Eoneren

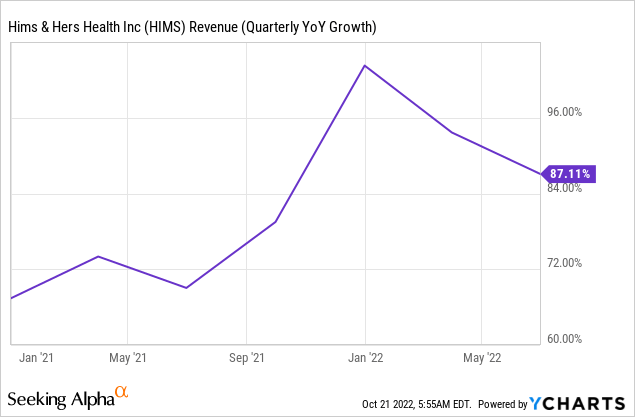

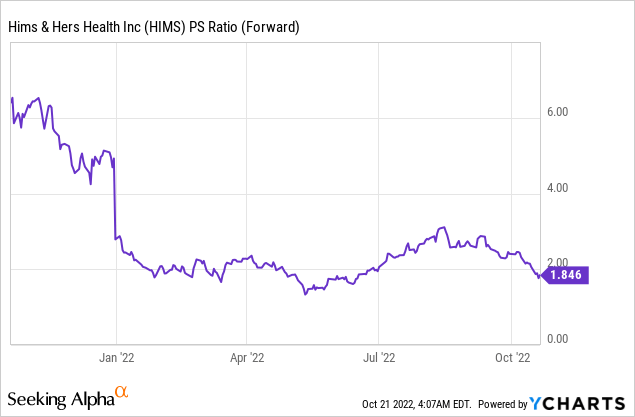

San Francisco-based Hims & Hers (NYSE:HIMS) grew by 87% for its last reported quarter with a gross margin of just under 77% as EBITDA profitability came into view. Despite this, the company continues to experience an almost historic collapse of its common shares as the market, under siege by a hawkish Fed, discounts growth to new lows. Don’t fight the Fed has gone too far, bears too rapacious, and the pullback now moving into the extreme. Whilst common shares don’t necessarily become cheap just because they have fallen from what bears describe as unsustainable all-time highs, Hims is now trading at a price-to-forward sales multiple of 1.85x. This is a valuation historically reserved for low single-digit growth companies operating in stagnating markets.

Hims & Hers is a digital native and fully vertical health platform where customers can gain access to solutions for hair, sex, and skin-related issues. The company is built around the internet, with the aim to provide a high-quality experience from website to door. The strong revenue growth comes on the back of operating in a space which continues to see increasing consumer adoption around the world with a total addressable market set to reach $500 billion. As more consumers embrace online health platforms to meet specific health needs, Hims should continue to report strong revenue growth numbers, a trend that should help support EBITDA profitability within a year. Understandably, that Hims continues to report losses has made the company a victim of the triumphant risk-off trade that has swept across the equity markets and made stocks a fraction of their previous highs. Hims has now seen its stock price fall year-to-date by 36.6% against a broader fall of 25% for the Russel 2000 small-cap stock market index.

Revenue Growth Is Material As Profitability Comes Into View

Hims last reported earnings for its fiscal 2022 second quarter saw revenue come in at $113.6 million, an increase of 87% over the year-ago quarter and a beat of $9.67 million on consensus estimates. This was driven by more than 100,000 in net new subscriptions which left the company exiting the quarter with 817,000 subscriptions, up 80% year-over-year.

Gross margin for the quarter came in at 77%, a 100 basis points decline compared to the year-ago quarter whilst an adjusted EBITDA loss of $7.5 million was an increase from $4.7 million in the year-ago quarter. This contributed to a net loss of $19.7 million, more than 2x the figure of $9.2 million in the year-ago quarter as the company continued to invest in operations to support growth.

The company’s price-to-forward sales ratio of 1.85x now sits near its lows achieved a few months prior. The current momentum certainly seems like Hims is heading back to this level as inflation remains elevated and the Fed has turned extremely hawkish to bring this back down to their 2% target.

The company raised its fiscal year 2022 revenue guidance to be in the range of $470 million to $485 million and adjusted EBITDA losses to not be higher than $27 million. Critically, management expects to reach adjusted EBITDA profitability within the next four quarters. This would represent a step change for the company and would set the tone for a rerating of shares if growth is still as strong as it is now.

Bears would be right to flag how competitive the space is with a number of VC-funded startups and public companies all vying for market share. But Amazon’s closure of its online health platform as part of a broad cost-cutting measure at the eCommerce against is a strong positive for Hims. It has removed an 800-pound competitor.

Hims should at its current pace of growth report fiscal 2023 revenue of at least $776 million. This assumes growth of at least 60% over the high end of its fiscal 2022 revenue guidance. With Hims holdings a net cash and equivalents position of $190 million, the company currently sports a 0.85x enterprise value to fiscal 2023 revenue multiple. When will low become too low? This will become even more glaring if the company hits its EBITDA profitability target.

Contemporary American Healthcare

Hims stock price will likely remain close to its 52-week lows and could stand to make new lows depending on how much more the market is set to deteriorate. This will likely come against consecutive earnings beats and an upward revision of guidance. With SaaS-like gross margins, 90% of revenue being recurring, and profitability set to be hit in under a year, the market has gone too far with its risk-off trade.

From a fundamental perspective, the sharp downturn is overdone. The stock is trading as though Hims is realizing negative growth. It makes no sense. As the company rides the secular growth market of digital health I think it will become clear that the market went too far. I’m a buyer here.

Be the first to comment