Achraf Hayati/iStock via Getty Images

Introduction

The Hilton Food Group (OTC:HLTFF) (hereafter just “Hilton” for simplicity sake) is a UK-based producer of protein-based foods. The company operates 24 manufacturing and packaging facilities across 19 countries where it processes meat, seafood and vegan/vegetarian protein options. As the food industry is characterized by low margins, I wanted to see how the company performed in the first half of the year and how it sees its margins and performance evolve in the current semester.

Yahoo Finance

The company has its main listing on the London Stock Exchange where it’s trading with HFG as its ticker symbol. The average daily volume is almost 150,000 shares per day for a monetary value of approximately 1M GBP. As there are 89.4M shares outstanding, the current market capitalization is approximately 500M GBP. As Hilton reports its financial results in GBP and trades in pence, I will use GBP as the base currency throughout this entire article.

It’s a sector with very thin margins, but Hilton Food Group is navigating through the difficulties

The company’s share price got decimated when it published its H1 results as the company issued a stern profit warning due to a lower consumer confidence level as the inflation is having an impact on its core markets. The company mentioned it has seen the volumes come under pressure as consumers are increasingly focusing on lower cost options and this obviously has a negative impact on the overall margins of the company. While there’s pressure on the demand side of the equation, Hilton also is facing higher raw materials expenses. A portion of these higher expenses can be passed on to the consumers (and this was the main driver of the revenue increase) but at the expense of volumes as consumers get more cost-conscious.

The uncertainty surrounding the second half of the year clouded a pretty decent first semester.

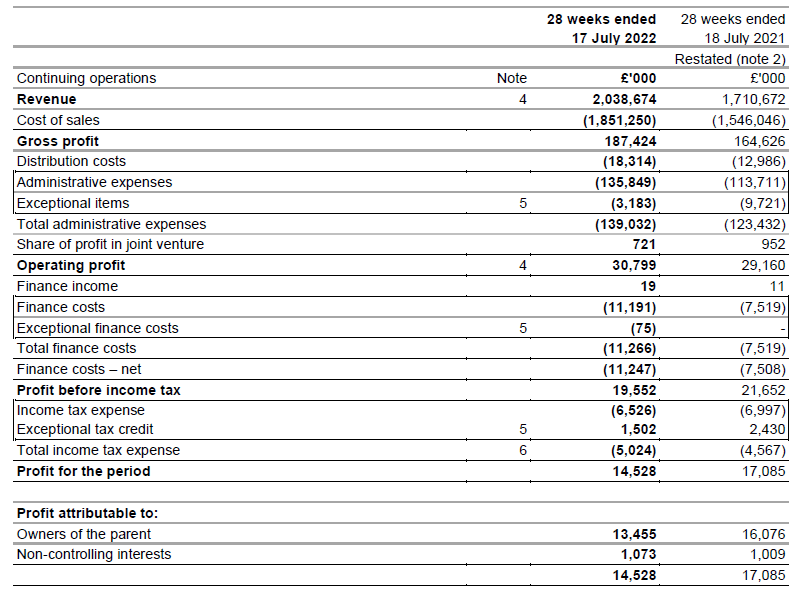

The company saw its revenue increase by almost 20% to 2.04B GBP, but as you can see below, that was almost entirely due to the ability to pass on the higher COGS to its customer base. While it’s great to see the gross profit increase by more than 10%, the administrative expenses jumped by about 20% resulting in an operating profit of 30.8M GBP. While that’s a 6% increase compared to the first half of 2012, it clearly shows the razor-thin operating margins Hilton Food Group has to deal with: The operating margin in the first semester was just around 1.5%.

Hilton Food Group Investor Relations

Hilton’s interest expenses also are increasing as it recently acquired a US-based salmon processing group to further expand its activities and that’s the main reason why the net income came in at a disappointing 14.5M GBP. Of that net income, approximately 1.07M GBP was attributable to non-controlling interests, resulting in a net income of 14.5M GBP attributable to the common shareholders of Hilton Food Group. This represented an EPS of 15.1 pence. Which means that even after the recent share price drop, Hilton is still trading at in excess of 15 times the annualized earnings.

