playb/E+ via Getty Images

We opened with a title: AGNC Investment Corp.’s (NASDAQ:AGNC) Achilles Heel; a story that might be considered unpleasant, yet understandable. Although markets always perfectly set prices, a more valuable question must be answered, one which gauges how real or representative that value is. We hope to shed a brighter light on this question. And for high dividend payers such as AGNC, the other primary question is still always about dividend safety. We have covered AGNC previously in our AGNC Investment: We’re Accumulating Despite Interest Rate Uncertainty. Our stance on accumulating hasn’t changed through dividend reinvestment and short calls, but we are adding more depth to the story.

AGNC’s Business

The company borrows money at the short-end of bond market (variable) and loans money into the mortgage markets at fixed, higher rates. This creates risk especially during turbulent interest rates periods, one that the bond market just entered.

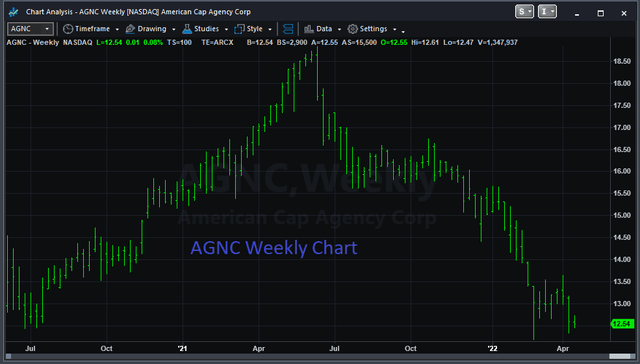

Collapsing Price

A chart created from TradeStation Securities follows.

Next, a table showing the Net Tangible Book Value vs stock price is included.

*Rounded values.

Clearly, the stock price follows the Net Tangible Book value, not a genius revelation, but nevertheless important.

Continuing, dividend coverage follows in the next table. The best estimate for coverage compares the dividend to the Net Spread/Dollar Roll Income found in slide 23.

| Dividend Coverage | 1stQ 20 | 3rdQ 20 | 1stQ 21 | 3rdQ 21 | 4thQ 21 |

| Net Spread & Dollar Roll Income* | $0.55 | $0.80 | $0.75 | $0.75 | $0.75 |

| Dividend | $0.36 | $0.36 | $0.36 | $0.36 | $0.36 |

* Rounded values.

The dividend coverage has been one and a half to two times the payout. We included 1st quarter 2020 with its exposure to a higher interest rate period. With the world health circumstances for the balance of 2020 and 2021, the Federal Reverse cut the short-end rate to basically zero. Prior to early 2020, short-term rates were at 2% for a few years. The dividend appears safe.

What Is this Price Driver?

With a stock price driven by changes in Net Tangible Value without dividends at risk, investors ought to know about the driving factors. By definition, Net Table Book Value is “total consolidated assets, minus consolidated intangible assets, and minus consolidated liabilities.” When divided by the number of shares outstanding, investors gain insight on the salvage value of a company. The definition leaves, at least this investor, in a fog. We turn to AGNC management comments concerning Net Tangible Book Value with our primary source the 2021 annual report for help.

The company strategy includes, “but our primary measure is looking at it and making sure that those capital market activities are accretive to our tangible book value.”

Next, management notes the effect of interest rate spreads:

When the spread between the market yield on our mortgage assets and benchmark interest rates widens, our tangible net book value will typically decline. We refer to this as “spread risk”.

The company’s strategy doesn’t hedge against spread risk:

although we use hedging instruments to attempt to protect against moves in interest rates, our hedges will typically not protect us against spread risk.

This is the Achilles heel.

When considering long-term effects, management noted:

wider spreads cause a decline in our tangible net book value, and we may experience increased volatility in our tangible net book value over the near term as the Agency RMBS market reprices to expectations regarding the normalization of Fed monetary policy. Over the longer run, however, wider Agency RMBS spreads improve the expected return on new investments and are beneficial to our business.

The short-term effect is stock price negative, but the long-term effect is positive; it increases cash generation.

