to own some of these “trophy assets.” In my personal opinion, Hongkong Land could consider being a bit more active in recycling capital. In that process, they could also steer their capital towards investments that have higher expected capitalization rates.

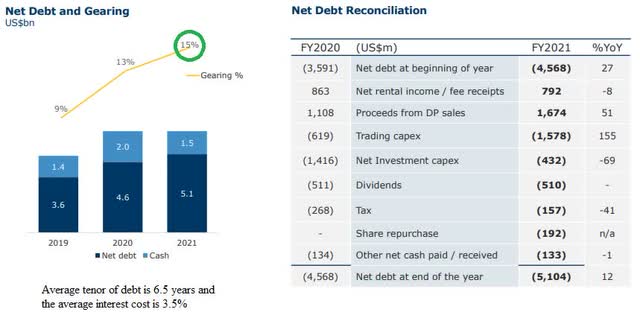

Balance Sheet

Most people think that all real estate companies in China – yes, Hong Kong is now part of China – are loaded with lots of debt. That is the story the business media portrays.

Sure, we got China Evergrande Group (OTCPK:EGRNF) and some others that are extreme cases.

But within Hong Kong, there are many very conservatively financed real estate companies. I just mentioned Sun Hung Kai, which I called a SWAN too, for good reasons.

Hongkong Land is another one of them.

HK Land solid balance sheet (HK Land – FY 2021 Presentation)

The increase in debt is mainly due to large investment going in the development at the West Bund in Shanghai.

What is it worth?

Here is where things start to get very interesting, in my opinion.

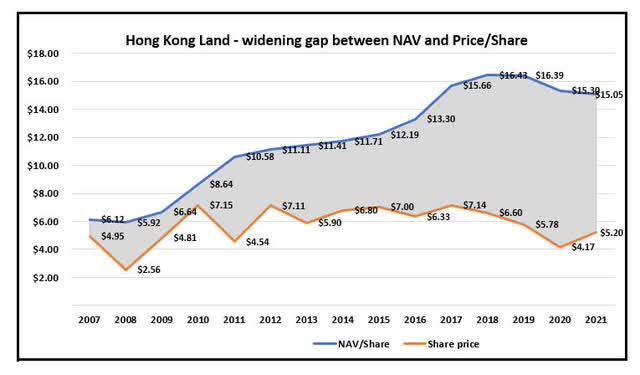

NAV per share is USD 15.05 As of today, which is 18 April 2021, its share price is just USD 4.78

And this, as I have shown you above, is not a money-losing heavily indebted company with no prospects.

I believe Benjamin Graham would have liked this company at its present price. In his book “Intelligent Investor” with commentaries written by Jason Zweig, Zweig refers to Mason Hawkins, which founded Longleaf Asset Management and is now called Southeastern Asset Management. Hawkins liked to find what he called:

60 cents dollars, or companies that traded for 60% or less of the value at which he appraised the business. That helps to provide the margin of safety that Graham insisted on”

Hongkong Land can be had for half of this. Its price to NAV is just 0.32

Future Growth

In February this year, Hongkong Land announced a small step towards investing in a totally new segment of real estate for the group.

Together with Indonesian company PT Astra International and LOGOS SE Asia Pte Ltd, they will invest in and manage modern logistics warehouses in Indonesia, with an initial focus on the Greater Jakarta area.

According to Mordor Intelligence, Indonesia’s freight and logistics market, of which modern warehouses are an integral part, is estimated to increase from US$81.3 billion in 2020 to US$138.04 billion by 2026. The increase is being driven by the growth of e-commerce, among other things, underpinned by the rapid advancement of digital technology. Indonesia’s modern warehouse sector is estimated to have ample room to grow, as Indonesia’s logistic infrastructure is still not well developed compared to its peers in Southeast Asia.

I do not expect this new business to move the needle much in terms of the value of the portfolio, but it will help in diversifying the company’s geographical exposure and towards the various segments of the real estate industry.

Returning capital to shareholders

We just looked at how Hongkong Land will grow the business going forward.

In addition to growing the business, they also return capital to shareholders. They have done that every year since going public.

Let us start to look at their dividend. It has remained the same since 2018, when they did increase the yearly dividend from US cents 20 to 22. They pay out their dividend two times a year.

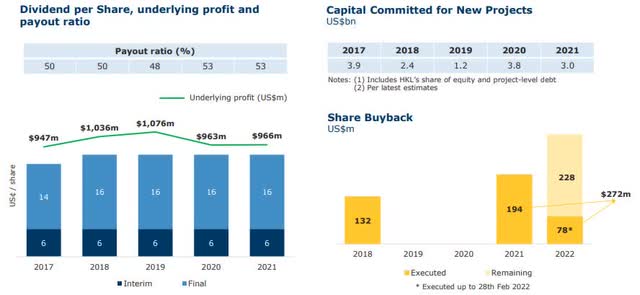

HK Land – dividend and share buyback (HK Land – FY 2021 Presentation)

With a payout ratio of 53%, it is a safe dividend. Especially bearing in mind that it did not change even during the pandemic, whilst many real estate companies had to reduce theirs.

I prefer to look at a longer history of dividend payments. Here is the development over the last 15 years.

