AsiaVision

Hims & Hers Health (NYSE:HIMS) has been my biggest position and most written about stock over the past year.

Company Background

Hims is a telehealth company which connects patients to licensed physicians for a range of medical issues, such as: sexual health, dermatology, mental health, and hair loss. The company facilitates the fulfillment of prescriptions by connecting its patients with licensed pharmacies after the company’s physicians have made a diagnosis. Hims operates in all 50 states.

Thesis

Hims’ stock has been routinely punished by the market as its share price has been in a downward spiral since it went public last year. Skeptics of the company claim (1) it is not profitable (nor will it ever be) and (2) has no moat. I disagree with both.

First, the company could be profitable today if it simply cut back its marketing expense, which for the purpose of valuation is a discretionary expense not necessary to maintain its current customer base.

Second, investors who focus on a moat and not value proposition are putting the “cart before the horse.” The value proposition comes first and that creates a moat. Hims has a great value proposition: provide patients with high quality, affordable healthcare in the convenience of their own home using a highly digitalized, engaging, and simple platform. As the company’s value proposition latches on, its infrastructure will grow, capabilities will expand, and its moat will widen.

Revenue has consistently outperformed and its customer base grows with each passing quarter. Putting the progress into numbers using my discounted cash flow analysis, we can see that the stock should be trading at around $17-$18. This represents over a 200% gain from current levels.

Q3 2022 Performance

Hims had an excellent third quarter report. Here are some of the fast facts:

- Q3 revenue was $145 million, up 95% YoY

- 79% gross margin

- 991,000 total subscriptions, +174k vs prior quarter

- 90%+ recurring subscription revenue

- (4%) adjusted EBITDA margin, +9% vs prior year

- 8.8 million medical consultations since launch, on pace to double FY 2021 consultations

Subscription Growth and Retention

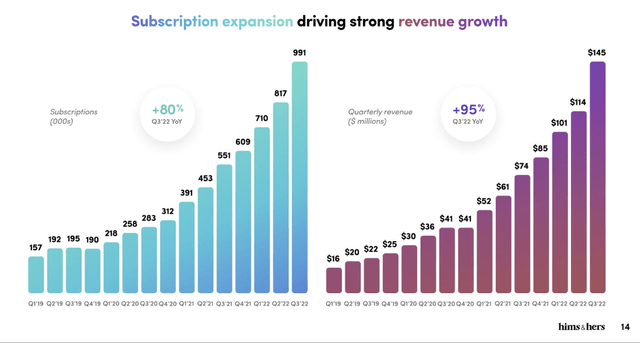

Quarterly Subscriptions and Revenue Growth (HIMS Q3 Presentation)

On the left side of the chart, we can see that the company’s subscription growth since 2019 has been exceptional. The company’s quarterly CAGR in subscriptions has been 14%. If Q4 subscriptions follow the same trend, then there will be about 1.3 million subscribers in Q4 2022; this is a 530% increase in the last four years.

On the right side of the chart, we can see the company’s revenue has also increased exponentially. In one of my previous articles, I forecasted Hims’ would earn $160 million dollars in Q4. The company now guides for $159 million in revenue; this is an 894% increase in the last four years.

I want to emphasize that the company has not even left its infancy stage. We are in the first inning with nobody out in this game. I expect subscription and revenue growth to continue to exponentially increase for the next few years as the adoption of Hims’ platform becomes more mainstream.

My Accurate Revenue Forecasts

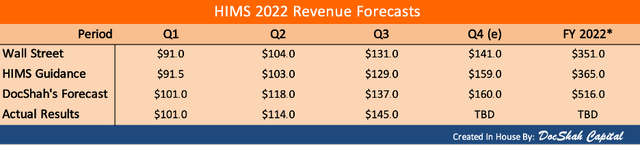

Speaking of revenue, I want to point out how exact my forecasts have been, in spite of Wall Street’s and the company’s own guidance differing materially. Below is a table showcasing the different forecasts made by each party.

HIMS 2022 Revenue Forecasts (DocShah Capital)

- Analysts’ quarterly forecasts are their forward guidance from the previous quarter.

- Hims’ quarterly forecasts is based on the same methodology.

- My quarterly forecasts were placed at the start of the fiscal year, without ever needing to be updated due to my accurate foresight.

*The FY expectations by all three parties is what we each expected the company to earn at the beginning of the year. You will notice that mine was extremely close, while the others were not even close. Wall Street severely underestimated the firm while I believe Hims sandbagged guidance for assorted reasons (I wrote about this in this article).

As of today, Hims guides for FY 2022 revenue of $519 million versus their guidance of $365 million at the start of the year. I guided for $516 at the start of the year. Looks like I hit the mark almost perfectly.

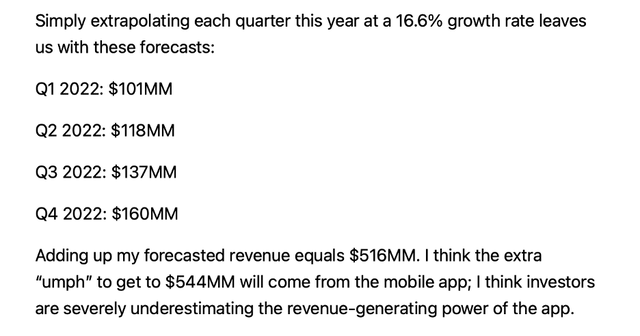

Proof: Here is the exact excerpt from my article early on in the year:

My Previous Revenue Forecasts (DocShah Capital)

Potential For Future Growth

Moving into Q4 and FY 2023, I want to highlight some of the strategies and opportunities the company is implementing in order to continue to grow fast.

