typhoonski

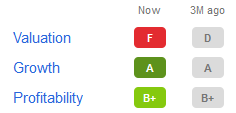

After peaking at over $30, the S&P 500’s (SPY) decline pulled GFL Environmental (NYSE:GFL) lower. Besides weak stock market sentiment, the stock faces downward pressure. The bearish short interest is 7.5% as the forward price-to-earnings ratio climbs to almost 60 times. While the valuation grade on GFL stock is an “F,” it has strong growth and profitability grades.

Why did markets react poorly to GFL’s third-quarter results posted on Nov. 2, 2022?

Q3/2022 Revenue Growth

In the third quarter, GFL posted revenue growing by 32.6% Y/Y to $1.83 billion. The company highlighted the solid waste price of 8.6% and surcharges of 2.1% are the highest in the company’s history. Chief Executive Officer Patrick Dovigi said that its merger and acquisition contributed to strong volume gains.

Revenue from the Environmental Services segment grew by 28.2% Y/Y to $920.4 million. GFL benefited from an increased level of emergency response activity, higher used motor oil selling prices, and higher industrial collection and processing activities.

Higher cost pressures from third-party maintenance and increased truck rental costs pressured GFL’s margins in the quarter. However, those costs, along with supply chain disruptions, are showing signs of easing. In addition, the company has an aggressive pricing and surcharge strategy to expand its margins in the next year.

Opportunities

GFL’s aggressive M&A is attracting bearish investors. The short float is high because skeptical investors do not believe its acquisitions will pay off. In the last quarter, GFL completed six acquisitions. In 2022, its acquisitions added around $30 million in annualized revenue.

In 2023, five of GFL’s renewable natural gas projects will come online. By mid-to late-2023, those projects will total over six million MMBTUs of RNG. It has another 7 million MMBTUs at seven sites in the pipeline.

The company will likely report ongoing strong performance from its Environmental Services unit. After achieving business momentum during the Covid lockdown, GFL will realize synergies from acquisitions. The company is running at margins in the 25% to 26% range. As it gains market share in Canada, it will sustain that margin rate. In addition, the energy sector is booming in Western Canada. Although it does not service oilfield customers directly, it will benefit from the related exposure in this region.

In 2023, GFL will improve efficiencies. For example, it will optimize routes and its fleet. Commodity-related costs should start falling.

Risks

Leverage through high debt and the impact of higher fuel and commodity prices are GFL’s two key risks. In the last quarter, GFL reported $9.358 billion in long-term debt. It issued another $155 million in long-term debt in the quarter while paying back $40.3 million. GFL has floating-rate debt that needs financing. Unless its credit ratings improve, the cost to service debt could rise.

GFL has interest rate costs that are 6% of its revenue. Its peers have interest costs in the 2% range. In the short term, the company does not have major maturities. However, when it matures in five years, it will need interest rate levels to fall.

GFL also has the option to shed assets to pay down its debt. This is an unlikely route since the acquisitions are adding positively to returns.

Cost inflation is a risk. This could erode GFL’s return on capital. The company has pricing power, which allows it to pass higher costs to customers. However, if customers cannot afford the price increases and seek another supplier, GFL’s revenue could fall. Central banks continue to raise interest rates to slow the pace of inflation. This would benefit GFL.

Stock Grade and Your Takeaway

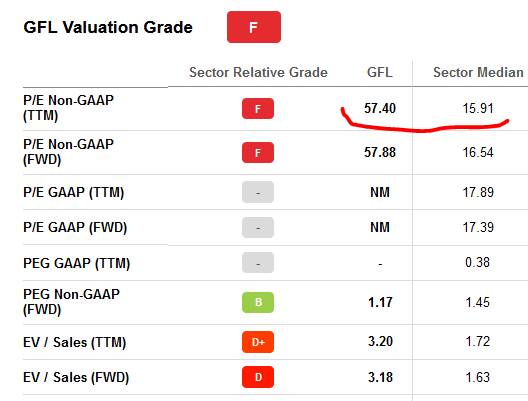

GFL stock has a low value grade, falling from a D three months ago to an F.

GFL grade

The P/E could de-compress if the stock market corrects lower.

seekingalpha premium

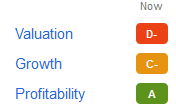

Peers like Waste Management (WM) are also trading lower. WM stock peaked in August at over $175. It traded recently at around $157. WM stock has an unfavorable value grade. Conversely, GFL stock scores a B+ on profitability while Waste Management scores an A.

WM Stock Grading (SA Premium)

In 2022, markets sent GFL lower. Investors are adjusting for risks related to its acquisition spree. As long as management expands its gross margins in the next one to two years, the stock should not drop further.

GFL remains a compelling stock to consider buying.

Be the first to comment