HK Land – 15 year history of dividends (Data from HK Land. Graph by author)

The yield is presently 4.5%

Now to share buybacks.

Here in Singapore, and in Hong Kong, the vast majority of the REITs dilute their shares every year as they make all the payments of the management fees and much of the distribution by issuing new shares. This is one of my main concerns about REITs here.

As a result, we have situations here where the manager of the REIT over the year is becoming one of the largest shareholders. That in itself is not a problem. But it will become more difficult to increase their DPU with the constantly increasing number of shares. These are shares issued to pay for their operating costs not for investments in new properties.

Fortunately, HK Land is not a REIT.

They are buying back their shares and have been doing so almost every trading day since they announced a buy back plan of USD 500 million.

Some companies talk about it, like Alibaba (BABA), which made huge announcements recently that they have authorized their share buyback to increase from USD 15 billion to USD 25 billion. However, since they announced this, and despite the share price being at a record low, there has not been a single purchase announced to either the Hong Kong Stock Exchange or the SEC in New York. By law, they would have to do so within 24 hours of the purchase.

Perhaps they think the share will get cheaper

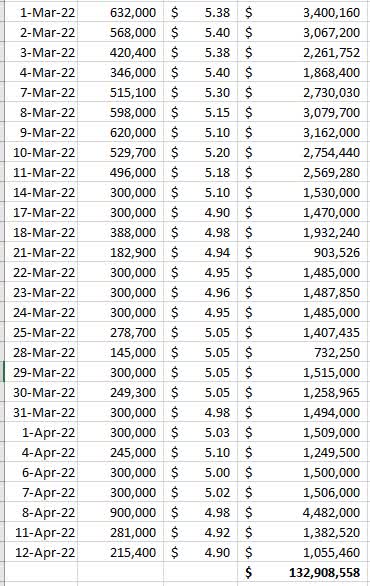

No such thing for Hongkong Land. I track their share buybacks regularly. Here is a screenshot from 1st March to 12th April this year.

HK Land – 15 year history of dividends (Data from HK Land investor relation. Compilation by author)

Their multi-year plan is to buy back shares worth USD 500 million. As can be seen in the graph above, they did USD 228 million last year and have so far done USD 133 million this year. I have no doubt they will reach close to the USD 500 million target this year.

It is also good for present shareholders that the price is now fairly low when compared to its historic levels. That means more shares get bought back and cancelled.

During 2021, they bought back 36.4 million ordinary shares which got cancelled out. At the end of the year, the company had 2,297 million ordinary shares outstanding. At the end of this year, the share count will most likely reduce by another 38 million shares.

The reduction of the last years then works out to approximately 3.24% fewer outstanding ordinary shares.

This exercise, when completed, saves them USD 16.4 million in dividend payments which theoretically can be used to increase the payment to the remaining holders of their shares.

Risk to the thesis

Every investment thesis has risks.

When a company is trading at such a huge discount to its net asset value, one has to ask “what is it that other investors see, that I am not aware of?”

HK Land – Gap between Share price and NAV/share (Data from HK Land and Yahoo Finance. Graph by author)

First of all, this big gap in valuation and actual share price is not new. It has been going on for a long time. From this, one may wonder if it is a value trap.

On the topic of values, we need to take into account that, for all properties in Hong Kong except a small plot of land granted to St John’s Cathedral in Central in 1843, it had been an established practice for the Government to dispose of land by granting leases to users with terms mostly either 75 years or 99 years. This is in stark contrast to land in the U.S., UK, EU and Australia, where most of the land are freehold.

Therefore, once the lease expires, you have two options. One is to return the land in the same condition it was when you leased it. The other option is to negotiate an extension on the land lease with the government. If you wonder how much that costs, you can read my last article on SHK Properties. The link is above.

It will give you an idea. Personally, I think this is also one of the main reasons why Hongkong Land want to have very low leverage as they will then have financial capability to extend the land if they wish to do so.

Nevertheless, at some point, when the lease is getting shorter, it’s value will be reduced.

The other risks are what will happen to Hong Kong?

Hong Kong experienced many challenges even during the 156 years it was a British colony. However, the last 5 years have made many people, including their own citizenry and long term residents, question if Hong Kong is the right place to live, work and invest in.

I am an optimist. Hopefully, a realistic optimist. I have seen the spirit of the people living there and I do think there is a future for Hong Kong. It will probably look somewhat different to what it was when I called it my home between 1992 and 1997, but it should be able to be relevant in the future.

Conclusion

To be called a SWAN, a company does need to be financially solid and have a profitable business with good management and a history of treating shareholders well. At least, that is my definition of a SWAN.

In my opinion, Hongkong Land does fit this description.

I would like to see them becoming more active in recycling some of their older properties in Hong Kong and diversify not only geographically but also into new sectors. Their planned logistic property investments in Indonesia could be one of several such initiatives.

Only time will tell if is great value which will be unlocked, or if the gap between NAV and price continues to remain high.

In the short term the market is a voting machine but in the long term it is a weighing machine,

However, investors perception and expectations of a company are important.

Perhaps it is time to rebrand “Hongkong Land” to “Jardine Property Group”?

It is still a buy, no matter what they call it

Be the first to comment