DAX, Euro Talking Points

EUR/USD Wrestles With Key Psychological Level

The downward trajectory pertaining to EUR/USD continues to persist with price action stalling at the key psychological level of 1.0800.

In the wake of the Coronavirus pandemic, an influx of stimulus from both the European Central Bank (ECB) and the Federal Reserve (Fed) has thus far assisted in reinvigorating economic growth, driving unemployment back to pre-pandemic levels.

However, although these measures have kept both economies afloat, inflationary pressures and ballooned balance sheets have placed additional pressure on policy makers to implement Quantitative Tightening measures in an attempt to curb rapidly rising prices.

Since the second quarter of last year, the culmination of a dovish ECB and the safe-haven appeal of the US Dollar has further weighed on the major currency pair as Europe’s economic recovery lags behind that of the US.

For all market-moving data releases and events, see the DailyFX Economic Calendar

With market participants pricing in a 50 basis point rate hike at the upcoming FOMC meeting (4th May 2022), Europe’s dependence on Russian energy has increased its vulnerability to the conflict between Russia and Ukraine, forcing the ECB to leave monetary policy unchanged.

As bears continue to test 1.080, further downward pressure could see EUR/USD making a fresh two year low.

EUR/USD Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

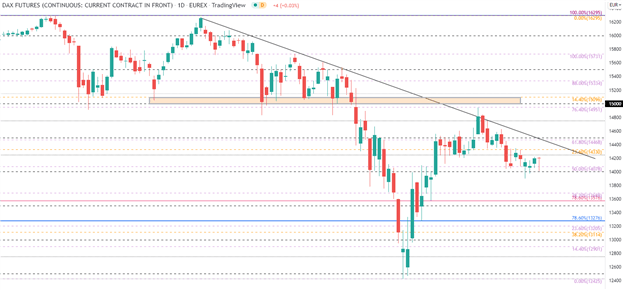

DAX Takes Strain as European Equities Remain Vulnerable to Geopolitical Risks

Although low interest have continued to support European equities, the geopolitical environment has limited gains, pushing the German Dax into a zone of confluency, formed by key technical levels.

DAX 40 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

With low body candlesticks illustrating lackluster price action, the Fibonacci levels of historical moves continue to provide both support and resistance between 14,078 and 14,330 respectively.

If prices manage to break through either levels, there is a probability that momentum may rise. From a bearish standpoint, a break of the mid-March support zone of 14,150 and 14,000 may suggest a broader decline is at hand, which makes way for the 13,688 Fibonacci level.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Be the first to comment