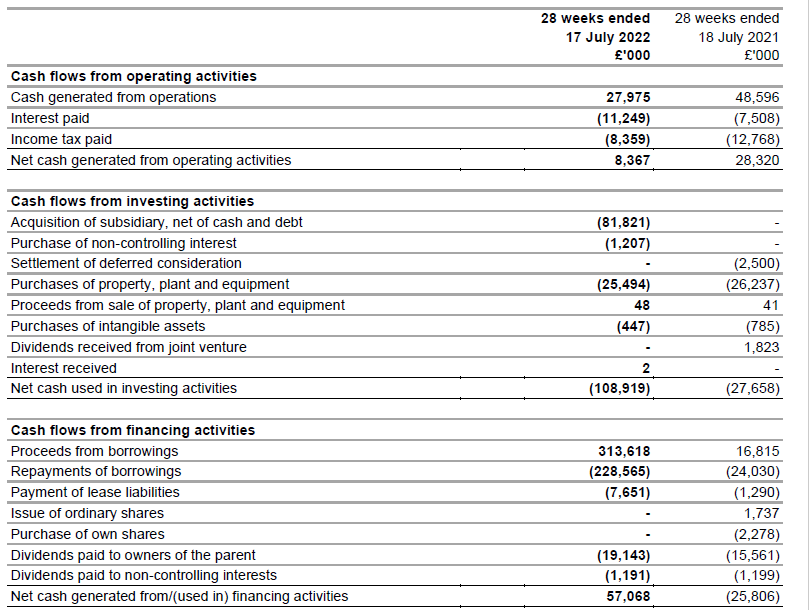

I always like to have a look at the cash flow statements as well, but unfortunately, Hilton’s half-year cash flow statement lacks details. While the company does report a “cash generated from operations” as you can see below, it doesn’t provide any detail on how that result was achieved. That’s important as I would like to see how the depreciation and amortization expenses and working capital changes have had an impact on the cash generated from operating activities.

Hilton Food Group Investor Relations

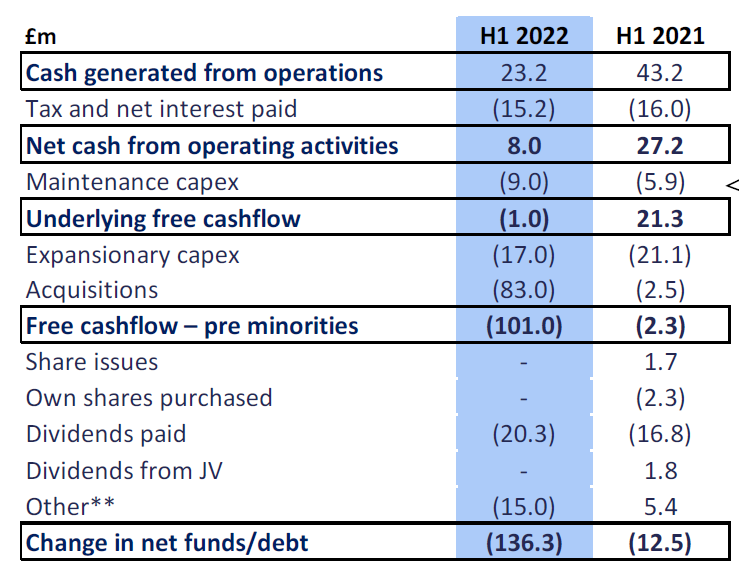

The cash flow statement unfortunately isn’t very helpful and even the footnotes don’t provide a breakdown of how the company reached the operating cash flow result. The corporate presentation also wasn’t very helpful other than the fact the company clearly broke up the capex in sustaining capex (9M GBP) and expansionary capex (17M GBP).

Hilton Food Group Investor Relations

And given the massive impact of inflation on the financial results of Hilton Food Group and the rapidly changing margins, I cannot just use last year’s results and margins to figure out how this year’s cash flow result is shaping up. In 2021 for instance, the company reported an operating cash flow of 95M GBP (adjusted for working capital changes, lease payments and dividend payments to non-controlling interests) and applying a full-year sustaining capex of 25M GBP indicates last year’s sustaining free cash flow result came in at around 70M GBP.

That’s good to know but doesn’t add value to the discussion of how much free cash flow Hilton will generate this year. The company is playing it safe and has already cut its interim dividend to 7.1 pence (down from 8.2 pence paid after H1 2021) and this means approximately 6-7M GBP in earnings is retained on the balance sheet. Assuming the cash flow result will be more or less in line with the reported earnings, this will help to keep the net debt level on the balance sheet under control.

As of July 17, Hilton had approximately 97M GBP in cash on the balance sheet while the total amount of borrowings increased to 318M GBP after the all-cash acquisition of Foppen, a US-based salmon processor. The balance sheet also contains a total of 249M GBP in lease liabilities but these are very long-term and are being repaid over a 15-20 year period.

The net debt level does not worry me as Hilton reported a 63M GBP EBITDA (excluding lease amortizations) in the first half of the year and by annualizing this result, the debt ratio remains below 2 times the underlying EBITDA. That’s fine.

Investment thesis

The market obviously wasn’t too happy with Hilton’s H1 update and it’s understandable the share price got hammered. That being said, despite the low margins, I do expect Hilton to remain profitable but it’s currently very difficult to figure out how much free cash flow the company will be making this year.

I’m on the sidelines but the recent share price drop has made Hilton more interesting as the margins should improve again in the long run. There’s absolutely no near-term urgency to initiate a long position in Hilton as we will likely only see an improvement from 2023 on, but it looks like the bad news is now priced into the current share price.

Be the first to comment