tadamichi

Introduction

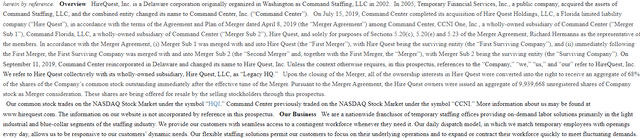

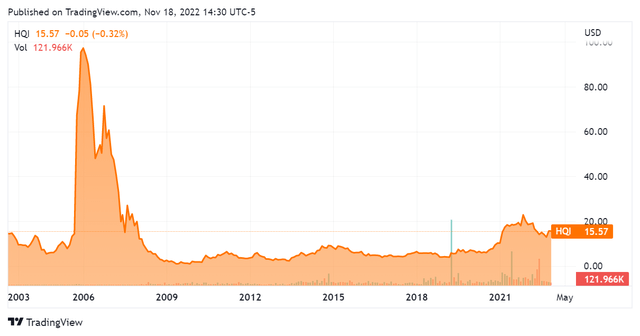

HireQuest (NASDAQ:HQI) is a franchisor focused on the staffing space. The company’s lineage can be traced back to 2002, where it was incepted as a private staffing company called Command Staffing LLC. As per the company’s latest S-1 prospectus, this entity merged with a public entity called Temporary Financial Services in 2005, rebranding itself as Command Center, Inc. In Q2 2019 Command Center went on to acquire another private entity called HireQuest and subsequently rebranded under this name, continuing to operate with this name and ticker since.

The company appreciated significantly in the run up to the 2007/2008 financial crisis but has been trading close to its earliest public price since.

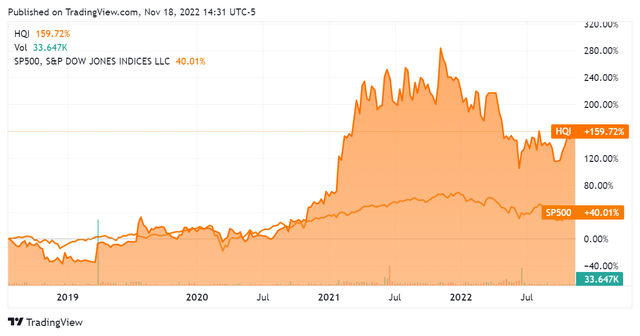

Things got interesting for this stock directly in line with its Q2 2019 purchase of HireQuest and subsequent rebranding. Note the very significant level of purchasing volume that was seen at exactly that time and the subsequent appreciation. Since that date this stock has outperformed the SP500 materially, generating returns of 159.72% versus the S&P500’s returns of 40%.

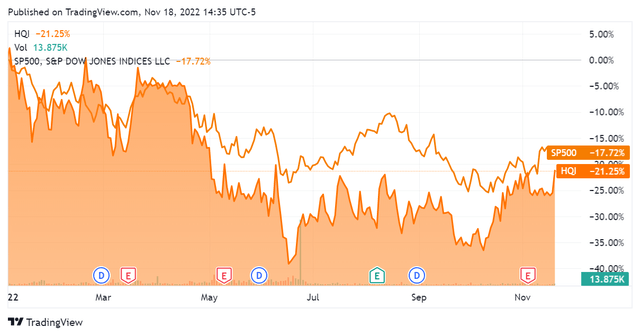

While a lot of this can be chalked up to the overall depreciation in the market during 2022, HireQuest has retained most of its appreciation since then, although it still continues to trail the SP500 somewhat on a YTD basis.

This article will review HireQuest’s business from a fundamental perspective and determine if it is a quality investment.

Business Model

As mentioned above HireQuest is a franchisor business. It is like any other franchisor in that it provides a central set of functions and a brand for its franchisees, taking a rolling royalty fee from its franchisees for the value that it provides them. The firm also provides growth capital for its franchisees.