AGNC does hedge against interest rate risk:

the principal instruments . . . to hedge our interest rate risk are interest rate swaps, swaptions, U.S. Treasury securities and U.S. Treasury futures contracts.

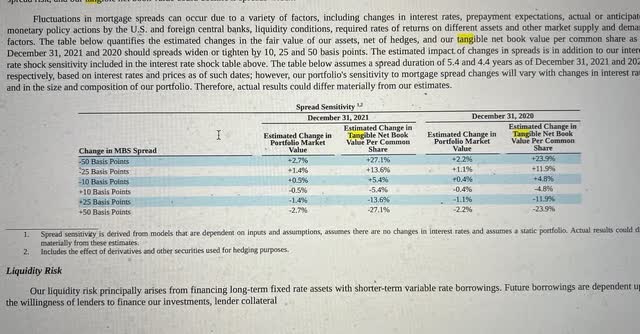

Management supplied an interesting chart containing risks for changes in Tangible Net Book Value vs. changes in interest rate.

At the bottom, the picture shows a 50 basis point change in MBS spread decreases the Net Tangible Book at 25%. The drop in Net Tangible Book from its high is 25%. The stock price also dropped 25% from its high, something the chart predicted.

Future Expectations

In a rising interest rate environment, pressure on Tangible Book will continue, while opportunities brought on from higher spreads will increase cash generation, generally. Further guidance from management as to the continued effect is an important piece of the investing factors.

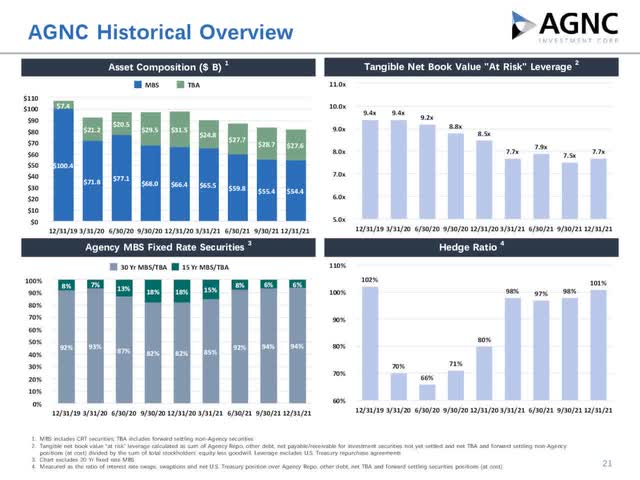

AGNC is conservatively managed shown below in the graph. The leverage shown, in the upper right panel of next graph, is low at 77%, when compared to the past.

Seeking Alpha AGNC Earnings Call 4th Quarter 2021

Plus, the company continues its interest rate spread hedge at an above 100 value, lower right panel. The average time value for their hedges equals 4 years.

Risk & Investment

We begin discussing risks with this statement from the last annual report.

During a period of rising interest rates, our borrowing costs generally will increase while the yields earned on our existing portfolio of leveraged fixed-rate assets will largely remain static. This can result in a decline in our net interest spread. Changes in the level of interest rates can also affect the rate of mortgage prepayments and the value of our assets.

Because the business model hedges this issue we do not view this as a risk.

An admitted risk from management comes through the purposeful price swings resulting from Tangible Book swings. In reality, under normal circumstances, this represents a buying opportunity.

But still more risks exist. The company began in the 2008’s zero interest rate environment. It hasn’t been around long enough for a historical study of what happens under high interest variability for long periods of time. Coupled with the truly unknown nature of how far the Fed will raise rates, it leaves uncertainty, something markets hate. It is this risk, in our opinion, that might represent the looming investor show stopper. Yet, this risk is managed with its average 4-year long hedge.

But, again, in our view, we feel that minus the spread risk, AGNC has value for investors to consider. We continue to sell calls at appropriate levels and use DRIP to increase our holdings. We won’t make this a major holding until interests stabilize at some value, high or low. We leave it for our readers to decide. The next conference call might offer enough further light to make decisions more clear, but the Achilles heel exists and will swing the stock price. The Achilles heel is most likely a buying opportunity.

Be the first to comment