PM Images

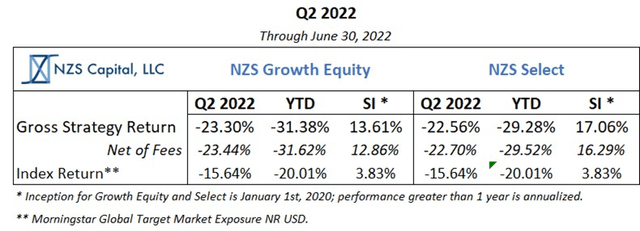

The NZS Capital Growth Equity strategy was down 23.44% net of fees in the second quarter of 2022; in comparison, its global market index benchmark declined by 15.64%. Year to date, the strategy was down 31.62% net while the index fell by 20.01%.

Since inception, the strategy has cumulatively risen 35.33% net compared to a 9.86% return in the benchmark. The NZS Capital Select strategy was down 22.70% net in the second quarter of 2022, with a net year-to-date decline of 29.52% and a cumulative net gain of 45.84% since inception.

The research process at NZS Capital is always guided by the unpredictability of the world around us. Our lens on the world, which does not rely on narrow predictions of the future, is ideally suited for long-term investors as the global economy transitions from analog to digital. We believe companies that maximize non-zero-sum outcomes for all of their constituents, including employees, customers, suppliers, society, and the environment, will also maximize long-term outcomes for investors. These adaptable businesses will take share as the economy continues its decades long transition from analog to digital, sector by sector.

Our view of the world informs our portfolio construction process, which combines a relatively small number of Resilient companies (larger positions) with a long tail of Optionality companies (smaller positions). Resilient businesses have very few predictions underpinning their success and a narrow range of outcomes, while Optionality businesses have a wider range of outcomes and their success hinges upon a more specific view of the future playing out. This combination of long-duration growth and asymmetric upside is well suited to navigating the increasing pace of change throughout the global economy.

Performance Discussion

The following second quarter 2022 performance discussion references the NZS Growth Equity strategy. Our investments and overweights in technology and communication services led the significant underperformance in the quarter, down 23.8% and 24.3% respectively.

The top-owned positive contributors in the quarter were SailPoint (SAIL), T-Mobile (TMUS), and Danaher (DHR).

Being underweight several large index positions contributed to performance as well – in times when most stocks in the market are declining, performance can be driven more by the stocks you don’t own than the ones you do.

Among the largest active detractors in the quarter were several software and semiconductor investments, including Workday (WDAY), Salesforce (CRM), Okta (OKTA), Microchip (MCHP), and Lam Research (LRCX).

We believe the stock valuations of these companies, and their sectors as a whole, reflect an overly pessimistic view of their long-term growth potential and an underestimation of the deflationary forces they bring to the economy, and we therefore added to many existing positions.

Other negative detractors were in the media sector, such as Walt Disney (DIS), Paramount (PARA), and Snap (SNAP), as slowing economic growth impacted advertising, and consumer media habits shifted toward short-form video.

Lastly, aluminum can maker and aerospace company Ball (BALL) detracted from performance over fears consumers would curtail their large, pandemic-era grocery store beverage purchases.

Market Commentary

Our primary focus at NZS Capital is finding companies driving the analog-to-digital transition in the global economy. These companies are largely powered by innovation and the creation of the most non-zero-sum (win-win) outcomes for all constituents, including employees, customers, society, the environment, and investors. In some cases, these companies are growing faster than the overall economy, are investing to improve their future prosperity, and are not overly focused on their short-term bottom lines.

Rapidly rising interest rates in 2022 have had an outsized impact on the valuations of many of the types of companies in which we invest. Globally, growth stocks were down 20.15% while value stocks only fell 11.50% in the quarter, with year-to-date declines of 27.92% and 12.34% (respectively) according to Morningstar(1).

Although we made several significant adjustments to the portfolio throughout 2021 to reflect the higher risk of interest-rate-driven valuation exposure, these changes were not enough to completely inoculate performance from the market’s reaction to the high inflationary environment and resulting aggressive central bank rate policies.