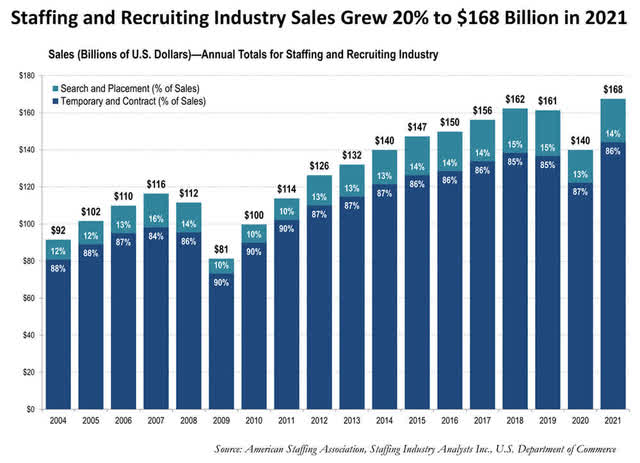

Unlike most other franchisors, however, HireQuest’s business is in staffing – commonly known as agency recruitment. This space is not particularly well-known amongst investors or the public at large, but it is a significant one with 2021 revenues of $168B:

American Staffing Association 11.18.22

As per the chart above, staffing comes in two forms: permanent placement (commonly called ‘executive search’ or ‘headhunting’) and contract staffing. Contract staffing represents the bulk of the market, generally accounting for 86% of overall revenues as seen above.

This business is quite straightforward: the company has contractors on its payroll that it then contracts out to its client base. The employees stay on the staffing company’s payrolls but often work on-site at the firm’s clients. The clients pay a set rate for each contractor to the staffing agency, with the company pocketing the difference between the rate paid and the compensation that it pays to its contractors (formally employees of the staffing firm). The margins on this are high and generally come in somewhere between 60 – 100 % from what I have seen first-hand.

HireQuest is a franchisor for contract staffing that operates as described above. While it does have some exposure to permanent placement/executive search through some of its brands, this is a minority portion of its business.

Overall it can be seen that HireQuest has a very large total addressable market for its franchisees.

Financials

Since this company has been in operation for some time we can look at things on a year-by-year level, with a particular focus on its performance since its merger with and rebranding into HireQuest in Q2 2019.

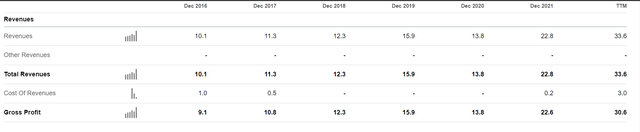

Since fiscal year 2016 revenues have been volatile, with a notable (although not overly large) downtick for the 2020 pandemic year. In 2021 the company appears to have bounced back, posting revenues that were 165% of those that it had in 2020. The trailing twelve months figure indicates continued momentum, with the figure already 148% of what it was in fiscal year 2021. This looks good.

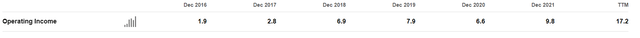

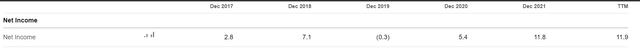

Along with this, the company is demonstrating a similar trendline as to its operating and net income. While 2019 was negative in terms of net earnings, the firm doubled its net income from 2020 to 2021 – and appears to be maintaining this TTM. The consistently positive operating income figure indicates that the business is consistently capital efficient.

SeekingAlpha.com HQI 11.18.22 SeekingAlpha.com HQI 11.18.22

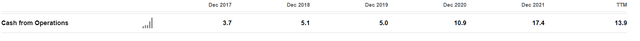

The firm’s capital efficiency and business model are also further reinforced by the company’s cash from operations. While this appears to have some volatility, we can rest assured that it is consistently positive.