Marketing

The company launched a campaign with the NFL during prime-time games on Sunday, Monday, and Thursday nights. The company also added moments around leading programs on Hulu for the Hers side of the business. Lastly, the company signed a new celebrity partnership, which remains a secret for now, but whomever it is, it’s expected to add significant brand exposure.

Technology

The company’s iOS apps have been skyrocketing to the front of Apple’s App Store. As of today, the Hims app is #33 in the medical category with a rating of 4.8 stars (5.7K total ratings). The Hers app is #134 in the medical category with a rating of 4.8 stars as well (603 ratings). In addition, in Q3 the company launched both apps on the Android platform (this will help bring in even more sales now).

Hims continues to increase the content on the app, tailor it specifically for the user, refine its layout, and make one click shopping even easier by optimizing the feed/algorithm. Lastly, Hims is making some investments to improve its app experience with new features such as, ‘intelligent routing’, which helps connect the customer to the correct operative instantly. All of these improvements make buying products easier for the consumer, which leads to more sales for the company.

Subscription and Retention Rates

Overall, app engagement continues to increase and the stickiness of Hims’ subscription-based model is only getting tackier. Last year, multi-month subscriptions were around 35%; however, the company has seen sequential gains since then meaning more customers are opting to pick longer duration subscriptions. This occurrence has coincided with the brand increasing its product offering and value proposition. Hims strives to maintain long-term retention rates north of 85% and that currently seems to be the case. The churn rate was not disclosed, but was mid-single digits last year. The multi-month subscription increase has been the main driver of solid retention and low churn.

Product Lines

The company plans to increase its number of proprietary products. The company’s new 25,000 square foot Arizona pharmacy is going to help keep up with increased demand and provide the ability to scale up the business. AOV has increased and online revenue generated per subscription in the third quarter was $141, up 7% from last quarter.

Acquisitions

An analyst asked Hims about potential acquisitions given the exponential scale the company has grown at this year. Many small companies have great ideas and technology, but find it too challenging to scale their business during a recession. These companies might seek the help of a larger player, such as Hims. In fact, CEO Andrew Dudum, confirmed he is seeing more consolidation ideas showing up on his desk. However, he feels the opportunity to grow internally is so robust, that he would rather focus on Hims itself at the moment. In other words, the bar is set extremely high for any potential consolidation activities. I am happy with his answer and agree with his game plan.

Valuation

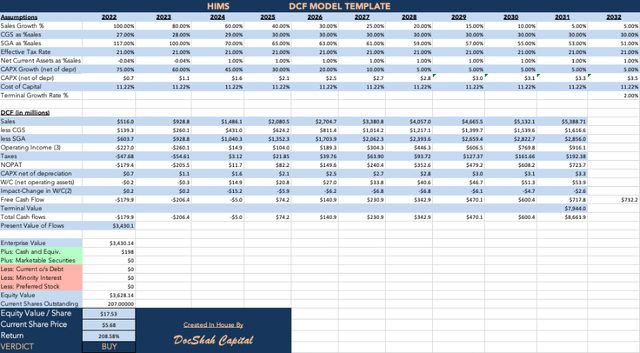

HIMS Discounted Cash Flow (DocShah Capital)

Sales

I predict sales growth for 2022 to be $516 million. From there, I gradually lowered sales growth over time.

COGS

Cost of goods sold and gross margins are flip sides of the same coin. Hims’ gross margin for 2021 was 75%. For 2022, I predict a 73% gross margin rate. From there, I gradually lowered it over the following years. Hims has expanded into numerous retail channels (Amazon, CVS, Walmart, etc.) and sales from those channels carry lower margins. Therefore, it is wise to factor this into the forecast.

SGA

The company’s SGA expense as a percentage of sales was 117% in 2021. I assumed this would stay the same in 2022 and then would gradually get better since overall sales would outpace the spending at this level.

Taxes, Net CA, CAPX

I kept the tax rate the same, flipped net current assets from negative to positive overtime, and rapidly increased the company’s CAPX to account for its increased need for infrastructure as the company grows.

WACC, Terminal Growth Rate

The WACC was calculated to be 11.22% using the CAPM model. The terminal growth rate is set to 2% to be conservative.

Stock Price

I reiterate my previous valuation and believe the stock price is worth around $17-$18, which represents a gain of over 200% from current levels. Hims expects to be EBITDA positive in the range of $0-$2 million next quarter. I believe the company’s bottom line will soon follow and will be generating positive free cash flows by 2024 or 2025.

Risks

- The company’s ability to scale and profitability could suffer if bigger players enter the marketplace.

- Interest rates rise substantially, making it difficult for the company to make the necessary capital investments.

- The government decides to regulate the telehealth space, dramatically increasing compliance costs.

- For the company’s set of risks, please click here.

Takeaway

An investment in Hims allows investors the opportunity to get in on the ground floor of what could be an industry changing company. Hims has continued to beat expectations each quarter and deliver record setting subscriptions and revenue, and they keep increasing brand awareness. Management has delivered on its promises and I expect the following quarters to build sequentially off the strength of the previous.

As stated earlier, I believe we are only in the first inning of the company’s future. As Hims transitions into profitability, investors can expect the business to expand even faster and the stock price should increase materially. Based on current levels, the stock could offer a 2-3x return. Investors who understand the risks, should delve further into this company as a potential investment.

Be the first to comment