We build our portfolios with concentrated Resilient investments balanced by a long tail of Optionality investments. In times of extreme market volatility, such as we have seen for the last couple of years, we stay vigilant to assure that every position size matches the range of outcomes for each investment. In most cases when a stock value swings dramatically, it doesn’t indicate a fundamental change to the long-term range of outcomes for the underlying business. Accordingly, when stock devaluation is driven by the market using higher discount rates to value future cash flows, the stock can become more attractive.

One of the most important characteristics we look for in Resilient investments is adaptability. Periods of economic volatility offer an opportunity for such organizations to capitalize on their flexibility and creativity, and the best management teams will emerge stronger on the other side. Resilient companies tend to be extremely good at both investing for the future and maintaining economic sustainability, regardless of the ambient economic weather.

Rather than reacting to uncertainty from a place of fear, the best management teams will play smart offense, preserving their own prosperity and continuing to look out for their customers’ best interests rather than dramatically cutting services or significantly raising prices. Such organizations understand that by always partnering with customers to economically and expediently solve problems, they have the best chance of preserving and growing their customer base and ensuring their own longevity. We therefore expect that, in aggregate, our Resilient investments will emerge from the downturn stronger than ever.

Optionality investments also tend to be adaptable, but they are generally more sensitive to economic weakness and other factors at play in times of uncertainty. Because these companies lean heavily on innovation and growth, they risk underinvesting if they don’t have the financial resources to weather a downturn. In combination with higher rates forcing a devaluation of future discounted cash flows, these less insulated businesses tend to suffer significant stock pullback relative to the market.

The market’s recent souring on growth stocks has created a once-in-a-decade opportunity to own Optionality companies with highly asymmetric outcomes in aggregate. Even though we don’t expect all of these investments to necessarily play out positively, taken in sum, the catalog provides an opportunity to compound positive growth for many years. By considering the current characteristics of the stock market, the macroeconomic outlook, and the elements of Resilient and Optionality investments, we see a better setup for returns than we have seen in some time.

We’re not in the business of calling market bottoms – we try to avoid all predictions that require a high degree of precision – however, we know it’s only a matter of time before the clouds clear and investors once again appreciate the value of the types of businesses in which we invest. It therefore becomes a question of how long it will take for the market to recover. We have prepared for this period by matching each position in the portfolio to its potential range of outcomes and incorporating a balanced set of businesses that we believe will both weather further uncertainty and be poised to see accelerating fundamentals regardless of what unknown storms the future brings.

While central banks are focused on trying to fix the inflation that resulted primarily from excessive fiscal spending and overly accommodative monetary policy during the latter stages of the pandemic, we are focused on how innovation remains the primary disinflationary force and productivity engine for the global economy. Taking our cues from biology, we know that adaptable companies providing the most value (non-zero sumness) to their ecosystems will take advantage of the ongoing volatility in the economy. By solving problems for their customers and providing more value for the same or less money over time, these companies will not only be combating inflation and contributing to economic recovery, they will be ensuring their best chances at prosperity.

Our expectation is that market-based economies in developed countries are generally self-healing. Thus, the fear of higher inflation is often enough to assure that inflation won’t come to pass. As the economy transitions to digital and information travels faster and faster, companies and consumers are able to adapt more quickly to changing conditions, including expectations of inflation. This should allow, in time, the self-correcting mechanisms of the economy to accelerate as well. For example, two companies that we invest in, Tesla and Amazon, both sell direct to consumers, allowing them to more quickly identify changes in demand and adjust their capital investments and headcounts accordingly. Such real-time knowledge and customer awareness are key contributors to adaptability and will become a more impactful motive force with the continued digitalization of the global economy.

While there are always reasons to be pessimistic, we see even more evidence to remain optimistic about the future of the companies we invest in on behalf of our clients.

Thank you for your continued trust, interest, and support.

FOOTNOTES

(1) The Morningstar Global Growth Target Market Exposure NR USD and The Morningstar Global Value Target Market Exposure NR USD indices.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment