CHUNYIP WONG

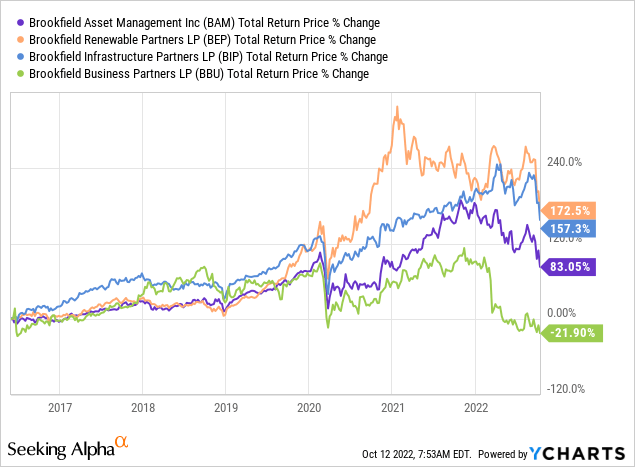

We are completing the Brookfield (BAM) investor day highlights series with Brookfield Business Partners (NYSE:BBU). You can find the articles for Brookfield Renewable (BEP) here, and for Brookfield Infrastructure (BIP) here. Of Brookfield’s public subsidiaries, BBU is probably the one that gets the least appreciation from investors, and it is the one with the worst historical performance. Still, we believe there are several positives that investors are not really taking into consideration, and today’s low price could turn out to be an excellent buying opportunity.

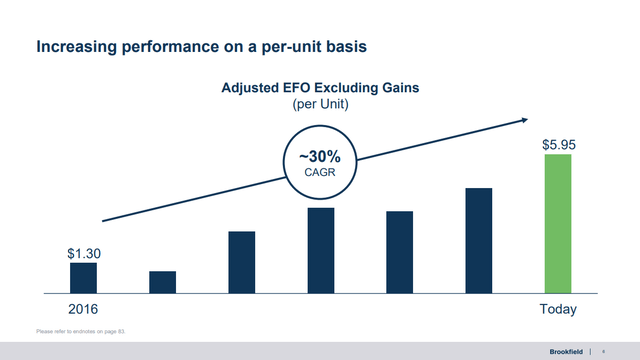

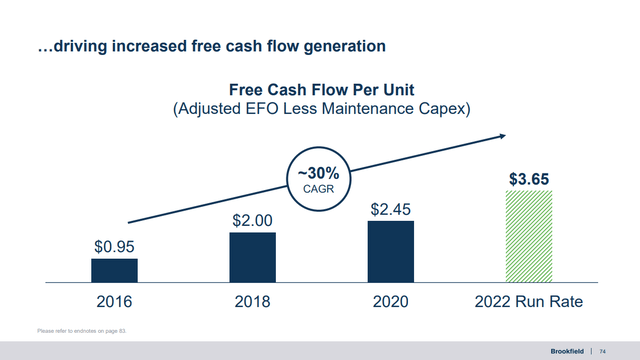

As a reminder, Brookfield Business Partners is the public subsidiary that specializes in private equity type of investments. It seeks to purchase businesses with durable competitive advantages, significant pricing power, that have low substitution risk, and stable cash flows. In the past year it has deployed $4.3 billion of capital and generated $1.1 billion in proceeds from monetizations. It is quite surprising that shares of BBU have performed so poorly given that adjusted earnings from operations have increased at a ~30% CAGR.

Brookfield Business Partners Investor Presentation

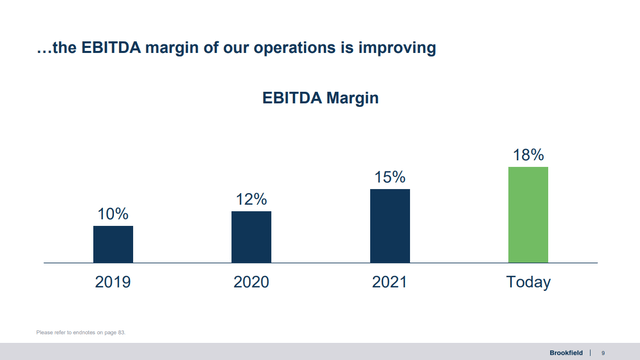

Part of what has been propelling earnings higher is the improvements BBU has made to its acquisitions. These improvements go from changes in commercial strategy and organizational design, to manufacturing footprint optimization, supply chain management, and digital transformation. It also helps that around ~75% of EBITDA already comes from large-scale and market-leading operations.

