georgeclerk

In the world of asset management, portfolio managers are graded on alpha generation, their returns minus the returns of the benchmark. There are various levers which good portfolio managers can pull to try to outperform, with the most common being sector selection and individual stock selection. In other words, they attempt to allocate more assets to the sectors that they think will perform better and the individual stocks within sectors that they think offer superior value/growth.

Like my peers, I also pull these levers, but there is another pool in which I like to fish for alpha because it is badly overlooked: Subsector mispricing. This article will detail my process for weighting real estate subsectors, but more specifically which subsectors are better right now and why.

The crowded sector trade

Top-down analysts are primarily allocating between the 11 GICS (Global Industry Classification Standard) sectors. In an inflationary environment with an above-normal chance of recession, they might overweight energy, utilities, and consumer staples. This is what Howard Marks refers to as first-level thinking.

The challenge here is that other portfolio managers are also doing this, so the advantaged sectors might be overvalued. A second-level thinker, according to Marks, would carefully weigh the sentiment implied by market pricing against the fundamentals.

“Inflation makes energy good, but does it help energy by as much as the market thinks it does?”

Second level thinking is the way to go, but at the GICS sector level it is really hard. You not only have to know what is fundamentally strong, but you have to be better at it than the other professionals.

You have to be smarter than the “smart money” to produce alpha at the GICS level.

Low-hanging fruit: Subsectors

Far less attention is paid to subsectors. Investors often buy into subsectors by accident, simply by consequence of their GICS sector picks. One might buy REITs as a sector via an ETF and not be aware how heavily they are buying into cell towers.

Thus, I see subsectors as fertile ground for alpha generation. In choosing between subsectors you are not competing with pros, but rather with haphazard overweights that result from about 50% of investment now being through passive vehicles.

That is a much easier task. I think I can outsmart accidental overweights.

So which subsectors are the good ones?

A similar exercise could bear fruit in any sector, but I am a REIT-specialized financial advisor, so I am only aware of the subsector-level mispricing within real estate.

Earnings season has brought a fresh batch of data to work with and quite a few subsectors are performing well fundamentally, with the following standing out.

- Industrial has 10%-80% rental rate growth depending on location of assets.

- Healthcare is recovering from the challenging COVID environment.

- Retail is getting both rental rate and occupancy growth for strong overall organic growth.

- Towers are getting additional income from existing assets by adding 5G equipment to their 4G towers.

First-level thinking would take this information and say:

“Buy towers, industrial, healthcare and retail”

But that would be ignoring the over and undervaluation caused by the ebbs and flows of passive investment into these subsectors.

Instead, we can apply Howard Marks style second-level thinking to subsector selection. It is a matter of comparing the fundamental strength with the level of fundamental strength that is implied by the valuations.

There are dozens of distinct property types within REITs, but most information aggregators such as S&P Global will break them down into the following 9 subsectors. Here are the subsector-level AFFO multiples. I use AFFO (Adjusted Funds From Operations) because it is the best earnings metric for cross-sector comparison.

|

Subsector |

Median AFFO Multiple on 2023 consensus estimates |

|

Hotels |

10.2 |

|

Healthcare |

13.4 |

|

Diversified |

12.1 |

|

Industrial |

21.9 |

|

Office |

11.5 |

|

Residential |

17.1 |

|

Retail |

14.1 |

|

Self Storage |

15.5 |

|

Specialty |

15.6 |

Towers are a subcategory within Specialty and have an AFFO multiple of around 19X.

So while the aforementioned 4 subsectors (towers, retail, industrial and healthcare) look strong fundamentally, that strength appears to already be priced into industrial and towers with their far above-average AFFO multiples.

Industrial and towers have enjoyed rapid growth for quite a few years in a row and have attracted attention or perhaps too much attention.

The strength in retail and healthcare, however, seems to be overlooked with AFFO multiples of 13.4X and 14.1X, respectively. In my opinion, these sectors are mispriced, so I am overweight healthcare and retail. At a sector level, I think the strength of industrial and towers is correctly valued.

Beyond inter-sector mispricing, there is quite a bit of mispricing within subsectors.

Intra-sector variance

The same passive ETF fund flows that cause sectors to be mispriced are resulting in large caps getting the lion’s share of investment dollars.

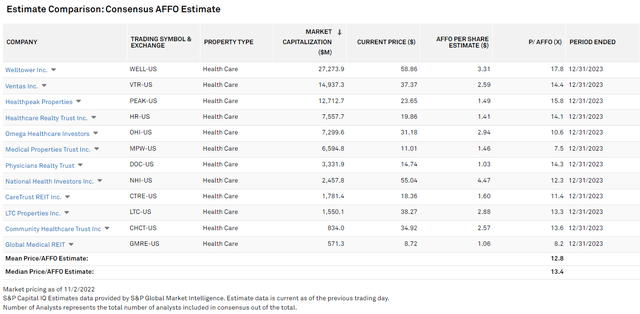

The following table is organized by market cap, and there is a clear correlation between size and premium multiple.

S&P Global Market Intelligence

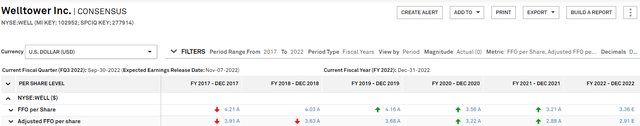

Welltower (WELL) does not trade at the premium 17.8X multiple because it is better, but rather because it is bigger. In fact, Welltower has been losing FFO/share and AFFO per share since 2017.

S&P Global Market Intelligence

In contrast, Global Medical REIT (GMRE) has been a beacon of stable growth.

S&P Global Market Intelligence

Despite its clearly better fundamental performance, it trades at just about the cheapest multiple (8.2X).

Why? Because it is the smallest with a market cap of $571 million and ETFs don’t buy small things in any real quantity. If you get a chance, listen to GMRE’s 3Q22 conference call. These guys are creating value with every property they buy.

Retail – arguably the best sector right now on a valuation-adjusted basis

In absolute terms, the industrial sector is the strongest, but adjusting for valuation, I think retail is best positioned.

I imagine that I will get some pushback on this statement as retail has weak sentiment due to having just come out of a rough period of double feature headwinds, COVID, and Amazon (AMZN).

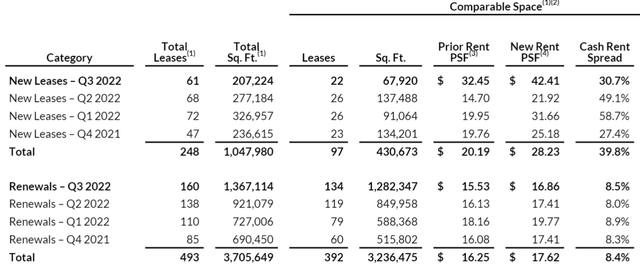

However, the sector has quite clearly turned a corner and is now headed solidly in the positive direction. As evidence, take a look at the 3Q22 earnings report of Kite Realty (KRG).

Kite had 39.8% cash rent increases on new leases signed in the past 4 quarters.

That is the kind of landlord-favoring dynamic that happens when a property type gets undersupplied. New development of shopping centers has been barebone for over a decade and has resulted in undersupply, which is now forcing tenants to pay up if they want quality space.

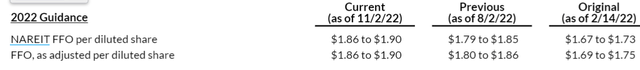

Leasing strength led to 2 guidance increases from Kite, each of which was fairly large increments.

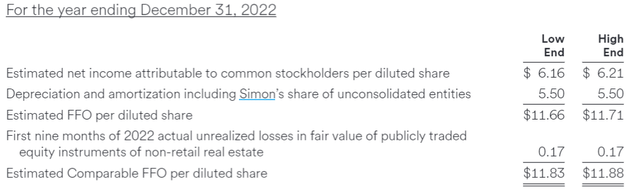

Simon Property (SPG) confirmed the strength exists in the mall space as well, or at least well-located high-end malls. Like Kite, Simon has increased its guidance twice this year on the back of strong leasing, with a new FFO/share guide of $11.83-$11.88.

That represents a 9.5X multiple on a highly respected company with a balance sheet that is often referenced as an example of a good balance sheet.

Wrapping it up

I could try to outsmart the world and compete in the crowded areas, but there are some very smart people out there who could probably beat me. It seems wiser to find mispricing where it is easy, the overlooked areas.

KRG and SPG are undervalued individually within the retail REIT subsector which is itself undervalued. The combined mispricing sets up for significant outperformance.

GMRE is a superior healthcare REIT with superior management at its helm, but its price is at the bottom of the list because institutions have blinders on to any company smaller than $1B.

Be the first to comment