nikkytok

The share price of Cheniere Energy Partners (NYSE:CQP) has been volatile over the last year, trading in a 52-week range of $38.19 to $61.91, closing on November 4, 2022 at $57.41.

Even though demand for LNG is expected to be strong over the next several years, and possibly longer, it appears a lot of that is already priced into the share price of CQP, pointing to probable limited upside going forward; I think an increase of approximately 20 percent is the ceiling.

Based upon the price movement of the stock, and more visibility and clarity concerning European and Asian markets, it looks like its share price is likely to correct in the near future because of the warm weather, even after dropping from its recent 52-week high on November 1. It could get a temporary boost, but until winter demand starts to kick in in response to colder weather, its share price will probably remain under pressure.

This is relevant because it could offer potential shareholders a better entry point and distribution yield if it corrects more. Further into winter we’re likely to see one more upward push in the share price in the near term, and then a pullback as the warmer weather of spring returns.

Since Europe is its primary market during this period of time, how much LNG usage in the winter will determine demand. As of November 2, gas storage facilities in Europe were 95 percent full, while German storage in particular was 99.3 percent full. If there is low drawdown in the winter from warmer-than-expected weather, it would have an impact on the short-term performance of CQP.

On the other hand, ASIA could make up for the decline in demand if prices drop and it starts buying up excess supply.

In this article we’ll look at the latest earnings number, LNG supply and demand over the longer term, and how safe the distribution of CQP is in the near and long term.

Latest numbers

CQP reported revenue of $8.85 billion in the quarter, beating estimates by $888.89 million. Earnings per share in third quarter was -$9.54, missing by $15.26.

Adjusted EBITA in Q3 was up $733 million, and up $1.3 billion for the first nine months of the year. The improvement there came from the “early termination of the Terminal Use Agreement (“TUA”) between Sabine Pass LNG, L.P. and Chevron (CVX),” and widening margins per MMBtu of LNG.

Net loss in the reporting period was $514 million, down from net income of $381 million year-over-year. The negative result was attributed to a “unfavorable changes in fair value of commodity derivatives, partially offset by increased margins per MMBtu of LNG and increased volumes of LNG delivered.” The loss associated with derivatives came from the appreciation of Platts Japan Korea Marker (“JKM”) that pricing was indexed to. That came about because its Integrated Production Marketing (“IPM”) agreement with Tourmaline included a fixed fee component. The risk there, as experienced by the company, was its exposure to fluctuations in fair market value.

As for its balance sheet, the company had overall liquidity of $2.8 billion at the end of Q3, with cash and cash equivalents of about $1.0 billion. It also had $195.00 million in restricted cash and cash equivalents. It had $750 million in commitments from its CQP Credit Facilities, and another $837 million under its SPL Working Capital Facility.

In regard to its credit rating, in September Moody’s Corporation upgraded Cheniere Partners from Ba2 to Ba1, and its Sabine Pass Liquefaction, LLC from Baa3 to Baa2. Fitch Ratings upgraded Cheniere Partners from BB+ to BBB-, and Sabine Pass Liquefaction, LLC from BBB- to BBB.

LNG supply and demand

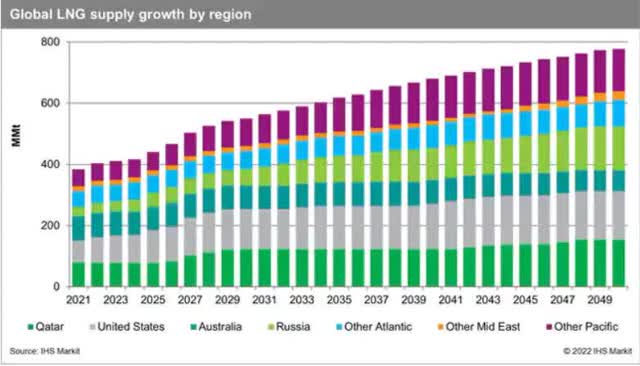

Overall demand for the global LNG market is expected to continue to for many years into the future. With supply slightly outpacing demand through 2026.

With 18 percent growth in demand projected, the LNG market will remain tight for at least several years, even though supply is expected to increase by 19 percent during that same time period.

With LNG markets expected to remain tight because of Europe attempting to cut back on its reliance upon Russian gas, expectations are producers are going to make more investment in liquefaction facilities in order to boost supply. But with the time it takes to bring those online, it’s unlikely to boost LNG supply before 2026.

This is a positive outlook for CQP, because of the approximate 87 million tons in imported LNG into Europe in order to help make up for the supply deficit coming from the cuts in gas imports from Russia, CQP has accounted for about 25 percent of that total.

With additional LNG supply not expected to come online in any major way until around 2026 at the earliest, CQP is positioned strongly to continue to meet a significant portion of European demand, and if prices pull back Asian demand as well. That’s because at this time Europe, because of its energy needs, is bidding up prices to the point of removing China in particular, out of the bidding process, resulting in China relying more on pipeline imports at this time, or alternative fuels.

Total Asian LNG imports have dropped 10 percent year-over-year, with Chinese imports down 11 percent, Japanese imports down 14 percent, and Indian imports down 25 percent.

Some of the risks associated with demand are warmer weather; high prices reducing demand; switching fuel; withdrawal from LNG storage, which has happened to some extent already; and pipeline gas replacement.

Recently natural gas prices in Europe at the Dutch TTF hub have dropped to their lowest levels in fourth months, in response to mild weather in October and November, accelerating imports, and storage levels that are near full capacity.

While those demand risks are real, the most likely scenario is priced will remain high over the next few years when measured against pre-COVID-19 prices.

Conclusion

With LNG demand expected to continue to grow for years, CQP is strongly positioned to meet a significant portion of that demand, especially in the European market, which is paying a premium for LNG at this time, at least temporarily pricing out many of the Asian markets.

The good news is, even if demand in Europe temporarily pulls back any time in the years ahead, I have no doubt Asian countries will start buying up the available supply. That would probably mean the price of LNG has declined, but that would likely only be a short-term situation. The point is, whatever supply CQP has should be acquired, no matter what market imports it.

As mentioned above, there are real risks in the LNG market now, but overall I tend to think they’re not as near as the rewards, and whatever downturn the LNG market experiences shouldn’t be for a prolonged period of time in the years ahead.

With higher LNG prices on average, and the type of demand that will buy up its available supply, CQP shouldn’t have any trouble paying out its distribution, and more than likely increasing it for the period of time demand is expected to increase.

I do think there are limitations with its share price because of a lot of its revenue growth is already priced in. Yet even though it’s not a growth stock, it has been providing growth and income to investors since early 2020. Generally speaking, I think the best of that is over, but the company was designed to attract investors interest in income, and in relationship to that, it should do very well for investors, although yields will be down from when it was available at a lower entry point.

As far as safety goes, CQP is a solid holding that should generate consistent income over time.

Be the first to comment