Brookfield Business Partners Investor Presentation

Growth will also come from new acquisitions, the company has committed ~$15 billion in new acquisitions, with over $4 billion at the company’s share. These acquisitions are expected to bring more than $2B in annual EBITDA.

Investing Opportunities

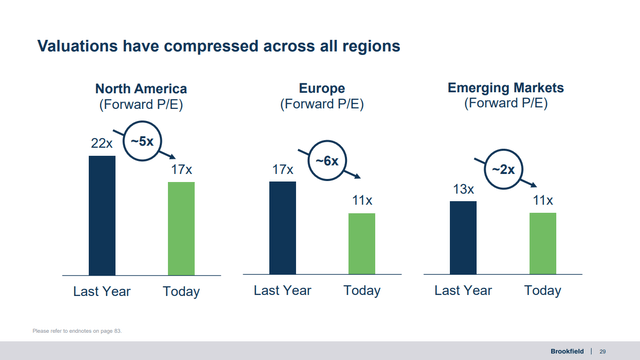

The company sounded very optimistic about how it is a great time to be a global value investor, and that there are multiple catalysts that help motivate transactions in all the regions in which the company operates. These catalysts include large conglomerate carve-outs, mispriced public securities, forced sellers, and stressed balance sheets. More importantly, valuations have come down significantly, as can be seen in the slide below. Multiples have particularly compressed in Europe, but North America and Emerging Markets have also experienced significant valuation compression.

Brookfield Business Partners Investor Presentation

This has led to some great opportunities for the company to acquire assets cheaply. Some examples include unidas, a market-leading Brazilian rent-a-car platform. BBU plans to double the size of its existing fleet, and the acquisition was at a great value from a forced seller. A sector where the company is searching for opportunities particularly hard is in healthcare. BBU believes this is an ideal time to be opportunistic given how much activity has slowed in terms of business transactions, while healthcare expenditures are increasing despite broader macro volatility.

Existing Operations

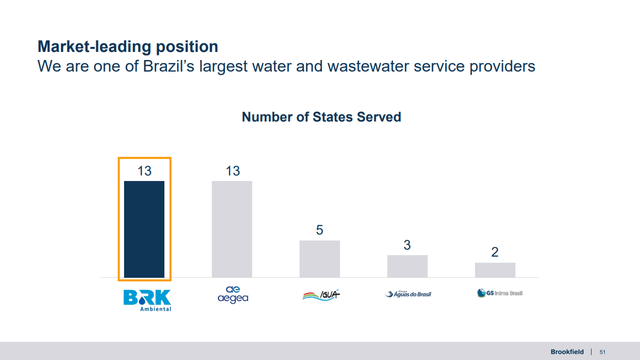

The company also talked about its existing operations and how well they are doing for the most part. For instance, BRK Ambiental has grown its EBITDA at 25%+ CAGR since 2017, and is quickly becoming a market leading water and wastewater service provider in Brazil. The company sees many opportunities to continue scaling the business.

Brookfield Business Partners Investor Presentation

Another key operation is Westinghouse, the nuclear technology services operations. It was recently announced that BBU will sell Westinghouse to Cameco (CCJ), Brookfield Renewable, and other investors for $8 billion. These operations are considered very attractive by the company due to its long-term and highly resilient contracted cash flows. Since the company made the acquisition it was able to roughly double EBITDA, so this monetization is expected to generate an attractive return for the company.

The third key business for BBU is Clarios, a global leader in advanced battery technology. While EBITDA improvement has been less impressive for this acquisition, at least its strong cash flow has supported ~$750 million of debt reduction.

Balance Sheet

The balance sheet has become a big investor concern given the rapidly raising interest rates. However the company explained that it does not use permanent corporate debt, instead relying on non-recourse borrowings. Each business is financed with an appropriate level of leverage, and the company is careful that debt be serviceable and sustainable across economic cycle.

At the corporate level the company has a $3.3 billion credit facility, and in general its debt has long-term maturities with limited financial covenants. The weighted average interest rate is ~4.9%, with ~5 years weighted average maturity. About half of the debt is fixed or hedged.

Valuation

There was a big effort to address the valuation of the company, and why management believes that BBU is trading at a significant discount to its intrinsic value. They believe that the discount is due to misconceptions around the quality of earnings, management of the balance sheet, and the way to value the businesses.

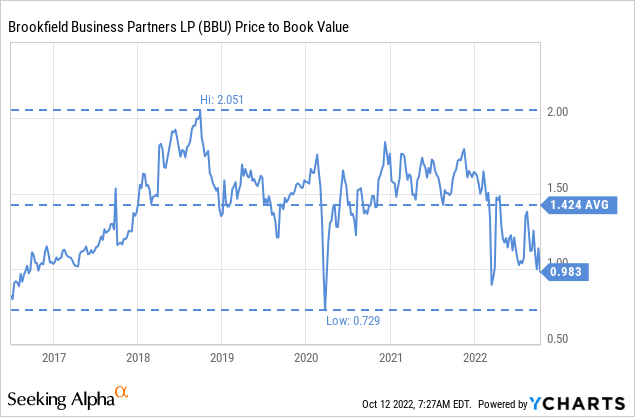

In any case, compared to its own history, it does appear that shares are extremely undervalued right now. Shares have rarely traded below 1x book value, and when they do trade below this level they tend to recover quickly.

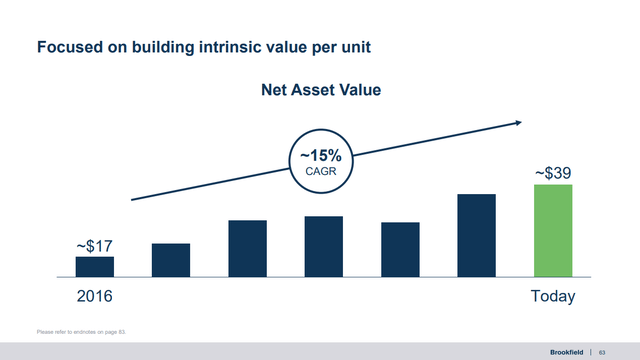

The company believes its intrinsic value per share is ~$39, which is about twice where shares are currently trading.

Brookfield Business Partners Investor Presentation

The 2022 free cash flow run-rate is ~$800M, which at the current valuation results in a 15%+ FCF yield. Based on these statistics we have to say that management made a compelling case that shares are significantly undervalued.

Brookfield Business Partners Investor Presentation

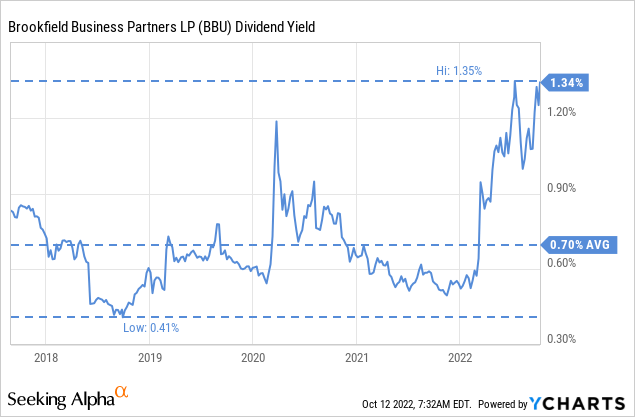

One thing we do find disappointing is the small dividend, which means that even at a depressed valuation shares do not yield very much. According to Seeking Alpha the payout ratio is 13.96%, so the company is keeping most of the earnings for reinvestment, but we believe shares would be much more appreciated if the dividend was higher and growing faster.

Risks

We believe rising interest rates are the greatest risk the company is currently facing, and while ~50% of the debt is fixed-rate or hedged it means the other half is not. The company estimates that a +75 bps interest rate increase would impact adjusted earnings from operations less than 5% due to an increase of ~$65M to interest expense.

Conclusion

Brookfield Business partners made a compelling case that its shares are currently undervalued, and that it is a great time to be a value investor. We were a little less convinced about its debt strategy, and do worry about the amount of leverage the company has, even if it is non-recourse for the most part. In any case, this is a company worth following, as it makes many interesting acquisitions around the world and is constantly recycling assets.

Be the first to comment