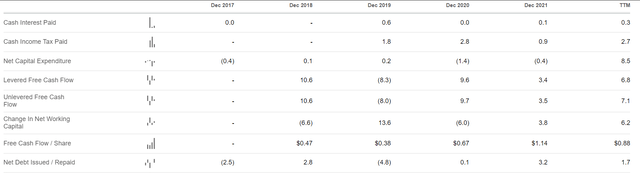

Looking further down the cash flow statement we see that HireQuest is generally cash flow positive. The 2019 negative figure is explained by their acquisition of HireQuest. Nonetheless, the 2021 numbers appear to show a decrease in free cash flow generation year-over-year, although the TTM figure indicates that it is regaining momentum on this.

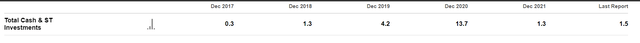

Since the company is paying cash on interest it is worth looking at its balance sheet to see the state of its cash holdings and liabilities. As seen below, HireQuest doesn’t maintain too much cash on hand at a given time. However it does not need to, as it operates as a cash flow positive entity.

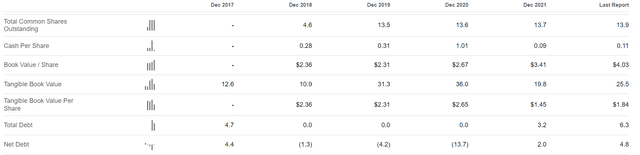

Nonetheless the company has taken on some additional debt as of fiscal year 2021, also visibly increasing this as per its latest quarterly filing. Nonetheless it is maintaining a positive and growing book value, indicating more assets than liabilities.

As seen before on the company’s cash flow statement, these interest payments can be expected to crimp its capacity to generate profits – and are doing so as of this article. This level of debt is relatively high, with total debts of $6.3M over $33.6M TTM revenues – 18.8%. However, it should not be enough such that the firm becomes cash flow negative.

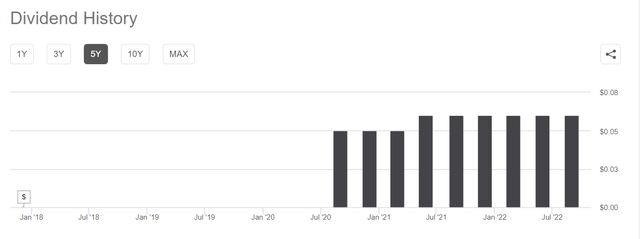

This belief is reinforced by management’s commitment to paying a dividend, which it certainly wouldn’t be doing if there was no cash left on hand. These payments amount to $0.06 per share quarterly as of this article, giving it a yearly expected dividend of $0.24 at a yield of 1.62% at its current price. This is not a particularly exciting dividend yield, and I would choose to interpret it more as a sign of confidence from management; it is nonetheless better than a zero dividend yield.

Conclusion

HireQuest is demonstrating momentum in its revenues, along with positive (albeit volatile) cash flows. It faces a very large total addressable market for its franchisees. As to secular trends the immediate labor market picture is relatively uncertain. This can actually represent a good thing for staffing agencies, however.

Since permanent labor is less elastic from an economic perspective, companies often choose to go with contractual labor in volatile/uncertain periods such as this one. I mentioned this in my previous bull case for EPAM Systems. Worth considering, however, is that the quantitative significance of an overall decrease in the labor market could overpower this effect – and we are seeing the cracks starting to show in this regard. Nonetheless a company such as this one would be far better positioned in this economic climate than a permanent placement service such as Korn Ferry.

While I think this stock has significant bullish indicators, it is also contending with a less-than-ideal macroeconomic climate and is not displaying the level of cash flow generation that I would like to see – along with increasing debt service commitments. While the revenue picture is strong, this may end up being affected in the immediate period as its franchisees deal with macroeconomic headwinds. Since the stock is still relatively in line with the S&P this year, I think it’s possible for it to appreciate, depreciate, or simply do neither; as such, it’s a hold.

Be the first to comment